2020 has been a tough time for the mobility industry due to the Coronavirus pandemic, declining car sales and changing consumer commuting patterns. This is expected to have a long-lasting impact on the mobility sector and encourage mobility companies to diversify their business models.

Rising economic uncertainty and health concerns to change demand for new cars

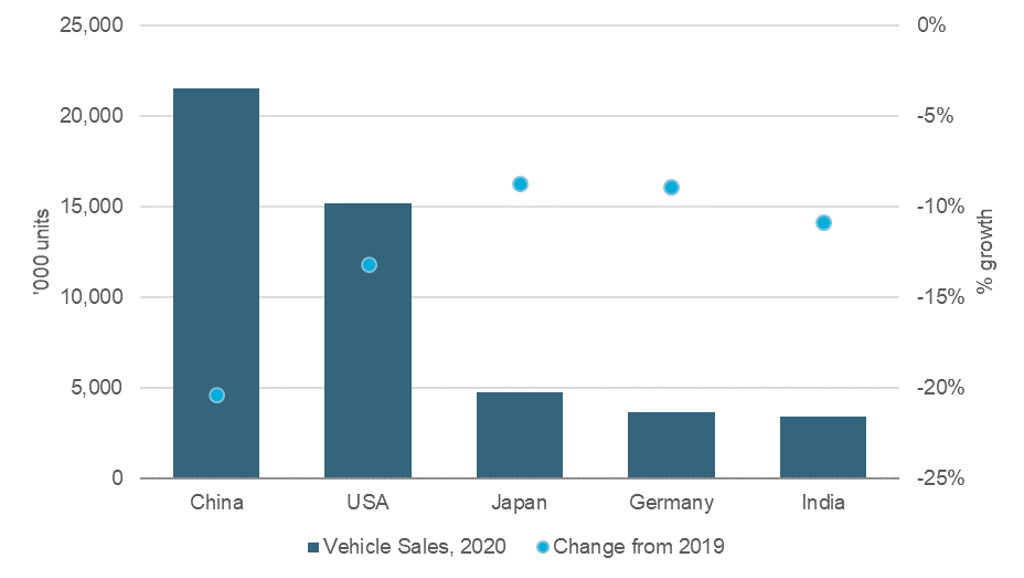

Demand for new cars is set to decline by 20% in 2020 to around 72.1 million units, the result of lockdown measures, rising economic uncertainty and increasing unemployment levels. New car markets in Southern European countries are forecast to take the hardest hit, although better than expected sales recovery in China is predicted to provide some relief for car companies in the Asia Pacific region.

Chart 1. New Vehicle Sales in Top Five Markets, 2020 (Forecast)

Source: Euromonitor International from national statistics, trade sources

Ongoing health concerns are expected to impact commuting patterns and the car selling process. For example, according to Euromonitor’s COVID-19 Voice of the Industry Survey conducted in April 2020, around 17% of respondents globally plan to permanently switch from public transport to private cars to reduce health risks.

New car sales in China also indicate that increasing numbers of households are purchasing a second car to avoid commuting on public transport. If similar trends prevail in key new markets, the global vehicle fleet could expand by around two million units by 2022.

