Many countries are experiencing a resurgence of Coronavirus (COVID-19) cases and there are growing worries of a second wave of the pandemic, especially in Europe. In response, governments are stepping up measures by focusing on localising lockdowns at the city and regional levels, in a bid to mitigate the economic and health disaster. Nonetheless, job losses and curbs on recreational activities are becoming more pervasive in cities and this is hurting local consumers and businesses.

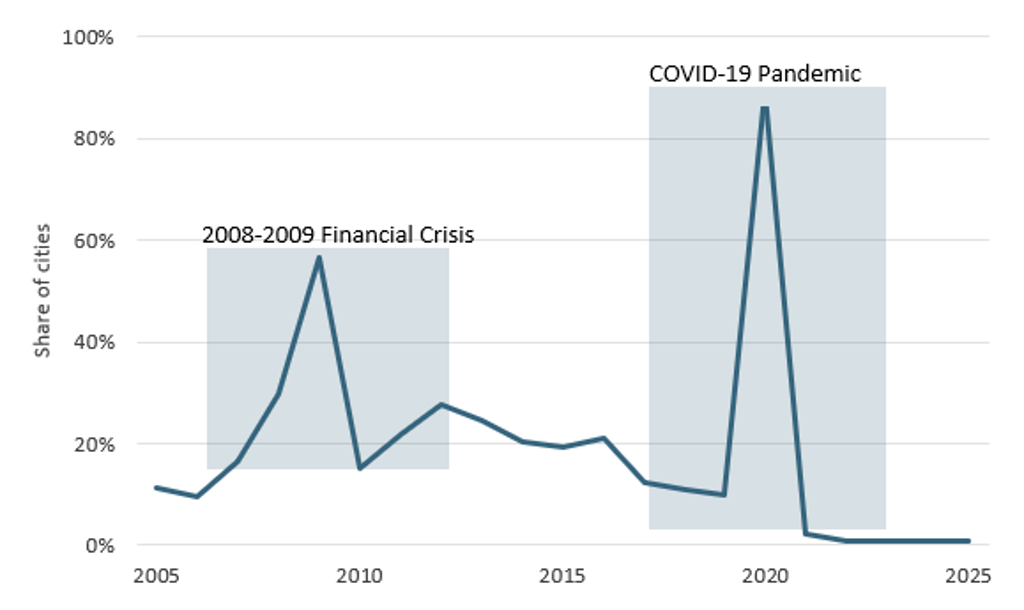

The economic toll is expected to be enormous, with Euromonitor International forecasting 9 in 10 cities globally to record negative real GDP growth in 2020 – considerably more than during the global financial crisis of 2008-2009. The effect is expected to move people down the income ladder, especially in many Western European cities.

Share of Euromonitor’s 1,219 Cities with Negative Real GDP Growth 2005-2025

Source: Euromonitor International from national statistics/Eurostat/OECD/UN/International Monetary Fund (IMF), International Financial Statistics (IFS). Note: Data for 2020 onwards is forecast.

