Coronavirus (COVID-19) has radically transformed the economic and consumer landscape of Latin America. It has changed the way consumers live, work, and shop. This “new normal” will present packaged food companies with significant challenges but also opportunities for innovation and growth. Although a vaccine in 2021 promises a return to normality, various aspects of consumer behavior will be permanently altered, including where we eat, how much we spend, how we think about health and wellness, and how we view and interact with marketing and publicity.

Consumption shifts to the home with more demand for convenience and home cooking

Travel restrictions, more people working from home, virtual classes, and increased economic precarity have resulted in millions of meal occasions shifting to the home. Breakfasts are relaxed now, with impulse and on-the-go categories such as cereal bars or Starbucks being replaced with more laid-back options like packaged bread, jams and preserves, milk, and instant coffee.

Lunches, meanwhile, have been transformed, with school cafeterias or office cubicles abandoned. The sudden need among families to organise every lunch and dinner at home demands products that save time and that prioritise convenience. For example, frozen ready meals, which quickly solve any meal occasion, have seen double-digit growth rates in Chile during 2020. Cooking at home has also seen a marked increase.

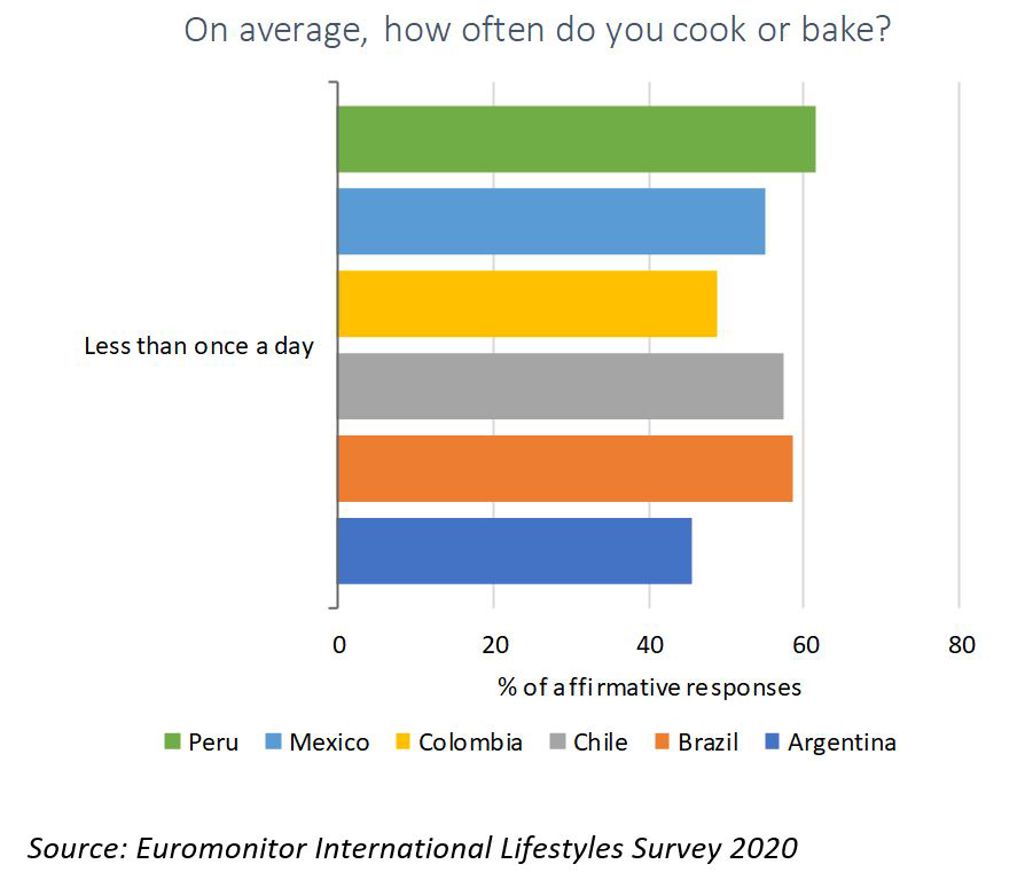

At the beginning of 2020 and before the pandemic, between 45% and 61% of consumers, depending on the country, cooked less than once a day on average in Latin America, according to Euromonitor International’s Lifestyles Survey, fielded in January and February 2020. Lack of knowledge or skills were mentioned as factors. The emerging new normal will present brands with an opportunity to accompany and guide consumers in the process of learning how to cook.

