The beauty and personal care industry has largely been considered recession-proof, the so-called “lipstick effect” often reflecting an opposite pattern to macroeconomic health, as seen during the 2008 global financial crisis. However, the Coronavirus (COVID-19) pandemic has seen unprecedented changes in consumption behaviour, directly impacting the industry, especially in Southeast Asia. Total retail sales of beauty and personal care in Southeast Asian markets are set to decline by -0.6%, falling short behind that of Asia Pacific’s aggregated growth rate of 1.6% from 2019 to 2020.

Demand for preventative health products expected to stay in 2020 and beyond

The unique circumstances of COVID-19 have boosted preventive health concerns among consumers. Higher hygiene standards causing stockpiling of bar and liquid soap have fuelled both value and volume sales of these categories, with a clear spike during Q1 2020 in Southeast Asia.

According to Via, Euromonitor International’s pricing intelligence tool, an average of 30% of liquid soap products listed online in Singapore went out of stock immediately after the DORSCON (Singapore’s risk assessment level of the Disease Outbreak Response System Condition) level alert was raised from yellow to orange on 8 February, in comparison to an average of 15% prior to this announcement. Similarly, hand care products perceived as clean and safe stand to benefit as the shift towards preventive health intensifies. The uptake of such preventative health products can be expected to persist beyond 2020 as health concerns remain key.

As in the last crisis, premium beauty takes the hardest hit

While Southeast Asia has been the main driver of growth for premium beauty, performance of the category is now likely to mirror economic decline. Looking back at the 2008 global financial crisis, the region’s premium beauty suffered the worst, going into negative territory in 2009, and only recovering to pre-crisis growth levels in 2011.

Coupled with loss of inbound tourists, strict lockdown measures and store closures, industry players are suffering reduced and stagnating consumption levels. L’Oréal reported a 3.7% like-for-like decline in overall sales for Q1 2020 (compared to Q1 2019) in Asia Pacific, with its Luxe division declining 9.3% globally. But despite the gloomy outlook, L’Oréal Indonesia managed to pull off double-digit growth, attributed to the growth of at-home beauty treatments such as facial masks and hair colourants, as well as uptake of eye colour cosmetics due to increased mask wearing. Indonesia is likely to remain a lucrative market for beauty and personal care in Southeast Asia.

COVID-19 accelerates uptake in e-commerce across the region

Temporary closures of bricks-and-mortar specialist retailers have accelerated the ineluctable rise of e-commerce still further. According to L’Oréal, e-commerce grew more than 60% in Thailand and Indonesia in Q1 2020. Popular Indonesian e-commerce platform, Tokopedia, also reported tripling of sales for health and personal care categories and doubling of sellers in March 2020