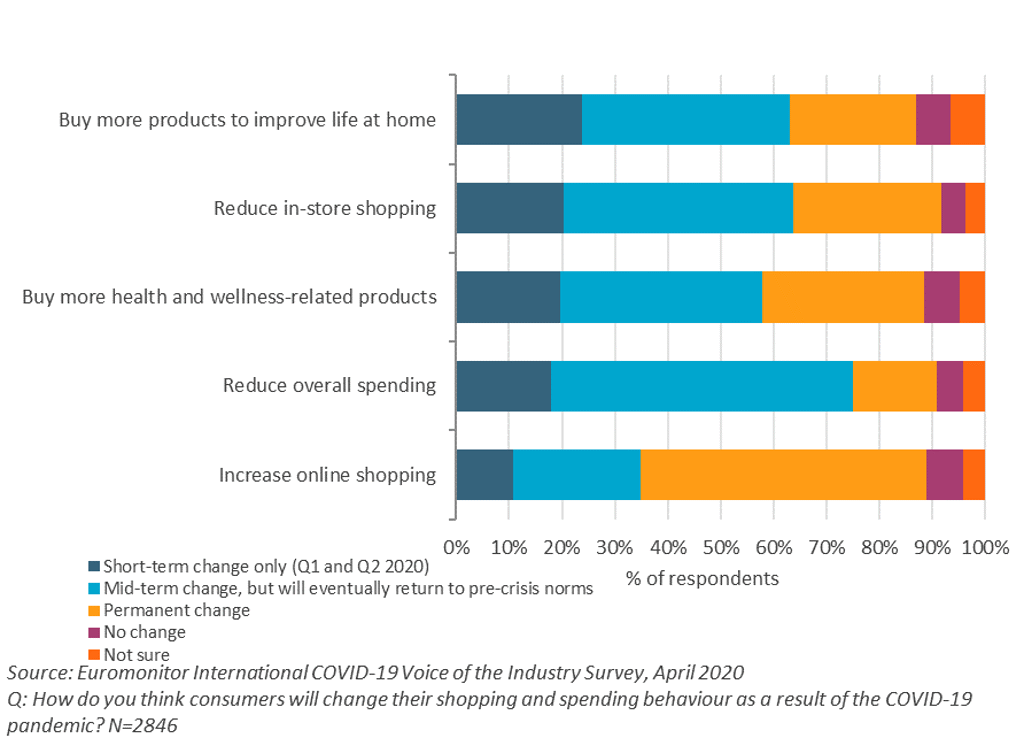

Changing consumer behaviour is also expected to change the selling process for new cars. According to the results of the survey, 28% of respondents plan to reduce in-store shopping permanently, while 54% plan to increase online shopping permanently. Car companies and dealerships will have to react to these changes and intensify focus on e-commerce sales channels to meet changing consumer demand.

Chart 2. Anticipated Changes to Consumer Shopping and Spending Behaviour, April 2020

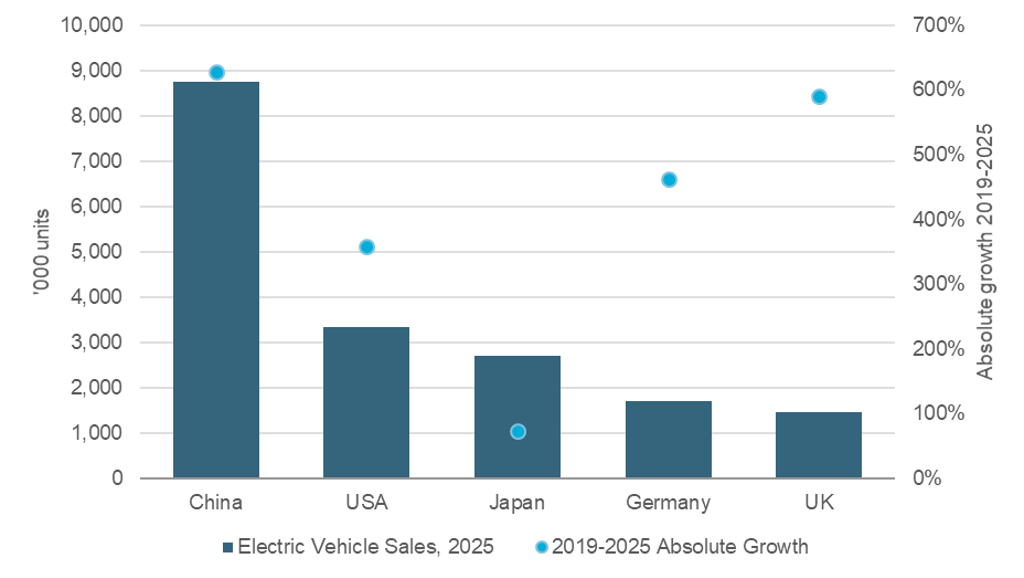

Electric vehicles forecast to gain greater market share

Despite the rising economic uncertainty, electric vehicle sales in the largest new car markets continue to perform well. Electric vehicles are forecast to sustain growth momentum and expand by 25% on average annually over 2019-2025, backed by stricter environmental standards, increasing attractiveness to fleet buyers and government subsidies.

For example, to stimulate demand for new cars, China expanded subsidies on electric vehicles until 2022, while Germany’s government confirmed subsidies to electric vehicle buyers of up to EUR6,000 in June 2020.

Chart 3. Electric Vehicle Sales in Top Five Markets, 2025 (Forecast)

Source: Euromonitor International from national statistics, trade sources

Thanks to extended subsidies, 2020 could also be a tipping point for electric vehicle adoption and accelerate the transition towards electric vehicles. Globally, electric vehicles are forecast to have a 9% share of the new car market in 2020 and 62% market penetration rate in 2040.

