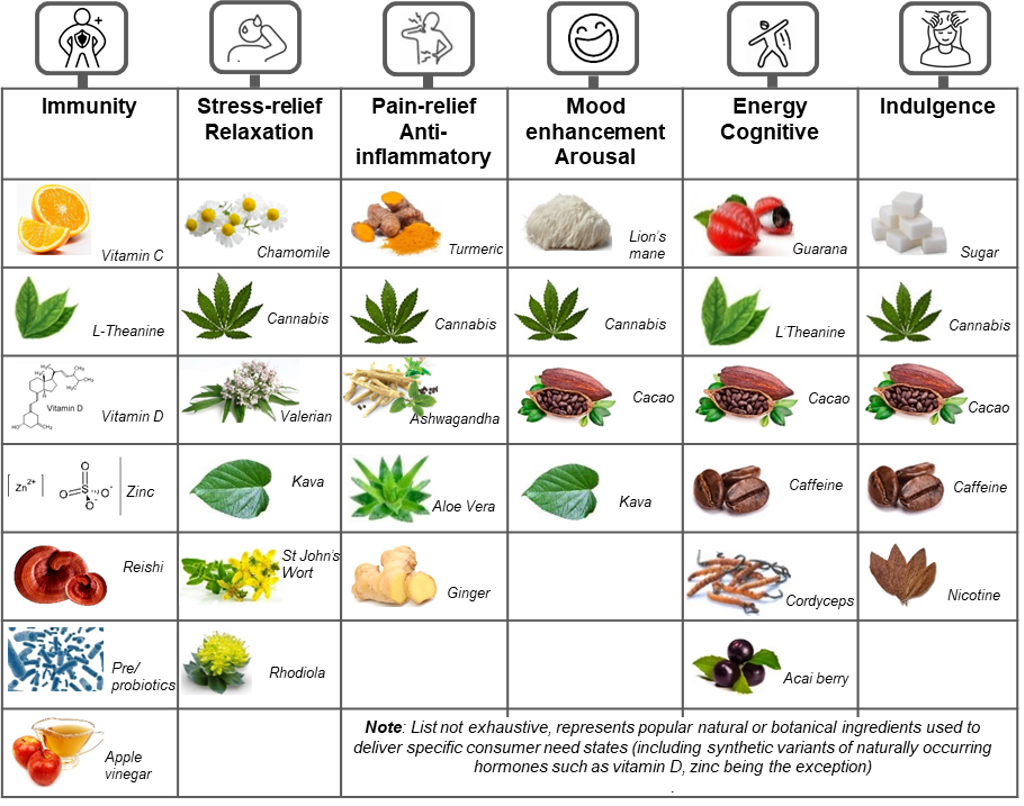

Complexity is an increasingly important feature of the functionality trend in beverages. Widely recognised botanicals such as chamomile, while still important, are being complemented by other ingredients of plant origin that are currently less well-known in Western Europe.

Brands are targeting a range of precise need states, covering various usage occasions. Indulgence is still key in many drinks categories, and the new approach to wellbeing focuses on a holistic approach to what a product can offer, rather than just what is missing (sugar or alcohol for example).

Evolution of ingredients

Botanicals and fungi with adaptogenic properties are not new. Many ingredients, such as goji berry or American ginseng, aimed at enhancing concentration and calmness, have been used in traditional remedies and dietary supplements for years. They are now increasingly found in actual food and beverages in Western Europe.

Beverage manufacturers are proactively leveraging plant-based ingredients which have huge creative potential in meeting evolving functional needs and targeting personal health. These ingredients are being used to straddle several need states.

Source: Euromonitor International

Innovation has also been spurred by the use of relatively new ingredients, such as algae – although to date only a limited number of microalgae species are approved under the strict food use regulations (Novel Food regulation in the EU).

Cannabidiol (CBD) products are moving into the mainstream in many Western European markets, while THC and other cannabinoids hold potential for the future (as and when regulatory changes allow).

Targeting focus enhancement and relaxation

The pandemic has exacerbated the existing pressures of modern life, resulting in rising stress, anxiety and sleeping problems. Mental wellbeing will increase in importance as consumers seek balance during the gradual transition to the post-pandemic era, and companies will respond.

Examples can be seen in beverages targeting two different but related areas of positioning – focus enhancement and relaxation. The rise of sleep health and similar apps could allow consumers to create patterns, tracking the success of the products they choose.

