A growing online presence, stemming from consumer demand for convenience and expanded product availability of international, indie and direct-to-consumer brands in the past decade, created a growing appetite for information among highly engaged beauty consumers. The digital beauty consumer evolved to not only become knowledge-savvy but also willing to challenge and vocally influence the beauty industry.

Digital disruption was already a transformative force pre-pandemic but will continue to accelerate due to the impact of COVID-19, as the pandemic converted non-digital consumers to digital consumers across markets. Understanding the digital beauty consumer and the evolution of beauty digitalization is paramount among companies in this space.

Rising potential for beauty apps and personalization

Beauty digitalization through apps is an avenue of opportunity beyond the pandemic. Virtual try-ons and consumer reviews will likely increase as substitutes to in-store trial. Almost 60% of global digital beauty consumers used beauty apps in the past 12 months in 2019, compared to 22% of the rest of online consumers, according to Euromonitor International’s Beauty Survey 2019. Beauty integration in apps drives momentum in China and among Southeast Asian markets (e.g. WeChat), but usage is nascent in markets with sizeable beauty e-commerce, such as the US and the UK. Apps that focus on preventative health and self-care and link health with beauty will be more relevant.

Amid tightening consumer spend from the pandemic, choosing the right product reduces the amount spent on multiple, ineffective products. Therefore, personalization will remain relevant among digital beauty consumers who can use digital tools to better understand individual needs and help guide product choice. For example, leveraging selfie analysis through the Skin360 diagnostics app, Neutrogena helps users understand skin type with scores, track changes and receive personalized routine recommendations refined through artificial intelligence (AI) over time. However, these unique selling points are more relevant in a post-lockdown and recovery phase. In the short term, personalization will take a backseat to essentials but is still an opportunity for brands to provide discovery and delight and to serve as a method for differentiation if backed by efficacy.

Beauty brands go live online

Livestreaming is the new frontier of digital engagement in the beauty industry. Similar to the well-known QVC or Homeshopping Network model, beauty products are showcased live, but livestreaming allows for real-time questions and audience feedback.

Additionally, the hosts are typically official brand ambassadors or beauty influencers. In June 2020, JD.com and Kuaishou, a video sharing and livestreaming platform in China, partnered to have key opinion leaders livestream and make short videos to promote Estée Lauder essence and MAC lipsticks, among other products, that were delivered through JD.com. Livestreaming helped solidify the success of beauty in JD.com’s 6.18 shopping festival, given that beauty products ranked among the top three categories on the platform in terms of number of customers. The growth of livestreaming in China in 2019 puts it at the forefront of this new area of digitalization, being the first country to implement rules on livestreaming e-commerce as of July 2020.

North America is another region primed for livestreaming investment. Brands in the Estée Lauder Companies Inc. and L’Oréal Groupe portfolios offered shoppable livestreams on their websites in the US and Canada. Some featured beauty influencers who already had strong ties to the brand and sizeable social media followings. As the beauty industry ramps up for digitalization, investment in livestreaming and digital engagement as a permanent feature of the beauty shopping experience is expected.

Opportunities in men’s grooming

Home seclusion during the pandemic provides opportunities in men’s grooming. Growing social media selfie culture and YouTube influencers are encouraging men to break norms and adopt cosmetic beauty routines to varying extents worldwide. However, the disparity of in-store male-centered color cosmetics options in most markets outside Asia Pacific pushes them to online channels.

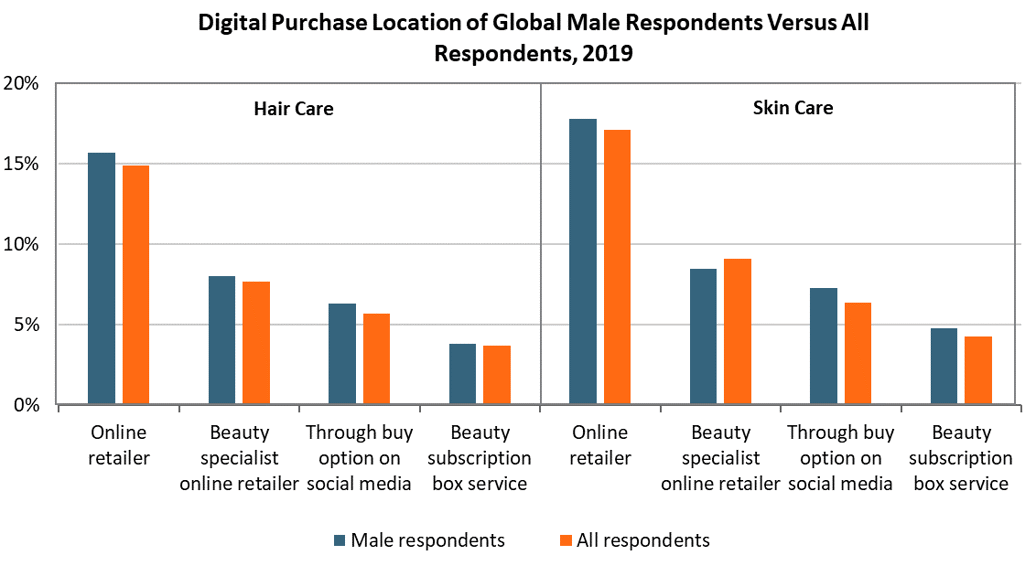

The preference for digital purchase locations among men is most pronounced in color cosmetics, whereas men trend with the buying habits of total respondents for hair care and skincare. Men’s grooming brands are aptly positioned to leverage digital to target consumers with products that suit them from the comfort and privacy of their homes and reduce time spent in stores.

Source: Euromonitor International’s Beauty Survey 2019

This digital beauty consumer segment will continue to grow in both size and influence as more shoppers rely on digital for beauty and personal care purchases, discovery and education during the COVID-19 pandemic and in the long term. Changes in the demographics of digital beauty consumers also create opportunities for beauty and personal care brands to establish and grow digital engagement with different consumer groups.