It is the first time in history that the Olympic and Paralympic Games, due to take place in Japan in July-August 2020, have been postponed, following the Coronavirus pandemic outbreak. The country’s economy will be hugely impacted by both events. While the International Olympic Committee (IOC) and Tokyo itself will be challenged to find the sweet spot in the 2021 sporting calendar to make the Olympic and Paralympic Games successful, it is inevitable that various industries in Japan, from travel to televisions, will experience a difficult time, weighing on an already weak economic outlook. However, social distancing measures arising from the pandemic will likely engender some new habits for Japanese consumers.

A congested sports calendar could dilute attention from the Tokyo Olympics in 2021

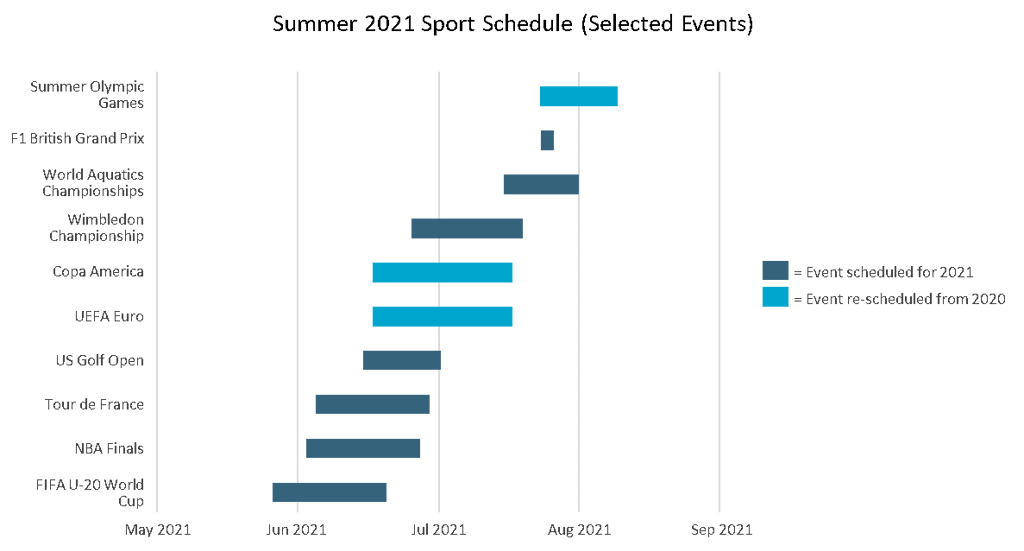

2021 is set to be a year when every major sports league play catch up, eager to close out the impacted 2020 season and recoup lost revenues. We are facing the most congested sporting calendar in history, which adds to the complexity of the situation for the IOC.

The world championship event of one of the biggest Olympic sports, swimming, is already scheduled to take place in the US in 2021; however, this is likely to be rescheduled. More concerning, however, is the prospect of the Olympics taking place and not attracting the global attention usually associated with an event of this magnitude. The world’s biggest leagues are seeking to close out postponed seasons and return to regular schedules, all the while capturing lost 2020 matchday, broadcast and sponsorship revenues.

