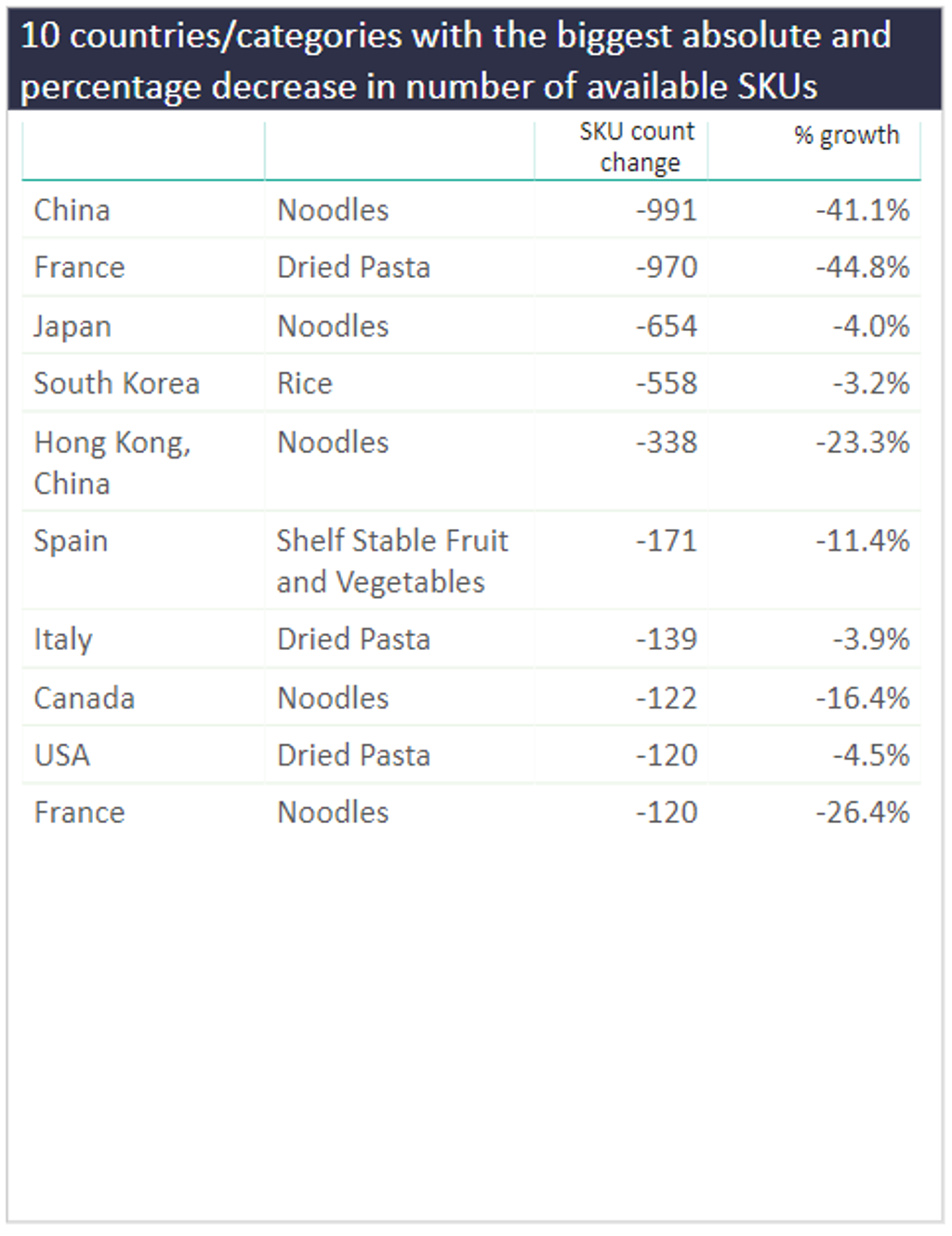

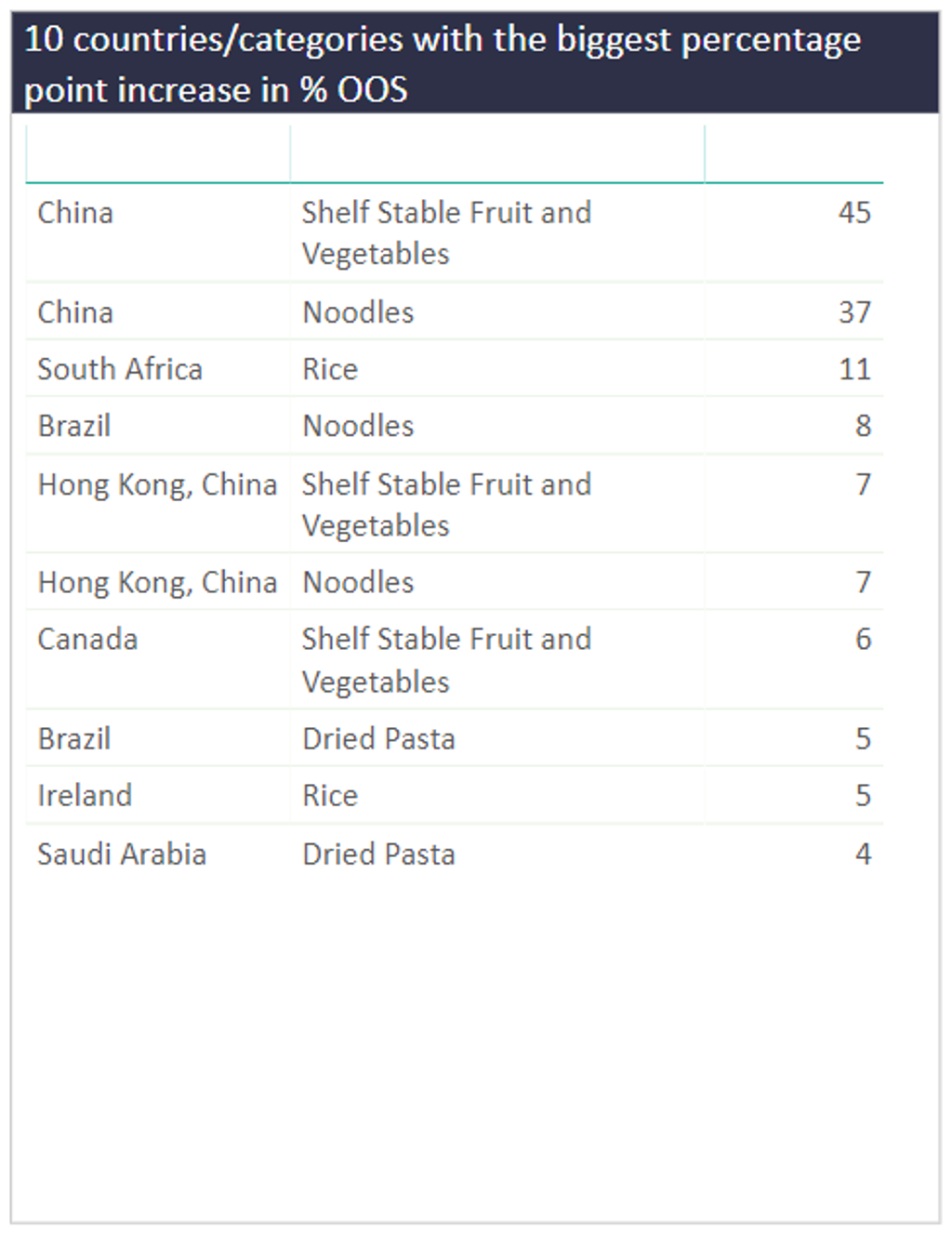

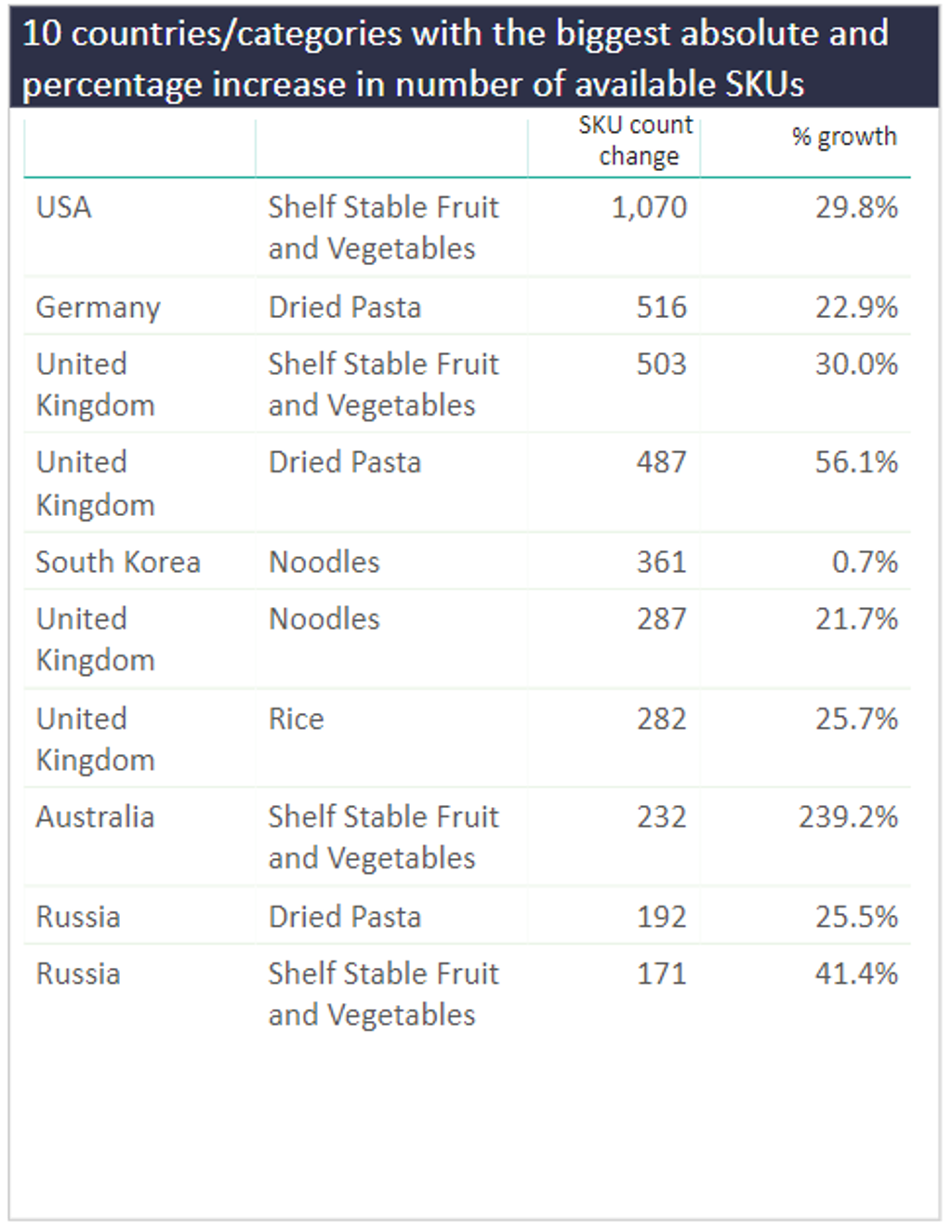

From July 18 through August 1, staple food categories were most visible in our top 10 rankings. Shelf-stable fruit and vegetables in China saw the highest percentage point increase in out of stock rate (OOS%) for packaged food whilst noodles in China saw the largest absolute decrease in available online SKUs and the second-biggest increase in OOS% during the same period.

