Brazil saw a recent spike in cases of Coronavirus (COVID-19) due to a new variant of the virus which is potentially more transmissible. Despite limited restrictions being imposed in the country in response to this surge, online product availability has still been fluctuating in the past month.

Countries around the globe have been in and out of lockdowns throughout 2020 and into 2021. In response to this shifting landscape, Euromonitor International has been tracking changes in online pricing and product availability across 10 industries to see how online retailers have responded to peaks in demand in different countries.

Looking at Brazil in particular, we can track how different product categories have been affected in terms of changing SKU availability and out-of-stock rates (OOS%) between 3rd January 2021 and 3rd February 2021.

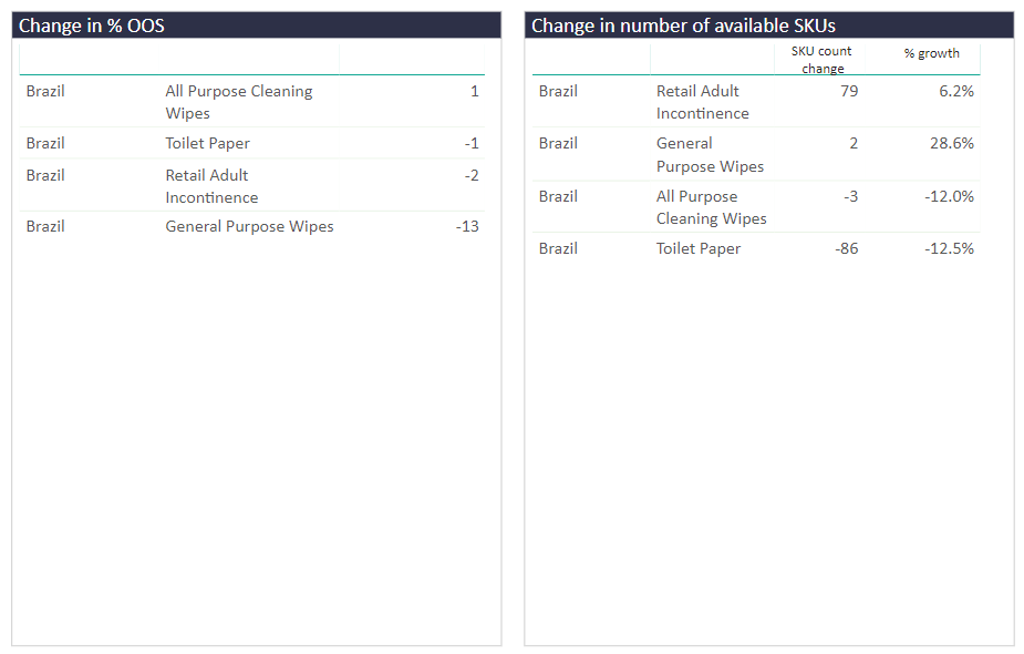

Home care categories saw decline in available SKUs

As we’ve seen across many countries, a spike in cases tends to result in increased demand for home care and tissue and hygiene products. Toilet paper and all-purpose cleaning wipes saw the biggest decreases in the amount of SKUs available online, with a 12% decline each. In terms of OOS%, the changes are not as steep, showing that online retailers are removing SKU pages to deal with increased demand instead of listing products as out of stock, resulting in a less informed shopping experience for consumers.