Source: Euromonitor International

Travel industry rebound expected in 2021

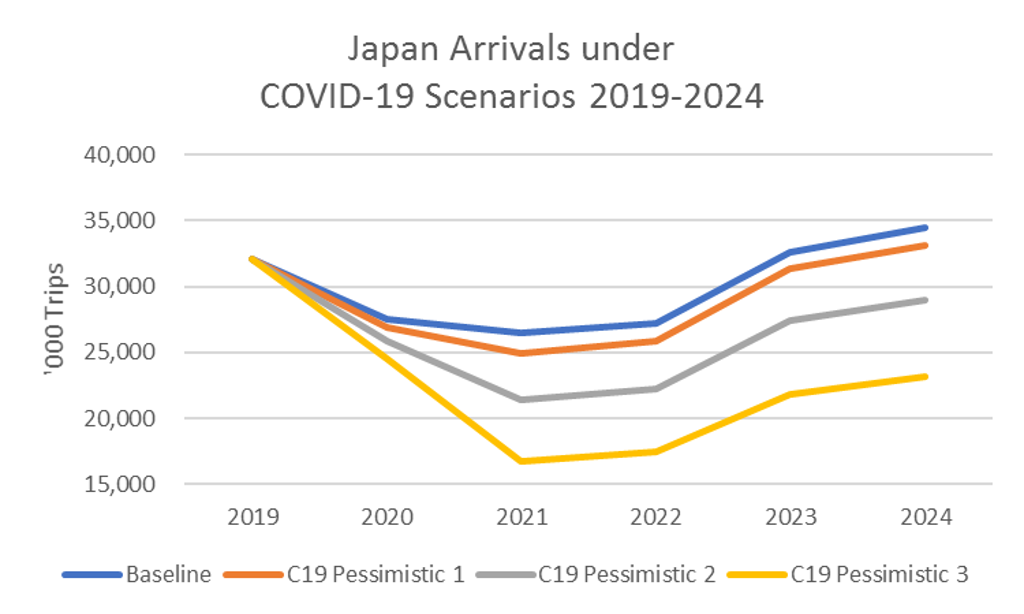

While the postponed Olympic and Paralympic Games are expected to damage inbound arrivals to Japan, we are seeing a larger impact from the coronavirus (COVID-19) outbreak, and the recovery for inbound arrivals depends on when the outbreak will be resolved in Japan and other countries such as China and South Korea, the two largest inbound source markets for Japan in 2019.

Euromonitor International’s pre-COVID-19 forecast for inbound arrivals to Japan in 2020 had a growth of 5% to reach 35 million. However, our latest forecasts including COVID-19 effects on inbound tourism to Japan expect a drop in arrivals of 10% over 2020, with a rebound of 14% forecast in 2021, which includes the recovery from the pandemic, as well as the influence of the Tokyo Olympics on inbound tourism.

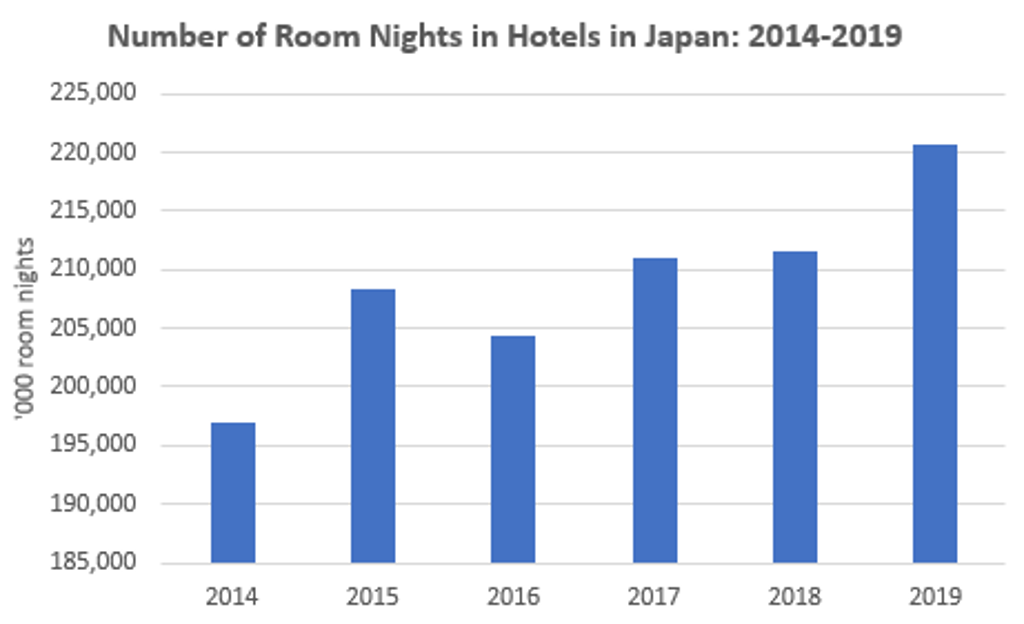

To match increased demand, hotels, ryokans and some short-term rental players eagerly expanded capacity over the past few years. According to Euromonitor International, the number of room nights in hotels in Japan showed consistent growth from 197 million in 2014 to 220 million in 2019. Hotel occupancy in Tokyo has been consistently high, at over 79% between 2014-2019, according to the Tokyo Metropolitan Government, greater than the national average, according to the Japan Tourism Agency. This indicates that even without the COVID-19 outbreak and the postponement of the Olympic and Paralympic Games, there was still a chance of a shortage of hotel rooms.