Public transport sector continues to face uncertainty, puts more emphasis on safety

Before the COVID-19 outbreak, public transport and shared mobility were encouraged as sustainable methods of travel that can significantly reduce carbon footprint. However, this has been subdued as social distancing measures and health concerns have discouraged usage of public transport.

Moreover, declining passenger numbers have resulted in heavy financial losses for municipalities and other mass-transit transport operators. For example, San Francisco’s BART system reported to be losing USD55 million a month during the lockdown, while public transport operators in the Netherlands are projected to lose up to USD1 billion during 2020.

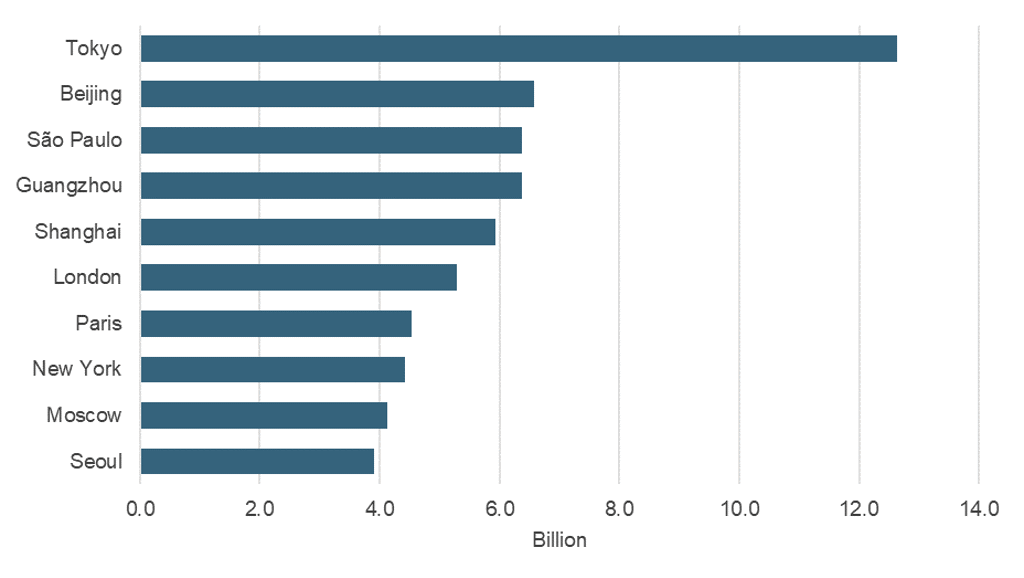

The losses add more uncertainty for public transport operators, as fewer financial resources could restrict future investments and development of public transport networks. Nevertheless, public transport remains the most attractive commuting option in the largest cities and stricter healthcare and hygiene measures could help to ease the health concerns of commuters.

As lockdown measures ease, municipal governments and public transport operators are implementing strict measures for more social distancing and better hygiene control aboard public transport to reduce the potential spread of infection. For example, cities in China started to use smart buses equipped with thermo visors and artificial intelligence tools to help identify people not wearing masks or with COVID-19 symptoms.

Chart 4. Top 10 Cities by Passengers in Public Transport, 2019

Source: Euromonitor International from national statistics

Shared mobility operators expected to diversify their business models

The COVID-19 pandemic has had a severe effect on companies providing ridesharing, bicycle-sharing and other micro-mobility solutions. For example, one of the largest players in the ride-hailing industry, Lyft, reported its ridership rate declined by 75% in April 2020. This created financial and liquidity problems for many companies, which resulted in declining fleets and halted expansion plans. Moreover, stricter hygiene and healthcare measures increased operating costs.

Despite the challenges, the outlook for the shared mobility industry remains positive as many leading players are predicted to resume their expansion plans towards the end of 2020. The shock of COVID-19 is also predicted to make the shared mobility industry stronger and more resilient in the future as many companies started to diversify and offer additional services, such as food or parcel delivery, as well as payment services.

For example, e-scooter provider Bird plans expansion into the payments sector, while one of the industry’s leaders Uber benefited from increasing demand for its food delivery service.

Autonomous vehicle programmes are likely to be delayed

Automotive and technology companies made significant improvements in vehicle connectivity and artificial intelligence; however, the COVID-19 pandemic is expected to delay the launch of fully autonomous vehicles.

