The beauty and personal care industry is largely considered recession-proof, but the unique economic, legislative and lifestyle factors surrounding consumption in the current circumstances of the Coronavirus (COVID-19) pandemic pose unprecedented challenges for the industry in 2020 and beyond, as we begin to see inevitable shifts in consumption patterns, channel dynamics and beauty routines. The discretionary nature of many beauty categories makes them especially vulnerable to economic slumps, as well as highly exposed to lockdown measures, selective retail closures and travel restrictions.

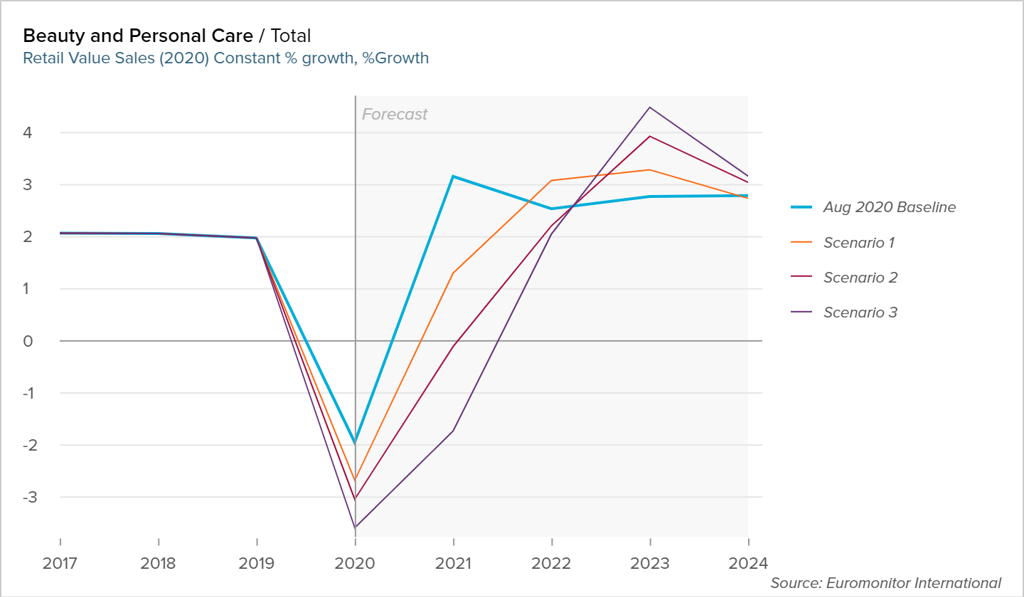

In Euromonitor’s baseline scenario, global beauty and personal care values sales are set to record a decline of 2.0% in constant terms in 2020, compared to 1.9% growth in 2019. Given the ongoing uncertainty with COVID-19, Euromonitor has also presented a series of future scenarios. In Euromonitor’s C19 pessimistic scenario 1, beauty and personal care value sales may decline by 2.7% globally, while scenarios 2 and 3 predict a decline no steeper than 4.0% in 2020.

Source: Euromonitor International’s Beauty and Personal Care Forecast Dashboard: Last updated 8 August 2020

Note:

Baseline: The latest annual forecast data based on a quarterly review.

Scenario 1: A more pessimistic outline than the baseline based on potential pandemic and related economic adversity, where there is a major second global pandemic wave in 2020, followed by a possible third wave in 2021

Scenario 2: A more pessimistic outline than Scenario 1 based on potential pandemic and related economic adversity, where there is a more significant second global pandemic wave in 2020 compared to the pessimistic 1 scenario, followed by a third and possible fourth wave in 2021, and large scale distribution of an effective COVID-19 vaccine or treatment is delayed into 2022-2023.

Scenario 3: A more pessimistic outline than Scenario 1 and 2 based on potential pandemic and related economic adversity where there are 3-5 global pandemic waves in 2020-2022 and large-scale distribution of an effective COVID-19 vaccine or treatment is delayed into 2022-2023.

Post-pandemic: Which trends will persist?

Many of the trends that were influencing the beauty and personal care industry in 2019 will be amplified in 2020, and beyond this:

• The COVID-19 pandemic is accelerating all wellness-related micro-trends, with the basic principles of health and keeping diseases at bay as a core priority. The “clean” to “conscious” movement will be reinforced, as consumers recognise that natural does not necessarily translate as better, and rather than dismissing entire ingredient groups will opt for a more considered and personalised approach to treating their skin concerns. Consumers will be searching for brands or products with a strong alignment to health, safety, immunity, therapeutics and an association with overall wellness.

