In part two of the water scarcity blog, we analysed the steps businesses are taking to track their water usage patterns in Southeast Asia. We discussed the concept of water stewardship programmes and its application to manage water risks in the textile industry in Vietnam. In part three, we will discuss products that do not require large amounts of water to be used at home.

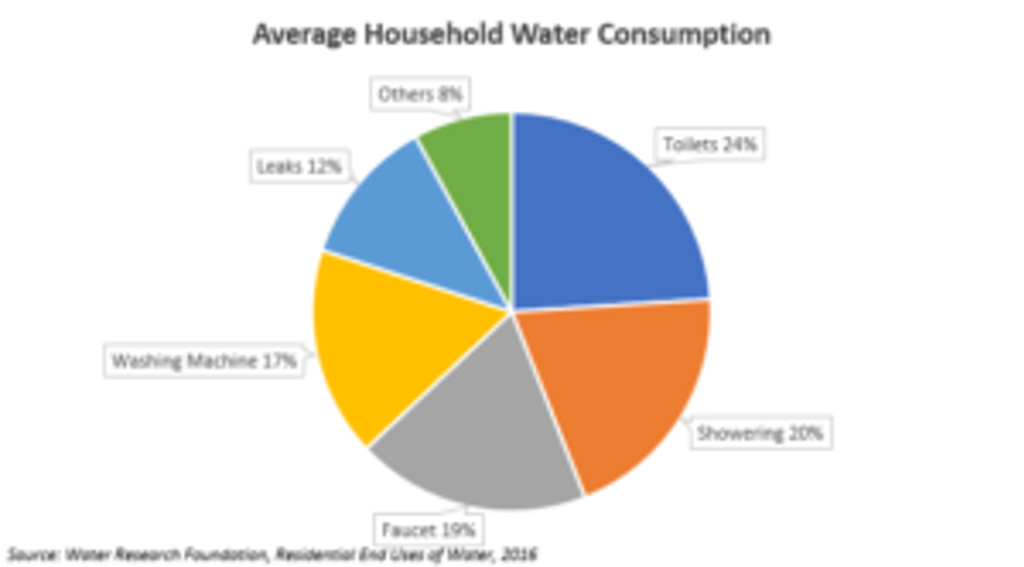

Typical uses of water in the household

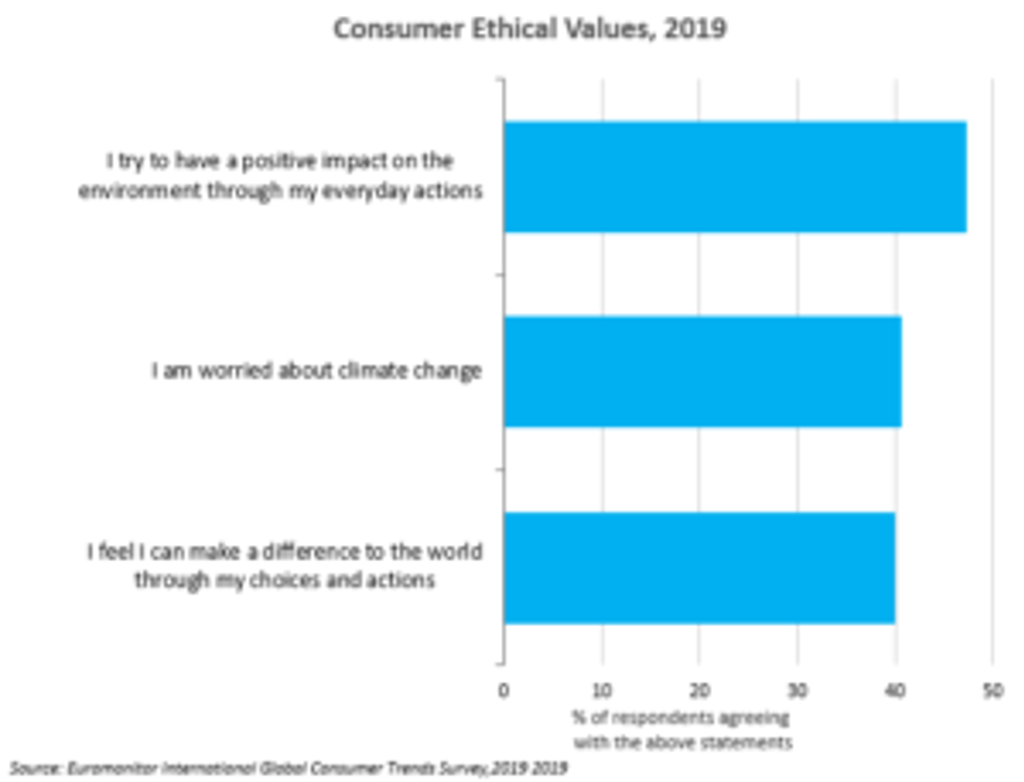

More consumers are becoming environmentally aware and display growing preferences for products that limit the negative environmental impact of using them.

According to Euromonitor’s 2019 Global Consumer Trends Survey, nearly half of survey respondents expressed the intent to have a positive impact on the environment through their everyday actions.

As a result of the rise of the environmentally-conscious consumer and the global water crisis, leading companies are releasing products that do not require as much water to use. These products cater to the typical uses of water in the household that include showering, laundry care and dishwashing. Particularly for consumers living in water-stressed areas, these products allow consumers to control their water usage patterns in their homes.

Low water solutions: laundry care

Source: Unilever

Given that home care activities require large amounts of water, leading companies such as Unilever developed low-water products. In 2018, Unilever launched Day2, a dry wash spray that removes odours from clothes without having to wash them. By extending the time between washes, Unilever claims up to 60 litres of water can be saved. Although Day2 is currently only available in the UK, Unilever could consider launching this product in water-stressed markets such as Indonesia in the future. However, price could be a hurdle to wide adoption in the price-sensitive market.

Other products that reduce unnecessary water usage are bar detergents and detergent powders which are still predominantly used in developing markets. Unilever has incorporated SmartFoam technology which requires a smaller amount of water to rinse soap suds. Compared to Day2, these products that have existed in markets such as Indonesia and Vietnam for many years would have a higher chance of market penetration.

Low water solution: beauty and personal care

Besides home care, showering takes up 30% of the average household’s water usage. Water is also a primary ingredient in the formulation and usage of beauty products. In recent years, innovative products with waterless formulations are on the rise, particularly in hair care. Examples include dry shampoo from brands such as Klorane and water-activated powder shampoo such as OWA Haircare, although many of these products are available in developed markets in North America and Western Europe.

Survey respondents from Indonesia and Thailand, which are large consumer markets, are looking for water-efficient products, however, it is expected that the availability of waterless products is limited. Given the lack of stable access to clean water in developing markets in Southeast Asia, there is merit in making more waterless products available in such places.

Untapped potential to develop more water-efficient products

Looking ahead, toilet care is another segment where water-efficient products can be developed as more consumers are educated on toilet hygiene. Much potential remains for the development of products that reduce water wastage.

Communication and transparency are key as the concept of a waterless product could be misleading. Water is used in nearly every part of the manufacturing process of a product, which means that it is near impossible for a product to be truly waterless.

There is the market potential for water-efficient products, however, their availability is limited in Southeast Asia. Given that the region has many water-stressed markets and is projected to be the next powerhouse in Asia, manufacturers should consider releasing water-efficient products that educate their target consumers accordingly.

For more information, visit the following links:

1. The Impact of Home Care of Water Scarcity: Low Water Products and Appliances

2. The Evolution of Beauty: From Green to Clean to Conscious