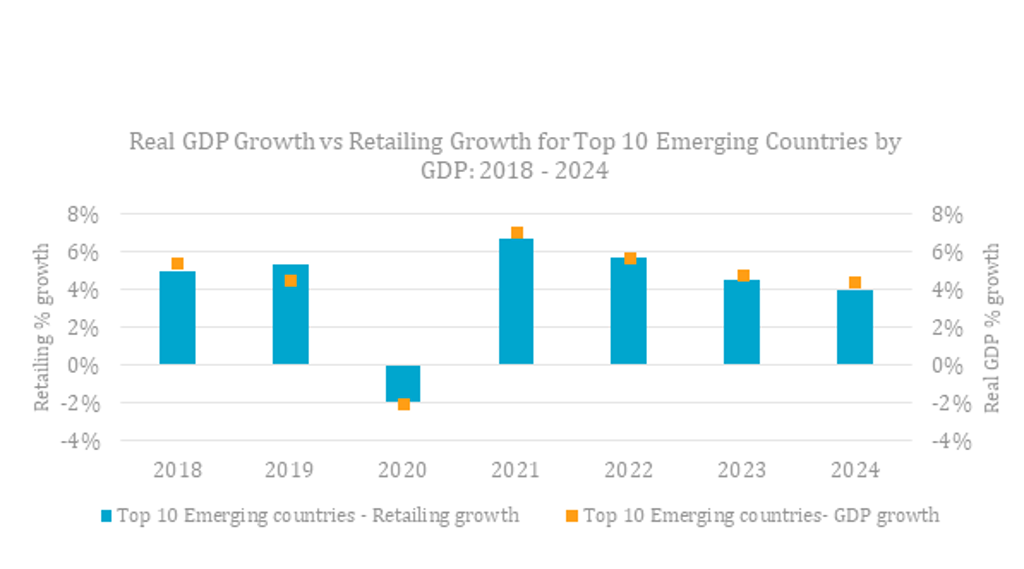

The Coronavirus (COVID-19) pandemic has severely disrupted economic growth across emerging countries in 2020, with a clear impact on retailing. India, for example, is one of the worst-hit economies, with real GDP contracting from 4.2% in 2019 to an expected decline of 5.1% in 2020; this is comparable to the impact on India’s retailing industry (growth of 6.1% at constant prices in 2019 to -5.5% in 2020). Given the limited medical infrastructure in many emerging countries, coupled with the rapid spread of the infection, governments have been forced to implement lockdown measures, with restrictions on consumer mobility causing supply chain disruption and retail store closures.

This has been particularly severe on retailing in countries like India, Brazil and Mexico, due to the pandemic’s high impact on the livelihoods of the substantial population working in the informal sector with low incomes. The pandemic has accelerated declines in already struggling economies like Turkey, Russia and South Africa, and decreasing oil prices have added to the slowdown in emerging countries, particularly in the Middle East and Africa region. In contrast, while China was the first country to see a spike in COVID-19 infections, it is one of the few countries in the world to report positive retailing growth in 2020 due to early containment of the virus and a stronger online retail network.

Source: Euromonitor International from national statistics/Eurostat/OECD/UN/International Monetary Fund (IMF). Note: Countries include China, India, Brazil, Russia, Mexico, Indonesia, Saudi Arabia, Turkey, Poland and Thailand. The countries are chosen based on GDP at 2019 constant USD prices. Retailing growth is calculated for retail value RSP excluding Sales Tax, USD constant 2019 prices

