A few months ago, Microsoft surpassed Apple as the world’s most valuable company, with a market capitalisation of USD 851 billion. Microsoft held the leading position as the most valuable tech firm in the 1990s, powering the revolution in PCs with its Windows operating system.

This was followed by a recessionary period, failing in mobile computing as Apple, Google and Amazon saw their fortunes rise. However, Microsoft has completed its comeback thanks to the integration of strong innovation, abandoning failing ventures, smart diversification and thriving in the Cloud with Azure.

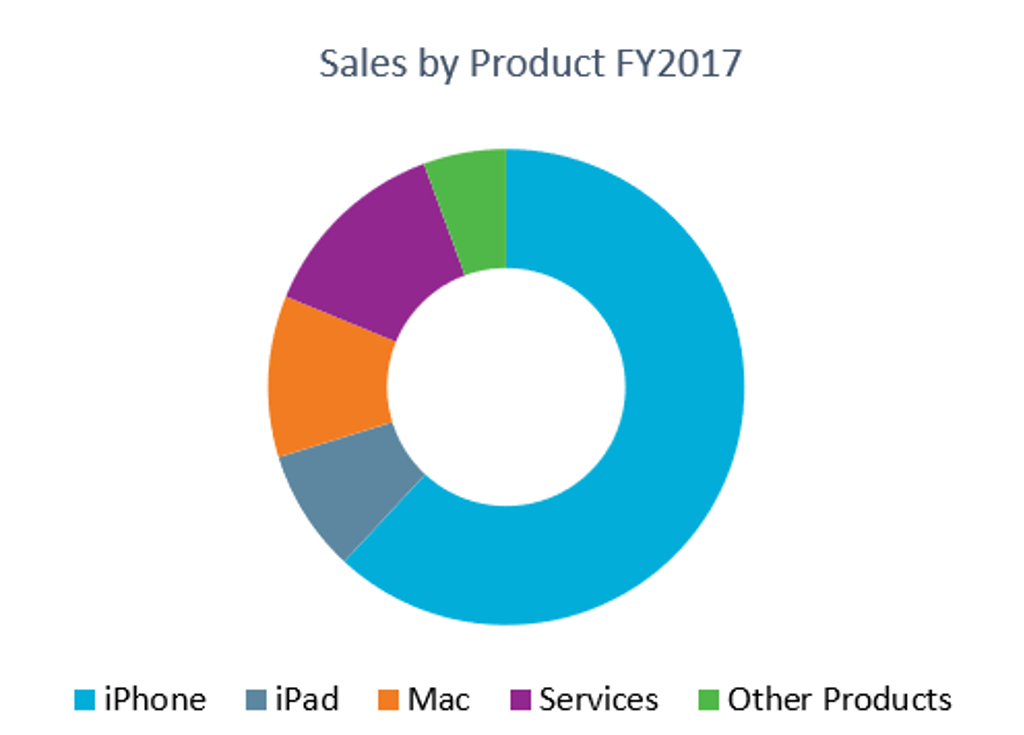

In contrast, Apple's iPhone business has seen slowing volume growth, while its two other major products – the Mac and iPad – saw sales either declining or stagnating. This resulted in the company projecting its services as the next big revenue success. Over financial year 2018, Apple’s Services were the fastest-growing segment.

Microsoft Cloud’s Success and Diversification

Although Microsoft still draws significant revenue from its Windows software, it has become a unique provider of a Cloud computing platform known as Azure to its business customers. It has also learned how to develop a steadier revenue stream from its Office software suite for both consumers and enterprises.

Microsoft is also now less dependent on a single product than in the past, with the acquisition in 2016 of professional social network LinkedIn, steady growth from its Cloud services and revenues from its Xbox gaming business, Surface tablets and PCs, and Bing search engine.

Most recently in November 2018 it partnered with the US Army on a USD 480 million contract to supply HoloLens devices that will help troops train using AR and VR. HoloLens is also now being used in the medical field in a ground-breaking way. A research project at Imperial College London is using the mixed reality headset to help plan plastic surgery in patients’ body parts, identifying which tissue and veins can be used in reconstructive operations. The system allows surgeons to see inside the body parts prior to any surgical intervention.

Where Apple still relies on iPhone sales for the vast majority of revenue and profit, Microsoft is well diversified across a number of different areas. The challenge for Apple, reaching peak smartphone in 2018, will be to manage to transition into services, offering a more stable source of revenue that is less subject to tech fashion.