Gloomiest scenario yields catastrophic results for consumer incomes

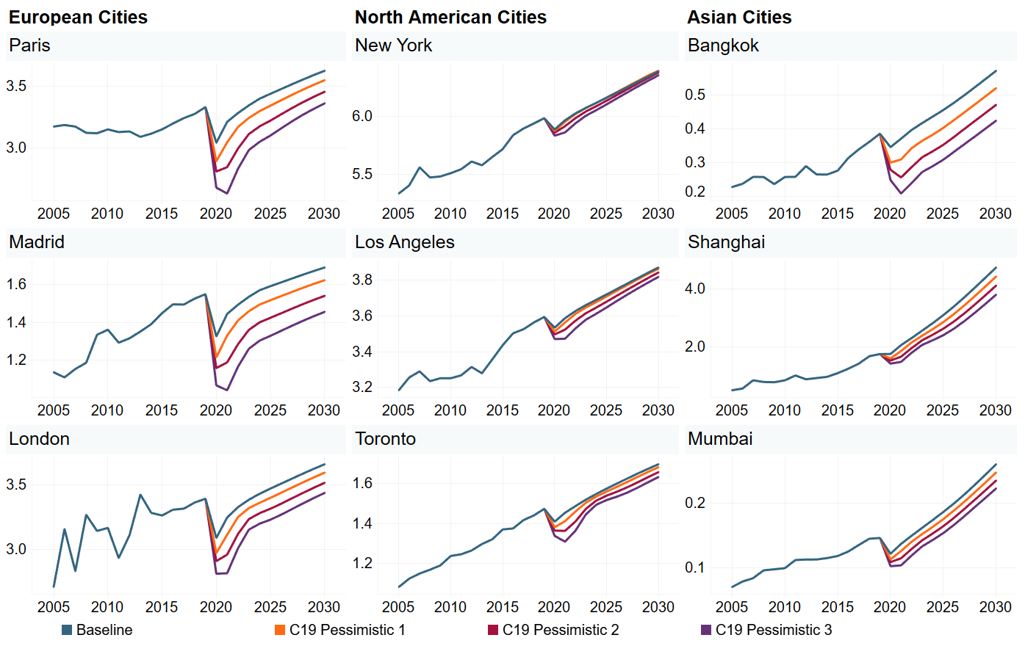

Uncertainty regarding the length and reach of the COVID-19 pandemic has resulted in numerous assumptions as to its magnitude and future direction. From the chart below it is possible to gauge the impact of the pandemic on the household income band earning USD45,000 or more per annum against our baseline forecasts and three possible scenarios, Pessimistic 1, Pessimistic 2 and Pessimistic 3.

Our baseline forecasts, which have a 48% chance of occurrence, predict a rather mild impact with incomes returning to pre-COVID levels within a few years, but this changes as the scenarios become more severe. For example, in London, this income group could possibly lose 400,000 households in 2020 under the worst scenario, Pessimistic 3, compared to baseline forecasts and only recover by the end of this decade. However, with just a 3% chance, the probability of such a catastrophic impact is relatively low.

COVID-19 Scenario Impact on Households with Disposable Incomes >USD45,000

Number of households in millions, 2005-2030, constant 2019 prices

Source: Cities Income Distribution Model from national statistics/Eurostat/OECD/UN/International Monetary Fund (IMF), International Financial Statistics (IFS), 15 October 2020. Note: Data for 2020 onwards is forecast

Key Western European cities to face a rough ride ahead

Western European cities have been amongst the worst affected by COVID-19, with daily infection rates in the second wave now surpassing those of the first wave. The economic toll after the first wave has already manifested, with millions of households having to come to terms with pay cuts and redundancy.