Grocery retail remains insulated as consumers prioritise essentials

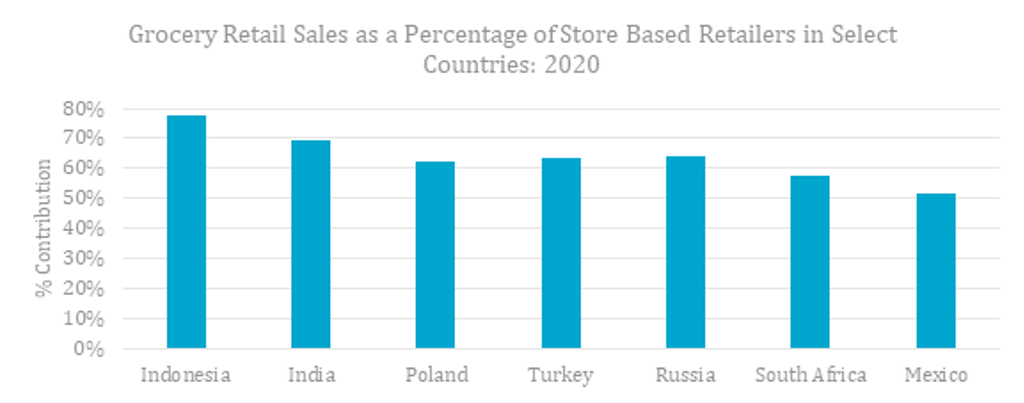

While consumers in emerging countries were increasing their spending’s on discretionary categories prior to the pandemic, the impact of the pandemic has shifted spending back to necessities, which has helped keep grocery retailers comparatively insulated. In many emerging countries, sales through essential outlets like supermarkets and pharmacies were allowed during lockdown, while other stores were completely shut or forced to limit their operations. Furthermore, grocery retailers’ higher contribution to total retailing in emerging countries, compared to that of developed countries, has limited the impact of COVID-19 on the overall retailing industry, to some extent.

Source: Euromonitor International

Even after lockdown, consumers have continued to spend cautiously on non-essential products, due to financial uncertainty and low consumer confidence. Furthermore, travel restrictions and the closure of foodservice outlets has increased dependency on home-cooked food, benefiting grocery retailers. Given the optimistic outlook for the grocery industry in the post-pandemic world, emerging countries offer lucrative expansion opportunities for leading modern grocery retailers compared to other formats. With consumers becoming more value-conscious due to the impact of the global recession on incomes, there are expansion opportunities for modern grocery retailers in highly populated countries like India, Indonesia and Brazil, where modern grocery retailing is still developing.

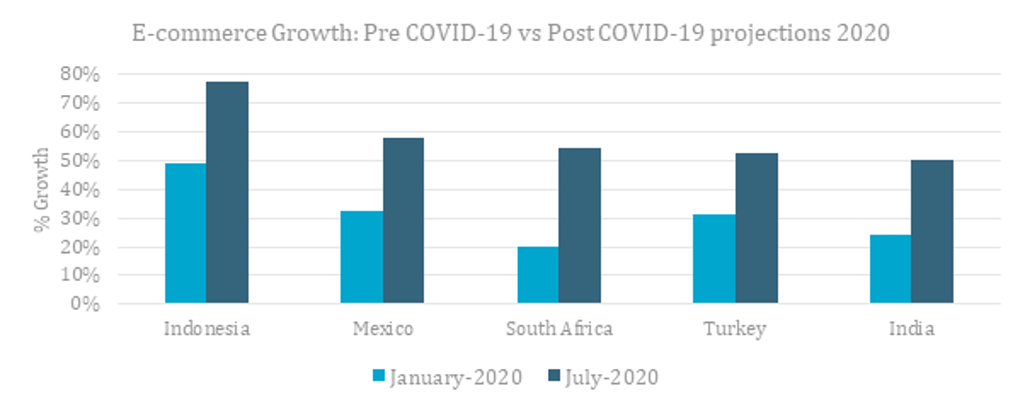

The pandemic has accelerated the shift to e-commerce in emerging countries

Apart from China, which is technologically-advanced compared to other emerging markets, sales through online channels have remained lower in emerging countries given consumers’ limited experience of using technology for shopping and due to poor last-mile delivery infrastructure.

However, with social distancing and home seclusion, a greater number of consumers in emerging countries are turning to online shopping for the first time. With more consumers starting to order online, coupled with reduced visitors to physical stores, leading retailers in emerging countries are being forced to invest in strengthening their online distribution to remain future proof:

• The most prominent development being seeing the increase of partnerships with mobility companies, food delivery aggregators and other third-party delivery companies to address the last mile connectivity issues. Retail partnerships with Swiggy in India, Uber Eats in South Africa and Delivery Club in Russia are some of the notable examples;

• With consumers getting accustomed to use of technology for shopping coupled with the convenience factor of online shopping, a lot of first-time users are expected to develop online shopping into a long-term habit.

Source: Euromonitor International

In more economically-developed nations like China and Poland, brands and retailers have also utilised online broadcasts and live streaming activities to sell non-grocery products. The pandemic has changed the way consumers are shopping and digital will become an important part of retailers’ strategy in the post-pandemic world.

Opportunities for new business models amidst continuing economic uncertainty

As per Euromonitor’s Voice of the Industry Retailing survey fielded in July 2020, 37% of respondents think the effects of the COVID-19 pandemic will decrease the overall revenue of their companies in the next year. However, the pandemic will lead to some long terms shifts in channel preferences; consumers will be reluctant to step out of their homes, especially for non-grocery purchases, and will turn to e-commerce more often than before. Increasing partnerships and investments in the last mile delivery space will be evident in emerging countries, giving rise to new business models.

While the outlook remains positive for grocery retailers, consumers will cut down or trade down while shopping for discretionary items, considering the lower income levels of consumers in emerging countries coupled with continuing economic uncertainty even in 2021.