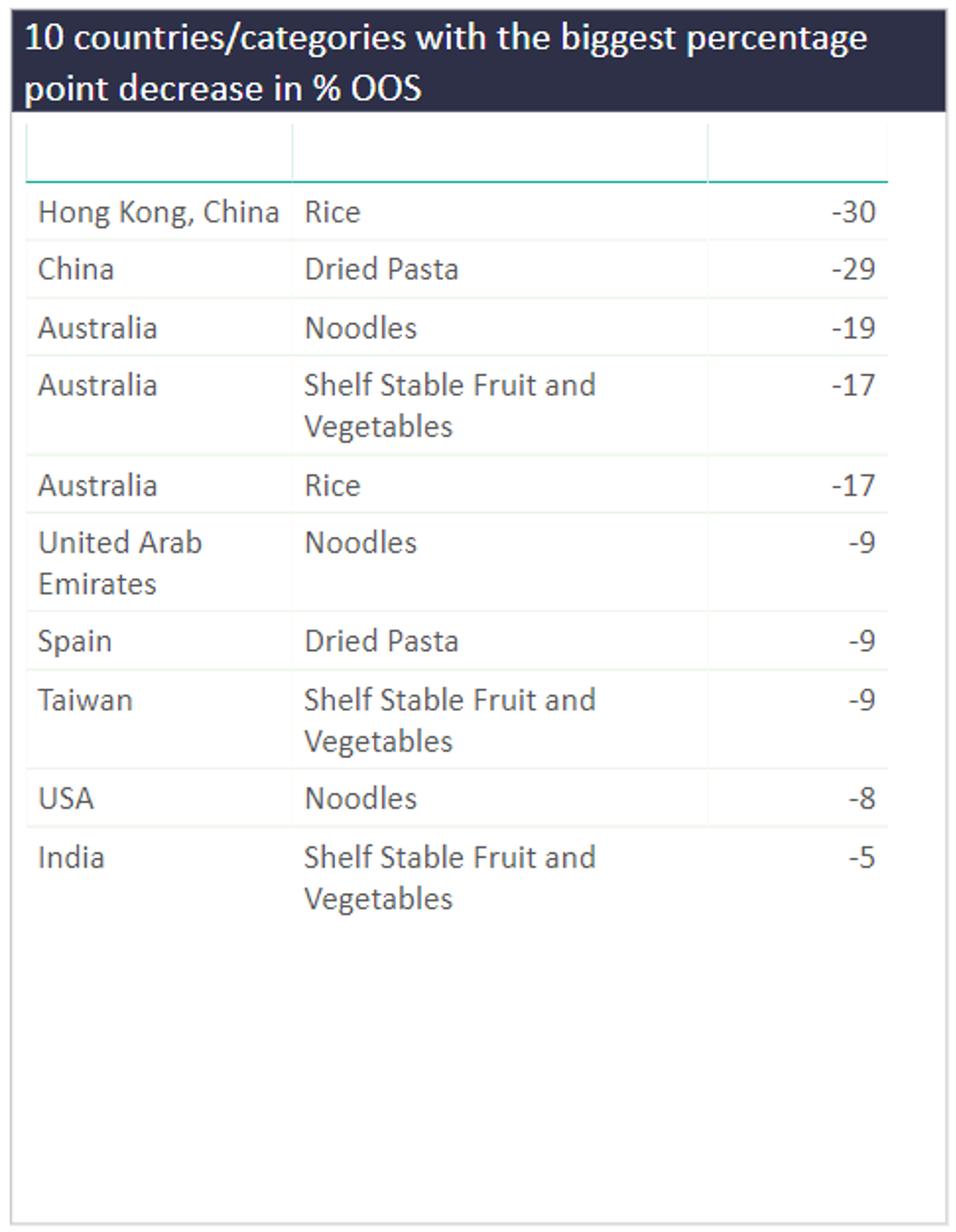

Availability of staple food categories (noodles, dried pasta, rice and shelf-stable food and vegetables) are coming under increased pressure globally.

The UK appeared in 4 of the top 10 countries/categories with the biggest absolute increase in number of available SKUs (noodles, dried pasta, rice and shelf-stable food and vegetables) indicating that the UK is not facing the same struggles with staple food categories as other countries.

Australia also had a strong 2-week period with 3 of the top 10 countries/categories with the biggest percentage point decrease in OOS% (noodles, shelf-stable fruit and vegetables and rice).

Getting product assortment and availability right is challenging at the best of times. The coronavirus (COVID-19) pandemic has had an unprecedented impact on consumer markets worldwide, with many people working from home or unable to leave their homes.

Many consumers have turned to online shopping as the best way to minimise the risk of infection, and the pandemic also saw many consumers engaging in stockpiling behaviour which is leading to significant product shortages. In turn, this places a tremendous burden on e-commerce retailers’ supply chains and logistical infrastructure.

Some markets have been more resilient than others or already had more robust e-commerce networks in place. Looking at a snapshot of out of stock and SKU availability gives you a view of how different markets are handling the challenges that the pandemic has brought to online retailing.

When tracking product availability, it is important to track both out of stock % and number of available SKUs as they result in two very different shopping experiences. To deal with increased demand during the pandemic, some retailers removed SKU pages altogether, reducing the number of available SKUs instead of listing SKUs as out of stock. If out of stock rates are low, but the number of available SKUs is rapidly decreasing, it creates confusion for the shopper to see SKUs being removed without notification. On the other hand, if out of stock rates are high but the number of SKUs remains stable, then shoppers are more informed about the overall availability of products on a retailer’s website.

With Euromonitor International’s new global e-commerce product and price monitoring platform, Via, extracting millions of data points every day for standardised cross-comparison quickly reveals what product categories are selling out during key periods of the coronavirus outbreak as well as the dramatic implications these demand drivers are having on online retail pricing for select categories.

Using Via, we were able to quickly and easily examine more than 20 million daily SKU observations across leading e-commerce retailers in 40 countries. Moreover, the data clearly shows how the availability of selected categories and their pricing dynamics has changed during this period. Use our Coronavirus: Pricing and Availability Tracker to learn more.