As discussed in part one of India’s consumption story also lies beyond the metro cities. Several regional brands have been holding on a strong market share in tier 2 and tier 3 cities and giving MNCs competition in various FMCG categories.

Here are three more companies that have established themselves in the regional market and are looking at gaining market share across India.

Pan-India distribution and acquisition to aid Prataap Snacks' momentum

Prataap Snacks is focused on understanding local consumer tastes and preferences through innovative product launches at competitive prices. Under the Yellow Diamond brand, the company initially started out with chips/crisps and rapidly expanded its portfolio. The entry into newer categories helped Prataap Snacks achieve double-digit growth while effectively catering to the tastes and preferences of different consumers. Today, the company offers a bevy of snack offerings, including katori, pipes, trikon, rings, chips, namkeen chulbule, puff and popcorn, amongst others.

Prataap Snacks is currently present only across 60% of the country and is looking to achieve a pan-India presence over the next two years. Southern India, Punjab, Gujarat, Uttar Pradesh are areas where the company has a limited presence. It is the recent acquisition of Gujarat-based Avadh snacks helping the company expand its presence in the state. Prataap Snacks has been rapidly expanding its distribution network, from 3,500 distributors in FY’17 to 4,100 distributors in FY’19.

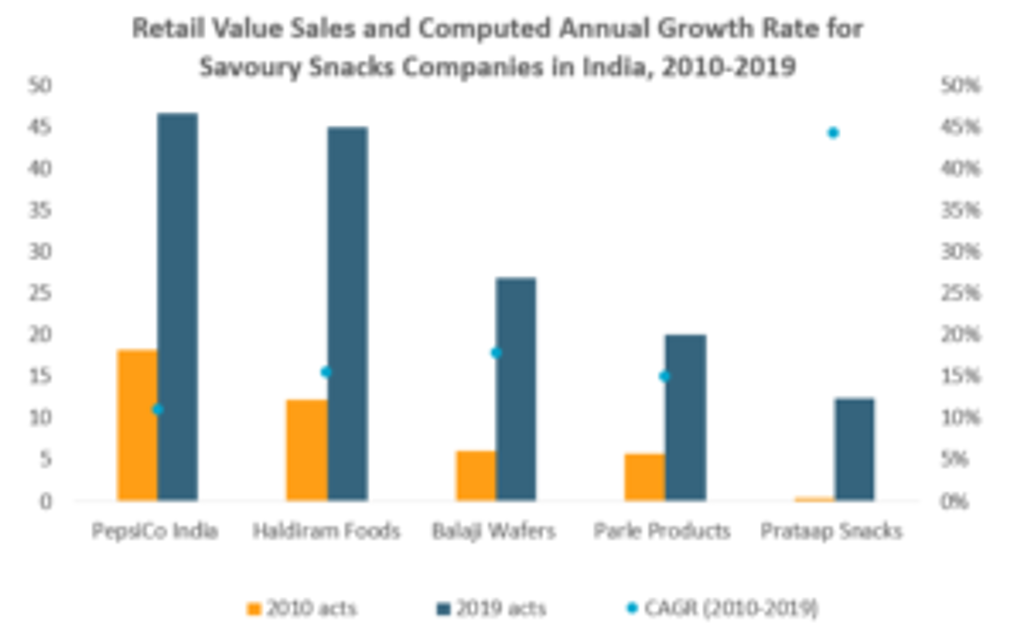

Source: Euromonitor International

Going forward, Prataap Snacks will look to leverage Avadh’s distribution network to enhance Yellow Diamond’s presence in Gujarat, while expanding Avadh’s offerings outside Gujarat to other states such as Maharashtra and Uttar Pradesh. Furthermore, expanding its distribution network into southern states will help the company retain its momentum and achieve double digit growth in the future.

iD Fresh continues to identify and cater to regional tastes and preferences

iD Fresh Foods Pvt Ltd, since its inception in 2005, has been offering products that make the first steps of Indian cooking convenient. Its first launch of iD Fresh Dosa batter in South India solved consumers’ daily challenge of preparing dosa batter at home; dosa being a staple food for most households. Following that in 2010, the company launched Malabar parotas (flatbread) which only needed to be heated before consuming.

iD Fresh was the pioneer in this category and was quick to be the category leader in south India. It became popular amongst non-resident millennials who avoided or lacked the skill to prepare the dough at home. After seven years of presence in select southern states, the company expanded in cities like Mumbai and Hyderabad which had relatively bigger working populations in 2012.

In 2016, iD Fresh introduced its products to Cochin and Coimbatore and launched Udupi-style Idli Batter, curd and paneer, catering to local tastes. It also introduced ‘iD Daileez’ to cater to the price-sensitive customer. In 2017, going back to its traditional Indian roots, the company launched Ragi Idly & Dosa batter. In 2018 it launched Vada Batter and packs of Traditional Filter Coffee Decoction, which is a traditional and popular beverage in the south.

