Natural and organic beauty brands enter the market at breakneck speed. Year-to-date analysis from Euromonitor’s new tool Via Pricing reveals that products with a natural claim are generally more prominent across beauty and personal care categories than those with an organic claim.

Through the daily extraction of online retailer data, in a global sample of almost five million SKUs across beauty and personal care categories, products with a natural claim accounted for 5% of the total and those with an organic claim only 2%.

Natural beauty claims command a higher price than organic claims

Natural claims were identified as most prominent in the hair care category, accounting for 8% of the total category sample, and accounting for 5% and 4% of the skin care and colour cosmetics categories respectively. Meanwhile, organic claims have a higher penetration in skin care (4% of category sample) than hair care (3% of category sample), and just 1% of the colour cosmetics category sample. Year to date analysis shows that while the highest priced products within the sample do not necessarily have natural or organic attributes, the price distribution of natural or organic brands is more centred towards the upper pricing tiers.

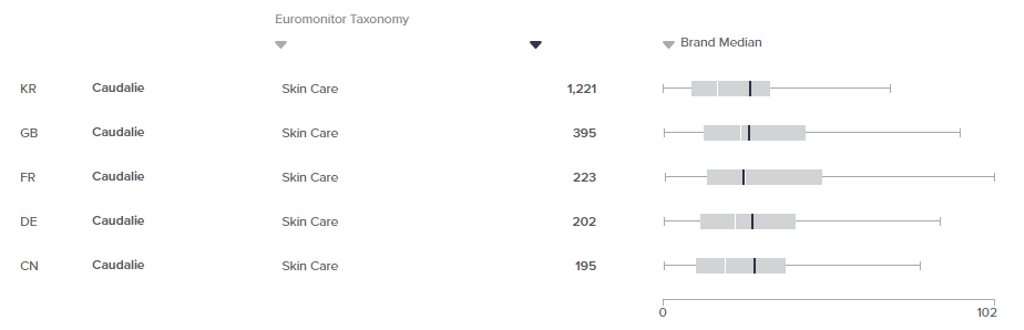

Via Pricing illustrates that naturally positioned brands have a higher median price than the category average across geographies. Especially in China, where the median price of the skin care category is around USD19, whereas the median price of the natural French skin care brand Caudalie is around USD28.

Median Price of Caudalie Brand vs Total Skin Care Category Price Distribution in South Korea, United Kingdom, France, Germany and China, Jan 2019-July 2019

Note: Vertical black bar indicates median price for Caudalie brand in each country shown. Grey box plot indicates overall price distribution for Skin Care category in each country. Vertical white bar indicates median price for Skin Care category in each country.

The Via Pricing SKU sample also shows that generally, organic claims command a higher price point than natural claims across both skin care and hair care. Colour cosmetics bucks this trend whereby natural claims command a higher price than organic, despite the natural market being a lot more crowded than organic in colour cosmetics.

In the U.S. , the world’s largest beauty market, our sample pulled around 4,000 Colour Cosmetics SKUs with a natural claim and less than 1,000 with an organic claim, debunking the myth that lower availability means a higher price can be commanded. It does, however, support the assertions drawn from Euromonitor’s Beauty Survey, which shows that consumers are marginally more willing to pay a higher price for natural claims in colour cosmetics than in skin care.

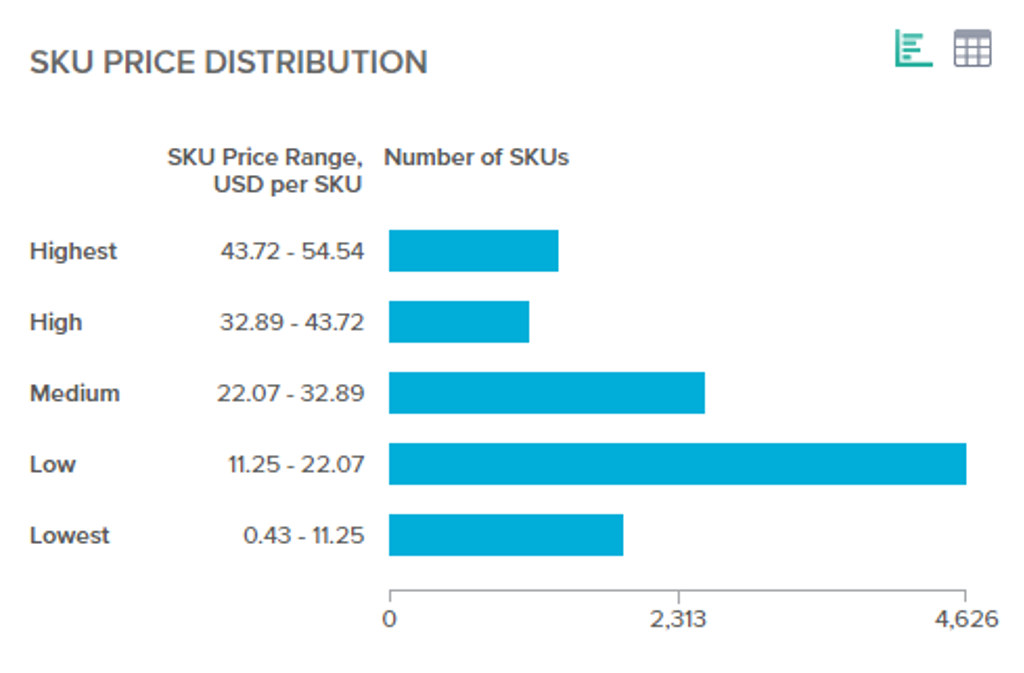

Owing to the lower ceiling price for organic claims in the colour cosmetics category vs. natural claims, organic product pricing is more concentrated in the masstige segment. This is considerably cheaper than the masstige segment in the natural colour cosmetics category. As the market for organic colour cosmetics grows, in-line with the awareness and demand in skin care and hair care, the lowest <USD$11 tier and the high and highest USD$33-55 tier could offer the opportunities with least competition.

Number of SKUs for Organic Colour Cosmetics by Price Range, Jan 2019-July 2019

Note: Number of Colour Cosmetics SKUs taken for all 40 countries tracked by Via pricing and featuring an Organic product claim.

Natural colour cosmetics claims prominent in China

China is the second largest beauty market according to Euromonitor’s Passport database, valued at over USD60 billion in 2018. Interestingly, although the Chinese colour cosmetics market is five times smaller than skin care by retail value, the sample revealed a higher proportion of SKUs with a natural claim in colour cosmetics than in skin care and compared to the global average.

Despite consumer preference for natural and organic skin care in China, our sample of almost one million skin care SKUs available to buy online in the country shows that the proportion of natural and organic products available is lower than the global average. In China only 4% of skin care products in the sample are positioned as natural and only 2% are positioned as organic vs. the global average of 5% for natural and 4% for organic.

On the other hand, the U.S. over indexes in terms of skin care with natural and organic claims. In the US 9% of skin care products in the sample are positioned as natural and 7% are positioned as organic. According to Euromonitor’s Beauty Survey, Chinese skin care consumers value “all-natural ingredients” more than any other consumer group, therefore analysis of this sample could tell us that there remains potential for greater availability of natural skin care brands to serve the demands of the Chinese market.

Global coverage refers to all 40 geographies covered by Euromonitor’s Via Pricing tool. Time frame January 2019-July 2019. Natural and organic SKUs could be duplicated if a SKU has both product claims. Includes sales from Amazon. All prices in USD$ fixed exchange rates.