The outbreak of Covid-19 is a human tragedy and its effects on travel and tourism are multi-faceted. It directly impacts families devastated by grief, workers that are facing uncertain prospects, while indirectly impacting local shops and hospitality due to tourism’s multiplier effect.

Our latest annual travel report ‘Accelerating Travel Innovation after Coronavirus’ dives into the impact of Coronavirus in four regions – Europe, Asia Pacific, the Americas and Middle East & Africa, looking into the innovative concepts to help accelerate recovery.

Dark clouds gather over Europe

Without doubt, Europe has faced one of its darkest hours post-war, with the reality of a second wave leading to new lockdowns across the continent. With the EU opening up over the peak season, there was some initial respite but not without challenges, as rules often changed, leading to a chaotic system.

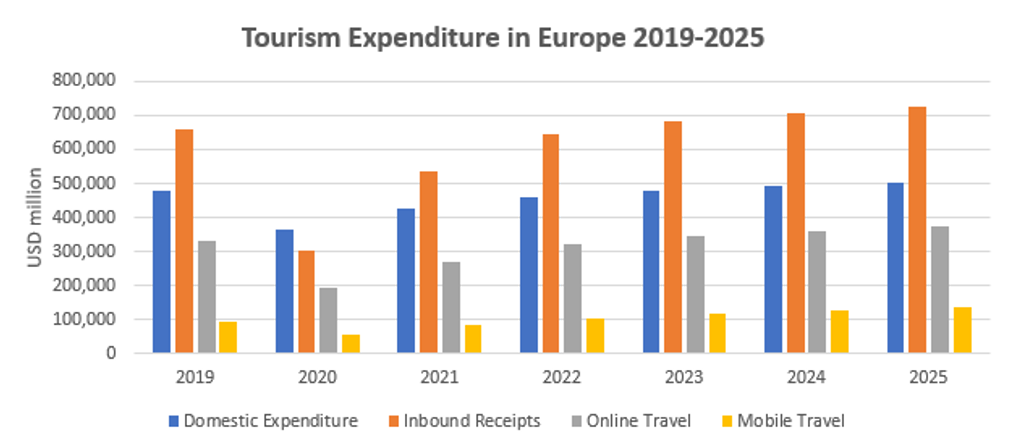

Domestic expenditure in Europe was the relative winner, forecast to decline by 24% in 2020 compared to international receipts (down 54%). Some sectors like intermediaries may take several years to recover. The region faces a deep recession with GDP to fall by 9% in 2020, with the EU providing EUR1.8 trillion for the COVID-19 recovery plan, and to meet the goals of the Green Deal as part of its sustainable, digital transformation.

The Nordics lead the pack, where 65% of travel businesses implement a sustainability strategy, according to Euromonitor International’s Voice of the Industry Survey – Sustainability (July 2020). Whereas 46% of travel businesses in the Nordics act with purpose and take account of all stakeholders, not just shareholders, compared to a global average of 37%.

Source: Euromonitor International. Note: Baseline forecast

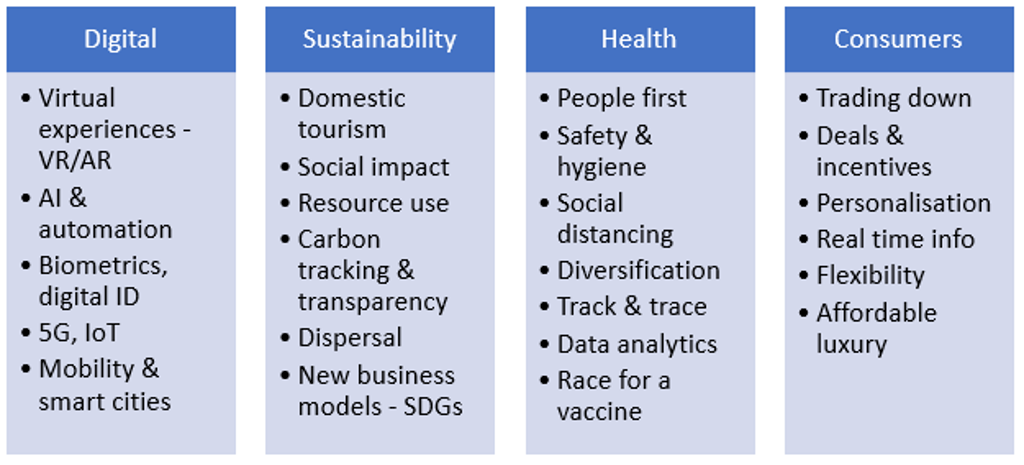

Innovating out of the crisis

Responding to the global SOS, travel brands are jumping on innovation to future-proof recovery post COVID-19. Innovation is taking multiple shapes as digitalisation and sustainability accelerate and converge. New source markets, consumer segments, business models and alternative revenue streams are just some of the strategies being explored to ensure survival.

