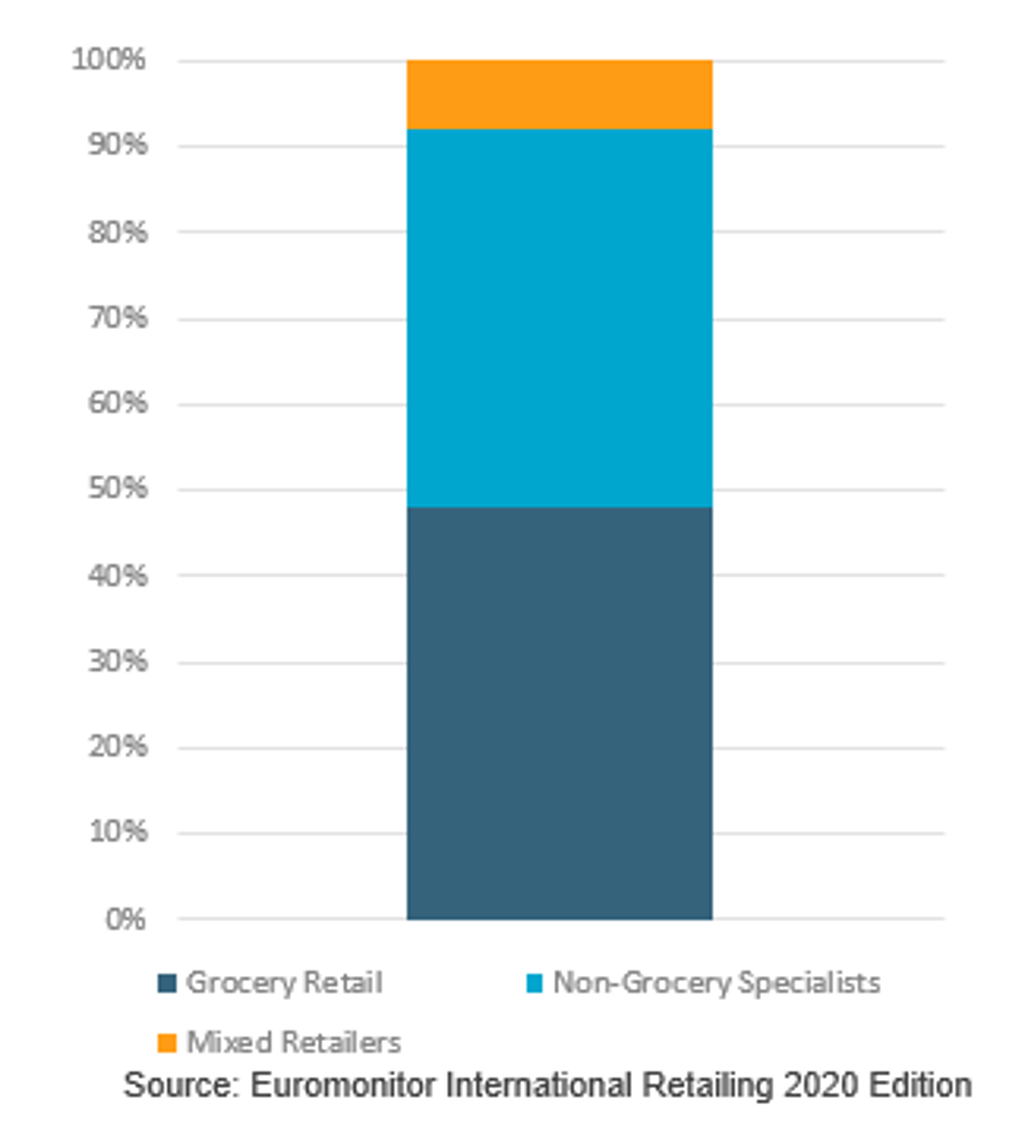

As efforts to mitigate the coronavirus (COVID-19) pandemic intensify globally, all retailers are facing difficult questions about how they can and should serve customers during this time. While grocery retail players are seeing surges in demand and traffic, the situation is playing out quite differently for non-grocery specialists and mixed retailers, which accounted for 52% of all store-based retail sales globally in 2019.

Governments around the world increasingly require non-essential stores to close as part of isolation measures, forcing many specialist retailers to shift their focus to e-commerce, lay off employees and rapidly shift strategies, including from profit to purpose-driven initiatives.

Global Store-Based Retail Value Sales by Type: 2019

Note: Euromonitor International defines non-grocery specialists as retail outlets that sell predominantly non-grocery consumer goods, such as apparel and footwear, consumer electronics and appliances, health and beauty products, home and garden items, and leisure and personal goods items. Mixed retailers refer to department stores, variety stores (including fixed-price retailers), mass merchandisers, and warehouse clubs

Health-focused specialists and grocery-oriented mixed retailers remain open with modifications

Channels including drugstores, chemists/pharmacies, warehouse clubs and mass merchandisers have generally been able to stay open due to their roles as purveyors of food, household essentials, and medications. Many chains in this space are experiencing demand surges for select product categories. Warehouse clubs such as Costco and Sam’s Club, for example, experienced sharply increased store traffic in many markets globally in March 2020 as consumers sought to stock up on key products in anticipation of extended shutdowns.

