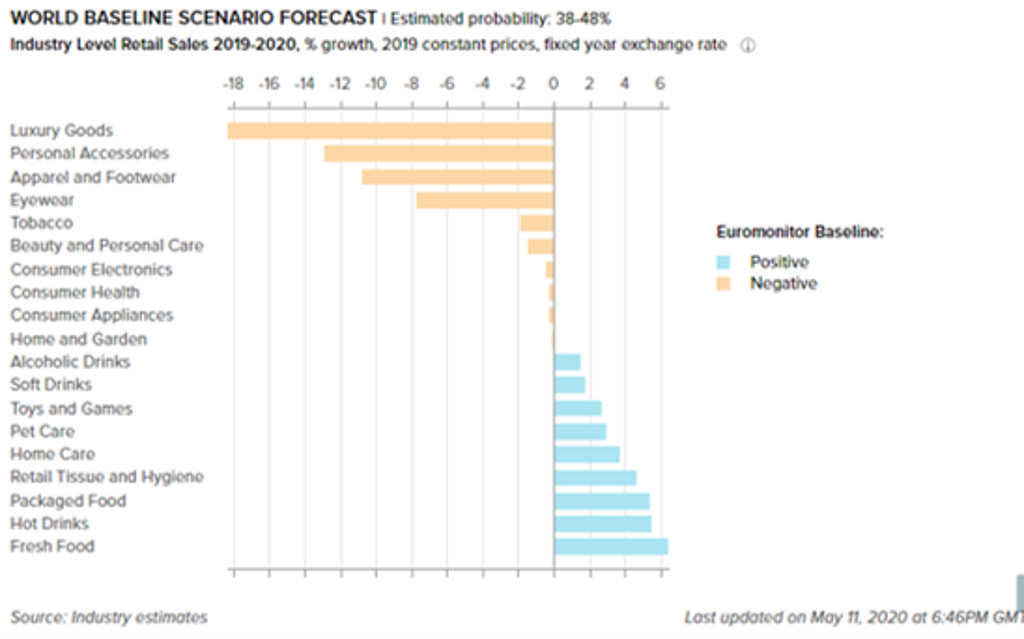

Prior to the Coronavirus (COVID-19) pandemic, most industries were forecasted to see positive value growth in 2020, but as the health crisis ushered in a global recession, the picture mid-2020 looks very different from just a few months ago.

Over half of FMCG industries are expected to decline, with luxury goods and apparel and footwear, sustaining exceptionally heavy losses. Others, such as alcoholic drinks, will grow but at a slower rate, whilst five industries – fresh food, hot drinks, packaged food, retail tissue and hygiene and home care – will substantially outperform their pre-COVID-19 expectations.

Their defining characteristics are both their level of exposure to non-discretionary spend and that they are benefitting from work, social and eating occasions moving into the home. However, 2020 will be a tricky year even for those industries that are seeing a surge in demand as they face headwinds from the expected global economic recession.

Source: Euromonitor International COVID-19 dashboard from industry sources

Stockpiling and pantry filling boost sales of packaged and fresh foods

With so much of the world in lockdown or cautiously emerging from it, many institutions and consumer foodservice outlets are still closed. As a result, eating occasions have shifted into the home, with consumers cooking from scratch using local produce, with a focus on healthy nutrition, benefitting retail sales of both packaged and fresh foods.

Short-term stockpiling and pantry filling of staples such as rice, pasta, noodles and canned/preserved food has caused a spike in sales. In the long term, the sense of needing to be “prepared” will prop up sales of both long-life and shelf-stable products. As a result, sales of packaged food and fresh food are set to increase by 3% and 4% respectively on their pre-COVID-19 forecasts. However, the longer-term poses risks to value sales as consumers look to economise on food spend by trading down and searching out discounts as the recessionary effects impact.

Retail sales boost as the café comes into the home

Similar to packaged and fresh foods, the closure of cafés and pubs has brought drinking occasions into the home, boosting retail at the expense of cafés and other consumer foodservice outlets. With consumers stocking up on staples of tea and coffee, value sales of hot drinks are expected to increase by 6% in 2020 (a 4-percentage point increase over the pre-COVID-19 forecast).

One category which is likely to respond well is coffee pods, despite being more expensive than other forms of coffee, consumers view coffee pods as an economising way to replace takeout coffee, bringing the café experience back home.

The fruit/herbal tea category is also outpacing others as consumers are looking to boost their immune systems. Herbal teas have been endorsed by both China and Iran as an option for fighting the virus, although the World Health Organization (WHO) has not followed suit. In countries where herbal tea has a strong health positioning, it is a popular choice for many.

Overall, the hot drinks industry should be resilient to volume drops as impending recession impacts consumer spending, but consumers are likely to trade down, reversing the premiumisation which most developed countries have been reliant on to drive growth in their coffee industries. It remains to be seen to what extent coffee pods will be able to stabilise value sales.

Efficacy takes over from sustainability in home care

Even though COVID-19 has benefited the home care industry, with value sales set to increase by 4% in 2020 (up from 2%), the pandemic is still sending shock waves through the industry. It has focused the market on hygiene and efficacy, undoing years when “scent”, “gentle” and “sustainable” were the buzz words and where there was a palpable sense of “chemophobia”.

There was an initial uptick in sales as anxious consumers started to clean more often and thoroughly with increased use of anti-bacterials and bleach. These “threat-based” cleaning behaviours are likely to continue in the long term. Consumers are also sticking with the brands they know and trust in these uncertain times, with classic home care brands such as Dettol, Clorox and Domestos responding well.

Despite a generally encouraging picture for larger companies offering traditional products, smaller companies, especially those trading on sustainability, may feel the pinch, and in the longer term, companies will need to think about how to marry efficacy with sustainability.

Retail tissue and hygiene see a surge in sales as consumers stockpile

Value sales of retail tissue and hygiene are anticipated to grow by 5% in 2020 due to consumer stockpiling of household staples and antibacterial products. Demand remains high as, despite lockdown easing in many places, more people are still spending more time at home.

In line with the threat-based behaviours mentioned above, more attention to daily hygiene will boost sales throughout 2020. Anti-bacterial hand and body wipes are set to maintain the impetus from COVID-19, whilst other categories, such as nappies/diapers/pants and sanitary protection, will see any initial uptick quickly normalise, and, going forward, may face pressure from consumers trading down.

Changing consumer needs around health, safety and income require manufacturers to be agile

These non-discretionary industries will weather 2020 better than previously forecast, with lockdown resulting in a surge in home eating, drinking and cleaning, all boosting retail sales. However, in the longer term, value growth is not assured, and as recessionary effects impact, consumers will look to maximise value by shifting to private label, seeking out discounts, and deprioritising premiumisation, as well as looking for a new set of values in their products. Manufacturers will need to be agile to meet both these changing consumer needs as well as respond to new health, safety and hygiene requirements.