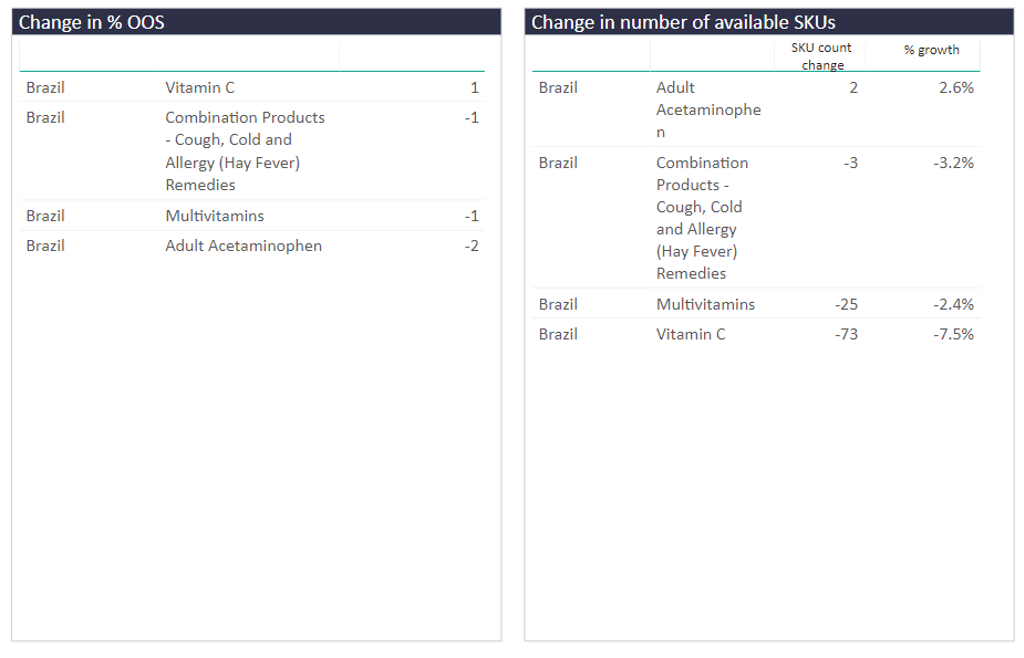

Vitamin C in high demand as consumers try to stay healthy

To keep themselves healthy during a global pandemic, many consumers look to at-home consumer health remedies or preventative measures. For that reason, we saw the biggest decrease in online SKU availability for vitamin C and multivitamins. For the OOS%, there were small changes of around 1%, again showing that online retailers are removing SKU pages instead of listing as out-of-stock.

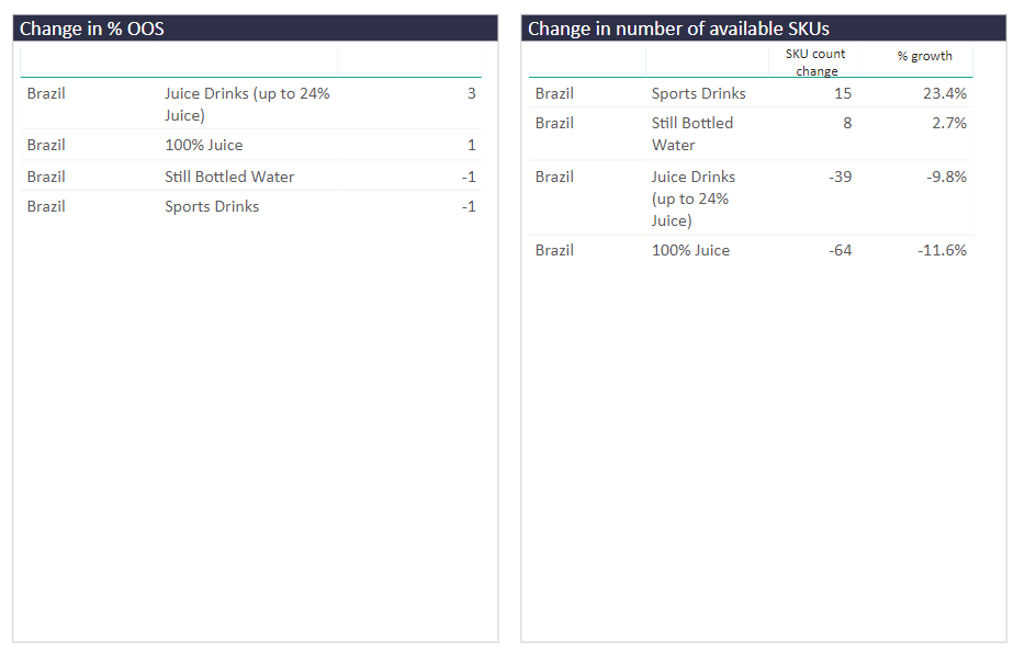

Similarly, 100% Juice saw declining SKU numbers online, as consumers chose healthier products to consume more vitamins and stay healthy during this time. 100% Juice and Juice Drinks (up to 24% Juice) saw a decline of almost 12% and 10% respectively.

