This article is part of a series on COVID-19 focusing on how the outbreak is affecting industries.

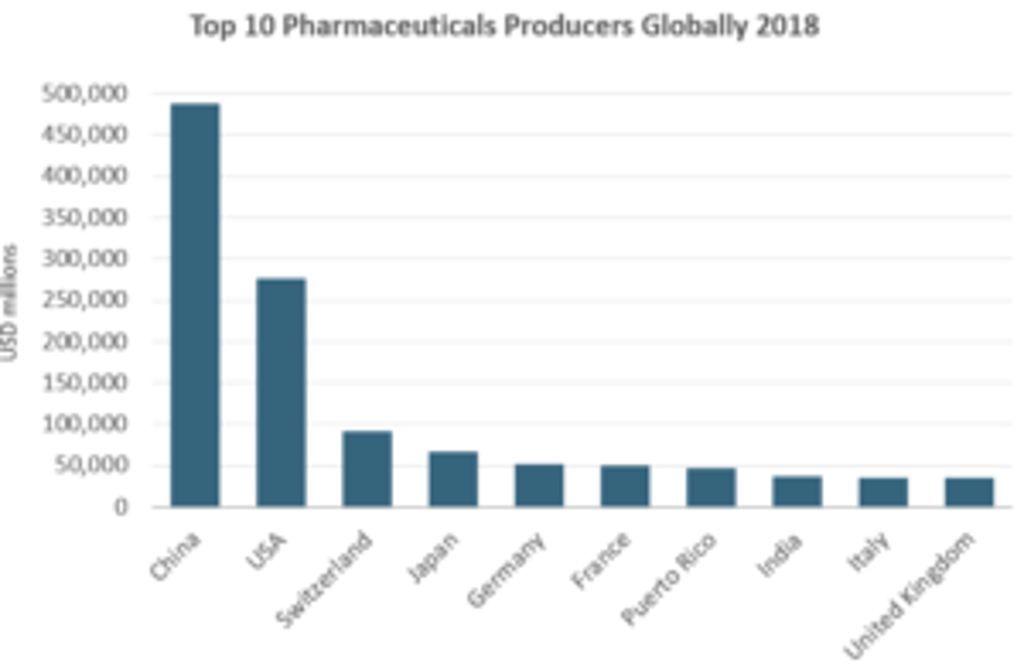

Global pharma producers have been highly dependent on Chinese ingredients since 2013, making coronavirus (COVID-19) a real threat for the commercial world as well as patients around the globe. The value of pharmaceuticals produced in China has been increasing since 2013, both in absolute terms and as a share of total world production. In 2018, China was the largest pharmaceuticals producer in the world responsible for 32.2% of all pharmaceuticals produced globally, up from 26.5% in 2013.

What is more, Chinese producers also managed to increase their pharma exports by 40% over 2013-2018, thus meeting 1.8% of the demand of foreign markets. This seems marginal at first glance, yet is significant, if considering that a major part of Chinese Pharma exports is active pharmaceutical ingredients (APIs) included in numerous lifesaving drugs.

Source: Euromonitor International

Prescription drug shortages expected if the crisis escalates

Supply chain disruptions have not yet manifested as companies usually have significant APIs inventory buffers for just-in-case situations. The inventories might shortly run low though, as the crisis continues:

• This will mainly affect the US, India, Germany, Netherlands and Brazil, as they are the largest export destinations of drugs from China. Despite thorough and precise planning and searches for vital supply alternatives, the impact will most probably be negative at least for the first two quarters of 2020;

• The US Food and Drug Administration (FDA) already reports that supply chain bottlenecks might lead to shortages of no less than 150 prescription drugs, ranging from antibiotics to generic medicines;

• Indian authorities claim a 20-30% rise in the prices of APIs and 301 producers being hurt from ingredient shortages for Mintelukast (asthma), Nimesulide (pain medication), Amoxicillin, Ofloxacin and Chloramphenicol (bacterial infections) and antibiotic Metronidazole - all being essential drugs;

• The supply chain disruptions are very likely to spill over to the rest of the world, as 70% of all APIs used in Indian drug production come from China, and India is responsible for 20% of pharmaceuticals production in volume terms globally.

Source: Euromonitor International

Big and small pharma are looking for COVID-19 treatment opportunities to stop a pandemic

On the other hand, major pharmaceuticals producers remain calm. Pfizer, Johnson & Johnson and Roche claim to diligently monitor supplies and are sure to provide necessary medicines if needed, including critical inventory needs. What is more, the developments in the treatment of COVID-19 might also improve the situation.

The most promising at the moment seems to be Gilead Sciences Inc. experimental drug remdesivir – which was unsuccessfully developed to treat Ebola but shows promising results against diseases like COVID-19. The drug has already been copied by Chinese company BrightGene. The company claims to have mass-produced the active ingredient and will turn it into the generic drug shortly. GlaxoSmithKline has also entered into a collaboration with Chinese biotech Clover Biopharmaceuticals to produce a COVID-19 vaccine. Other major producers like Johnson & Johnson, Moderna, Inovio Pharmaceuticals, Novavvax, etc are also tackling the issue, giving a high chance of overcoming a global pandemic.