With consumers’ dietary preferences continuously evolving it has always been important for those in the food industry to keep track of what is trending and how to position products. The rise of e-commerce, accelerated by Coronavirus (COVID-19), has also made food claims more visible to consumers; Euromonitor International’s Digital Consumer Survey reveals that 48% of global respondents typically purchase food and beverages online via computer, smartphone, tablets or other devices.

But whilst some food claims are a matter of marketing, others require longer-term investment and a broader strategy to be effective. We look at the top five strategies that food companies are using to boost their longer-term growth using product claims.

1. Become better-for-you

Selling healthier food has been a pillar of growth for many food companies over the past few decades. Nestlé, for example, has very much set the tone for the industry by aiming to provide healthier and more nutritious products within its portfolio. Food companies such as Nestlé have invested heavily in healthier products by exploring ways to add more vegetables, fibre and wholegrains whilst reducing the amount of sugar, salt and saturated fat. The three most prevalent health claims globally in 2019 were No Sugar, Antioxidant and Low Fat according to Euromonitor International’s Product Claims and Positioning database.

Reformulating food whilst matching consumers’ expectations of taste, however, requires time and resources which is why many have sought to fast track their route to becoming a better-for-you company through acquisition. A high-profile example is PepsiCo, which has demonstrated an appetite for acquiring healthier snack brands such as Bare Snacks and Health Warrior.

2. Pivot to plant-based products

A more recent strategy within food claims has been on plant-based products. Despite initial concerns over how COVID-19 might affect consumer demand for this trending set of food claims, sales of plant-based products have seen a further acceleration. This is not only driven by the fact that several slaughterhouses have become coronavirus hot spots, but also because the health and sustainability halos around plant-based products have remained top of mind for consumers.

Leading food players continue to invest in plant-based products in order to seize some of the growth opportunities. Danone, for instance, launched the first plant-based variant of its iconic Activia brand in Europe in 2019. The company also continues to grow brands under its Danone Manifesto Ventures programme such as plant-based brand Forager which builds on cashew milk in its formula.

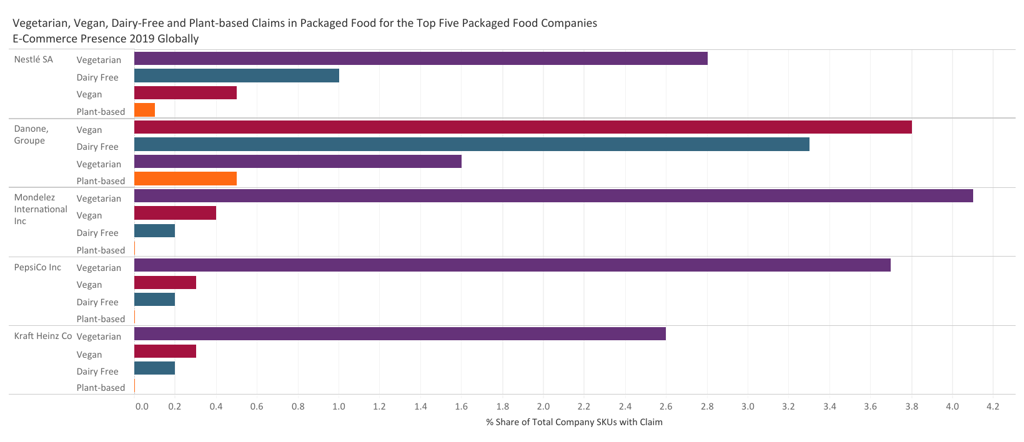

Nestlé also made further inroads into meat substitutes with its Garden Gourmet Sensational Burger and veggie mince in Europe and its Awesome Burger under Sweet Earth in the US. The product claim landscape differs significantly between leading markets such as the US and Western Europe and companies need to ensure that they select the right positioning for new product launches to resonate with local consumers. While the prevalence of Vegan versus Vegetarian claims differs considerably across those markets, plant-based appears to be an emerging claim to watch out for in the future.

Source: Euromonitor International

3. Nourish the natural movement

The natural movement, often referred to as ‘clean labelling’ by the industry, is a concept that refers to shorter ingredient lists, the removal of ‘artificial’ ingredients and their substitution with more natural ones that consumers feel familiar with. Over time consumers have increasingly taken an interest in the composition and nutritional information of the food they eat.

