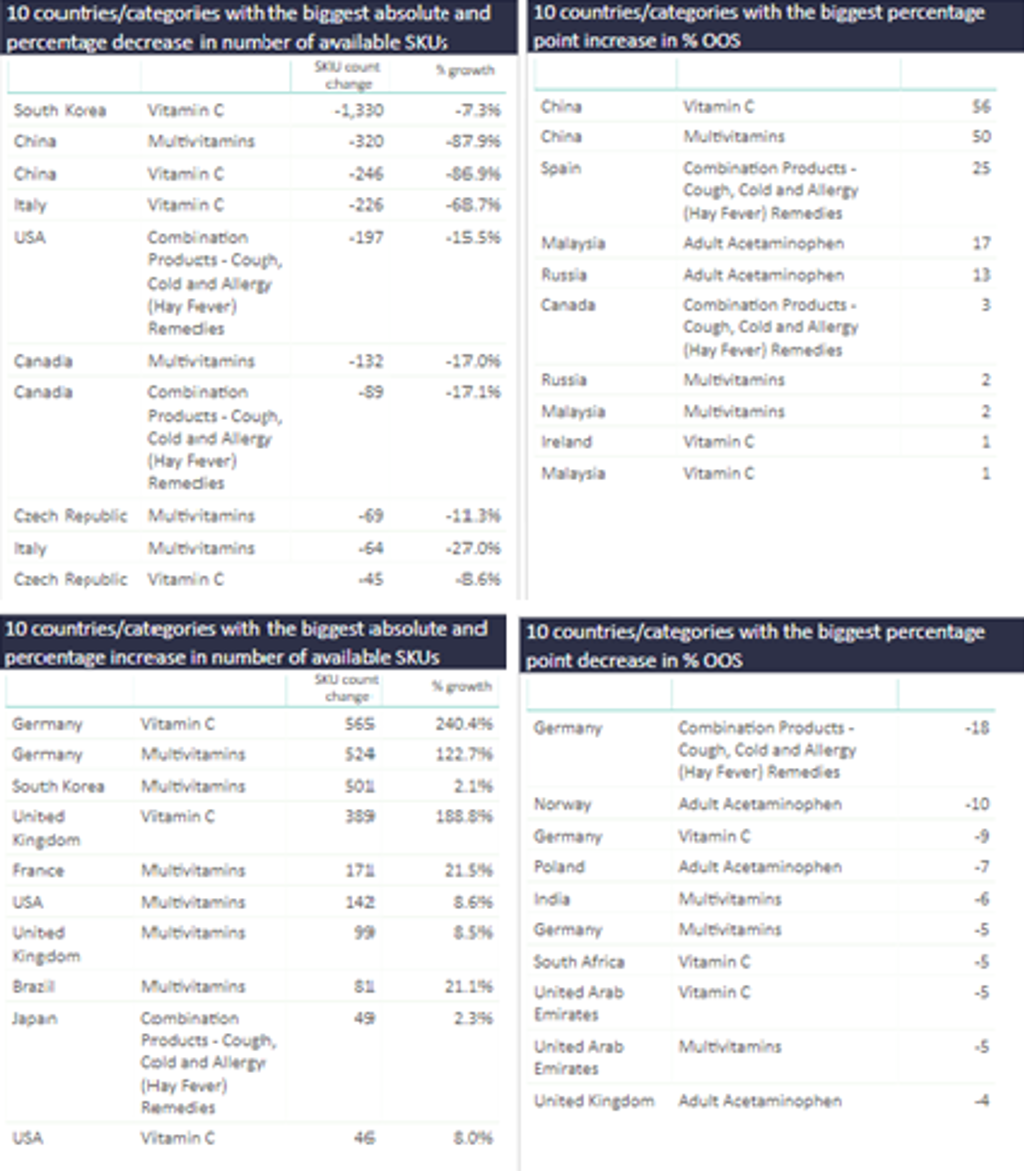

From August 24th to September 7th, multivitamins and vitamin C saw the biggest fluctuations in product availability and out-of-stock (OOS%) rates in consumer health.

Vitamin C and multivitamins in China saw the highest percentage point increase in OOS%, while vitamin C in South Korea saw the largest absolute decrease in available online SKUs in the same period. Interestingly, South Korea doesn’t show high out of stock rates, which suggests that retailers removed SKU pages instead of listing products as out-of-stock in response to increased demand following the country’s recent spike in COVID-19 cases. Large decreases in SKU availability across all countries in the top 10 show that consumer demand for medicines and vitamins remains high throughout the pandemic.

In terms of rising online product availability, Germany dominates with the biggest absolute increase in the number of available SKUs (vitamin C and multivitamins) and appears 3 times in the ranking for biggest percentage point decrease in OOS% rates for vitamin C, multivitamins and combination products. This indicates that Germany is responding well to increased consumer demand during this 2-week period. And while South Korea saw the biggest OOS% rates for vitamin C, the country saw the third biggest increase in SKU availability for multivitamins.

Getting product assortment and availability right is challenging at the best of times. The coronavirus (COVID-19) pandemic has had an unprecedented impact on consumer markets worldwide, with many people working from home or unable to leave their homes.

Many consumers have turned to online shopping as the best way to minimise the risk of infection, and the pandemic also saw many consumers engaging in stockpiling behaviour which is leading to significant product shortages. In turn, this places a tremendous burden on e-commerce retailers’ supply chains and logistical infrastructure.

Some markets have been more resilient than others or already had more robust e-commerce networks in place. Looking at a snapshot of out of stock and SKU availability gives you a view of how different markets are handling the challenges that the pandemic has brought to online retailing.

When tracking product availability, it is important to track both out of stock % and the number of available SKUs as they result in two very different shopping experiences. To deal with increased demand during the pandemic, some retailers removed SKU pages altogether, reducing the number of available SKUs instead of listing SKUs as out of stock. If out of stock rates are low, but the number of available SKUs is rapidly decreasing, it creates confusion for the shopper to see SKUs being removed without notification. On the other hand, if out of stock rates are high but the number of SKUs remains stable, then shoppers are more informed about the overall availability of products on a retailer’s website.

With Euromonitor International’s new global e-commerce product and price monitoring platform, Via, extracting millions of data points every day for standardised cross-comparison quickly reveals what product categories are selling out during key periods of the coronavirus outbreak as well as the dramatic implications these demand drivers are having on online retail pricing for select categories.

Using Via, we were able to quickly and easily examine more than 20 million daily SKU observations across leading e-commerce retailers in 40 countries. Moreover, the data clearly shows how the availability of selected categories and their pricing dynamics has changed during this period. Use our Coronavirus: Pricing and Availability Tracker to learn more.