As the global population grows, the demand for protein grows accordingly. This is not only because there are more mouths to feed; protein is also highly recognised as a must for a healthy diet. However, as the projected growth in demand for animal-based protein increases so do the concerns around environmental issues. Its production requires significant land and water resources, and produces much CO2, generating a large carbon footprint.

With climate change high on the agenda of many countries, all industries including food are expected to take necessary action to tackle this issue. In addition, consumer awareness of such issues, negative health associations with meat consumption and animal welfare concerns have increased significantly. This has resulted in a growing number of consumers shifting to a flexitarian or even a vegan diet.

As a result, finding sustainable plant-based protein sources to meet the growing protein demand has taken root in the agenda of large international ingredients companies and many small start-ups that have emerged, specialising in this field.

Soy dominates, but…

Plant-based protein in food is currently relying heavily on soy, an ingredient which has been in the hot seat for some time due to its alleged adverse impacts on the environment (eg deforestation) and it is expected to be insufficient in meeting growing demand in the future.

Hence, it becomes a matter for the ingredients companies to find alternative plant-based sources which are more environmentally friendly and offer more variety in the plant-based space.

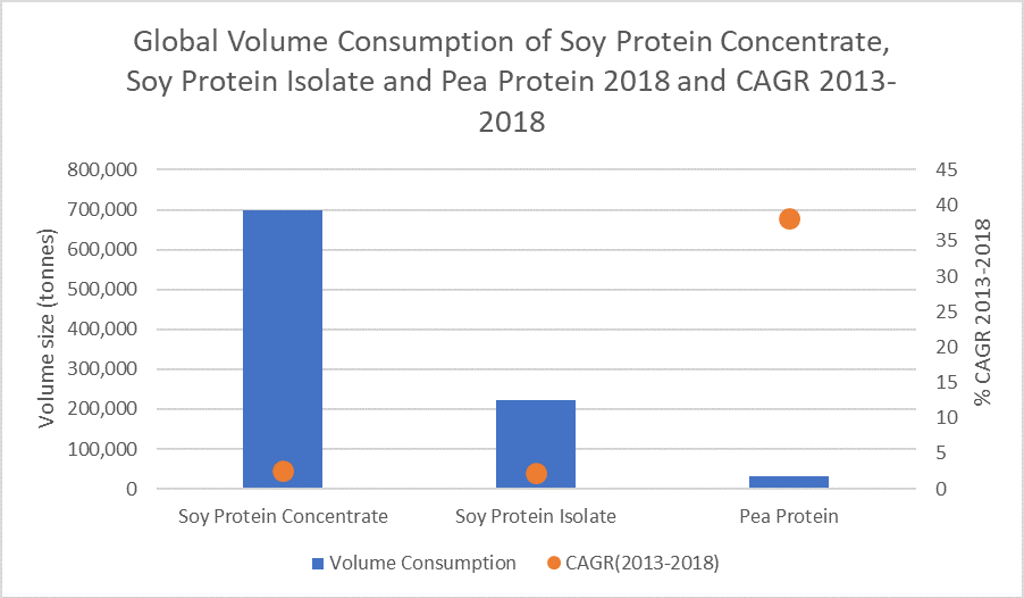

Source: Euromonitor International

… pea protein may be the next frontier in meat substitutes

While pea protein obviously has a long way to go in order to reach soy’s global consumption, its growth between 2013 and 2018 is promising. However, soy remains in the lead thanks to high acceptance, especially in Asia Pacific, meaning ingredients companies continue to invest heavily.

In this regard, Kerry’s plan to include soy in its ProDiem range, which was launched in 2018 providing pea, rice and oat protein, is a good indicator that soy will maintain its dominance in the plant-based space in the longer term.

Ingredients companies intensify their investments in plant-based sphere

Key players in the ingredients industry are heavily investing in plant-based protein with a special focus on pea protein. Some big players are setting up joint ventures with relatively small-scale companies specialising in plant-based protein solutions.

In this regard, Cargill’s joint venture with Puris in 2018, a pea protein producer based in North America, and Ingredion’s 2018 joint venture with another North American company, Verdient Foods, were important milestones in enhancing the position of pea protein within the plant-based space.

In the quest for alternative protein sources, DSM also took an important step by establishing a joint venture with French agri-food company Avril in 2020, creating Olatein to produce canola protein. In addition, Givaudan worked with UC Berkeley in 2019 to research and identify the future protein sources that hold the potential to be game-changers within the plant-based space; coming up with six; oats, mung beans, garbanzo beans, lentils, flax and sunflower seeds.

In 2020, Givaudan announced that it would establish an innovation centre dedicated to plant-based protein together with Bühler, a Swiss technology company, in Singapore.

Coronavirus to drive private label focus

Undoubtedly, Coronavirus (COVID-19) has changed consumers’ eating habits, affecting the future of food in the long term. Consumers have become more aware of the connection between health and what they eat, and preventative health plays an important role when buying food. In this regard, COVID-19 has propelled plant-based demand as it is perceived to be healthier.

On the other hand, the high price point of many plant-based options has been a key challenge, which will be an even bigger issue with the recession created by the pandemic resulting in lower disposable income for many.

In this context, Cargill’s February 2020 announcement that it would launch plant-based patty and ground products for private label is of considerable significance as past experiences show that during times of crisis consumers become more price-sensitive, often trading down to private label which sells at a lower price point than branded products.

To respond to this expected growing demand, more and more ingredients companies operating in the plant-based sphere are expected to invest in private label solutions.