The outbreak of Coronavirus (COVID-19) has significantly disrupted the manufacturing sector and global supply chains. According to Euromonitor International’s Voice of The Industry COVID-19 Survey results in April 2020, around 54% of companies surveyed quoted the extensive impact of the pandemic on their daily operations.

Euromonitor International’s Supply Chain Sensitivity Index can help to evaluate which industries are the most vulnerable to supply chain disruption and how unexpected shocks can impact households and B2B buyers. The impact of COVID-19 on different manufacturing industries is prone to variation, but industries which are most reliant on efficient transportation and delivery systems and industries with long supply chains are feeling the heaviest impact. As a result, we expect to see supply chain diversification and regionalisation, especially in industries providing essential goods.

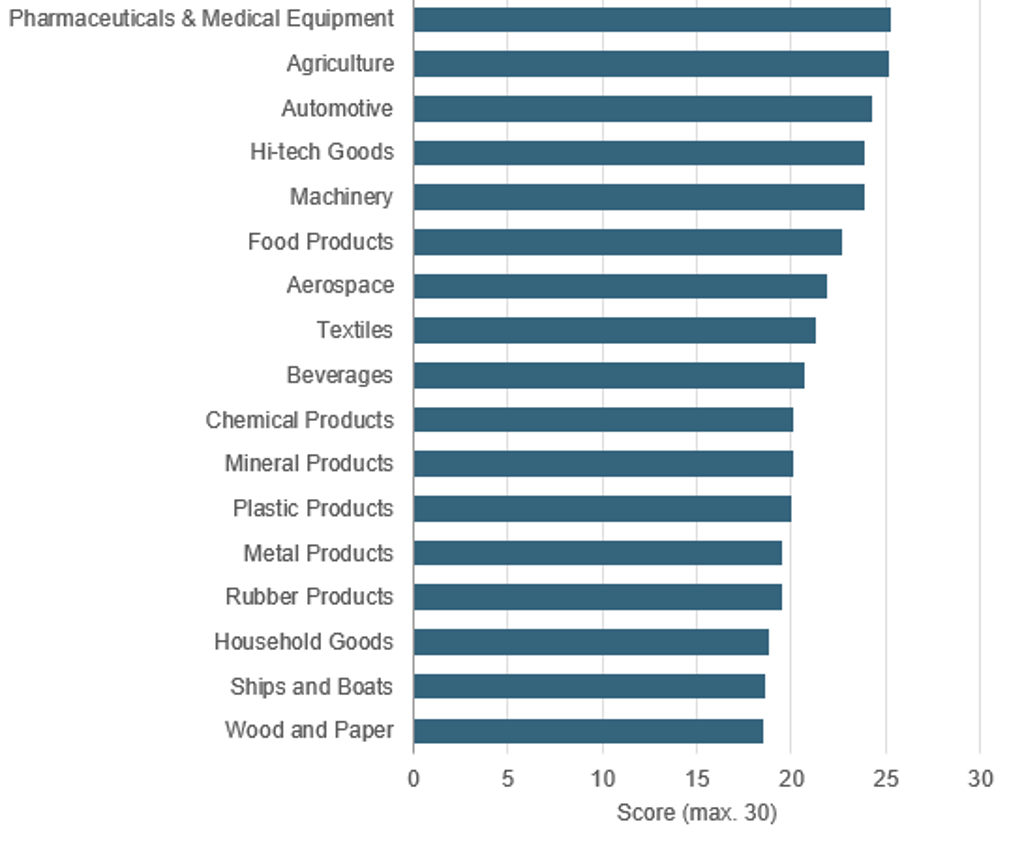

Supply Chain Sensitivity Index in Selected Manufacturing Industries 2019

Source: Euromonitor International. Note: Industries with higher scores have more sensitive supply chains

