The global fashion industry declined by 18% at current prices in 2020, in contrast to 2% originally forecast prior to the pandemic, according to Euromonitor International. There is no question that 2020 has radically changed the face of fashion and consumer shopping habits. Now we are well into the 2021 earning season, when public companies are releasing their fiscal year reports and looking at revising their business plans, and it is time to embrace a degree of optimism. We have identified five key trends facing fashion as companies move beyond the pandemic and rise to the challenge of bouncing back stronger in 2021 and beyond.

Fashion to account for nearly 10% of absolute growth in retail e-commerce sales 2020-2025

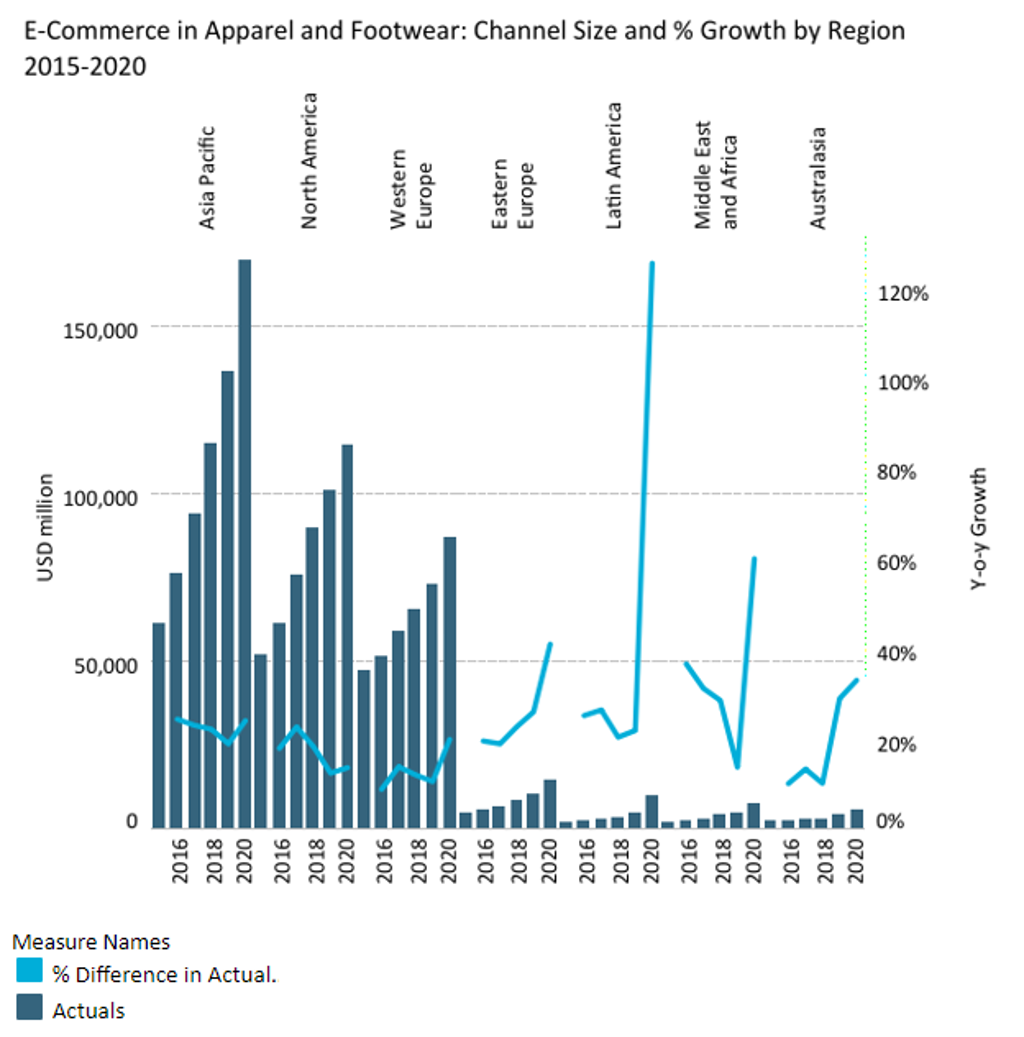

In time, we will look back at 2020 as the moment of challenges, but also progress. Nowhere else has seen the unprecedented growth that has transpired in the digital and e-commerce space, amid the Coronavirus (COVID-19) crisis. In 2020, 16% of all consumer goods were bought online, according to Euromonitor International, more than double that in 2015. It is not surprising to see the surge in online spending in fashion with non-essential stores subject to restrictions or closed to the public during long periods of lockdown. The full-year sales growth of Europe's biggest online-only fashion retailer, Zalando, provides a good example. Its net sales jumped 23% to a new record high of EUR8 billion in fiscal 2020. Euromonitor International’s findings show the strong uptake of e-commerce across regions in apparel and footwear, with consumers in emerging economies in Latin America, Middle East and Africa and Eastern Europe making the greatest shift to online shopping. But the story is really far from over. Over 50% of absolute growth in global retail over the forecast period 2020 to 2025 will come from sales in e-commerce. Within this, almost 10% of e-commerce sales will account for fashion over the same period. This is a significant shift in retail that will create new challenges and opportunities for fashion retailers and brands.