Focus Enhancement

Focus-enhancing products aim to boost productivity by increasing energy and concentration. Adaptogens, for instance, are a class of herbs that assist the body in handling stress and combating fatigue to enable better mental performance. Ginseng, holy basil and guarana are among the best known, although there are numerous others.

A new twist on the classic energy drinks formula has been emerging. In March 2021, Britvic introduced a new natural energy drink under its Purdey’s brand. Purdey’s Refocus contains fruit juice as well as botanical extracts (damiana guarana extract, oak bark, Chinese ginseng), natural caffeine, and vitamins. While, PepsiCo launched Rockstar Energy+ Hemp in Germany in April 2021.

Relaxation

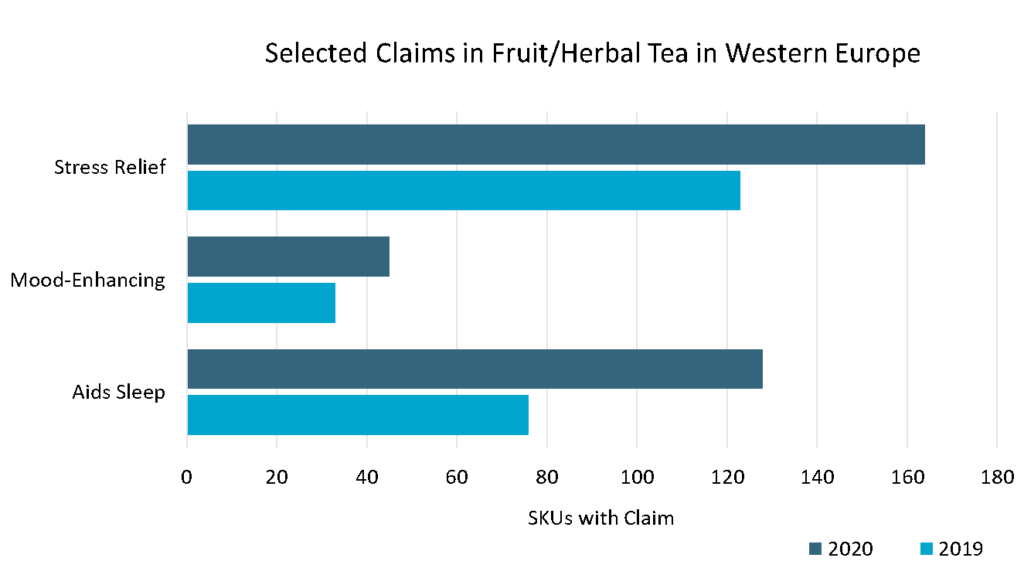

Relaxation products induce calm or aid sleep. Herbal teas have the strongest positioning of any beverages, as they involve different mixes of botanicals. A precise targeting of need states is critical to success in this segment.

In the last year, the number of calming/mood-enhancing herbal teas available online has significantly increased. Many manufacturers expanded or introduced a range of products, playing with different herbs and targeting specific needs with product names such as calm, relax, or bedtime.

Source: Euromonitor International Product Claims and Positioning 2019, 2020

Hemp is coming to the fore when it comes to calming innovation. In April 2021, Clipper Teas launched two new organic infusions – Clipper Organic Karma Mama Hemp and Clipper Organic Groovy Ginger Hemp, which combine hemp seed with other botanicals. Both SKUs are positioned as calming, self-care infusions.

Edi’s Spirited Euphoria is a non-alcoholic spirit distilled from hemp. This falls within the new generation of alcohol alternatives that claim to offer the benefits of relaxation without the negative effects of alcohol. The Three Spirit range is another example, with the use of botanical extracts such as lion’s mane mushroom and cacao featuring prominently in its Social Elixir, which is positioned as a “mood elevator”.

There are still challenges to overcome in terms of consumer education and acceptance, nevertheless, functionality provides an important point of differentiation in the increasingly competitive non-alcoholic sector.

Conclusion

Innovation in functional beverages will remain dynamic in Western Europe; however, legislation presents a potential obstacle in the region. Rules governing the use of ‘new’ ingredients and health claims tend to be relatively strict, and amendments take time.

Outside of herbal tea, the penetration of many product claims remains low. Within the existing legal framework there are still opportunities for beverage products to benefit from a clear and well-communicated functional positioning. Education from brands around ingredients will be crucial.

If you would like to know more:

Euromonitor Identifies 6 Cannabis User Profiles in 2021

Minding Myself: Focusing on Our Mental Needs

Preventative Health Positioning Offers Growth Opportunities for Brands