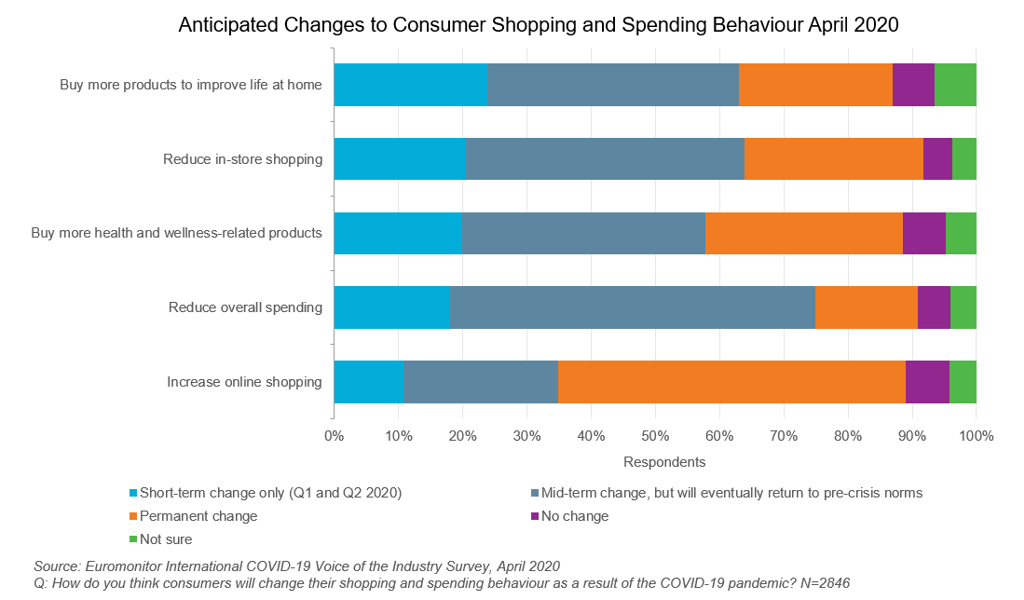

N = Number of respondents = 2846

Industry players have been quick to capitalise on the digitalisation wave through various strategies, such as organising social media live streams or implementing virtual product try-ons. Increased collaboration between brands and retailers to produce interactive “live-tertainment” also helps drive traffic for online purchases. For example, L’Oréal Paris Philippines joined forces with Lazada and Shopee to hold live sessions for content such as make-up tutorials for “video-ready” meetings.

What’s next for BPC in Southeast Asia?