Source: Euromonitor International

Many lodging outlets are facing a sharp decline in room occupancy rates. For example, the Kyoto City Tourism Association reported that the monthly room occupancy rate stood at 54.3% in February 2020, a 24.2 percentage point year-on-year decline from February 2019 and that it is expecting the situation to be worse in the coming months. It will be critical for the government to support the lodging industry during this outbreak, through subsidies and reduced taxation, in order to prevent a shortage of accommodation by the time of the Olympics in 2021.

As of 24 April, the Foreign Ministry listed 87 countries as travel advisory level 3 (travel prohibited) and the rest of the world as level 2 (recommends against any non-essential trips), the broadest warning it has ever issued. In response, large national travel intermediaries such as JTB, HIS, and Rakuten cancelled all their oversea package tours for April, regardless of the destination.

According to Euromonitor International’s Industry Forecast Model, the number of arrivals to Japan will recover to pre-crisis levels by 2021-2022, depending on the economic damage of COVID-19. Domestic trips may be able to recover faster than international trips, but the industry is still likely to face a harsh environment, especially after the Japanese government announced a state of emergency for some cities, including key visitor destinations, such as Tokyo, Osaka and Kyoto.

Source: Euromonitor International Travel Industry Forecast Model

Many players are being forced to scale back operations to deal with the crisis. For example, All Nippon Airways (ANA) and its labour union agreed to ask its 6,400 cabin attendants to take 3-5 days partially paid leave per month, starting from April, due to drastically reduced travel demand. Tokyo Disney Resort temporarily closed its theme parks at the end of March and postponed the reopening date several times due to the uncertain situation.

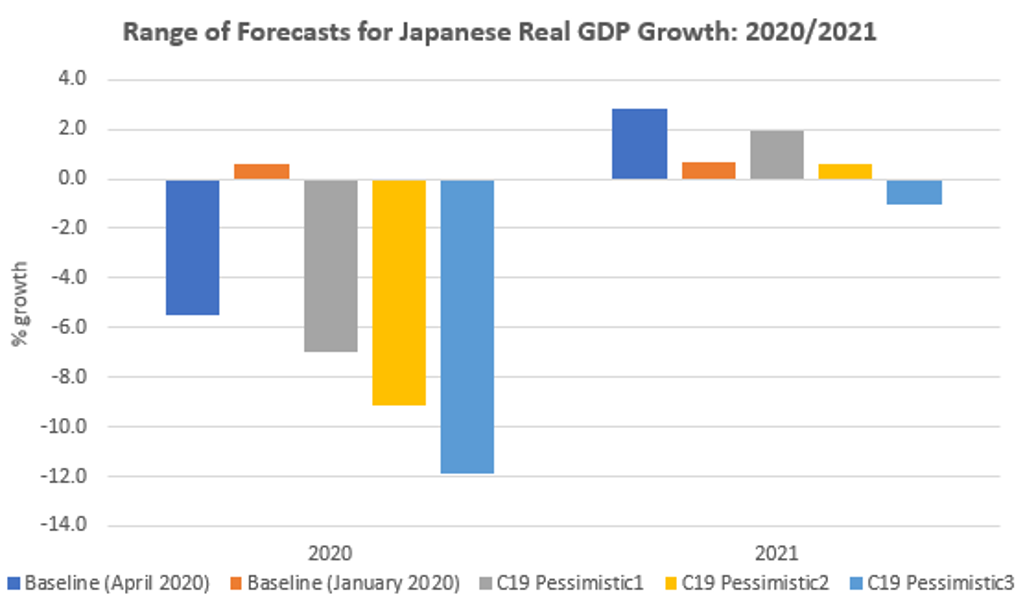

Japan’s economy to face a deep recession

Japan slipping into a deep recession became seemingly inevitable as the global pandemic hit in early 2020. The postponement of the Tokyo Olympics and Paralympics further cemented the downward trend for economic growth. The major contributing factor is social distancing restrictions. Each month with strict quarantine/lockdown is expected to reduce annual output growth in advanced economies, including Japan, by around three percentage points.

