The growth of coffee is a global phenomenon. Euromonitor International’s Industry Forecasting Model (IFM) can help build understanding of this highly complex global market by showing that despite this complexity, there exist just four general types of coffee growth patterns. Thinking of the coffee market in terms of these four types reveals insights not possible using more traditional groupings like geographic region.

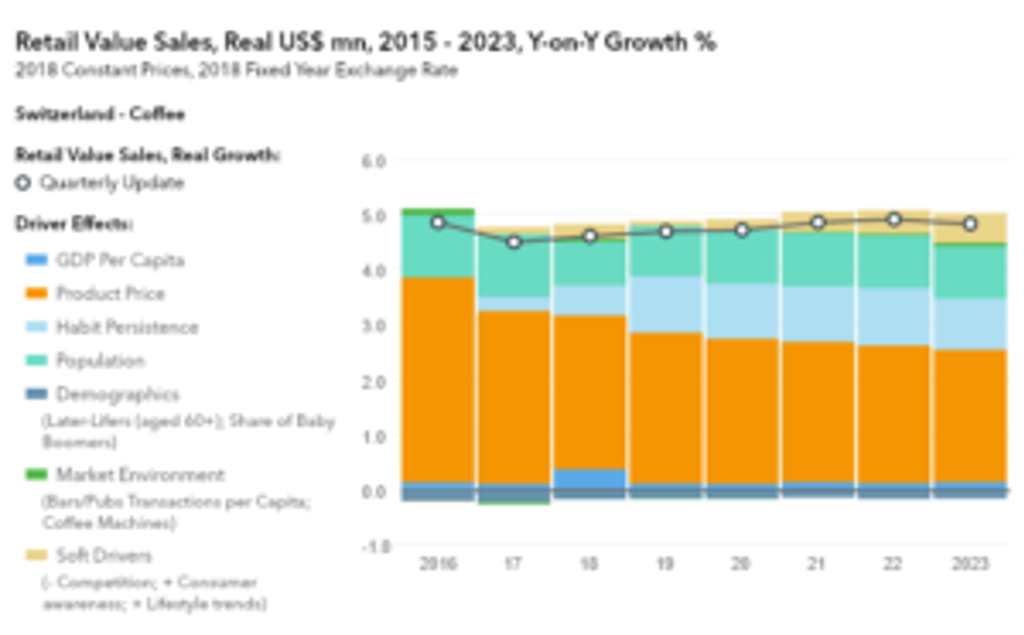

The above picture is a screenshot from the IFM depicting the growth of the Swiss retail coffee market in value terms year over year from 2016-2023. Switzerland is a country in which premiumisation trends are very strong, which can be seen reflected in the graph. The largest single portion of growth for any given year is the orange bloc representing price increases. Other factors are playing a role, but clearly none are as important as rising prices. This makes Switzerland a “premiumisation-led” market.

A similar exercise can be done for all of the 78 countries for which EMI’s Hot Drinks IFM has coverage. The result is the map above, which shows these 78 markets all placed into one of four groups based on which is the dominant factor driving local coffee demand.

Group one: The premiumisation-led markets

These are countries, nearly entirely in the developed world, where coffee is a well-established portion of consumer lifestyles. The coffee market is highly mature and with average consumption high and population growth low there is little potential in volumes. Higher-value approaches though are doing very well and taking occasions from long-established formats like standard ground and instant.

Nearly half of all value growth globally between 2018 and 2023 will take place in these countries as consumers trade up to more expensive formats. Pods and RTDs in particular will be heavily reliant on these countries in the coming years.

Example countries: France, Spain, the United States

Group two: The income-led markets

These are countries that in most cases have historically preferred tea to coffee, but as incomes rise are seeing increasing numbers of consumers with disposable income embrace coffee as a sign of their arrival in the global middle class. They are found mostly in developing portions of Eastern Europe and Asia and unlike in the premiumisation markets both value and volumes are doing well here.

Coffee shops are particularly important here both because they allow a place for consumers to learn about coffee as well while also serving a social role. Over half of global coffee shop growth will take place in these countries in the coming years.

Example countries: China, Indonesia, Russia

Group three: The population-led markets

In these countries growth comes from a rising number of coffee drinkers. This works to the benefit of current formats as these markets see little in the way of category switching. Consumers may want to trade up but are often restricted by their incomes from doing so, which means that basic and affordable formats like instant are the key to the overall market.

These countries are generally found in Africa or Central America. A handful are found in developed countries as well in places where immigration rates as high enough to keep basic formats growing enough to become more important than premiumisation trends.

Example countries: Canada, Ethiopia, Mexico

Group four: The soft driver-led markets

The final group is seeing growth driven by less-quantifiable factors known collectively as the “soft drivers.” These countries usually have immature markets and have embraced coffee with a fervor that goes well above what the quantitative models would predict. Coffee is reaching more consumers in this country that before because of coffee shop expansion, new product launches and promotional campaigns.

While the smallest grouping in absolute size of the four, the soft driver countries are some of the most interesting countries in global coffee and growth rates are quite rapid.

Example Countries: Ireland, Turkey, the United Arab Emirates