Euromonitor International ran a digital event for Europe, Middle East, Africa and India on 9 July. We presented our latest travel research to help destinations and travel brands as they start the long process of recovery post Coronavirus (COVID-19).

Here are the responses to the questions asked during the Q&A section of the event.

Do you have recovery times for Africa? Its tourism supply looks very different to that of the Middle East?

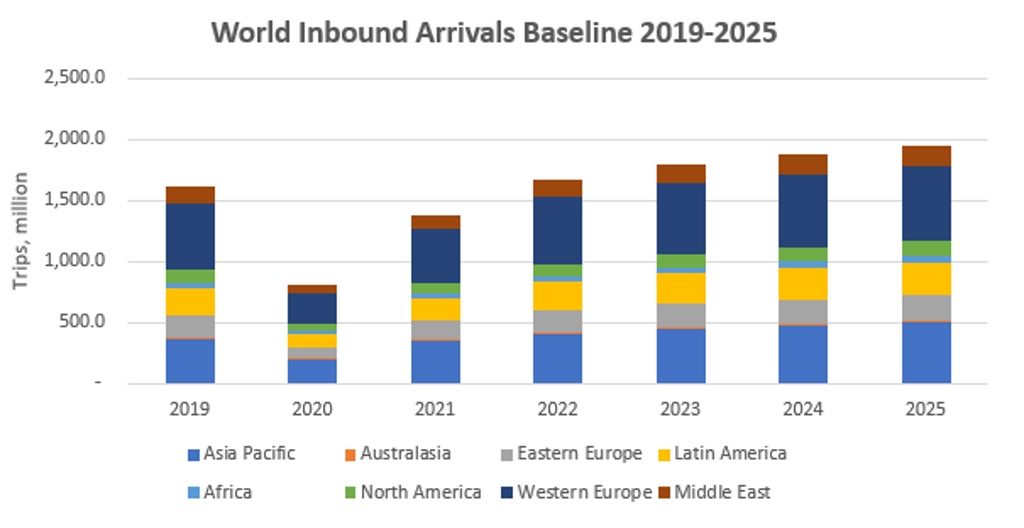

The Middle East is forecast to experience one of the sharpest declines in tourism demand in 2020 as a result of COVID-19 and travel restrictions, with a predicted fall of -52% for arrivals to the region. While tourism demand in Africa is predicted to fall by -46% this year.

Recovery times will be slower for Africa, however, taking a minimum five years to recover, compared to four years for the Middle East. Africa was one of the last regions to be hit, and due to the lack of healthcare, the high levels of poverty and inequality, its recovery post-crisis may be inhibited, exacerbated by the recession.

Source: Euromonitor International

Do you see any movements happening from Europe and the US to India in the next 12 months?

India is one of the worst-hit countries by COVID-19 and flights to India were suspended until 31 July. Our Travel Forecast Model predicts that arrivals to India will drop by 45% in 2020, with a strong rebound in 2021 of 65%, with recovery to pre-crisis 2019 levels expected within three years. US arrivals to India are forecast to drop by -51%, compared to -49% for key European source markets in 2020.

There is a strong Indian diaspora that will help drive the visiting friends and relatives (VFR) market, along with the very strong domestic market. Luxury and upscale hotels will lose out to mid-market hotels in the short to midterm, as value for money becomes paramount.

How is business travel expected to recover over the next 2-3 years? Will it be like leisure or slower?

On a global level, the impact of COVID-19 has hit business travel harder, with receipts forecast to be down -52% vs -50% for leisure receipts in 2020, with both segments expected to recover by 2022, within three years. However, on a regional level, there are some sharp differences, with Western Europe business receipts expected to decline by a staggering -62% in 2020, as Europe closed its borders, halted international travel and conferences went virtual; a trend that is expected to remain in the midterm.

It is great to see that sustainability is a priority for consumers and businesses in the 'new normal'. Do you have more data you can share?

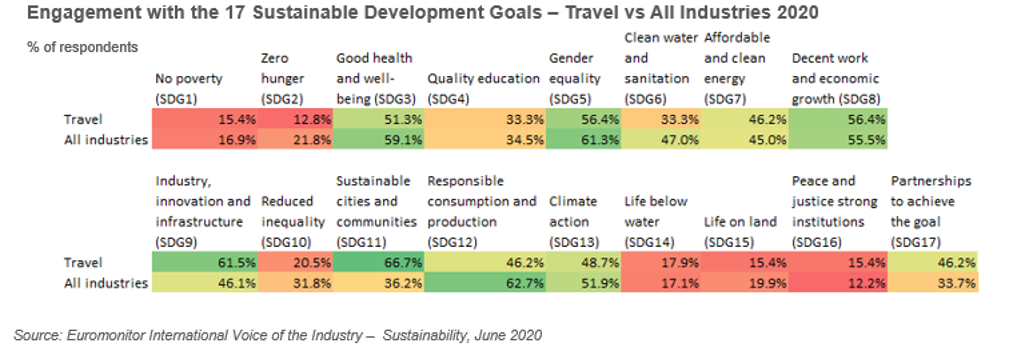

According to Euromonitor’s latest Voice of Industry – Sustainability (June 2020), we are seeing strong engagement with the Sustainable Development Goals by the travel industry, 50.4% compared to 48% for all industries. However, there are signs that travel is trailing in other areas such as leadership commitment to sustainability, with only 14% of CEOs being climate activists compared 21% of all industries. There are also strong indications (43%) that investment in innovation and NPD in sustainability are being rolled back post-pandemic, whereas this should be regarded as a vehicle for recovery and future resilience.

