A version of this article originally appeared in Retail in Asia.

The Coronavirus (COVID-19) global pandemic has had a serious impact on the global luxury market. According to Euromonitor International’s Luxury Goods 2021 edition, the global market shrunk by 15% in value in 2020.

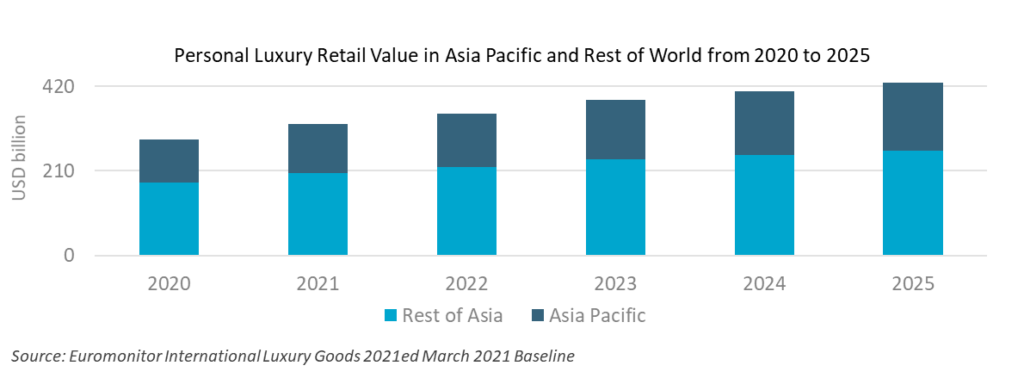

Personal luxury (seven categories in total, which includes designer apparel and footwear, luxury eyewear, luxury jewellery, luxury leather goods, luxury timepieces, luxury writing instruments and stationery, and super premium beauty and personal care) in Asia Pacific saw sales decline by 7% in 2020. But the region’s share of global personal luxury goods increased from 32% in 2019 to 37% in 2020, clearly illustrating Asia Pacific’s growing importance. The outlook for personal luxury in Asia Pacific remains favourable, despite the negative impact of COVID-19. Over 2020-2025, sales are expected to rise by a CAGR of 10% in US dollar terms at 2020 prices, to account for 40% of the global personal luxury market by 2025.

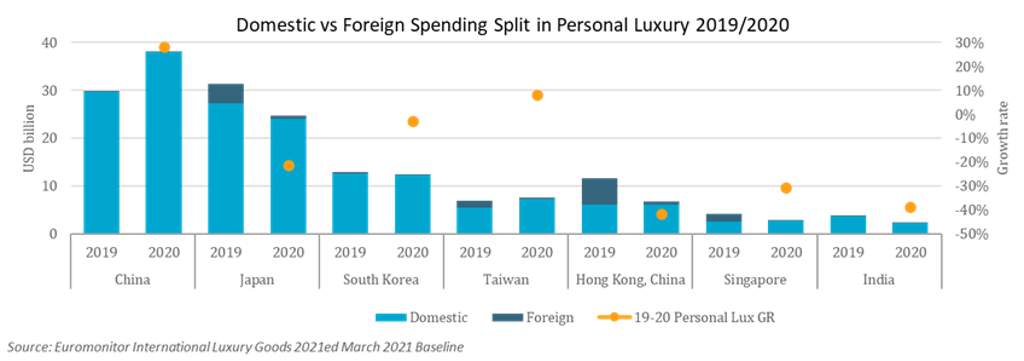

China has now surpassed Japan as the leading personal luxury market in Asia Pacific, and Taiwan has surpassed Hong Kong for the first time. Major declines in tourism levels and accordant tourist spending, coupled with weakened demand from local consumers in 2020, led to sluggish performances in several major shopping destinations in the region, notably Japan, Hong Kong and Singapore. In comparison, repatriated spending from comparatively unscathed affluent and middle-class consumers in mainland China and Taiwan underpinned resilient growth in these two markets.

China and South Korea are expected to see sales growth return to the pre-pandemic levels of 2019 by the end of 2021. China will be increasingly significant, commanding a 41% share of all personal luxury sales in the Asia Pacific region by 2025, up from 36% in 2020.

