Coronavirus (COVID-19) has disrupted entire industries this year as stores shut, consumers stayed and worked from home and online shopping soared.

Since the early stages of the pandemic, e-commerce adoption accelerated with many consumers reliant on online shopping while in isolation or lockdown. In response to this shift, Euromonitor International has been tracking changes in online pricing and product availability across countries and industries to see how retailers have responded to peaks in demand.

As we approach the end of the year, in the midst of new lockdowns but also awaiting vaccination rollout, we looked at the key categories that were most in-demand online, across packaged food, tissue and hygiene and consumer health since March 2020.

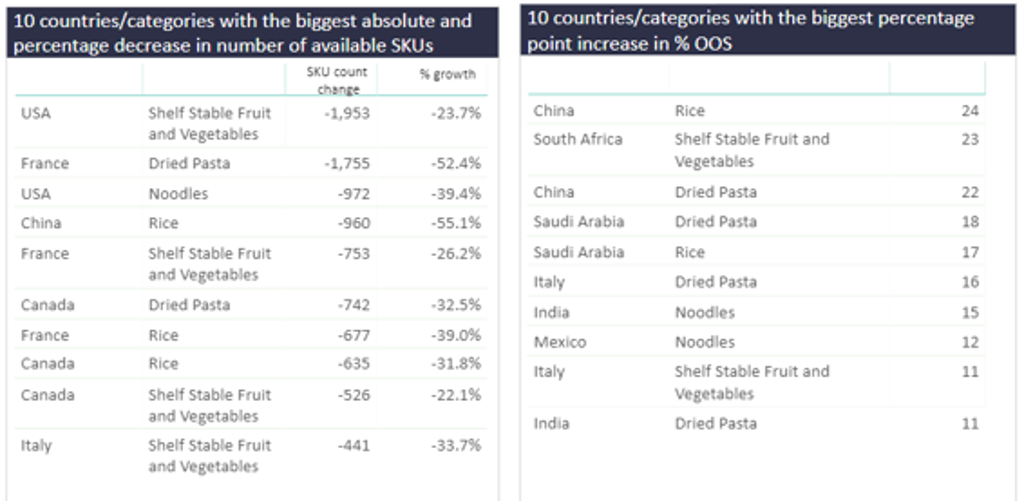

Packaged food: pasta, noodles, rice and shelf-stable fruit and vegetables were in demand

Globally, low cost and long-life packaged food staples have seen a big increase in demand since the beginning of the pandemic. The USA saw a big decrease in the number of SKUs available online for Shelf Stable Fruit and Vegetables and Noodles. Meanwhile, France and China saw decreases in Dried Pasta and Rice SKUs from 1st March – 1st December. Canada also appears three times on the top 10 rankings for the same categories. All of this clearly shows a spike in demand for online retailers in the regions hit hard by the virus: Western Europe, Asia and North America.

In terms of increased out-of-stock rates (OOS%), China, South Africa, Saudi Arabia, India and Italy appear most frequently since March 1st.

Rice in China appears on both lists for decreasing SKU count and increased OOS%, showing the sheer size of demand for that category specifically and retailers responding by both removing SKU pages or listing products as out of stock.

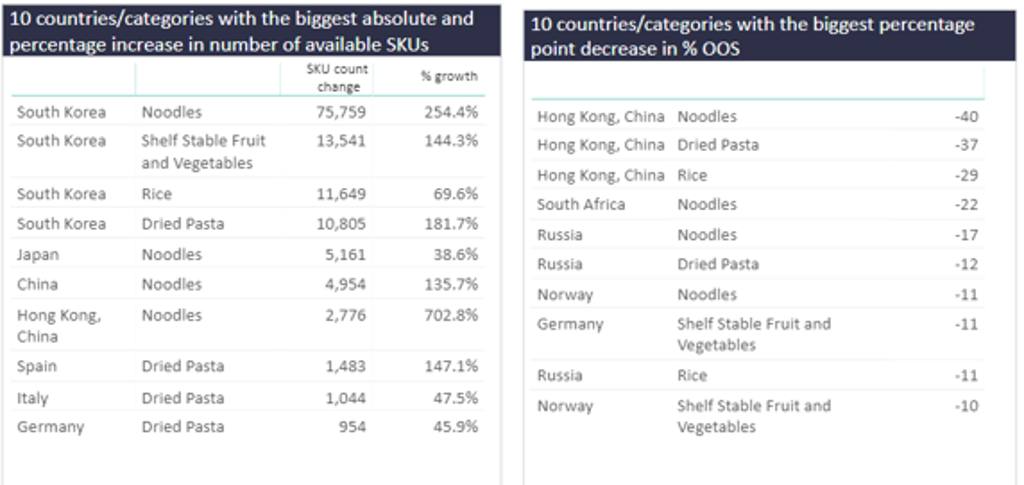

Conversely, South Korea saw strong increases in online SKU availability for the four key categories most affected within packaged food: Noodles, Shelf Stable Fruit and Vegetables, Rice and Dried Pasta. Alongside, Hong Kong saw the biggest decrease in products listed as out of stock since March 1st for Noodles, Dried Pasta and Rice, showing that retailers in both countries responded well to consumer demand for staple items.