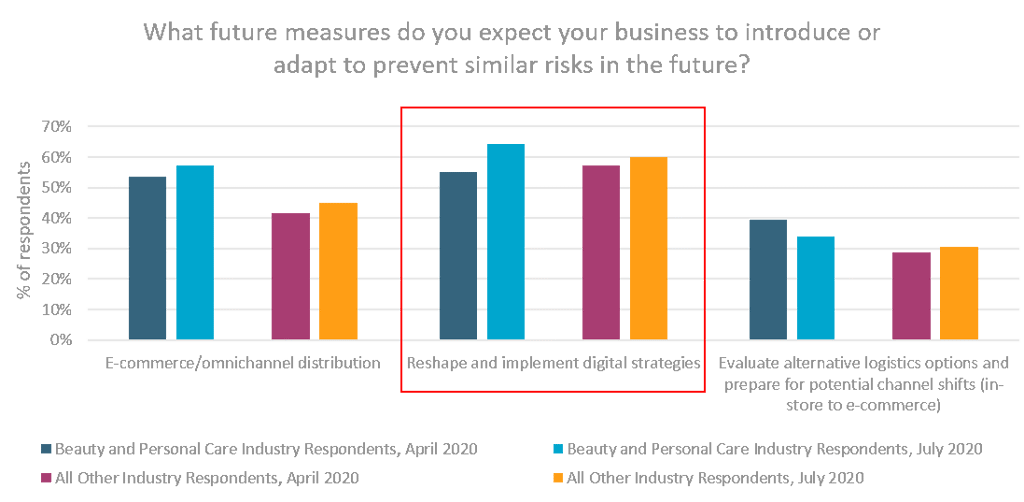

• Additionally, channel diversification and digital engagement will be more important than ever. Existing e-commerce disruption has prepared beauty players for a more permanent shift to this channel, with e-commerce sales in beauty and personal care growing by a 19% CAGR over 2014-2019, supported by an acceleration in digital tools that offset in-store sensorial trial. Beauty players should aim to build better virtual experiences while cementing new points of sale within social networks and live streaming. The shift to digital should also be seen as a longer-term opportunity to create online platforms and communities for product discovery, advice and sharing at a time of heightened uncertainty, insecurity and anxiety.

Source: Euromonitor International’s Voice of the Industry: Coronavirus Survey, April 2020, July 2020

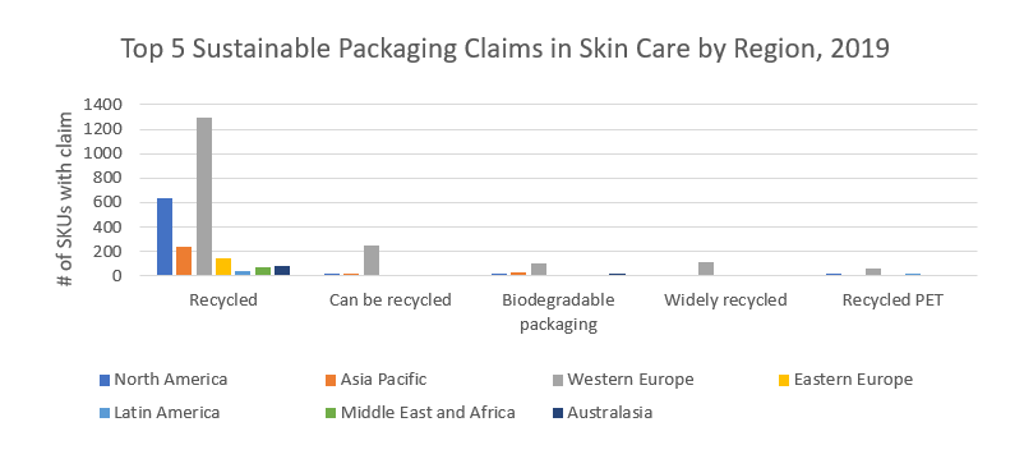

• Lastly, the transition from sustainability to purpose will be a long-term change. The factors that were driving sustainability pre-pandemic are still present, but now sustainability is shifting so that purpose is the key part of corporate strategy. In the immediate outbreak, the beauty industry responded swiftly by repurposing operations to meet the global shortage of hand sanitiser. Sustainability will evolve in importance for beauty players while putting people over profit will rank high among consumers’ expectations for the beauty industry. Brands will be expected to display greater transparency across their entire supply chain, as consumers prioritise credentials such as safety, transparency and ethical sourcing.

Source: Euromonitor International Product Claims and Positioning, 2019

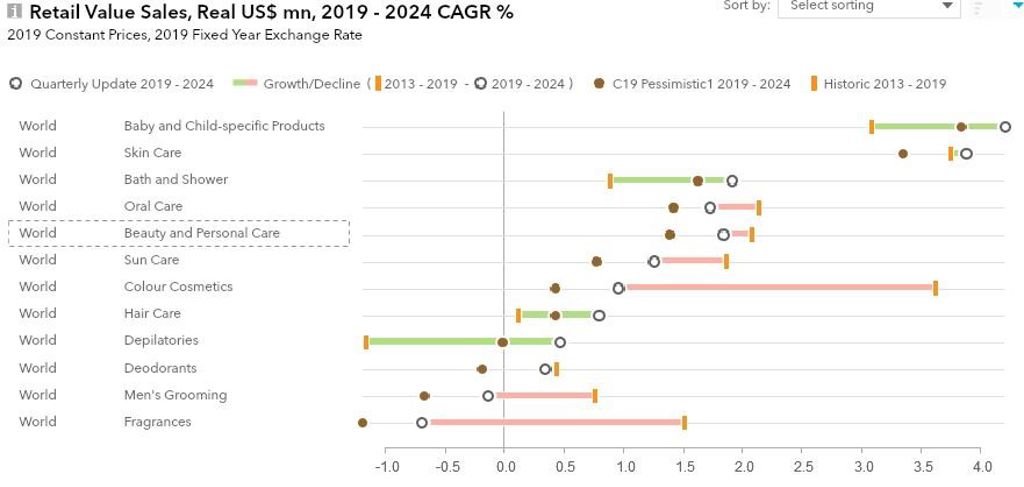

Beyond 2020

Asia Pacific will continue to be a bright spot for the industry, due to the region’s systematically better response to the pandemic. It is expected to recover ahead of other regions. However, a slower global recovery is expected due to potential for a second wave, with projections of global beauty and personal care value sales growing 1.5% CAGR from 2019 to 2024, at constant 2019 prices. These forecasts are a U-turn from the industry’s 2014-2019 CAGR of 5.0% globally.

Source: Euromonitor International’s Industry Forecast Model: Last updated August 24, 2020

Overall, all FMCG industries have been negatively impacted by the pandemic, but beauty and personal care have shown it is relatively more resilient than other non-essential FMCG. Beauty and personal care will be less impacted, as e-commerce will soften the blow. Beauty players must consider how to navigate the “new normal” in a frequently changing environment.