Euromonitor predicts that the Chinese outbound market will recover more quickly than others. Is this because they are more curious or less risk-averse? How can the Chinese market contribute to #BuildBackBetter?

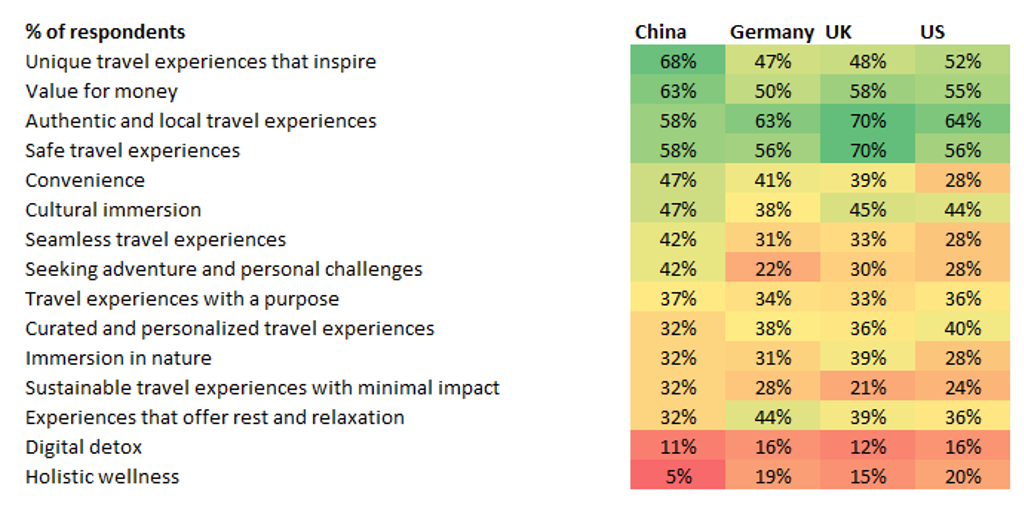

Based on Euromonitor International’s Voice of Industry Travel Survey (April 2020), Chinese consumers showed less interest in safe destinations than other key source markets like the US, Germany and the UK where it was in their top two priorities.

This suggests that the Chinese market is more resilient, supported by a high desire to travel, especially for unique and local experiences (travel restrictions permitting). Despite localised flare-ups of COVID-19, China is expected to be ahead of the curve in terms of demand recovery as it was first to enter the crisis, and our Travel Forecast Model forecasts a decline of -52% for outbound trips, compared to domestic falling by -32% in 2020, with faster recovery for the outbound market once the go-ahead is given for international travel.

China shows a much stronger interest in sustainable travel experiences or travel with a purpose (68%), compared to Germany (63%) and the UK (55%), respectively. This is an opportune moment for China’s leading travel players with global reach, such as Ctrip, to drive a sustainable, digital recovery.

Preferred Travel Destination Attributes by Key Source Markets 2020

Source: Euromonitor International Voice of Industry Survey – Travel (April 2020)

How can we adapt to the new trends in travel and tourism after COVID-19?

The travel industry is going through a massive period of disruption where some sectors may never revert to pre-crisis levels, such as MICE travel or even cruise. For mature regions like Western Europe, the recovery will be slow and painful, compounded by the global recession.

There is now a once in a lifetime opportunity to take stock, think more strategically, to build greater resilience, tackle the challenges ahead based on a system that is fair and equitable – which we already have the blueprint for through the UN’s Sustainable Development Goals – and leave no-one behind.

For travel SMEs and destinations, that means getting up to speed with post-pandemic trends: the shift from sustainability to purpose, the new normal: what’s here to say, the new experiential consumer and hometainment, wellness redefined, innovation the new core, and where and how consumers shop. Working in partnership is another way that travel businesses are pulling together to come out the other side, as seen with even Google and Apple data sharing to help the pandemic efforts.

For Egypt, how should we adapt marketing policies to promote travel and tourism?

Egypt has seen flights restart from 1 July 2020 which is a first step. There is a strong luxury and upscale positioning for Egypt, popular with groups and couples, however, families have shown impressive growth and would be a good target.

Adapting marketing campaigns to match different priorities is critical across key source markets, promoting safety to the UK, compared to authentic experiences for Germany and the importance of leaving a positive impact for Saudi Arabia, these countries being the main source countries of tourism demand.

Which market segments do you expect to recover quicker?

Domestic markets are expected to recover first followed by intra-regional and finally international tourism. Destinations with a strong focus on beach, nature, adventure, and wellness are gaining in popularity. Based on Google search data, beach, camping, staycations, luxury travel and Airbnb rentals are all performing well, whilst trekking, spa breaks, eco-lodges and safari are showing recovery, compared to all-inclusive, package holidays and cruise that are still way below pre-crisis levels. World sales of campsites are expected to fall by -35%, less impacted than hotels (-43%) or short-term rentals (-40%), according to Euromonitor’s latest Travel 2021 research edition.

To learn more about the future of travel, access the report "Future of Travel 2040".