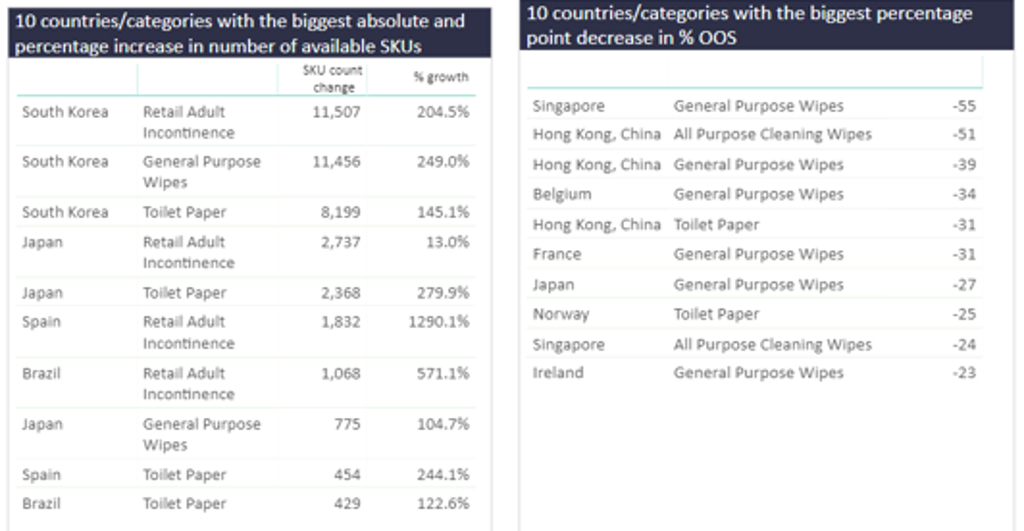

How toilet paper fared across the globe

There were numerous news reports from around the world about consumers bulk buying toilet paper. This led to major stock issues with some retailers even limiting the amount each customer could buy.

Between 1st March – 1st December, the countries that saw the biggest improvement in availability for toilet paper were South Korea, Japan, Spain and Brazil in terms of percentage point increase in SKUs available online. Meanwhile, Hong Kong and Norway saw the biggest decrease in OOS%, showing retailers in these countries were also effectively replenishing stock.

On the flip side, China, the US, Canada and France saw the biggest decrease in available online SKUs for toilet paper and China also topped the ranking for most OOS%. These countries that struggled with online availability for toilet paper also had issues with packaged food availability between 1st March – 1st December, showing that retailers in those countries felt the strain of meeting consumer demand across numerous product categories.

