Prevention can be defined as taking vitamins and dietary supplements (VDS) on a regular basis to avoid illness, and although it might seem like a reaction to coronavirus (COVID-19), it has been a growing trend within the consumer health industry for over a decade. Consumers across the globe are choosing over the counter (OTC) preventive options at the expense of products prescribed for the treatment of an existing illness.

Within Latin America, consumers still overwhelmingly prefer analgesics such as acetaminophen or aspirin, but sales for these and other treatment options have been stagnating since 2011, following a global trend towards preventative vitamins and dietary supplements. Growing consumer awareness, local preferences for herbal options, price barriers (for treatments), pharmacy accessibility and access to a doctor’s consultation are all key drivers for growth within vitamins and dietary supplements.

COVID-19 adds urgency to consumer demand for preventative OTC medicine. Consumers are not only trying to prevent contagion but also fortify their immune systems so as to better manage the virus in case they are infected. Uncertainty and fear will be drivers in the consumption of products aimed at prevention.

The effects of COVID-19 on consumer health

Though it is quite early in the spread of COVID-19, it is already clear that the outbreak is causing a spike in growth in relevant consumer health categories, like cough, cold and flu remedies, and immunity dietary supplements. In some countries, there has already been a run on these products, which is likely to mean that there will be a cap on near-term growth, as supply is disrupted, and shortages occur. Consumers report high satisfaction with their current cold and flu treatments, which suggests that COVID-19 will push consumers towards the products that they use and trust, rather than experimenting with unfamiliar alternatives.

It is interesting to observe how countries within Latin America are reacting in regard to preventative measures. Colombians, for instance, are not regular vitamin consumers, as natural fruit juices are readily available and part of the culture. While the pandemic has increased awareness of vitamins and dietary supplements, high prices coupled with an existing economic crisis aggravated by the oil shock means sales have not increased significantly. Peruvians, on the other hand, are established fans of sports nutrition protein products and believe these products will boost their immune systems, so are therefore consuming within this category at higher than expected rates.

The mental health aspect of the pandemic is also set to play a significant role in consumer health. Anxiety, stress, sleeping troubles and other symptoms have arisen among consumers from around the world. As a result, categories such as sleep aids and digestive remedies (especially anti-diarrheal ones) were all expected to grow. However, sales for sleep aids have actually decreased in Colombia, as a result of the national lockdown; reduced social activity has so far translated into improved sleep habits. In Peru sales for digestive remedies did increase, but for a totally different reason; people started to cook food at home. The more traditional meal being potatoes and rice, consumers needed laxatives rather than anti-diarrheal remedies.

Stockpiling will not significantly affect annual sales

Although stockpiling during the alarming initial months seemed to herald explosive growth, the current situation is not expected to significantly alter the category breakdown of sales in Latin America. Local consumers ran out to buy trusted OTC products like paracetamol and aspirin for future treatment in addition to probiotics and vitamin c as a preventative measure. These categories experienced record-breaking growth during the first and second quarters as consumers saw the impending winter and increasing contagion as forces to be reckoned with.

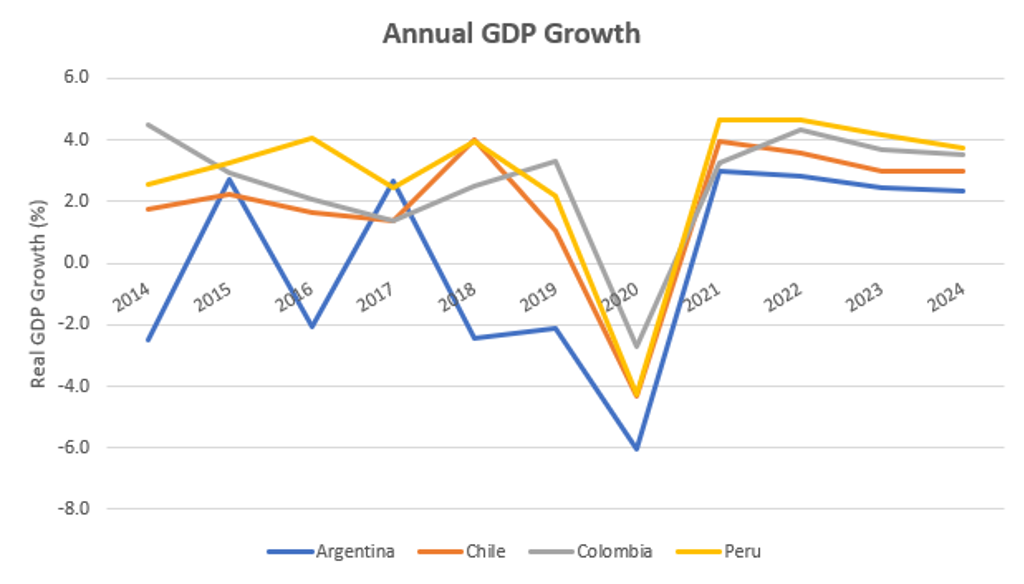

However, we can expect a deteriorating economic scenario with negative growth rate expected for all countries in the region, with a deep contraction of -6.1% in the case of Argentina and a more optimistic case for Chile of -4.3% according to the Euromonitor International macro-model dashboard. This has been aggravated by the oil shock, which will strongly impact oil-dependent countries such as Ecuador and Colombia.

This complex economic scenario coupled with limitations in distribution and supply mean that any growth caused initially by stockpiling cannot be sustained. We can expect a more moderate performance during the second half of the year and a similar sales breakdown for products aimed at prevention versus treatment.

In addition, consumer behavior plays a key role when analysing category performance. New consumers of vitamins and dietary supplements could prove short-lived, as new habits related to self-care are not easily adapted and Latin American’s characteristic price sensitivity will more likely benefit more accessible products or even traditional/herbal popular treatments. Another point of interest is Latin Americans’ high sensibility to news related to the pandemic. For example, ibuprofen sales decreased in Chile following a news report that France's health ministry suggested that popular anti-inflammatory painkillers (such as ibuprofen) could worsen the effects of COVID-19.

Preventive solutions have undoubtedly seen a boost in sales as a result of COVID-19, with growth well above that of treatment categories, which will have flat growth in 2020. Treatments will, however, continue to be the preferred option for Latin Americans, during and after the pandemic. The prevention trend goes beyond OTC purchases now though; it means greater consumer awareness in Latin America and habit changes that might be more likely to persist in the face of a drawn-out global pandemic.