Pharmaceuticals and agriculture industries have the most sensitive supply chains

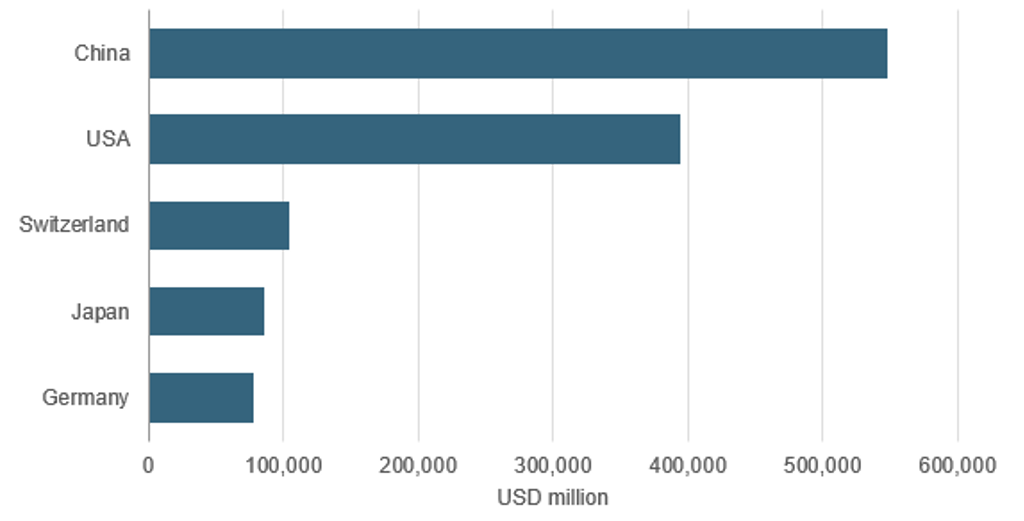

The pharmaceuticals and medical equipment industry has the most sensitive supply chain due to heavy reliance on efficient transportation networks, high dependence on supplies from China and lack of substitution alternatives. For example, China supplies around 70% of global active pharmaceutical ingredients (APIs). The outbreak of COVID-19 has exposed weaknesses in the global supply chain of pharmaceuticals, as supplies from China have dwindled following lockdown measures. Although full-scale crisis has been averted thanks to large stockpiles of critical medicines, prolonged supply chain disruption could cause a shortage of pharmaceuticals globally.

Top Five Producers of Pharmaceuticals and Medical Equipment 2019

Source: Euromonitor International from national statistics

Agriculture is another industry with a sensitive supply chain, largely due to heavy dependence on efficient transportation, delivery and storage networks. Transportation bottlenecks could potentially cause short-term food supply problems and hinder global food security. This would largely affect consumers in emerging countries due to their greater sensitivity to rising food prices.

Industries with long supply chains face increased risks

Industries with long supply chains, such as automotive or electronics, are also at higher risk, their supply chains highly sensitive to production disruption in core manufacturing hubs. In turn, this disruption can extend further up the value chain and disrupt operations of other B2B industries.

The outbreak of COVID-19 exposed the vulnerability of supply chains, as manufacturers of machinery, automotive and electronics were forced to temporarily halt their production due to lockdown measures in China. Prolonged disruption could potentially impact global manufacturing and transportation sectors, as supplies of spare parts are likely to dwindle, taking time for component manufacturers to fully restore production volumes.

How do we measure an industry’s supply chain sensitivity?

Several factors, including transportation networks, the industry’s role in the global supply chain, the role of suppliers, and the ability to substitute goods, all influence an industry’s supply chain sensitivity. The key assumptions include:

| Factor | Explanation | Industry Examples |

| Ability to substitute goods | Industries producing essential goods face higher sensitivity to changes in their supply chains. Due to a lack of substitute goods, such industries face difficulties in finding alternative suppliers and disruption is likely to affect the daily lives of consumers. | Food products, agriculture, pharmaceuticals |

| Industry’s role in the transportation network | Efficient transportation networks are essential in providing undisrupted trade flows. Industries receiving a higher share of B2B revenue from the transportation sector have potentially more sensitive supply chains. | Automotive, rubber, chemicals – among key suppliers to the transportation network |

| Industry’s role in the global supply chain | Industries having higher B2B revenue share have potentially more sensitive supply chains. Disruption in core supplier sectors could disrupt global production in other industries. | Machinery, electronics – among key suppliers to manufacturing industries |

| Geographic dependence | Measures global production share that the top five countries generate in each industry. Production disruption in one of these countries would disrupt global supply chains. | All manufacturing industries |

Future supply chains to become more regionalised and diversified to minimise risks

To avoid similar disruption in the future, companies and governments are expected to increasingly diversify production and supply chains. For example, the EU is expected to spend part of the planned EUR1 trillion COVID-19 relief package on industrial strategies which would help to strengthen regional supply chains. However, at the moment the relief package is still in gridlock, yet to be confirmed.

Supply chain diversification and regionalisation is especially relevant to industries providing essential goods, such as food products and pharmaceuticals, as well as industries playing a key role in the global manufacturing and transportation network, such as electronics, machinery and automotive. It is likely that these industries will lead production diversification and intensify production reshoring from Asia over the next 2-3 years.

More information on supply chain analysis is available in the Coronavirus Impact on Global Supply Chains strategy briefing.