Asia Pacific was the first region to face Coronavirus (COVID-19), with the pandemic first emerging in Wuhan, China, leading to the lockdown of millions of people in an attempt to curtail the spread in the first half of 2020, with many restrictions still in place. China’s economy has recovered better than expected, with forecast GDP growth of 1.7% in 2020, but countries like South Korea, Japan and India have been thrown into recession, with real GDP declines of 1.2%, 5.8% and 4.2% respectively.

Stealing a march on recovery

Buoyed by the region’s income potential, recovery prospects are comparatively optimistic, however. Tourism demand (international and domestic) is expected to return to pre-crisis levels in Asia Pacific within three years. In the short to mid-term, domestic and intra-regional tourism will act as a shock-absorber for the decline in international demand.

Growth will be spurred on by value for money products such as short-term rentals and low-cost carriers which are predominantly booked online or via mobile. There will be a lag for hotels and package holidays, expected to take five years to recover to 2019 levels. The main challenge for Asia Pacific remains how to manage its growth in a sustainable way that protects the triple bottom line.

The region will have to adapt to the changing source market landscape, as a key source market like China takes a step back from international travel in the short to mid-term, pivoting to domestic tourism.

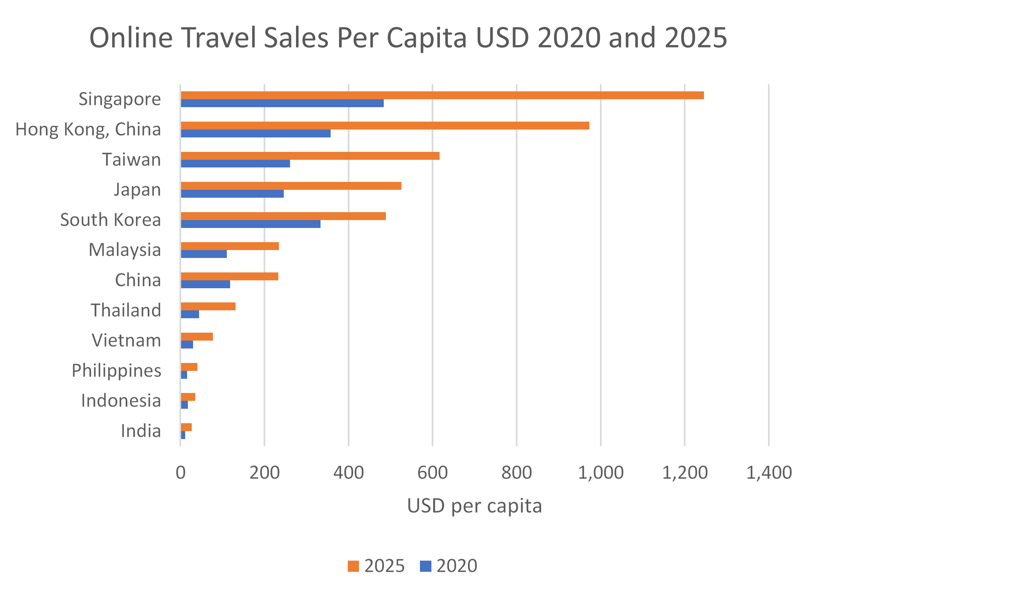

Home to the world’s largest population of internet users – 1.9 billion people and spending USD2.8 trillion on digital commerce - innovation thrives in Asia Pacific. Mobile sales are the most developed in this region, accounting for 62% of all online travel sales in 2020.

Source: Euromonitor International. Note: Baseline forecast

Digital-first innovation

The majority of travel innovations in Asia Pacific are infused with digitalisation, tackling a variety of different needs related to COVID-19 such as a safe and contactless customer journey, mobility, sustainable destination management and virtual experiences.

The acceleration towards AI and automation are visible in countries such as China’s FlyZoo Future Hotel, where facial recognition and robotics are deployed to create a seamless customer experience. However, major concerns remain regarding privacy and personal freedom.

The Maldives is often used as an example of the existential threat posed by climate change, as the low-lying coral islands face potential submersion from rising sea levels. Lux* Resorts in South Ari Atoll launched a unique system of floating solar panels in August 2019, that are placed on the sea to gather energy and are integrated with the grid. The resort has partnered with Swimsol, specialising in offshore photovoltaics and the floating solar system has boosted energy capacity by 40%. In terms of consumer engagement, guests have access to a live solar tracker in their villa via the IPTV, so they can view the energy produced, diesel and emissions saved.

According to Euromonitor International’s Voice of the Industry Survey – Sustainability, 53% of travel companies are looking at investing in energy over the next five years.

