Coronavirus (COVID-19) continues to shape the consumer goods market across Sub-Saharan Africa as consumers seek value for money and embrace omnichannel retail. Due to the pandemic, GDP fell by an average of 2.8% across the region in 2020. However, the rollout of vaccines is expected to lead to an upturn in economic recovery in 2021, with real GDP growth of 3% projected for Sub-Saharan Africa. For now, opportunities there are competitively priced staples, household cleaning essentials, and preventative healthcare. But companies need to assess which of these trends will remain, in the long run.

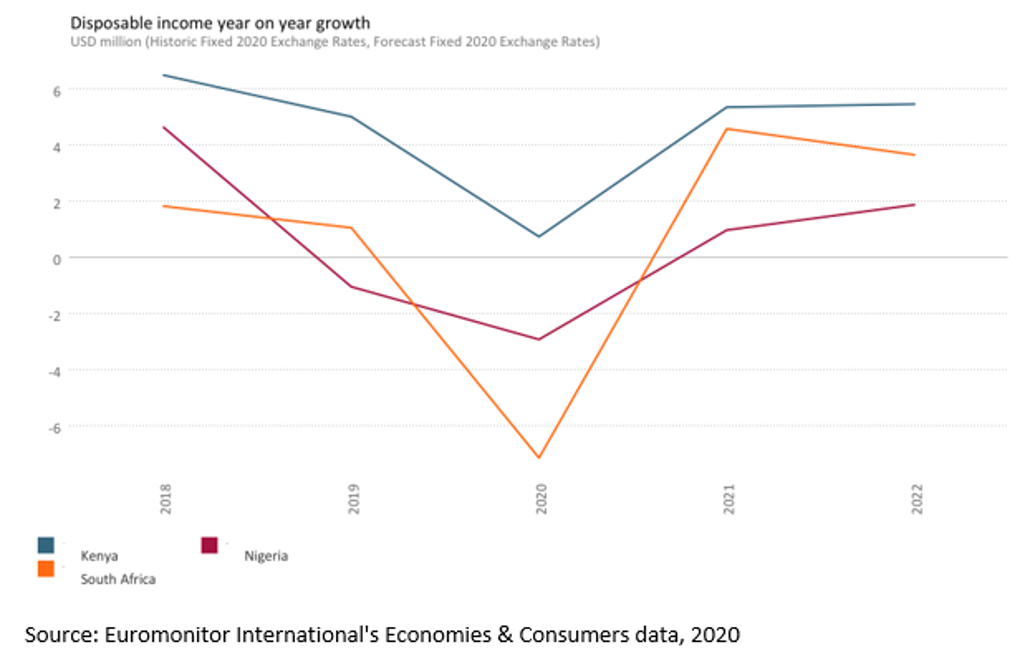

Disposable income decreased across the region in 2020, with South Africa experiencing the most dramatic decrease of 7%. However, consumers’ disposable income is expected to regain its growth trajectory by the end of 2021. The pressure on household income will encourage consumers to seek value for money and reprioritise spending towards essentials.

Disposable Income Year-on-Year Growth 2018-2022

Staple foods such as rice in Nigeria, maize meal in South Africa and Kenya, and cooking oils will continue to be popular, essential food choices, at the expense of indulgences such as snacks. For example, in Nigeria, rice grew by 13% in value terms during 2020. Moreover, basic multi-functional cleaning materials such as bleach and bar detergents will meet consumer need for value and home hygiene, as concerns around the spread of the virus remain. For instance, bar detergents in Kenya grew by 6% in volume terms during 2020. In addition, vitamins and dietary supplements, and traditional remedies will take preference over other consumer health products, as consumers continue to seek out preventative health care as part of the New Normal. To illustrate, vitamin C outperformed other types of vitamins in both Kenya and Nigeria in 2020.

A renewed focus on essential products can ensure manufacturers and retailers capitalise on consumer need for value for money. One way to ensure success is through offering price promotions and value deals to cash-strapped consumers. In South Africa for instance, Pick n Pay is offering Nestlé’s Maggi 2-Minute Noodles Mega 5 Pack, already a value offer, in a two for one deal. Moreover, by expanding the range of pack sizes on offer, a larger consumer segment can be reached. For example, Quaker Oats launched a smaller pack size of its Instant Oatmeal in flexible packaging with success in Nigeria.