Many stores that have remained open have introduced new measures to protect shoppers and manage demand, such as Costco and UK-based drugstore Boots, including:

• Reduced opening hours;

• Dedicated shopping hours for the elderly and those with health conditions;

• Limiting the number of shoppers;

• Limiting the quantity of items that a consumer may purchase at one time, and restricting returns on high-demand items;

• Limiting or cancelling services that require employees to be in close contact with shoppers, such as jewellery and optical goods;

• Encouraging consumers to place online orders;

• Temporarily prohibiting the online purchase of non-essential categories to facilitate orders of more critical items;

• Allowing delivery personnel to deliver to mailboxes or other low-contact, secure locations;

• Installing protective visors and glass at check-out counters to protect cashiers and pharmacists;

• Placing stickers on the floor of stores to indicate how far apart shoppers should stay from each other and employees.

Protective Visors Installed at a Boots Location in the UK

Source: Boots

Workers’ conditions and rights in the spotlight

The risk that frontline retail employees face from the pandemic due to their exposure to the public has emerged as a pressing issue. Contractors and employees of grocery delivery services such as Instacart in the US, for example, have pushed for greater rights and protections.

Negative headlines around worker conditions have the potential to be particularly impactful for companies not viewed as essential by the general public. Global vitamins and dietary supplements retailer GNC, for example, has argued that it is an essential business and can, therefore, stay open, even as the company’s employees speak to the media about feeling unsafe continuing to report to work.

This challenge may prove to be particularly acute for brands that built ethics and transparency into their branding. Vertically integrated, digitally-native apparel specialist Everlane is one example. The US-based company was founded around the idea of radical transparency in its operations, supply chain, and treatment of workers. Some of Everlane’s customer experience employees had reportedly been in the process of developing a union when pandemic-related business closures came to the US. Everlane drew negative headlines and customer backlash at the end of March 2020 when news broke that it had laid off most of the employees involved in the prospective union in anticipation of pandemic-related lost revenue.

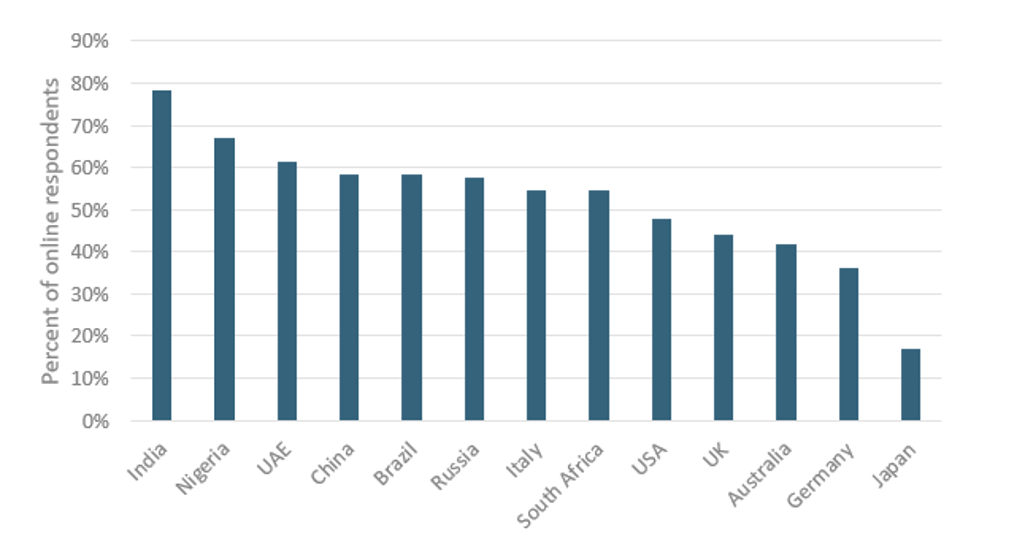

Agree or strongly agree: I only buy from companies and brands that I trust completely

Source: Euromonitor International Lifestyles Survey 2020

Retailers accelerate omnichannel and purpose-driven initiatives

Non-essential retailers, such as department stores, apparel and footwear specialist retailers, and leisure and personal goods specialist retailers, are generally turning to e-commerce and PR to help them weather the crisis:

• PerfectCorp, which makes VR and AR tools for brands to use in its popular YouCam Makeup app, is offering its tools for virtual cosmetics try-ons and training on using VR for brands free until July;

• Social media site Pinterest has continued to launch new merchant features as it works to make its platform a shopping destination. It has rolled out a Verified Merchant program, which allows member brands to upload product listings to be featured in Pins, and added additional improvements to its advertising services.

Many non-essential businesses are turning to charity and community support as ways to keep their employees working and engender goodwill:

• LVMH has famously shifted some of its fragrance facilities to produce hand sanitiser, which it plans to donate to government health entities;

• From luxury to fast fashion, many apparel brands globally are dedicating their factories to producing medical equipment in light of the shortage of medical supplies and weak consumer demand. Kering Group in France and Grupo Inditex in Spain have both announced that they have shifted production from fashion to making medical masks.

Poor sales performance expected in 2020

Virtually every non-grocery specialist and mixed retailer is facing the prospect of poor sales performance in 2020. Many retail companies have announced mass layoffs and furloughs; for example, in late March, non-grocery retailers that announced unpaid furloughs included US department store chain Macy’s and global apparel and footwear specialist retailer Gap Inc. Retailers that have been able to keep their stores open or are seeing substantial e-commerce demand, such as Amazon, have announced their intention to hire thousands of employees to keep up with demand.

Retailers are facing difficult decisions about how to continue their operations in light of the pandemic and ensuing economic crisis. They should ensure that the actions they take are in line with their brand values, and companies operating as non-grocery specialists and mixed retailers should take this time to try new digital tools and channels as a way to reach consumers even though stores are closed. Retailers which adopt these strategies are more likely to emerge from the crisis with stronger foundations for future growth.