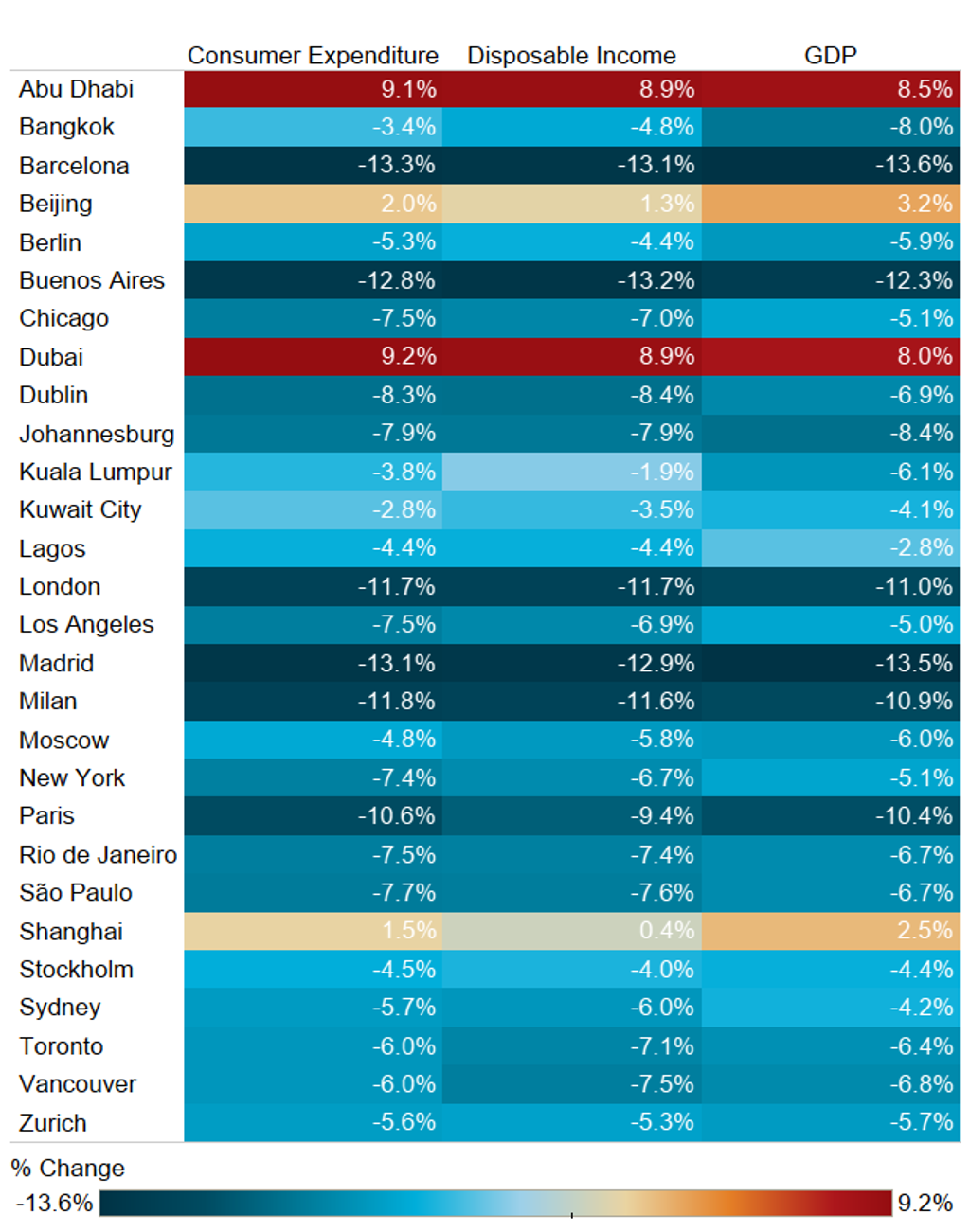

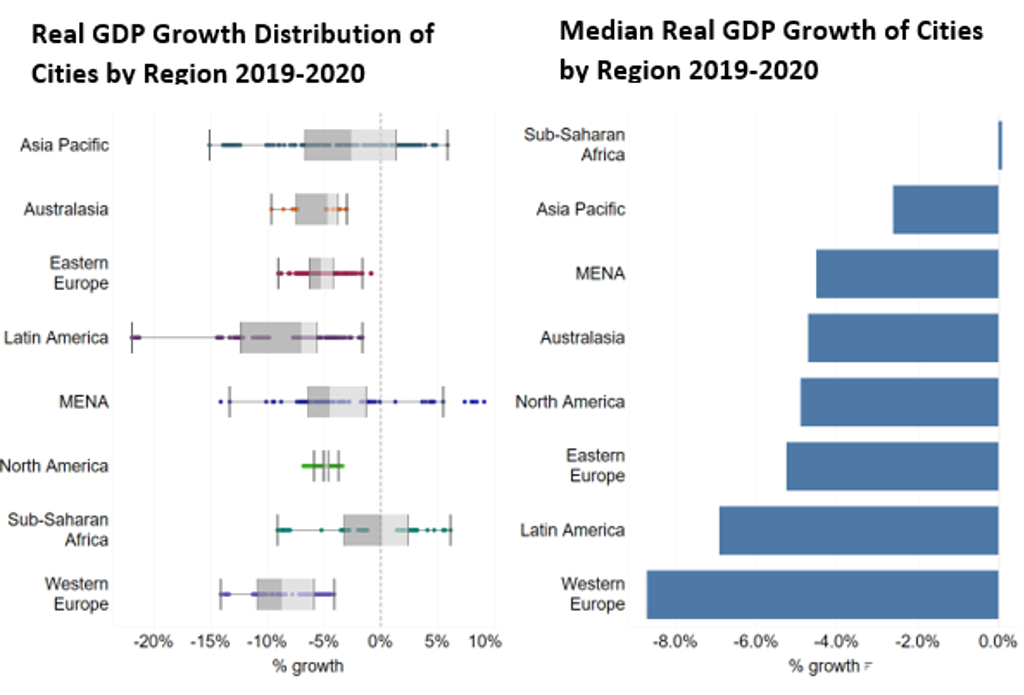

In 2020, Spanish and UK cities will face some of the most acute economic challenges with local governments set for large-scale budget deficits, reduced business activity and unemployment growth. For example, London is expected to record a real GDP drop of 11.0% in 2020, with this figure rising to 13.5% in Madrid and 13.6% in Barcelona. The latter has been especially affected due to the city’s dependence on tourism which has succumbed to social distancing and travel restrictions.