Converging Pillars of Travel Innovation after Coronavirus

Source: Euromonitor International

Embracing transformation

Visitors — the lifeblood of the tourism economy — disappeared in 2020, forcing European destinations to go back to first principles. Reinvention through VR/AR was popular, whilst others kept the conversation going online, like #GdanskWillWait. Destinations have turned to their residents, offering apps to discover “off the beaten path” activities and tours.

Digitalisation of the customer journey has continued apace, with AI and automation deployed to iron out pain points. Mobile apps have provided greater transparency to consumers about their travel impacts such as Meravando in Germany, enabling carbon offsetting for cruises.

Innovation has been spurred on by the new hygiene and social distancing protocols. Aircraft seat design even got a makeover with www.aviointeriors.it and its Janus middle seat innovation.

Aeroguest, a mobile app, in Denmark solves COVID-19 related problems such as the need for touch-free, seamless experiences. Consumers can check-in, choose their room, add experiences all from the app, reducing the check-in process to 30 seconds.

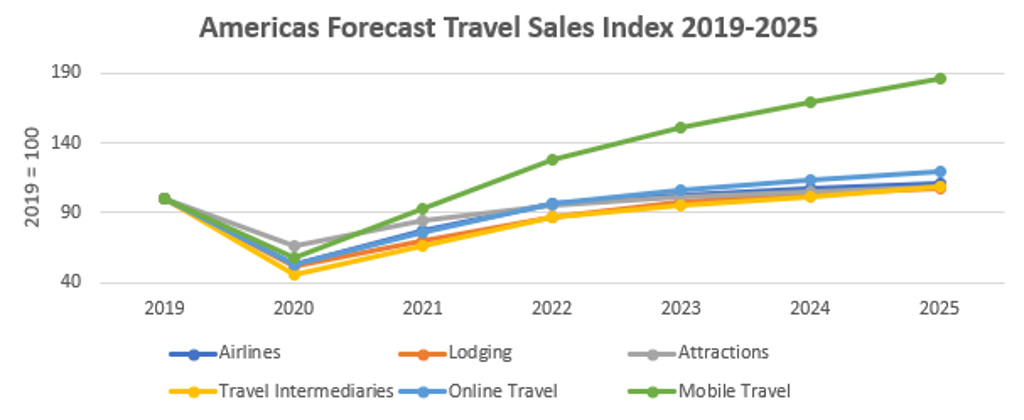

The Americas – turning the page

The Americas continue to be beset by the pandemic in H2 2020. Countries in Latin America were some of the last to leave lockdown, and some remain shut like Argentina and Chile, compounding the economic impact of social unrest pre-COVID-19. Panama, Argentina, the US and Peru face expected declines of over 50% in receipts, with the region expected to fall by 53% in a best-case scenario.

The US CARES bill (USD2.2 trillion) came to an end in October 2021, with unemployment expected to rise. With Biden announced as the winner of the 2020 election, there is an opportunity to reset and use travel and tourism as a means for recovery.

US travel businesses expect increased usage of AI at 61% over the next five years, 57% will introduce Internet of Things, and 25% aim to leverage robotics, according to Euromonitor International’s Voice of the Industry Survey, Travel (April 2020).

Destinations like the Dominican Republic have turned to technology to help reassure visitors that it is safe by arming them with real-time information about COVID cases and deaths, using AI and geolocation. The country also offers COVID insurance package in case travellers fall ill whilst on holiday. Arrivals are down 65% in 2020, but with 1.7 million trips still taken according to the Caribbean Tourism Organisation.

In Argentina, the Imagine Initiative is a very simple but effective idea of a Green Passport, encouraging consumers to track their personal travel impact. It is not inconceivable for the CommonPass health passport to integrate climate impact data in the future, alongside biometrics and digital ID.

Source: Euromonitor International. Note: Baseline forecast; 2019 is the base year (given as 100) for value sales in USD million