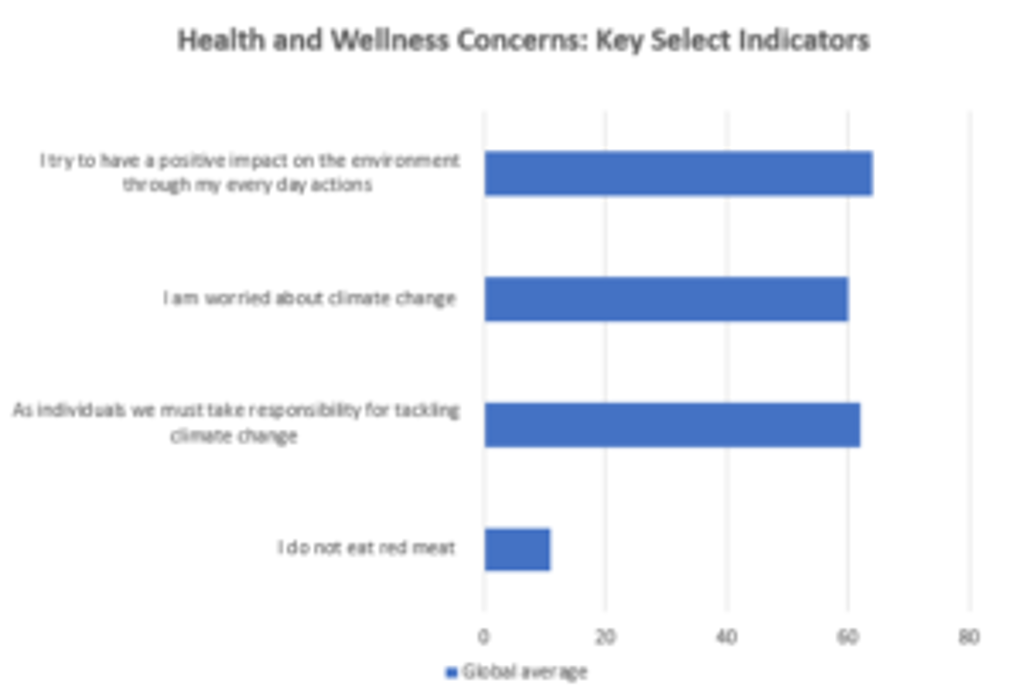

Although sustainability in eyewear has typically lagged in other fashion categories, a shift in consumer attitudes has undoubtedly fuelled an increased level of focus on a range of environmental and ecological issues related to this, as exemplified by Euromonitor’s Consumer Lifestyle Survey.

Over 60% of consumers surveyed by Euromonitor claimed that they are worried about climate change, while 62% of consumers survey believe that we, as individuals, must take responsibility for tackling climate change. ‘There’s huge global awareness and people are beginning to realise it’s urgent, as well as important. We are cooking the planet. People are consuming too much,’ David Green, CEO at David Green Eyewear, South Africa, affirms.

Source: Euromonitor International

Formed in 2005, David Green Eyewear’s handmade frames, range from £200 to £300 and are manufactured to reflect the purity and colour of their environment, using materials such as fallen leaves, reeds, mother of pearl and wood for the frames and natural vegetable dye for the colour. The company also prides itself on using a production facility, where 80% of the energy is solar. In addition to the frames being made sustainably, plastic-free packaging is used for all the products.

Euromonitor met with the owner of David Green Eyewear to examine the challenges and opportunities in this unique category of sustainable eyewear.

Where is your customer base largely coming from?

David Green: Our customers are getting younger. It’s a youth-driven thing. A lot of pressure to be sustainable is coming from the youth, which is good news.

What role does the internet play in pushing sales?

David Green: We only supply to optical stores. We do not sell direct to the customer and have no plans to. We need the customer to have a high level of engagement and to tell the story face to face. Storytelling is very important to us.

Nevertheless, we have a website with an online catalogue. But no prices. The role of the website is as a ‘beehive’ and the rest of social media are the ‘bees’. The worker bees are involved in Facebook, Instagram and Twitter and their job is to bring the work into the hive.

I have a whole community online and they are looking at fashion. Social media is a very important platform for us, but I recognise that you need a combination of ‘air’ support, as well as ‘on the ground’.

Which markets do you see as offering the biggest opportunities for your brand?

David Green: The UK is the biggest market for us. It is more of a mature market, with a more discerning customer, seeking more meaning in what they are purchasing.

What other markets are you targeting?

David Green: As well as South Africa and the UK, we sell in China, Switzerland, and the US.

In the US, there is a strong green movement growing and we get a good response. We find our brand succeeds in aesthetically pleasing places, like Ohio. We are not a big city brand.

What are the major challenges that you are facing as a sustainable eyewear player?

David Green: Now, it’s the developing markets that are more difficult to enter, and South Africa is the most challenging market for us. Here it’s the ‘luxury brands’ that still dominate, overshadowing sustainable eyewear. If someone gets an attractive brand, it will override the purpose of sustainable eyewear.

Euromonitor International’s 2019 World Market for Eyewear strategy briefing discussed the impact of sustainability concerns on the global eyewear market while our Lifestyle Survey identifies the global consumer trends that impact various FMCG industries. For more insight, click here.