However, this is not to say that all cities are expected to be heavily burdened by the pandemic equally. Developing economies, especially in Sub-Saharan Africa, Asia-Pacific and the MENA region, have been somewhat more robust in avoiding large-scale economic collapse during the pandemic. In fact, numerous cities across the regions are expected to record economic growth despite the current economic hardship. Several factors could be at play, such as less dependence on consumption as a driver of the economy and a smaller focus on cities in generating economic output.

Consumer Expenditure, Disposable Income and GDP Growth of Key Cities 2019-2020

Constant 2019 Prices

Source: Euromonitor International from national statistics/Eurostat/OECD/UN/International Monetary Fund (IMF), International Financial Statistics (IFS). Note: Data is forecast.

Source: Euromonitor International from national statistics/Eurostat/OECD/UN/International Monetary Fund (IMF), International Financial Statistics (IFS). Note: Data is forecast.

More government restrictions will severely threaten businesses

National governments are tightening restrictions on movement to stem the spread of the virus and are following a more localised approach as opposed to national lockdowns. For example, in October 2020, the French President, Emmanuel Macron called for a curfew in nine major cities across France including Paris, Marseille, Lyon and Toulouse, putting approximately 20 million people under tighter restrictions. At the same time, the UK government introduced a three-tier system which seeks to reduce interaction and movement of people depending on the severity and magnitude of COVID-19 infections in any given region.

While restrictions are being implemented to save lives and reduce stress on public health services, it will be extremely detrimental for businesses in the hospitality, catering, leisure and entertainment industries. For example, Delhi is forecast to see spending on leisure and recreation drop 15.3% (constant 2019 prices) in the year to 2020, with similar falls expected in Buenos Aires (-12.9%), Barcelona (-12.9%) and Milan (-11.6%). With much uncertainty ahead many businesses may simply not survive, while others will have to undergo restructuring or rely on government assistance.

COVID-19 will unleash a myriad of challenges for cities, especially in Western Europe which are forecast to experience the largest economic contractions. Lockdowns and social distancing will make it impossible for some businesses to continue, and recovery is hard to predict in the near term given the uncertainty, direction and magnitude of the pandemic. Indeed, the longer this continues, the greater the emphasis will be on cities adapting to maintain their reputation as engines of global economic growth.

Baseline and the Three Scenarios of COVID-19 Assumptions Explained

Baseline - Global GDP growth: 2020 -5.7%, -3.7%. Probability: 43-53%

One main global pandemic infection wave in 2020 with possible local second waves. Global stock prices down by 0-30% relative to pre-COVID-19 forecast. Global infection rate at 1-15% and infection mortality 0.3-1.3%.

An effective vaccine or treatment for COVID-19 is available around the middle of 2021. Government and central bank fiscal stimulus and quantitative easing/lending programmed are sufficient for reducing most of the negative effects of wage cuts and job losses.

C19 Pessimistic 1 - Global GDP growth: 2020 -6.5%, -4.5%. Probability: 27-37%

In this scenario, the world experiences two or three global pandemic waves in 2020 and 2021. Global infection rate 5-25% and infection mortality rate 0.3-1.3%. Global stock prices down 10-40% relative to pre-COVID-19 forecast.

An effective vaccine or treatment for COVID-19 is available around the middle of 2021. Significant rise in business closure rates in high social contact sectors due to cashflow/liquidity shortages persisting through 2021.

C19 Pessimistic 2 - Global GDP growth: 2020 -6.5%, -5.0%. Probability: 12-22%

This scenario includes two to four global pandemic infection waves over 2020-2021. Distribution of an effective COVID-19 vaccine or treatment is delayed into 2022-2023. Global infection rate 10-35% and infection mortality rate 0.5-2.0%. Global stock prices down by 40-60% relative to pre-COVID-19 forecast.

There is a massive rise in business closures in high social contact sectors, due to cash flow/liquidity shortages persisting into 2022. Severe supply chain and labour supply disruptions worsen production slowdowns and cause shortages in some goods.

C19 Pessimistic 3: Global GDP growth: 2020 -7.0%, -5.0%. Probability: 1-5%

This is the worst-case pandemic scenario. The scenario includes three to five global pandemic waves in 2020-2022. Distribution of an effective COVID-19 vaccine or treatment is delayed until 2022-2023. Global stock prices down by 50-80% relative to baseline. Global infection rate 10-40% and infection mortality rate 0.5-2.0%.

There is a massive rise in business closure rates throughout the economy, as cashflow/liquidity shortages persist into 2022. Supply chain and labour supply disruptions worsen production slowdowns a causes severe shortages of many goods.