Health is now a more comprehensive concept, involving both mental and physical wellbeing

Consumers are looking for functional food that supports immunity, one of the hottest trends in 2020. Categories that stand out include dairy products (milk and yogurt) and honey. This will also be an opportunity for brands to fortify their products with vitamins D or E. Permissible indulgence has to do with treating oneself, and high-quality chocolate with a healthy touch like a high content of cocoa has benefited.

Health also involves emotional wellbeing. In this sense, consumers and companies are moving from sustainability to purpose. Consumers are trying to help local farmers, small enterprises, and local stores to support their local economy and community, which in turn improves their emotional wellbeing.

Value-for-money becomes key for a region with high levels of poverty

Latin America will experience rising unemployment, going from 10.9% in 2019 to 12.2% in 2020, according to Euromonitor International. The biggest losers of the region will be the lower-middle classes, who are in danger of falling into poverty. Reduced disposable income and increased unemployment mean that many consumers will prefer value-for-money options, such as private label and B brands of major players, which both usually offer a lower price but with good quality. Cuisine & Co from Cencosud is an example of a private label option with a modern positioning that is present in Chile, Argentina, Colombia, and Peru across a vast number of categories. Some brands have also increased options of economical packagings, such as plastic bags for yogurt in Argentina. The number of discounters in the region is expected to grow by 6% in 2020 and by 10% in 2021. Colombia shows a very high development of this channel from which other countries can learn.

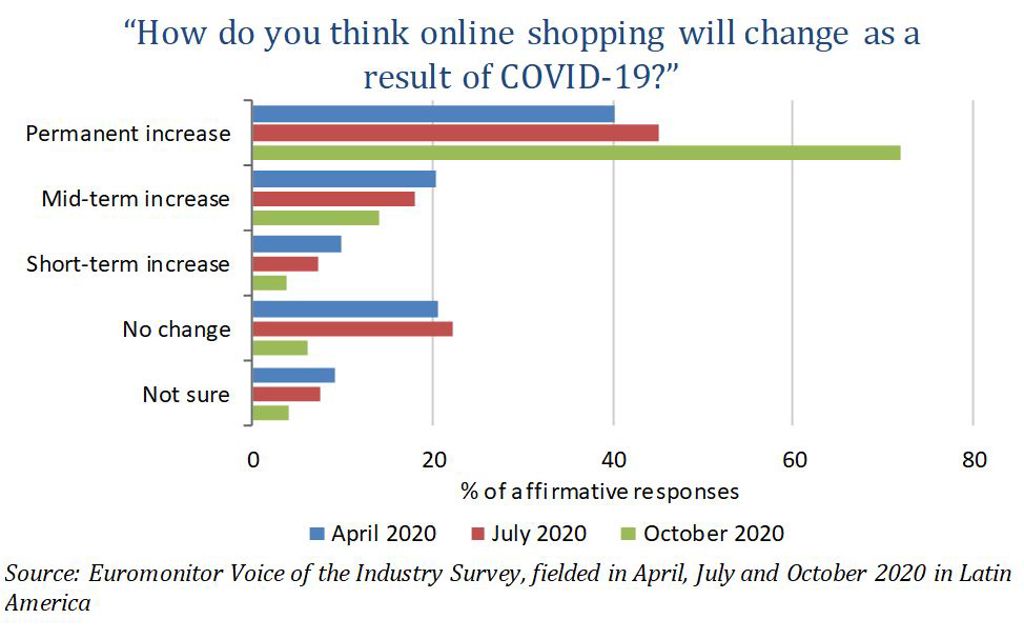

E-commerce in Latin America has expanded more in 2020 than was forecast for the next decade

Consumers increasingly value the ability to shop from home while social distancing and the migration to digital services will only accelerate. The biggest e-commerce company in the region, Mercado Libre, announced that its number of unique active users has grown by 84% in 2020, going from 61.1 million in January-September 2019 to 112.5 million in January-September 2020. Numerous packaged food companies have launched their own direct to consumer e-commerce websites to take advantage of the permanent connection of consumers and their unwillingness to go to physical stores.

Many companies are utilising social networks as one of their main channels of communication with consumers, including not only Facebook and Instagram but also YouTube and TikTok. TikTok, for example, is growing fast in Latin America, especially among younger generations. Nestlé’s recent campaign in support of its cereal Triton via influencers in TikTok in Chile is a good example of this trend.

According to Euromonitor International, Latin America is one of the regions of the world most affected by the pandemic economically, with a decline in real GDP of 8.4% estimated for 2020 in the most probable baseline scenario. Therefore, identifying new export markets will provide opportunities for growth.

If you are interested in knowing about these opportunities in more detail and examples of Latin American companies that illustrate them, you can find the complete report here.