Millennials (born between 1980-1994) and Generation Z (born between 1995-2009) account for 46% of the global population in 2021, making them the most important consumer segment. Engaging millennials and Generation Z has become more challenging after the outbreak of the Coronavirus (COVID-19) pandemic, as many young people experienced worsening education, employment and income prospects, and a rise in stress and anxiety. Engaging young consumers, however, has never been an easy task for business, given these cohorts’ unique characteristics and diversities. Both generations have high expectations for technology and innovation and increasingly value experience over things while being progressive and socially responsible. These are characteristics that have driven a shift in today’s consumption from conspicuousness to consciousness. They are also real activists and can influence older generations.

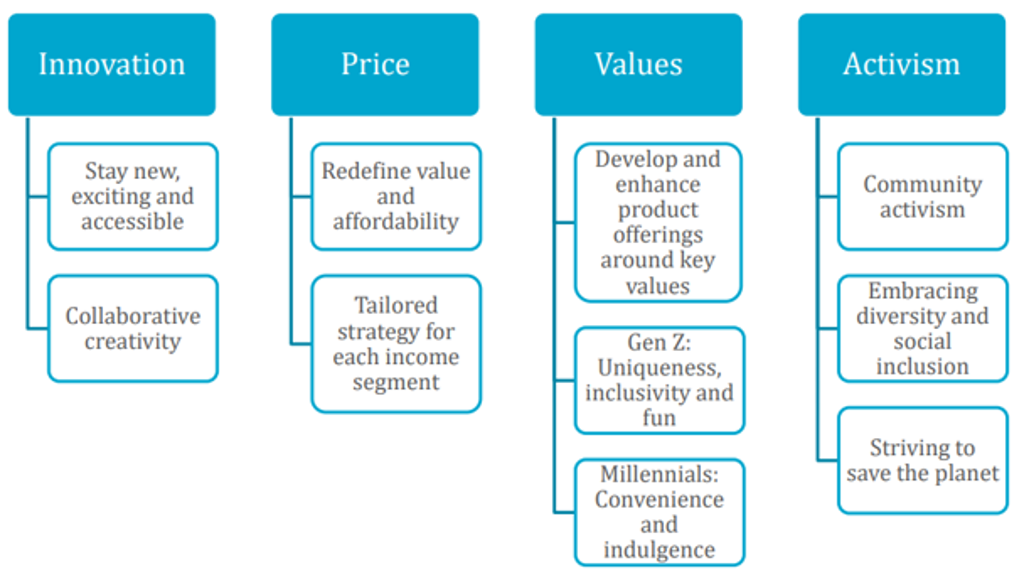

In order to stay relevant to young consumers in times of uncertainty, companies should focus on four pillars of engagement strategy: Innovation, price, values and activism.

Four Pillars of Engaging Millennials and Generation Z

Source: Euromonitor International

Collaborative innovation to leverage the creativity of young consumers

Young consumers are constantly looking for products and services that are new, exciting and accessible. They want to be a part of the innovation process, collaborating with business to get what they want and need. Gen Zers in particular want to maintain fun in their lives, even more so since being cut off from friends during COVID-19 and millennials want convenient solutions and safer out-of-home experiences for their young families. As a result, alternative channels to shop, play and live are evolving; social media, virtual venues, e-sports and digital gaming, alongside safe out-of-home venues and social distancing pods for exercise, dining and festivals. These new platforms, as well, as new services such as virtual try-on or in-store fitting appointments, will enhance lifestyles in the future as they sit alongside normal pre-COVID-19 routines.

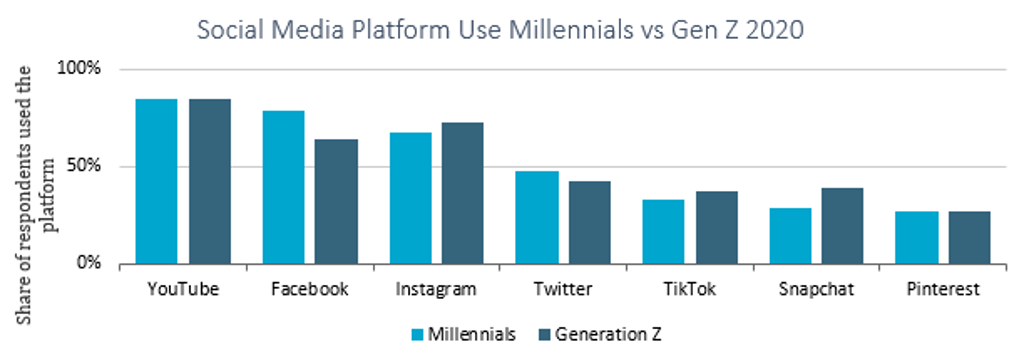

Source: Euromonitor International Digital Consumer Survey 2020

Price strategy to align with new value and affordability perceptions

Even before the pandemic, millennials and Gen Z consumers’ perception of value was already multi-dimensional, as it did not depend on pure price or quality, but also on personal and societal values such as uniqueness, wellbeing and sustainability. Now amid the pandemic and recession, as many young consumers have seen their income declining, value and affordability will be increasingly important factors informing their purchase decisions. In 2020, the global average annual gross income of people aged 25-29 dropped by 6% in real terms.