Crossover collaboration to reach Asia’s young, affluent consumers

Over recent years, crossovers between luxury brands and popular characters, ranging from pop art to Japanese manga, has been increasingly trending. This is widely seen as an effective way to engage with the younger generation of luxury customers. This consumer base, compromised of Gen Z and millennials, is poised to become the driving force behind personal luxury over the forecast period. It will be important to use innovative and unique collaborations to stay relevant and engage with this key demographic. According to Euromonitor’s Voice of the Consumer: Lifestyles Survey, 2021, 62% of millennial and Gen Z consumers like to try new products and 47% of Gen Z and millennials want to engage with brands for product innovation. Novel, fun and innovative crossover products are valuable to recruit these young customers.

Given the growing popularity of Japanese manga among young consumers across Asia Pacific, Loewe and Gucci both launched cross-over editions of Japanese characters in 2020. Both collections effectively worked as a sales booster for revenge shopping in Asian countries to appeal to young customers, especially in China and Japan.

Localisation rising in importance in Asia Pacific

The rising importance of Asia Pacific to the health of global personal luxury has made localisation more important than ever. Seeking a greater intimacy with local luxury consumers to strengthen brand desirability could prove critical in the post-pandemic world.

Localisation is not new to Asian customers and has frequently been used for brands seeking to gain entry to the Asia Pacific market for the last decade. But localisation can no longer focus on just using an Asian face to represent the brands or open local storefronts. It is understanding consumer values that is key to further expansion. According to Euromonitor’s Voice of the Consumer: Lifestyles Survey, up to 43% of affluent and wealthy respondents in 2021 agreed they prefer purchasing from brands that are aligned with their own values, an increase from 34% in 2020. This new localisation targets the synergy between brands’ universal equity and the cultural or societal values a local market upholds.

Graff, a UK based jewellery company, used five self-made female entrepreneurs to represent the brand for its butterfly collection in Hong Kong, establishing a firm connection between its perceived brand values and local female role models.

Sustainability, affordability and collectability driving circular luxury in Asia Pacific

In Asia Pacific, the pre-loved luxury goods market has drawn great attention in recent years, a trend which has been accelerated by the impact of COVID-19. Sustainability, affordability and collectability have been identified as three key drivers that have been pushing forward circular luxury (a recycling/regenerative business model inspired by a circular economy, in which products can be reused for as long as possible to reduce waste ) in Asia Pacific since the pandemic.

Since the onset of COVID-19, consumers are showing greater interest in sustainability and are considering the wider impact of purchase. Vintage stores are becoming hot destinations for key opinion leaders (KOLs) and key opinion consumers (KOCs) in Asia Pacific, driving the fashion value of vintage luxury goods.

On the industry side, Vestiaire Collective, the online vintage luxury site with a strong base in Asia, has accelerated its collaboration with luxury groups since 2020. In March of 2021, Kering acquired a 5% stake in the company, signaling the focus of circular luxury to its business blueprint.

The need to take advantage of digitalisation yet maintain exclusivity

There has long been a common concern among luxury brands that going digital might compromise the sense of exclusivity, which is the cornerstone of the industry. Following the onset of COVID-19, an omnichannel strategy has become increasingly important, refining strategy for luxury brands in order to both increase accessibility and yet still maintain the sense of exclusivity for its customers.

The objective of an omnichannel approach is to build a seamless customer journey that is unhindered by channel, through high level of data integration across on-and-offline retail. In the omnichannel model, the customer is the centre of all touchpoints. Once the customer data is captured from one touchpoint, all other channels will be coordinated to deliver a seamless and personalised experience. This is how luxury brands can ensure exclusivity in the digital era; through high-level personalisation. According to Euromonitor’s Digital Consumer Survey in 2021, affluent consumers in Asia Pacific value connection with brands and exclusive experiences much more than that of the average global level. This shows the increasing importance of an omnichannel approach to elevate and personalise the customer journey for Asia Pacific’s affluent consumers.

Looking forward

To address the bright prospect of personal luxury in post-pandemic Asia Pacific, it is imperative for luxury brands to consider the emerging trends and remain competitive. This means an increased focus to deliver premium exclusivity to new luxury customers, staying in touch with local consumer values, being sustainability-driven, and ensuring high-level personalisation aided by digital technologies.

If you're interested in knowing more about the recovery of the luxury market in China and Asia Pacific, listen to our recent podcasts Optimism for the Luxury Goods Market in China and Fashion Friday: Luxury Market Recovery in Asia Pacific as well.