A version of this article originally appeared in the Sports Nutrition Innovation digital issue of Natural Products Insider.

Evolving health trends continue to influence consumption patterns within nearly every food and beverage category. One of the biggest testaments to this is the explosive popularity of performance energy drinks. This emerging beverage segment provides manufacturers with new opportunities to expand but also poses a threat to well-established categories, particularly sports drinks.

In the short to mid-term, the COVID-19 pandemic will lead to stagnating growth of performance energy due to shifting consumer habits. Sports drinks are expected to outperform previous estimates as immediate health concerns lead consumers to seek out hydration benefits. Looking ahead, performance energy sales are expected to return to growth as the U.S. begins to recover, while sports drinks will continue to grow past previous expectations.

Bang pioneers the fast-growing performance energy drink segment

Performance energy is a fast-emerging segment within the overall category. Energy drinks include added ingredients, such as B vitamins, taurine, L-carnitine and guarana, that serve as an additional boost to the already-high caffeine content. Performance energy drinks combine aspects of energy drinks, sports drinks and workout supplements. These beverages contain creatine, BCAAs, zero sugar and upwards of 300mg of caffeine—nearly twice the levels of most energy drinks.

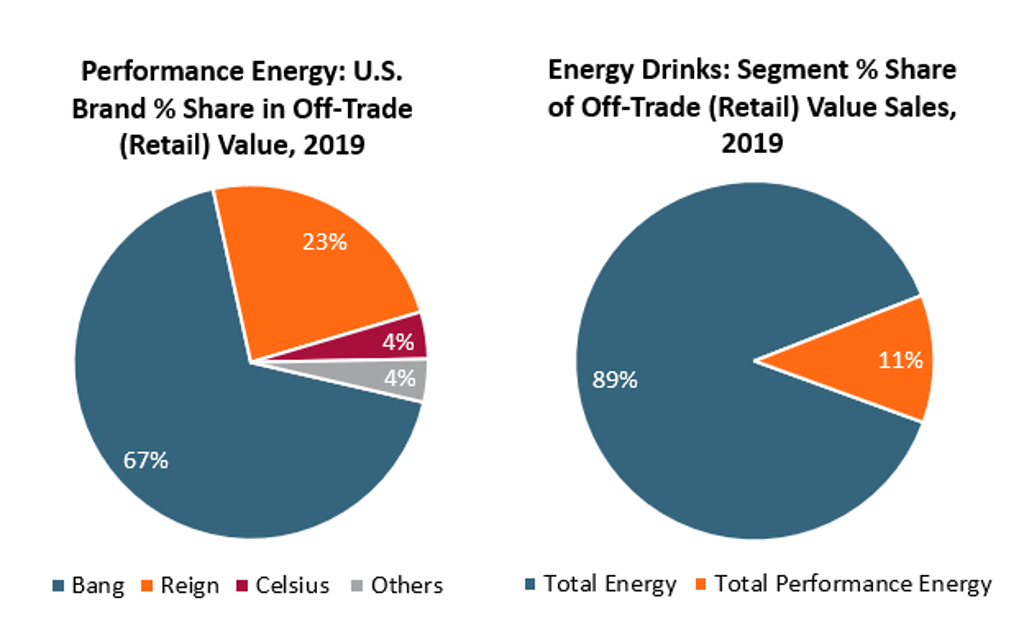

Category leader Bang was one of the earliest market entrants. In early 2018, Bang began expanding retail distribution, mainly through convenience stores, to reach a wider consumer base. Not long after, the performance energy segment exploded in popularity. In 2019, Bang overtook Rockstar to become the third-largest energy drink brand in the U.S., according to Euromonitor International.

Bang’s unprecedented performance and new entrants are driving rapid segment growth, further expanding the broader energy drinks category. As of 2019, the segment had an 11% share of total energy drink sales in the U.S., totaling more than $1.6 billion, according to Euromonitor International.

Source: Euromonitor International

Note: “Performance energy” is not an official category tracked by Euromonitor International. Figures are estimates based on Euromonitor International data.

Sports drinks also expand amid growing health and fitness trend

Sales growth of energy drinks has outpaced sports drinks in the U.S. since 2017, according to Euromonitor International. Now, performance energy brands are direct competitors to sports drinks. Though also benefiting from the growing fitness culture, sports drinks have been unable to keep up due to comparatively limited functionality. Smaller brands boasting high-protein content or natural ingredients are slowly moving the category away from artificial ingredients toward expanded functionality, making them better positioned to compete with performance energy drinks.

Sports drinks manufacturers are looking to the reduced-sugar segment to expand. Until recently, reduced-sugar sports drinks were lagging. One reason is that artificial sweeteners are facing wide consumer skepticism. Reduced-sugar sports drinks were also viewed as less effective at hydrating since electrolytes are produced from salt and sugar. In 2019, however, the segment saw a turnaround, generating retail value sales of $750.9 million and retail volume sales of 540.5 million liters in the U.S., according to Euromonitor International.

Short- and long-term impacts of COVID-19 on sports and energy drinks

Foodservice closures, an economic recession and rapid changes in consumer behavior left many soft drinks categories unevenly affected. Though sports and performance energy drinks appeal to the same consumers, sports drinks are now being looked to for general hydration, which is giving the category a boost.

In addition to bottled water, sports drinks will also remain on a growth trajectory. Based on Euromonitor International estimates, sales are expected to spike in 2020 and remain above forecasted growth through 2024.

Energy drinks, including performance energy, are expected to stagnate this year. However, as the economy recovers and safety restrictions are lifted, the category is expected to also rebound, albeit not completely. Growth will return as Americans fall back into fitness routines, and performance energy will continue to be a driving segment.