In Asia, many SMEs have turned to agriculture or embraced agritourism as well as working more closely with local food suppliers for survival. KKDay, an online travel unicorn in Taiwan, launched online ordering of Taiwanese snacks to deliver around the world at the height of the pandemic, finding an alternative revenue stream.

Triple shock for the Middle East and Africa

The Middle East and Africa suffered a triple shock effect with the economic impact from COVID-19, historically low oil prices that turned negative in April 2020, as well as the shutdown of travel and tourism.

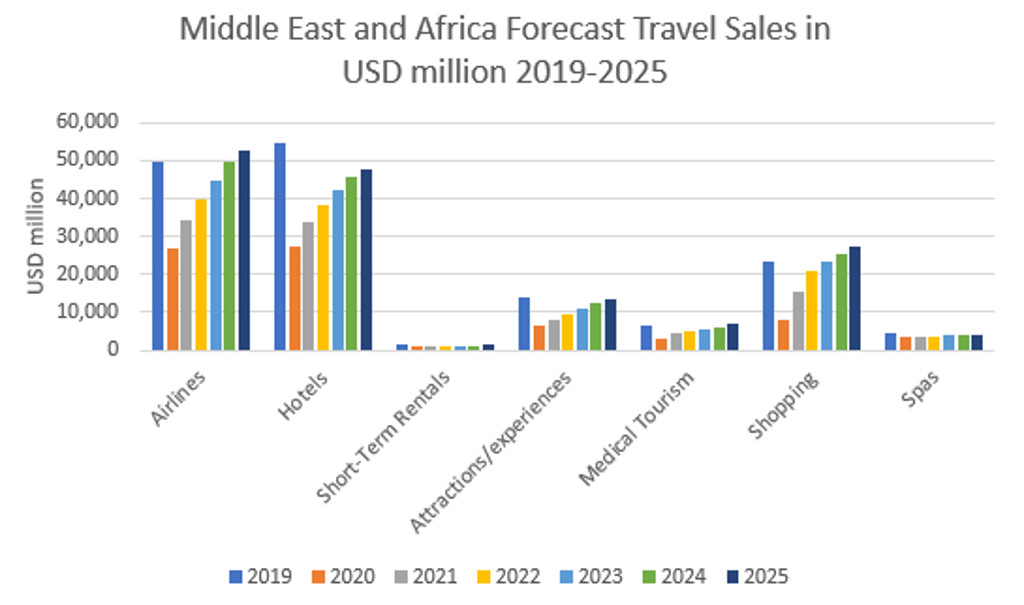

The region is predicted to take at least four years to recover to pre-crisis levels of demand and spending. Business and MICE travel is set to pick up faster, with a lag for leisure, whilst the outlook for domestic tourism looks fragile. Lodging, intermediaries and transport players are expected to face a long haul, taking five to seven years to recover after mass closures and cancellations.

Innovation in the Middle East and Africa has focused on new health and safety protocols. In Saudi Arabia, technology was developed to scan visitors when entering the Grand Mosque with thermal cameras. The country faced significant declines of 80% in inbound receipts due to bans on religious visitors at the height of the pandemic.

Egypt, Uganda and South Africa have launched virtual experiences including virtual safari tours thanks to live streaming as a way to continue to engage with potential visitors.

Source: Euromonitor International. Note: Baseline forecast.

Conservation in crisis

The impact of COVID-19 has had catastrophic effects on conservation following the collapse of tourism revenues that help support communities, conservancies and national parks. This puts communities that usually receive income for protecting land and wildlife in a highly precarious position. Financial schemes like Wildlife Credits were rolled out in Mozambique, Namibia and Tanzania, incentivising communities to co-exist with wildlife and not resort to poaching. These types of intervention are even more critical after COVID-19 and continue to be supported by the World Wildlife Fund.

Post-pandemic, innovative approaches to incentivisation are being taken one step further to secure the survival of endangered species, like lions in Tanzania, through convivial conservation and a Conservation Basic Income. This business model could be a game-changer in achieving a sustainable future that balances environmental needs, communities and biodiversity.

Sustainable transformation is not without its challenges: 42% of travel businesses stated that they would roll back on developing sustainable products and services after COVID-19, at a time when three-quarters of consumers are expected to be looking for these types of innovations.

With the travel industry in dire straits, the urgency to innovate, digitalise and look even beyond sustainability is ever more critical. The need for radical change is amplified by the growing number of voices speaking as one across government, activist investors, NGOs, consumers and businesses. The call for a planet-conscious mindset, a green recovery and sustainable transformation has never been louder.

Read more on the outlook in Europe and the Americas, or download our complimentary annual travel report ‘Accelerating Travel Innovation after Coronavirus’.