In 2020, COVID-19 led lockdown accelerated the advocacy and acceptance of Korean culture in India. Home isolation gave the time and opportunity to the Indian consumers to deep dive into the Korean culture through K-Dramas and K-Pop and experience it through K-food. The rising popularity of K-Food in India presents a unique growth opportunity for Korean food manufacturers, ingredients and condiments manufacturers and the Consumer Foodservice sector in India post-2020.

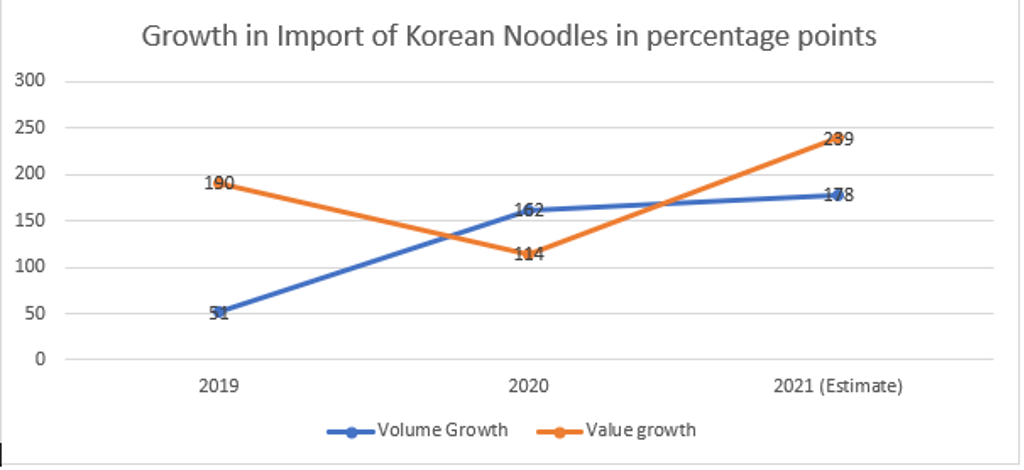

The increase in the viewership of K-dramas and K-Pop influenced the uptake and consumption of K noodles in India. The viewership of K dramas and K pops one Netflix, an online streaming platform, reported a YoY 370% jump in 2020 and the import of Korean Noodles in India also witnessed a volume growth of 162%in2020

Source: Ministry of Commerce and Industry in India

K-Dramas gained popularity in India because of factors like storyline, fashion, and aesthetics. To understand the audience of K-Dramas in India, we ran a survey with respondents who were Indian and K-Drama fans. Interestingly, 88% of the respondents were willing to try Korean food, while only 40% of them had never tasted Korean food.

Typical K food consumer in India

It is not surprising that Indians are drawn towards Korean Food. Ingredients such as rice, noodles, vegetables, meat and ingredients such as sesame oil, chilli, pepper, soy, and spices are common across Korean as well as Indian cuisine. The Korean food plate consists of a protein source like meat or tofu, broth, rice and side dishes like kimchi, seaweed, anchovies etc. Korean food. has gained popularity because of the health benefits associated with it as well as the influence through K-dramas. With easy access to information and recipes online, Indian consumers are not shying away from experimenting with food and are experimenting with the cuisine adding an Indian twist to it.

Through an interview with a popular South Korean noodle brand, Nong Shim. We gathered that there has been a sale of 1 mn USD in 2020 – which is a 130% growth from 2019. The company is now considering India as an important market and focusing on products that cater to Indian consumers. Nong Shim and another popular Korean Noodle brand, Samyang are currently targeting Tier 1 Indian markets because of high income and customer awareness.

Korean noodles are also easily available across e-commerce platforms such as Amazon, Flipkart, BigBasket etc. Following the suite, other Korean speciality formats are also leveraging this opportunity. Korikart.com – an India-based online marketplace that specialises in Korean products and brands has a wide array of Korean ingredients, condiments, and instant noodles. Korean speciality Foodservice outlets such as Daily Sushi in Bengaluru, Hahn’s Kitchen in Gurugram etc. have gained prominence in India. Even McDonald’s has introduced a BTS Meal across multiple channels in collaboration with South Korean Boyband BTS in South and West India.

The Korean culture has gained a huge acceptance in India in 2020 and continues to do so in 2021 owing to its increasing fan base.

K-noodles manufacturers would also need to think about the competition they would face from established Indian brands such as Maggi, Yippie!, if they expanded to mass consumers. As of now, Korean food manufacturers have an opportunity to develop their distribution and expand their market amongst a niche base of consumers who are experimental and willing to pay a premium for noodles. The growth of K-food in India, the entry of Korean brands, and how the local market adapts to this acquired taste remains an interesting space to look out for.