The company has been continuously innovating and introducing products that cater to regional tastes and thereby create new categories.

The three pillars of Wagh Bakri’s growth are: localisation, strategic expansion and passing profits to consumers

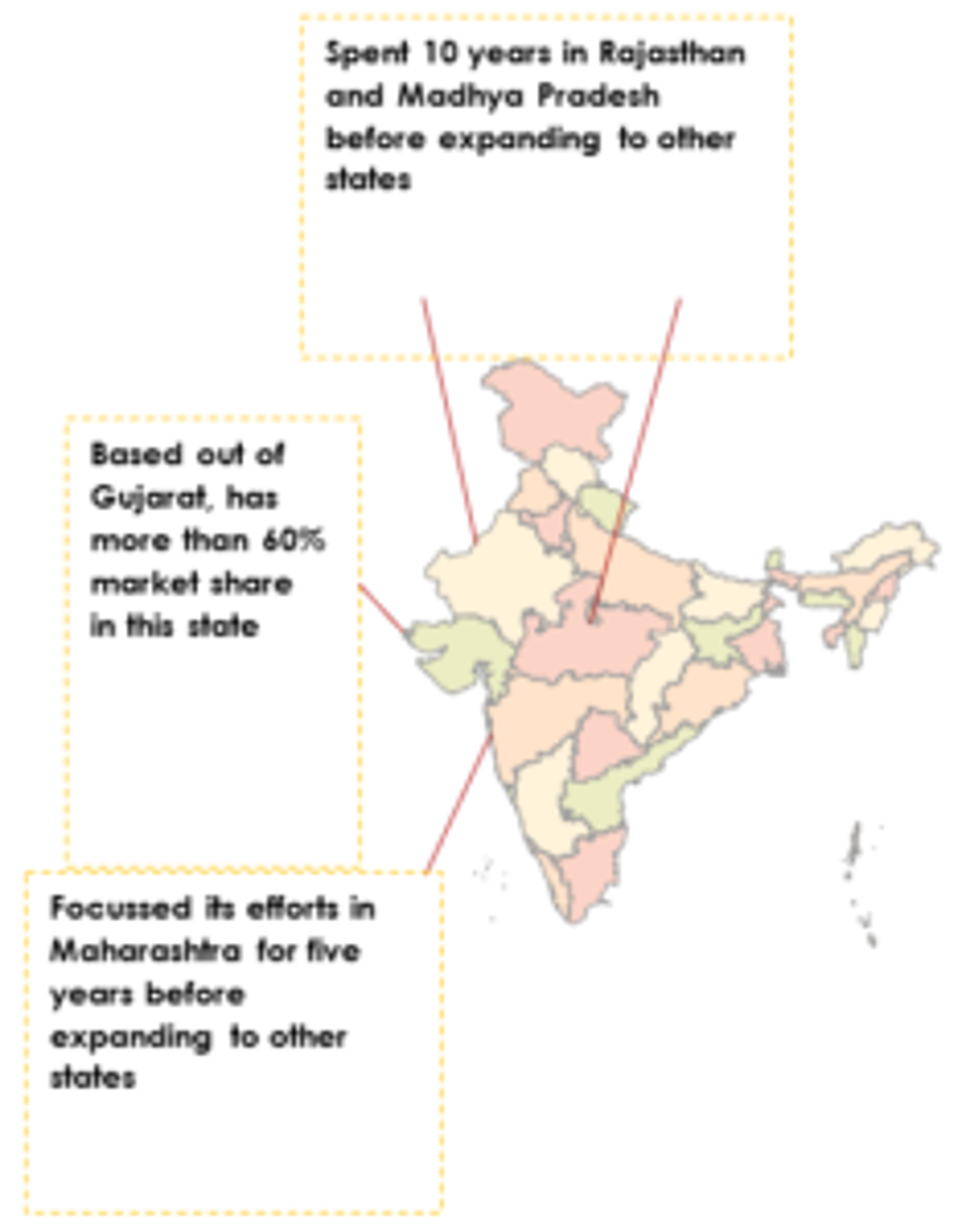

Gujarat Tea Processors and Packers Limited (GTPPL)’s Wagh Bakri started operating regionally (exclusively in Gujarat) but is on its way to becoming a national brand. It understands regions and the fact that tea is a local product with varied preferences.

Wagh Bakri, mostly concentrated towards central and western India, is expanding its nationwide presence but not rapidly. The company treats each state as a separate market and focuses only on one or two states at a time and doesn’t believe in simultaneous expansion. It only moves to another state after gaining significant market share. Before extending its brands to Maharashtra, it focused on Rajasthan and Madhya Pradesh for 10 years. Similarly, before expanding to Delhi, it focused on Maharashtra for five years. The company expanded its offerings in the northern and southern states recently and is now available in 17 states.

Source: Euromonitor International

The company focusses on passing profits to consumers by reducing prices in instances where it has achieved its profit targets. Unlike other competitors, it doesn’t increase the price of its product based on market trends, unless compulsory.