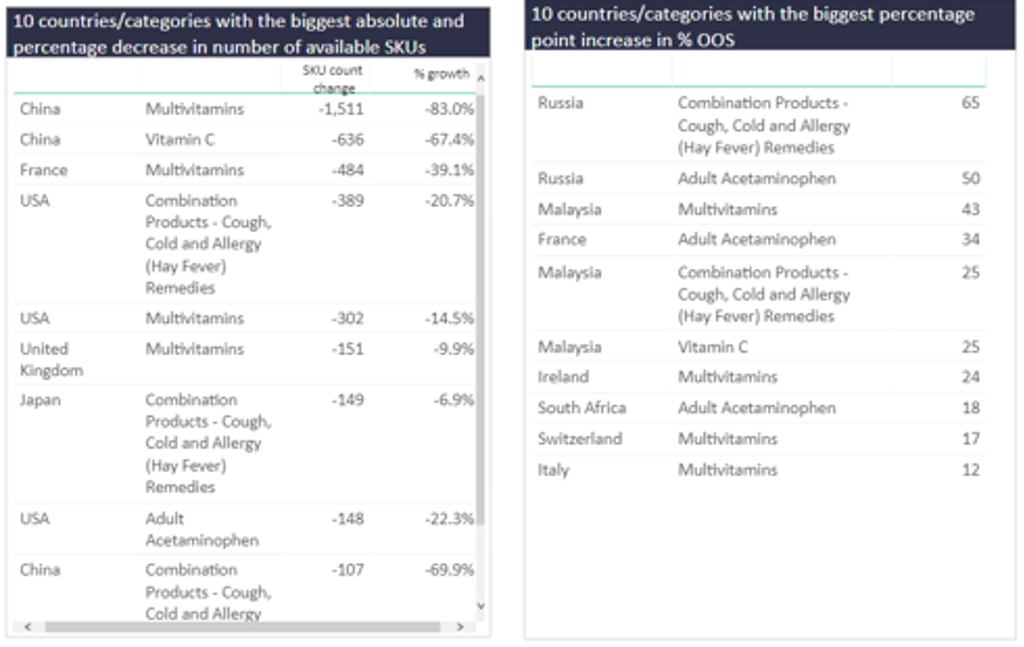

Vitamins highly sought after by health-conscious consumers

This year saw consumers increasingly focus on their health at home, and demand for vitamins, supplements and over-the-counter remedies rose accordingly.

China, France and the US appear in the top 5 for the biggest percentage point decrease in the number of available SKUs online for Multivitamins, Vitamin C and Combination Products (Cough, Cold and Allergy Remedies). Russia, France and Malaysia show the biggest increase in OOS% for consumer health products, specifically Combination Products, Multivitamins and also Adult Acetaminophen as consumers treated pain or fever at home or stocked up in advance to avoid leaving the house.

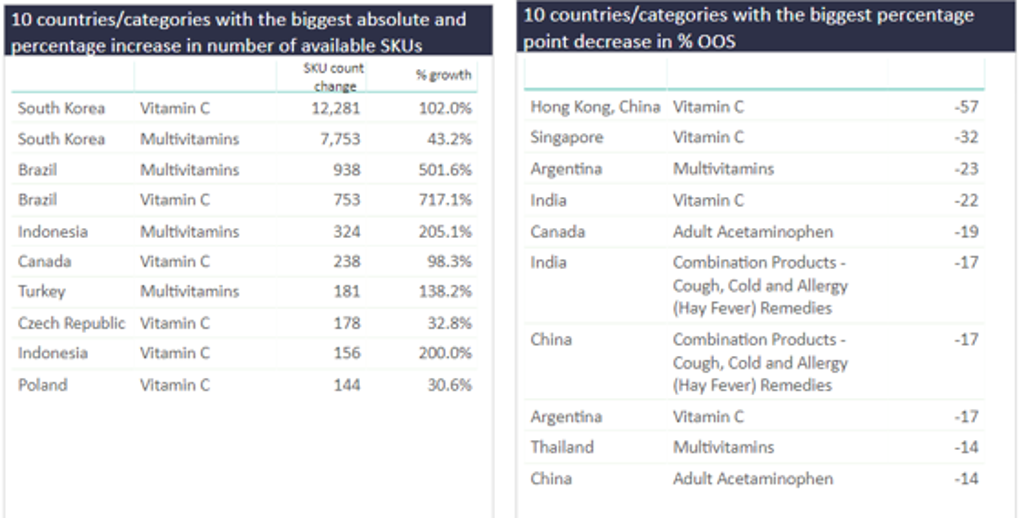

In terms of improving availability, South Korea appears again with the biggest increase in available online SKUs for Vitamin C and Multivitamins, followed by Brazil and Indonesia. Hong Kong, Singapore, Argentina, India and Canada had improving OOS% for Vitamin C, Multivitamins and Adult Acetaminophen.

COVID hot spots saw most volatile online product availability

Broadly speaking, the countries with the biggest fluctuation in product availability in these key categories mirror the countries that became ‘hotspots’ or epicentres for the pandemic. For example, China appears frequently in the ranking for high OOS% or decreases in SKU availability, which makes sense given China was the initial epicentre for the pandemic and supply chains were significantly disrupted in the winter and spring. The US, which has the highest number of confirmed COVID cases, also appears regularly when it comes to rising OOS% rates or falling SKU availability, On the other hand, South Korea and Hong Kong appear frequently on the lists for countries with improving product availability, reflecting more sophisticated and flexible e-commerce networks and supply chains, allowing retailers to be better able to meet surges in demand.

How we track SKU availability and OOS%

With Euromonitor International’s new global e-commerce product and price monitoring platform, Via, we were able to quickly and easily examine more than 20 million daily SKU observations across leading e-commerce retailers in 40 countries to track how the availability of selected categories and their pricing dynamics changed throughout the pandemic. Use our Coronavirus: Pricing and Availability Tracker to learn more.