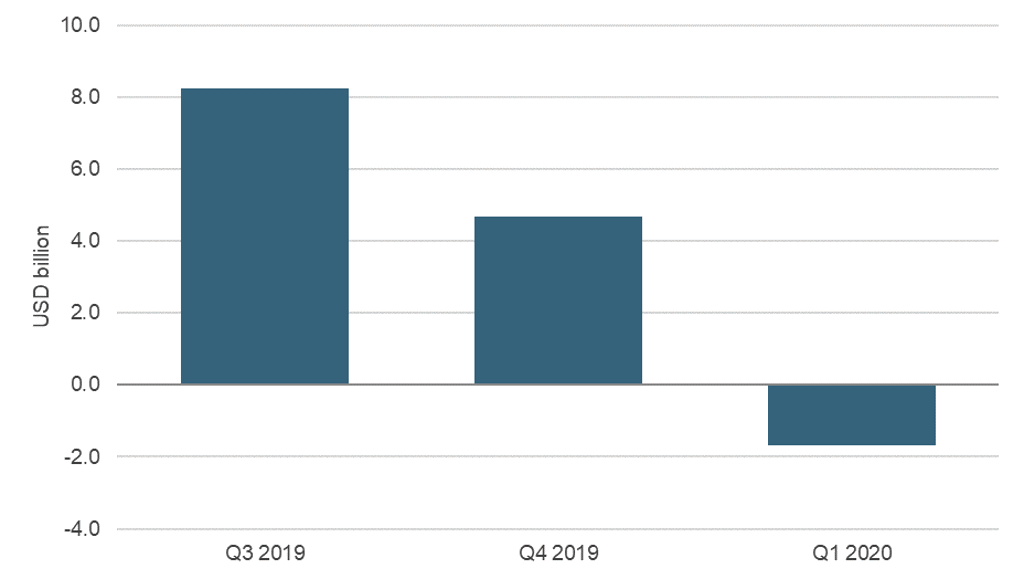

Due to mounting losses in the automotive industry, many companies started to face liquidity problems and will have to review their future investment programmes. It is likely that these companies will delay or cancel some of their autonomous vehicle programmes, as the programmes are still at a nascent stage and it would help to free up more cash flow.

Chart 5. Combined Profits of Top 10 Car Companies, Q3 2019-Q1 2020

Source: Euromonitor International from company reports

Moreover, autonomous vehicle legislation remains another hurdle and it is likely that discussions and legislation changes will be delayed as countries now face more urgent economic and healthcare issues. Based on these factors, the launch of fully autonomous vehicles is predicted to be delayed until 2030.

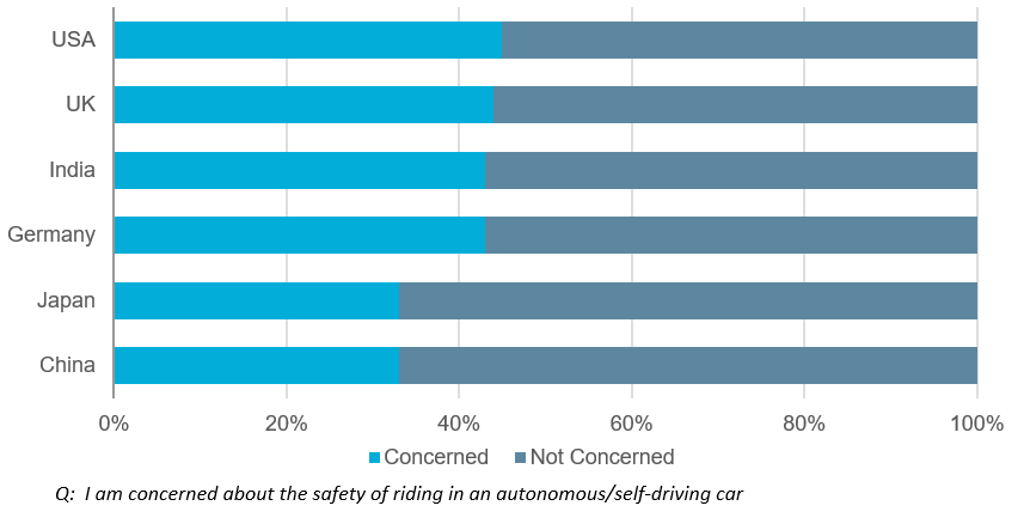

Chart 6. Consumer Comfort Level in an Autonomous Vehicle in Selected Countries, 2020

Source: Euromonitor International Mobility Survey, 2020