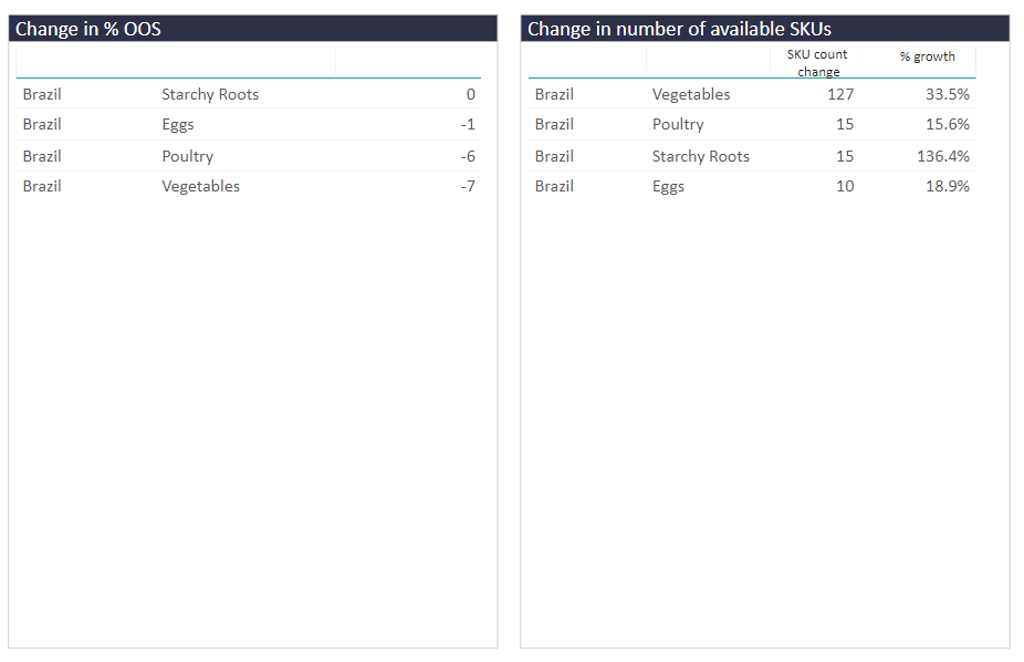

Fresh foods see improving availability

Starchy roots and vegetables saw increases in online SKU availability and improving or stable out of stock rates. This suggests that consumers are perhaps favouring longer life food staples instead, or that these categories are not bought via the online channel as often. Either way stock levels and availability was not as hard hit for fresh food versus other categories.

How we track SKU availability and OOS%

When tracking product availability, it is important to track both out of stock % and number of available SKUs as they result in two very different shopping experiences. To deal with increased demand during the pandemic, some retailers removed SKU pages altogether instead of listing SKUs as out of stock. If out of stock rates are low, but the number of available SKUs is rapidly decreasing, it creates confusion for the shopper to see SKUs being removed without notification. On the other hand, if out of stock rates are high but the number of SKUs remains stable, then shoppers are more informed about the overall availability of products on a retailer’s website.

With Euromonitor International’s new global e-commerce product and price monitoring platform, Via, we were able to quickly and easily examine more than 20 million daily SKU observations across leading e-commerce retailers in 40 countries to track how the availability of selected categories and their pricing dynamics changed throughout the pandemic. Use our Coronavirus: Pricing and Availability Tracker to learn more.