Back in 2013, Microsoft acquired Nokia but failed to gain a foothold in the mobile business, largely dominated by Apple and Android smartphones. This failure in the mobile business had a positive effect as it required Microsoft to work with competitors in OS. Until now, however, Apple’s own devices have been needed to access and use most of its services, a strategy Microsoft dropped 10 years ago.

AR/VR Impact: Microsoft Looks towards a Mixed Reality Ecosystem

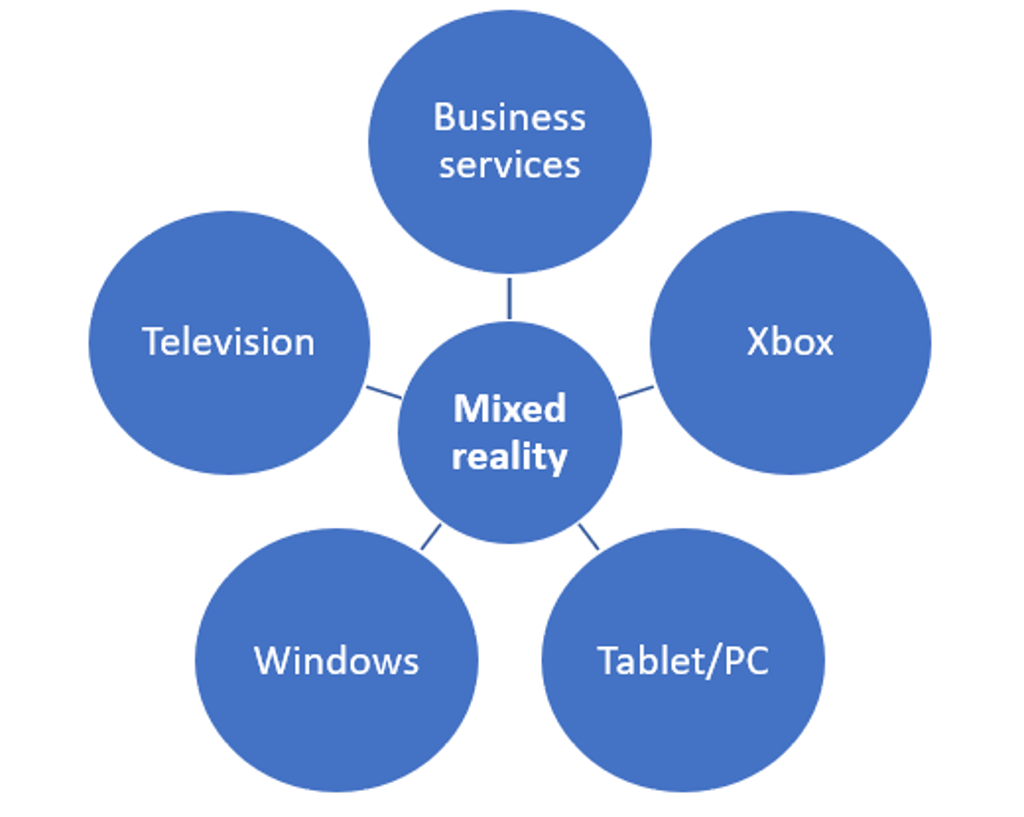

With the launch of AR HoloLens in 2016, Microsoft is looking to combine its business services, consumer electronics hardware and software division, and Xbox users into one ecosystem centred on mixed reality.

The HoloLens is expected become the primary screen unifying business and personal use with what Windows PCs and tablets are currently used for, as well as the screen for entertainment, whether that is playing Xbox video games or streaming media content on television. The medium-to-long term potential of the smart glass is expected to be significant once the price gradually becomes more accessible to consumers.