Our economic forecasts for 2020 and 2021 consist of four scenarios due to the immense uncertainty coming from the spread of the disease and responding to political action:

• The most likely scenario, to which we assign around a 40% probability, would mean that the Japanese economy would contract by 5.5% in real terms in 2020;

• The second most likely scenario – C19 Pessimistic1 – will play out with around 30% probability. Japan’s economy would contract by 7.0% in 2020 and grow by only 1.9% in 2021;

• The other two scenarios, C19 Pessimistic2 and 3, account for a possibly larger health crisis, which would overrun healthcare systems around the world. A global pandemic would re-emerge with a second wave in autumn 2020 where social distancing restrictions would last until mid-2021. Under these scenarios, Japan’s economy would shrink by 9.1-11.9% in 2020 and would still likely be in a recession in 2021.

Source: Euromonitor International Macro Model

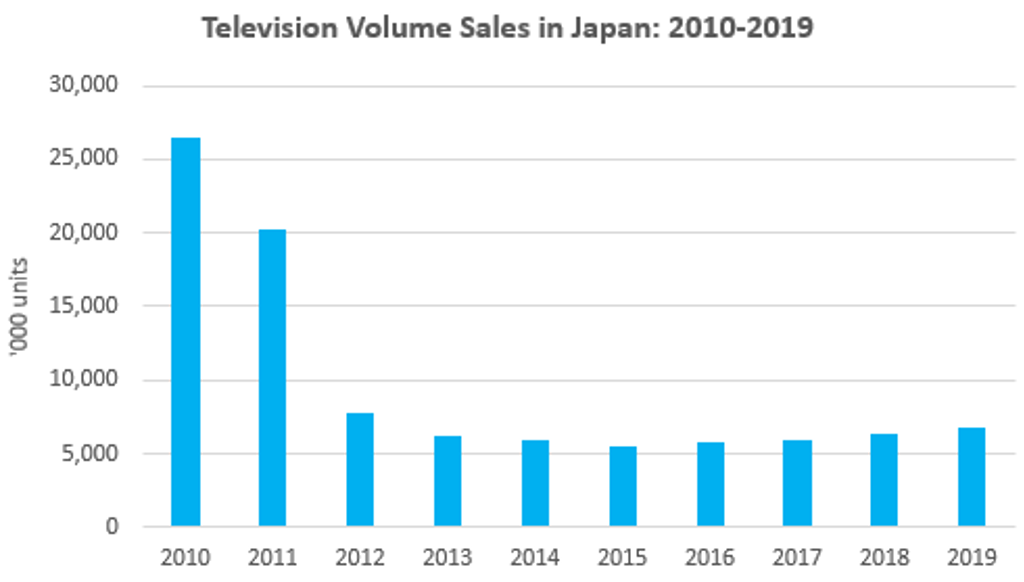

Expected demand for televisions to be delayed

2020 was expected to be a bright year for the television market in Japan. Manufacturers expected the Olympic and Paralympic Games in 2020 to be the perfect time to promote and showcase their products. Furthermore, considering product life, 2020 was an ideal time for consumers to replace any televisions bought in 2009 and 2011, both record-breaking years for television sales in Japan. During this time, many consumers switched to new televisions in order to adapt to the broadcast switch from analogue to digital, also supported by the government’s subsidy “eco point” aimed at stimulating the domestic economy, following the global financial crisis.

The postponement of the Olympic and Paralympic Games will put consumers off purchasing new televisions, while the economic recession will mean consumers refrain from purchasing expensive products. Visits to electronics and appliance specialist retailers are decreasing too, while the e-commerce rate will not suddenly bump up television purchases, which are a large and expensive product that consumers prefer to see in-store before buying.

Source: Euromonitor International

Potential for new consumer habits amid self-isolation

The pressure to stay home may be a chance for Japanese society to introduce new consumer habits. Digital apps and software are expected to become more common for various uses, including work and entertainment. Combined with the development of VR/AR and a 5G service (starting this year in Japan), players which can provide new and exciting digital experiences – including the growing “Virtual Travel Experience” – may experience increased demand as the pandemic continues.

Authors:

Alan Rownan, Industry Manager - Sports and Entertainment

Davide Calzoni, Senior Analyst - Sports and Entertainment

Giedrius Stalenis, Consultant – Economies and Consumers

Tatsunori Kuniyoshi, Analyst – Services and Payments

Taro Yamato, Analyst – Home and Tech