Shifts in consumer behaviour highlight the importance of omnichannel distribution

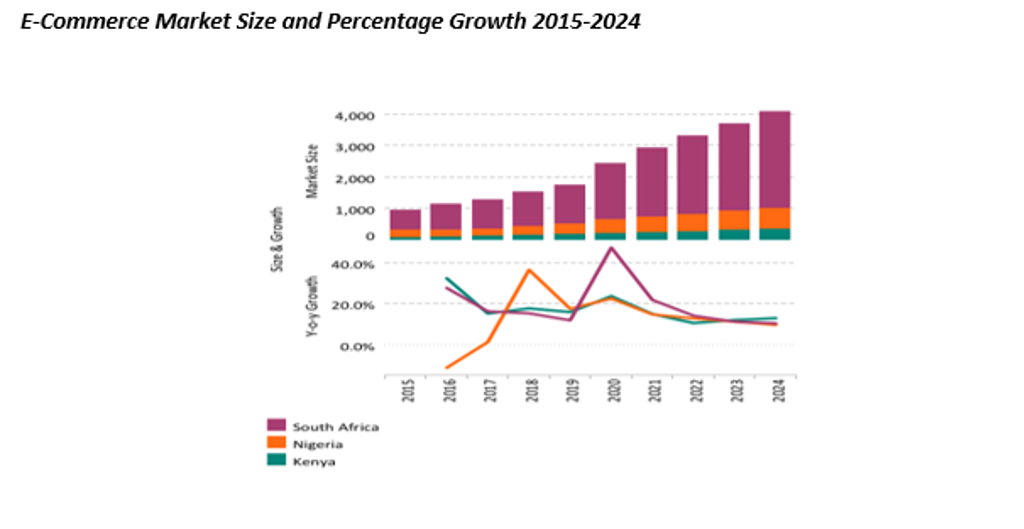

Retailing sales in Nigeria and South Africa shrunk by 18% in 2020, while retail sales in Kenya declined by 7%. However, the pandemic fast-tracked existing strong e-commerce growth, with many companies expanding their reach. For example, Woollies Dash, a mobile app-based, same-day delivery service was launched by Woolworths in South Africa. The service aims to provide groceries to consumers and complements the company’s online store.

E-commerce is expected to continue its strong growth trajectory, registering double-digit growth over the long term. Growth is most evident in South Africa, reaching more than 40% in 2020. E-commerce is heavily supported by m-commerce; in a region where mobile phones are the primary means of internet connectivity, the channel will be critical in any marketing mix.

However, consumers will continue to buy from traditional channels such as open markets as they meet consumer's need for value, convenience, and proximity. This is especially true for low-income consumers, who typically buy small quantities of goods at a time. How and where consumers shop will also continue to evolve, and an omnichannel distribution strategy will be increasingly important.

Source: Euromonitor International Retailing data, 2020

The pandemic has led to an increased focus on local production and consumption as supply shortages were experienced during 2020. Consumers are in part driving the shift as they mindfully choose local over imported goods. Furthermore, government legislation aimed at local economic stimulus coupled with the increased cost of imported goods will also boost local production and consumption. For example, the government-funded Proudly South African campaign has started to showcase locally-manufactured products such as detergents on a dedicated website. This initiative benefits small scale manufacturers in particular.

Innovation provides manufacturers and retailers with the opportunity to capitalise on changing consumer habits and needs. Consumers will continue to seek value for money until household disposable income levels recover. For example, this could include revised product formulation to reduce cost (eg reducing alcohol percentage to reduce excise duties) and sustain consumers that are price-conscious.

Retailing sales in Sub-Saharan Africa are expected to grow by 7% in 2021. However, country-specific recovery will vary due to the different impact of COVID-19 and unique local circumstances. Kenya and Nigeria’s respective retailing industries will recover the fastest, exceeding their 2019 market sizes by 2022. However, South Africa’s retail industry will only return to its former value size by 2025. Within this context, consumers will continue to seek value for money while they embrace omnichannel shopping driven by e-commerce. Value chain participants can tap into these opportunities by adapting to consumers’ shifting needs through innovation and by safeguarding their supply chain through an increased focus on local sourcing.

For more insight into strategies for adapting to the post-pandemic drinks landscape, take a look at our briefing The New Normal for Consumer Goods in Sub-Saharan Africa.