Microsoft Xbox One Focusing on a Growing 4K Television Market

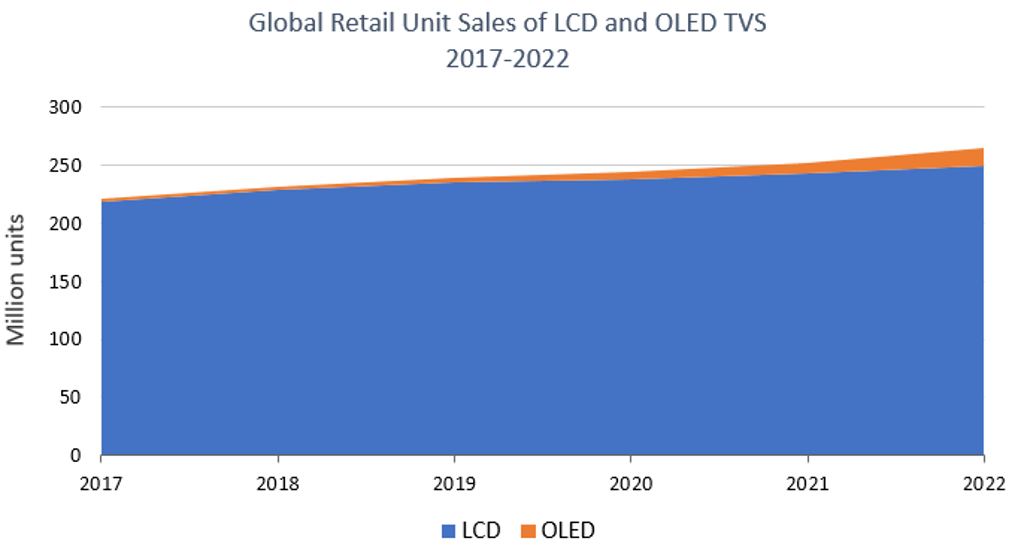

Microsoft released the Xbox One X in 2017, advertising it as one of the most powerful consoles available on the market and targeting consumers interested in 4K gaming and entertainment. Consumers are showing strong interest in getting high-quality visuals from their home entertainment systems and an increasing number of the new LCD and OLED TVs are 4K capable, in parallel with a fast-growing offer of 4K content. In this way, Microsoft is looking to capitalise on those higher-income households owning OLED TVs and willing to pay more for better-quality visuals.

AR/VR to Have an Increasing Impact over the Forecast Period

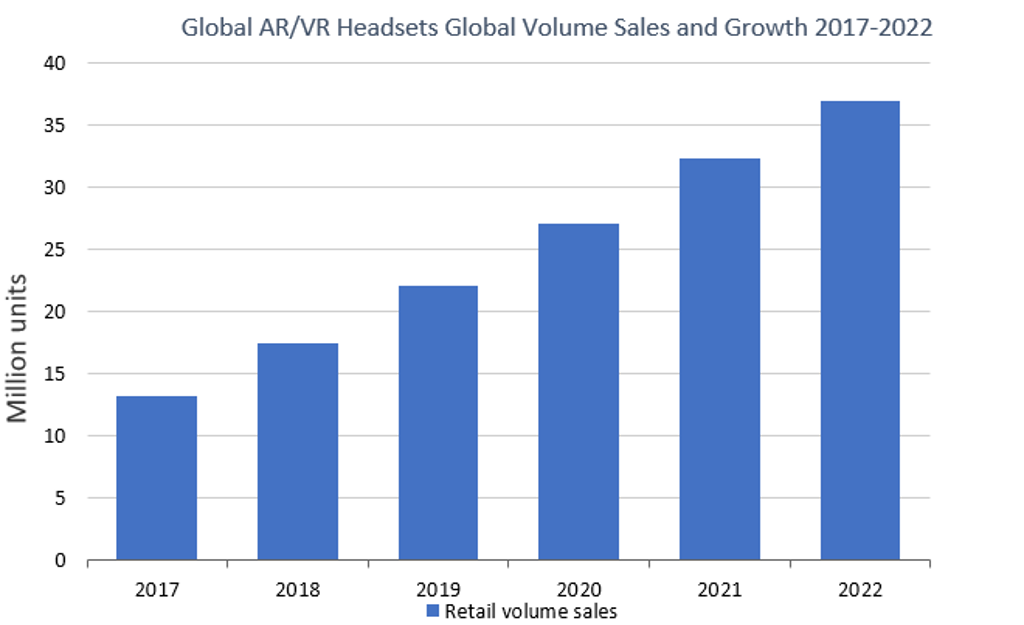

Global AR/VR headsets started to pick up in 2017, with 13 million volume unit sales. These sales were attributed to Microsoft HoloLens, Gear VR and Google Cardboard. Increasing consumer awareness, falling prices of premium VR and the wider introduction of AR headsets in the coming years are expected to positively impact on the sales of AR/VR headsets in the forecast period. Volume sales in the category are expected to reach 36.9 million units by 2022 and Microsoft is capitalising on this growth to achieve additional sustainable revenues.

Apple Bets on Services

We have just looked at how Microsoft is well diversified across a wide range of categories and products, so what is Apple’s strategy to tackle the iPhone and iPad revenue stagnation?

The group recently started to move towards opening up its services, allowing Amazon's Echo smart speakers to work with Apple Music from 17 December 2018. It is also expected that Apple’s strategy will increasingly focus on encouraging consumers to use Apple products as services rather than expecting an entire product replacement. The services category includes Apple Pay, Apple Care and Digital Content and Services. Licensing and other services are also incorporated into the segment, including iTunes, the App Store, iCloud and Apple Music.