Source: Euromonitor International COVID-19 Dashboard

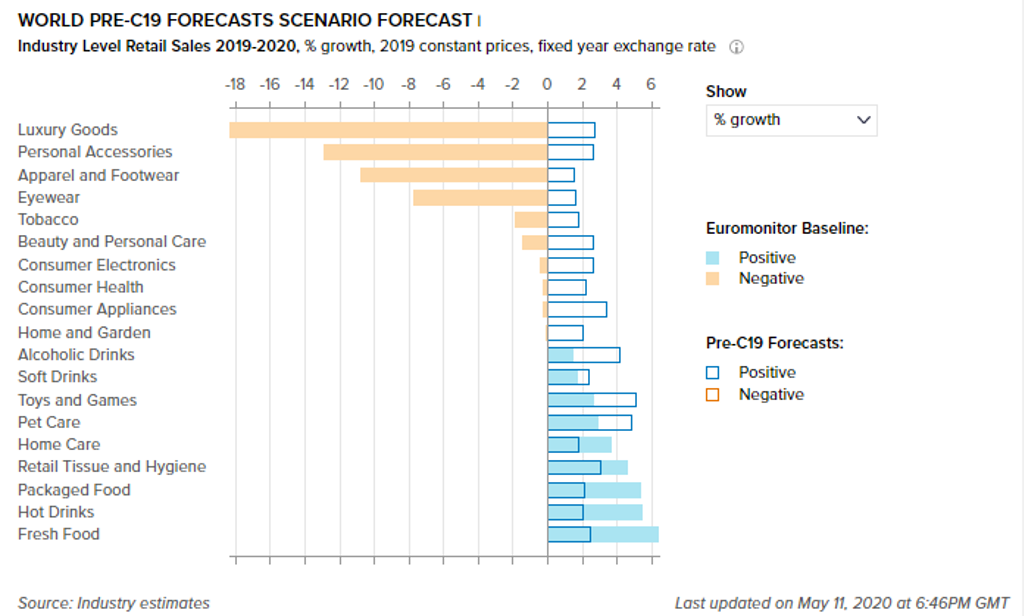

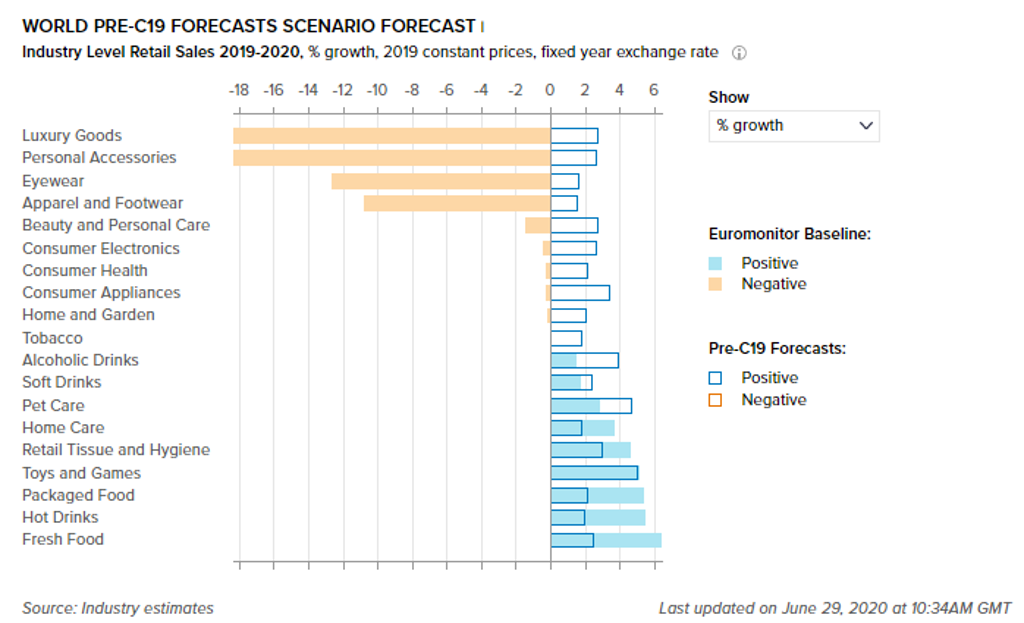

Looking at Euromonitor International’s COVID-19 Dashboard (updated 29 June 2020), the effects of COVID-19 are set to see global retail value sales of beauty and personal care to decline by 2%, after taking into account the baseline scenario for a post-COVID-19 environment, compared to the pre-COVID-19 forecast of 3% growth in 2020.

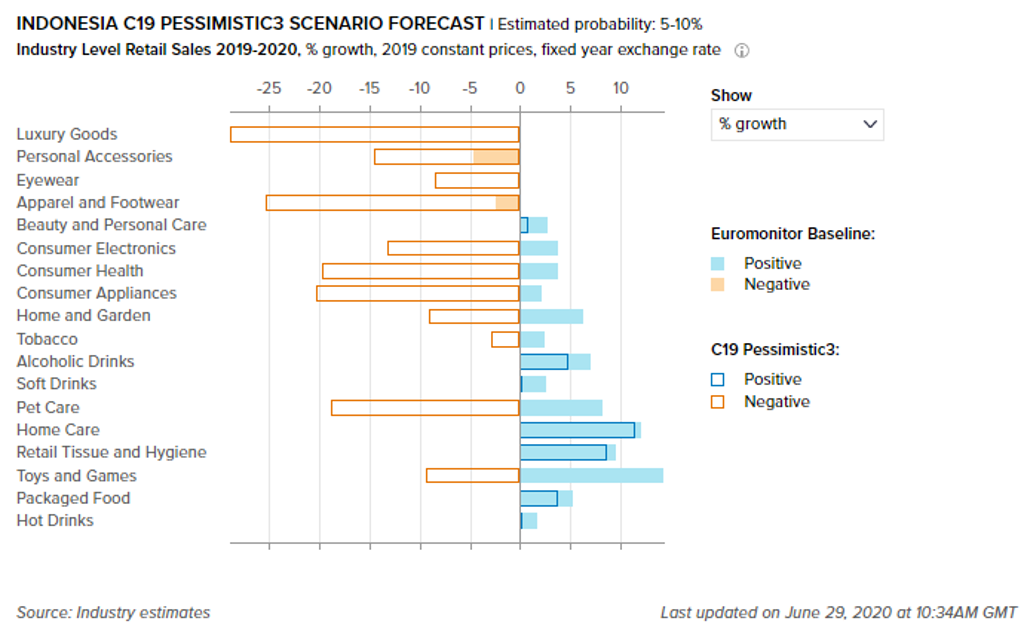

Nevertheless, Southeast Asia remains a key driver of growth for beauty and personal care, particularly in fast-growing, underdeveloped markets with a rising middle class, like Indonesia and Vietnam. Zooming in on Indonesia, the COVID-19 Dashboard below postulates positive growth rates between 1% (pessimistic scenario) to 3% (baseline scenario) for beauty and personal care, signifying strong consumer confidence in the market.

Source: Euromonitor International COVID-19 Dashboard

While the impacts of COVID-19 are sure to leave lasting marks on the beauty industry, positive prospects in terms of brand positioning and consumer engagement models can still emerge and stimulate growth. Undeniably, the shift towards digital retailing and reconstruction of the offline shopping experience, to factor in greater hygiene awareness measures for staff and consumers, are examples of changes set to become permanent in the immediate future.

As for the future of BPC in Southeast Asia, the bullish outlook, thanks to the region’s historic growth and untapped market potential, will lay solid foundations for the industry to recover from the slump, potentially stronger than before.

For more information, access our The Impact Of Coronavirus On Beauty And Personal Care report.