However, as the level of price sensibility varies across different income groups, there will be no one-size-fits-all strategy. Businesses and brands will need to reassess their target consumer group’s perceptions towards affordability and refine their value and price strategies accordingly to meet their new needs and priorities. Overall, risk-averse young consumers will seek products and services that deliver value and quality, as well as peace of mind for them.

Connect with young consumers’ values and priorities

Millennial and Gen Z purchase decisions are defined by their values and life priorities. Companies should embrace the similarities between the wants and needs of both cohorts when developing and renovating products and services but must also understand and accommodate differences between them, especially in this new normal brought about by the pandemic. Covid-19 hit these progressive cohorts hard, forcing many to reassess their situations, their ideals and expectations both now and for the future. New routines and needs have evolved around wellness, self-improvement and new ways of doing things. COVID-19 has proven that not only is change possible, but it can happen quickly, driving young consumers’ determination to do things differently and build back better for themselves as well as the planet and society.

New young activists are demanding change for both people and the planet

Determined millennials have been joined by anxious, angry and highly expressive Gen Zers who are taking activism online via social media and digital gaming, building larger communities of activists for greater impact. According to Euromonitor’s 2020 Lifestyles Survey, 48% of Gen Z and 46% of millennials said they would be more engaged in their community in the next five years. Lockdowns and restricted living have intensified their discontent. Dejected and vulnerable, they are outraged by yet another global crisis that has disrupted many areas of their lives. They have run out of patience and are fighting back. Consumers expect businesses to be more visible, active and transparent. They are choosing to boycott brands that do not mirror their values and instead, are switching to those that are taking a stand on environmental and social issues.

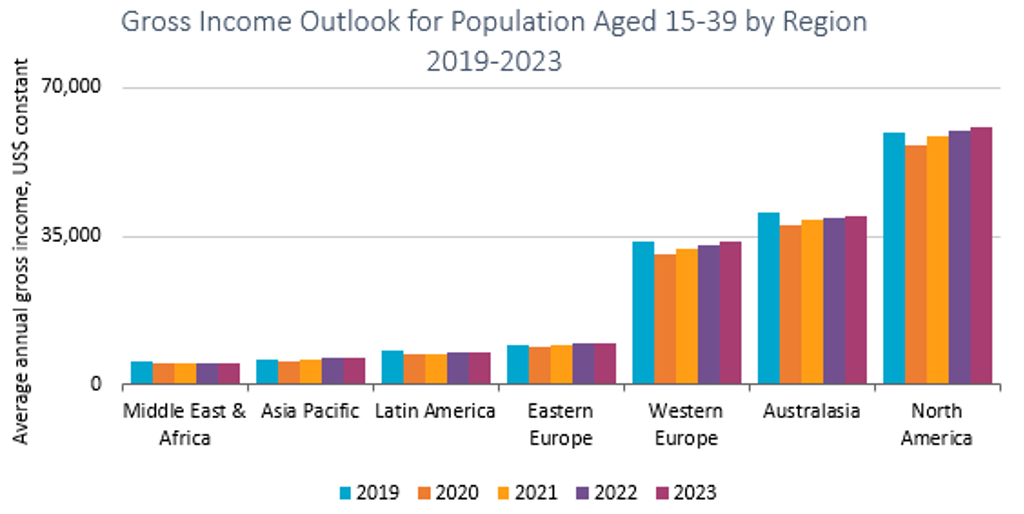

The gross income of young consumers remains squeezed in the short term

With the pandemic having deep impacts on the economy and employment, young consumers’ income growth will remain subdued in the coming years. In all regions except Asia Pacific and Eastern Europe, millennials and Gen Z’s average gross income is expected to return to prepandemic level only in 2023 or even later. But despite a slowdown in young consumers’ income growth, the future consumer market will continue to be shaped by millennials and Gen Z. To successfully engage with young consumers in the new normal, businesses must adopt agile innovation and redefine their strategies to align with the new priorities and values of young consumers.

Source: Euromonitor International from national statistics. Note: Data from 2021 are forecasts.

For more detailed analysis on Gen Z and millennial consumers and how to engage them please read our full report “Engaging Millennials and Generation Z in the Coronavirus Era”.