Revenues from services have increased significantly over the years and represented the second-largest contributor (13%) to sales for Apple in 2017. Apple Pay is currently available in limited markets, although its reach in emerging markets should allow strong revenue growth in the forecast period. Partnerships between Apple Music and key technology players such as Amazon are also expected to boost Apple Music’s subscriber base.

The iPhone remained Apple’s key revenue contributor in 2017, accounting for 62% of its total sales. At the same time, revenues from services such as the App Store increased 23% over 2016-2017 to USD30 million, showing that while hardware is Apple’s key revenue component services are increasingly becoming an integral part of the user experience.

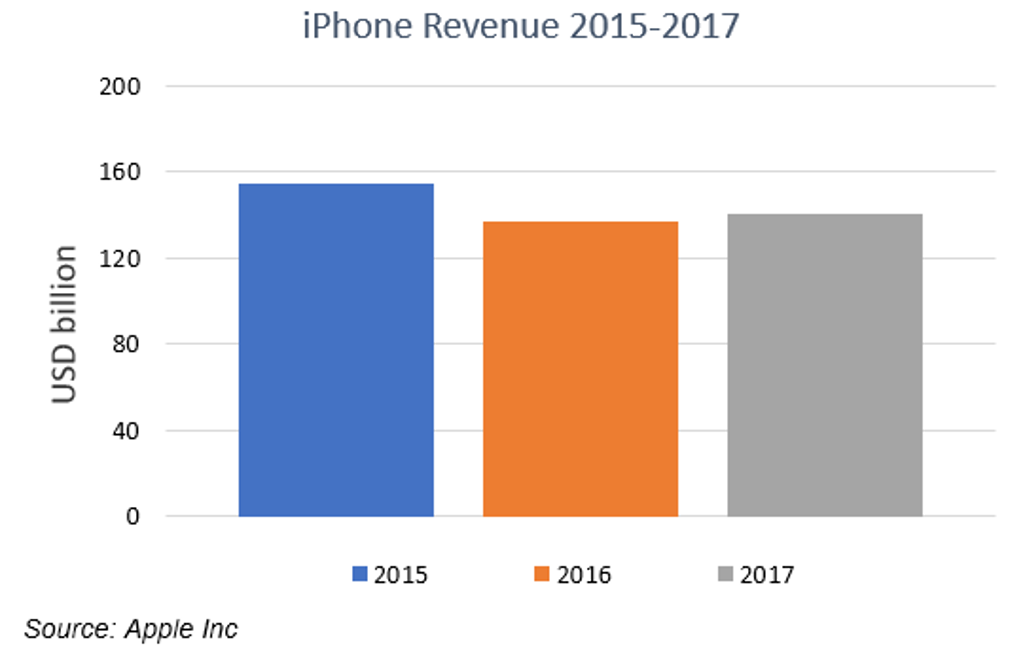

While iPhone sales plummeted in 2016 – as many consumers refrained from upgrading to iPhone 8 – and sales only recovered slightly in 2017, revenues from streaming picked up strongly from 2015. The acquisition of music discovery app Shazam in 2017 is a strategic move for Apple as it enabled the group to offer some strong competition to streaming rival Spotify. Apple streaming will need to open up new markets as its offer is still limited to a small number of countries

M-Commerce as an Opportunity for Apple Pay

Apple Pay is expected to benefit from the popularity of m-commerce, especially in developed markets like the US and the UK. Chinese consumers were among the first to embrace the multi-functionality of mobile devices and, as many of them do not have bank accounts, mobile payments are sometimes their unique cashless payment option. WeChat (Weixin) started out as a messaging app and has since emerged as the biggest and most popular mobile payment platform.

The large unbanked population in emerging markets, and in particular Africa, represents a strong M-commerce opportunity as these consumers are keen on embracing cashless payment options. However, the price of Apple Pay products will need to fall in order to benefit from this trend.

So, Who Wins the Race?

Microsoft is currently focused on cross-platform technologies – such as the Cloud or AI – and is aiming to secure the future of mixed reality computing with AR/VR headsets. Apple is looking to offset its iPhone revenue slowdown by investing further in services, recently announcing that the segment is expected to reach sales of USD50 billion by 2021.

The company is also building up more momentum in the category with a potential streaming video service slated for early 2019, as a Netflix competitor. However, it should not be forgotten that all these efforts will face fierce competition from key tech players such as Google, Amazon and Facebook – no matter what the next big thing is for Microsoft and Apple, their peers will also be hungry for a piece of the action. Apple has 5G coming up – but AR/VR, AI and the Cloud are here to stay.