Connected consumers in Asia Pacific are embracing connectivity and the ubiquity of the mobile device. In fact, many Asian consumers turn to this handheld device first to perform an array of activities. The transformative mobile landscape enabled Asia Pacific to advance other regions in many facets of life.

Within the last decade, smartphones emerged as a must-have device for consumers globally, with Asia Pacific leading the way. Asian consumers are fully embracing mobile platforms and turning to phones for commerce activities, such as buying products and services.

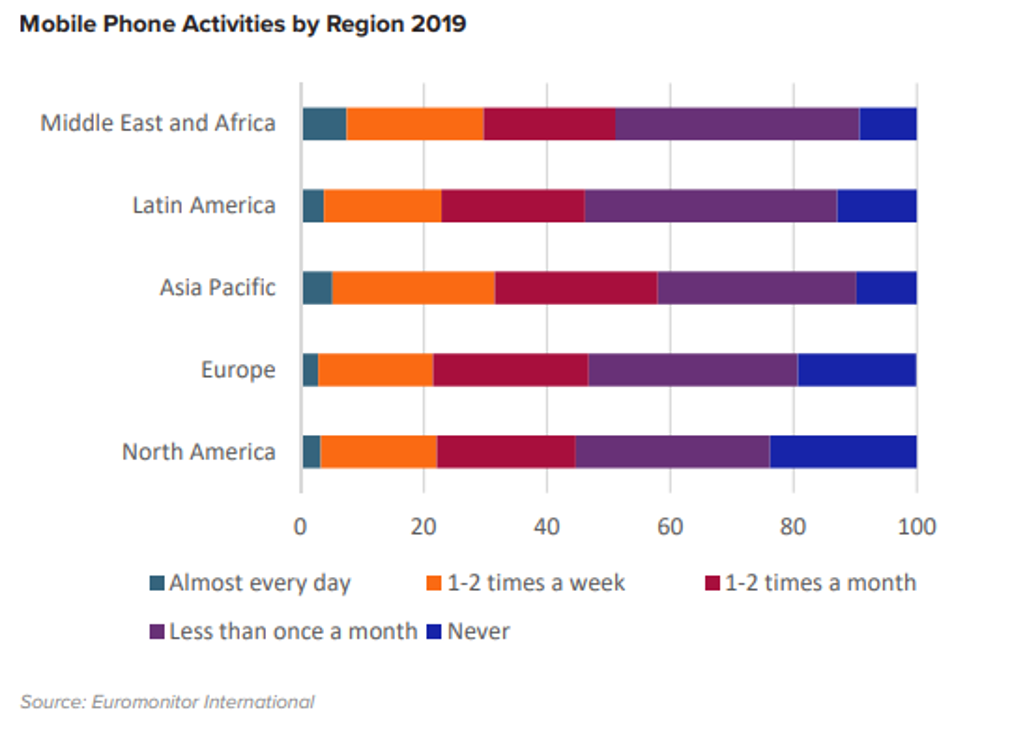

Nearly 60% of Asian connected consumers have used a mobile phone to buy a good or service at least monthly according to Euromonitor’s 2019 Lifestyles Survey.

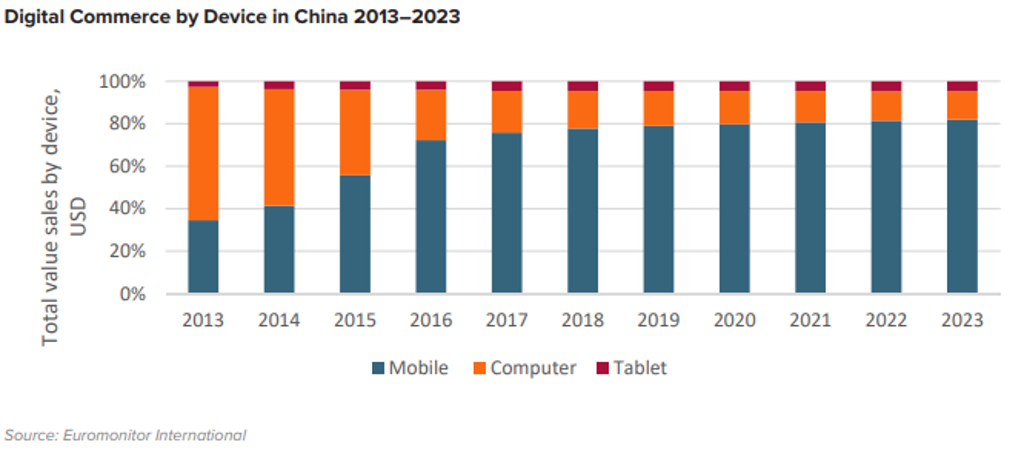

China was the first true mobile-centric nation. Chinese consumers account for 1.4 billion mobile internet subscriptions as of 2018 — more than three times those in the U.S., the next largest market. For the first time in 2015, Chinese consumers made more purchases through mobile phones than computers. Many factors led to Chinese consumers truly embracing mobile commerce.

Like other emerging markets, China turned to mobile devices to establish digital connectivity, due to the cheaper network investment and falling product prices. The existing retail landscape was weak and inefficient, thus opening the door to online competitors.

Third-party payment apps, such as Alipay from Alibaba’s affiliate Ant Financial, emerged to provide a safe way to transact online and propelled this shift. Chinese consumers embraced smartphones, using these new gadgets to interact with brands as well as to conduct commerce.

The “mobile-first” mindset is being replicated by China’s Asian neighbours. As of 2018, two-thirds of digital spend in Asia Pacific occurred through mobile, with more than half in markets like Hong Kong, South Korea, Indonesia and the Philippines.

In contrast, the ratio is about half that in other regions. Younger consumers are driving mobile adoption in Asia Pacific as more affordable handsets become available. Some Asian markets like Japan and Singapore are slower to make this transition.

Prospects for Asia in the Years Ahead

The global economic balance is gradually shifting to Asia and this shift will gain momentum over the next few years. Rising incomes in emerging Asia and growth in discretionary consumer expenditure will boost online purchases.

China will remain the largest digital commerce market in Asia. However, the region is expected to witness new growth centres such as India and Indonesia. With a youthful population, both countries are quick to adopt new technologies.

In fact, Indonesia is one of the most mobile-savvy countries in the region. India is pushing digital initiatives in terms of broadband investments and the launch of new payment platforms. Large regional companies, notably Alibaba, invested heavily in digital commerce businesses in both countries: Tokopedia in Indonesia and Paytm in India.

Retailing will remain the largest industry, with goods purchased online accounting for 44% of digital commerce in Asia Pacific. A key growth area is the apparel and footwear industry. While online sales in this category represent only a small percentage of total sales in many Asian nations, this is not the case in markets like China and South Korea.

For additional information download our white paper Digitalisation in Asia: How One Region is Shaping Worldwide Trends.