Indian cities are the new demand hotspots for packaged food brand owners. The heightened interest in self-care and increased home cooking has brought significant attention to food, while consumers’ reverse migration to tier II and III cities has influenced and urbanised food trends in smaller cities and towns. It has therefore become essential for companies to reassess and reformulate their product and channel strategies to remain competitive.

What follows are three food trends that are shaping demand for and consumer behaviour towards food in Indian cities.

The rise of functional food

Preventative health has emerged as one of the top health priorities of city-dwelling consumers, and food has taken a leading role in managing their health goals. Consumers seek preventative health benefits from foods, with the line between food and medicine blurring rapidly. Food functionality has become a mainstream topic for discussion beyond tier I cities – equally amongst brand owners and consumers. Food functionality is inspiring product innovation in areas such as immunity-building, gut health, weight management and wellbeing. Ayurvedic ingredients are back in demand and are making their way back into Indian kitchens. Brand owners are likely to place confidence in the significant appeal and efficacy that Ayurvedic ingredients claim to offer in terms of enhancing functionality. As the urban demand hotspots shift to tier II cities due to reverse migration, companies are likely to extend their product reach to tier II consumers – who are equally willing to pay more for health attributes as their tier I counterparts, as per the Indian cities research conducted in October 2021.

Source: Euromonitor International’s Indian cities Beta release 2021, n=3,780

Naturalness, the most sought-after attribute

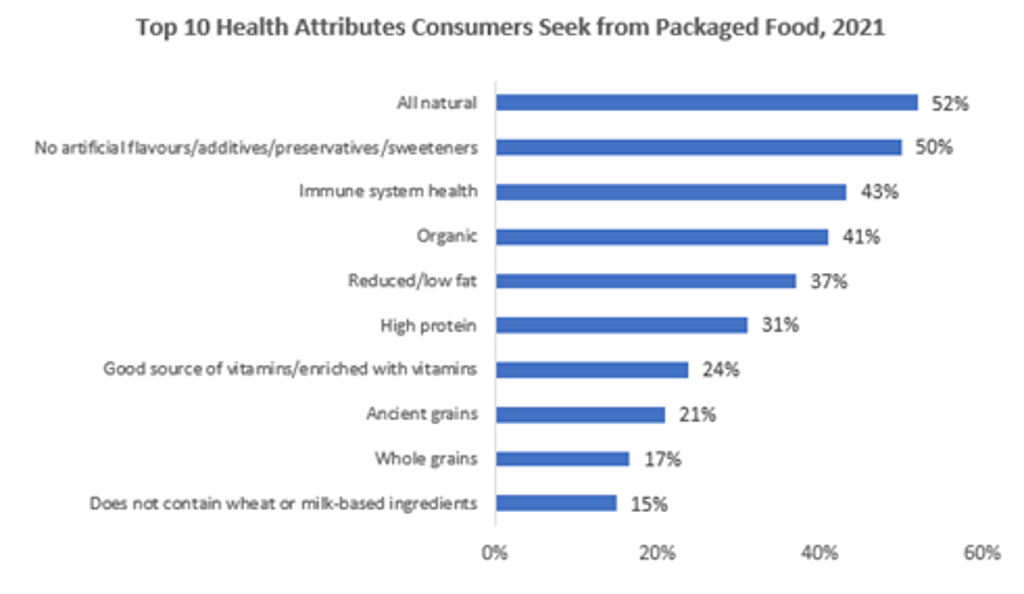

Naturalness and no artificial preservatives have specifically emerged as the key features for product distinction and are the most sought-after attributes in Indian cities. Companies are reviewing their product formulae to remove or replace artificial ingredients with more natural options in response to the natural movement. The “urbanite city consumer” is increasingly scrutinising ingredients and labels, hence driving up demand for natural products. Expanded distribution of relevant brands through e-commerce channels will continue to bridge the gap in product mix between tier I and II cities.

Digital wellness and personalisation

Consumers in cities are intensely involved in self-education regarding healthy nutrition and more effective ways of living, via information found online and through digital apps. Understanding of the need to find the right balance between food and workout regimes has promoted the growth of digital applications such as Fittr, HealthifyMe and others in tier II cities with limited workout centres. Consumers will continue to prioritise self-care, with no compromises on the time and space allocated to workouts, thereby leading to demand for personalised wellness solutions and nutrition concepts.

New opportunities for healthier foods also exist beyond tier I cities

The urbanisation of food trends in tier II and III cities and consumers’ willingness to pay more for foods with health claims will create new growth pockets for newer brands, such as Timios. Multinationals will also be able to extend the distribution of their premium and healthier packaged food product portfolios beyond tier I cities such as Delhi and Mumbai.

Euromonitor International’s recently published report on packaged food preferences in Indian cities explores consumer demand for healthier foods across key areas in greater detail. The report discusses the trends in 2021 and beyond.