In order to meet the demand for more transparency, leading food companies have innovated and reformulated their products to appeal to those looking to eat simpler foods. Nestlé, for example, launched its new Nesquik All Natural in Europe in 2019, using less sugar and containing only five natural ingredients.

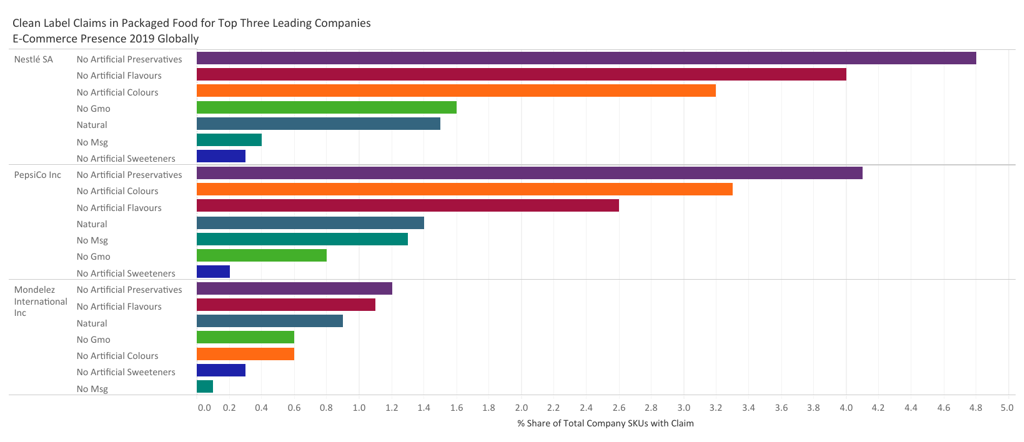

In 2019, No Artificial Preservatives, Natural and No GMO were the most prevalent clean label claims made on packaged food products available globally through the e-commerce channel. Natural is among the product claims that resonate well with today’s consumers. The penetration of the Natural claim was highest in sweet spreads in 2019 with a digital share of shelf of 7.9% globally, followed by dairy and savoury snacks.

Source: Euromonitor International

4. Support sustainable sourcing schemes

Sustainable and fair sourcing has become another hotbed for product claims in the food arena, particularly as companies decide on whether to build their own sustainable sourcing scheme or adopt an independent third-party label. Mondelez, for instance, turned its back on the Fairtrade label for its Cadbury Dairy Milk and launched a non-Fairtrade edition of its Green & Black’s chocolate in recent years.

In addition, Nestlé announced in mid-2020 that it would drop the Fairtrade label for its Kit Kat products in the UK and Ireland. In the UK Kit Kat ranked among the top five chocolate confectionery brands with a Fairtrade claim available through e-commerce in 2019, alongside Cadbury, Green & Black’s and Divine.

While sustainable sourcing remains a key topic for increasingly conscious consumers, Nestlé is banking on its in-house cocoa plan scheme certified by the Rainforest Alliance moving forward.

5. Repeat the reduce, reuse, recycle mantra

Sustainable packaging has become a key aspect of wider sustainability goals for leading food companies. Investment in solutions to reduce the use of plastic, develop recyclable, compostable or biodegradable packaging and to support a circular economy continue to increase.

PepsiCo, for example, promised to phase out all plastic packaging for its Bubly brand in 2020 and to transition to 100% recycled PET for its LifeWTR brand in the US. Recycled PET is a product claim that is expected to gain traction in the years to come with other companies such as Danone committed to make its Evian bottles 100% recycled PET by 2025.

Elsewhere, Nestlé has moved its Yes! bar, Nesquik All Natural and Smarties sharing block to recyclable paper wrappers. This new packaging is made from a coated paper that is sustainably sourced and widely recyclable.

Conscious consumerism’s rise creates opportunities

Leading food companies need to align product claims with their corporate goals, but they also need to ensure that those claims resonate with local consumers. The penetration of healthy, clean and ethical labels still remains low in most packaged food categories. This provides room for food companies to put a stronger emphasis on product claims related to healthy and plant-based eating, natural ingredients, sustainable sourcing and packaging.