Source: Euromonitor International

Fashion purchases shift to loungewear as remote working becomes a permanent change

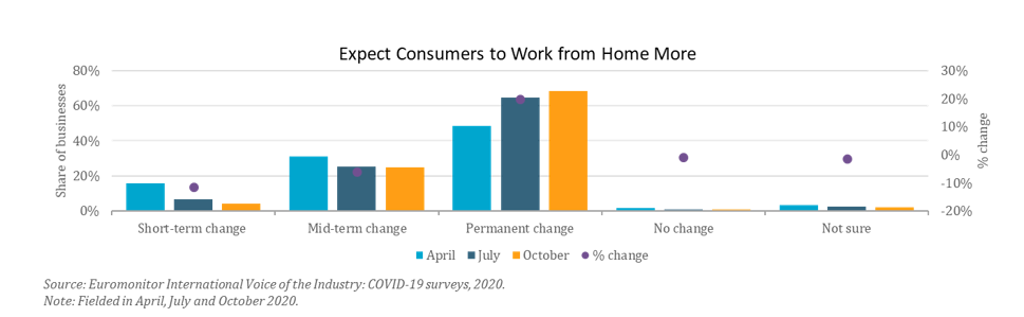

One of the most prominent changes arising from the pandemic is the shift to working from home. Almost two-thirds of survey respondents in October 2020 expect a permanent shift to some form of working from home for many office-based jobs, an increase of 20% compared to comparable survey results in April 2020 (Voice of the Industry: COVID-19 Survey, 2020). With more consumers working from home on a regular basis, consumer behaviour has changed significantly, where fashion purchases have shifted to buying more loungewear and home wear, such as Levi’s that launched its first-ever collection of bed linens and tableware with Target in the US in 2020. As remote working is likely here to stay beyond the pandemic, especially in North America and Europe, there will be more opportunities for fashion companies to diversify into different categories, including loungewear, homeware and small furnishings.

Remote working is likely to be a permanent change post COVID-19

The loss of commute invites consumers to invest in athleisure

With the loss of the commute, people are also filling newly found time with exercise regimes or hobbies. As a result, consumers are investing in clothing for their new pastimes. Dominant players like Lululemon, Gap’s Athleta and Nike have reported stronger sales than other apparel retailers during the pandemic. Gap’s active brand for women, Athleta, for example, surpassed the USD1 billion mark in sales in fiscal 2020 with 16% annual sales growth. Everyone is rivalling for a piece of this athleisure pie. Even the puffer jacket that promoted the 2021 collaboration between Gucci and The North Face, taps into this current consumer mindset. We expect health and wellness will continue to be an essential consumer quest that will further influence purchase criteria over the forecast period, benefiting sports-inspired fashion.

Global wakeup call for embracing diversity in fashion

COVID-19 has been a wake-up call about inequality and inclusion, bringing people closer together. Consumers are increasingly seeking brands with purpose and meaning. According to Euromonitor International’s November 2020 Voice of the Industry Lifestyles Survey, 33% of respondents believe ethical living (increasing attention paid to environment, sustainability, animal welfare, production and labour practices) will be very influential on sales in their industry in the next 12 months. Levi’s is well positioned here, historically priding itself on a belief that a business can deliver profits through principles and strong core values. While others, such as Nike, following criticism in recent years in March 2021 said that it will be changing its bonus structure to tie into the company making progress in deepening diversity and inclusion throughout its workforce, protecting the planet, and advancing ethical manufacturing.

Second-hand clothing market booms amid Coronavirus

Finally, the second-hand fashion market has boomed since the Coronavirus pandemic began, with the post-lockdown consumer driven by climate, cost and community. A number of resale sites, such as Poshmark, Depop, and Thredup are coming out on top, as brands, such as adidas, Gap and Abecrombie, look to offload products that have not been sold during the pandemic. Poshmark was among a wave of companies that have recently been listed on the stock market. Euromonitor International also sees opportunities in the second-hand and rentals luxury market. While Ralph Lauren became the first major luxury brand to offer clothing rentals, with the launch of The Lauren Look in March 2021, with many stuck at home, with a looming recession, it is not surprising that consumers have stopped buying new clothes and we expect that they will continue to buy second-hand or rental clothes online.

Euromonitor International does not foresee a scenario where consumers will be putting on their unused high heels and carrying brand-new heavy handbags any time soon. Indeed, elements of the quarantine wardrobe, including jogger pants, athleisure and recurrent second-hand online purchases, will be firmly cemented into the consumer’s everyday life post-pandemic.