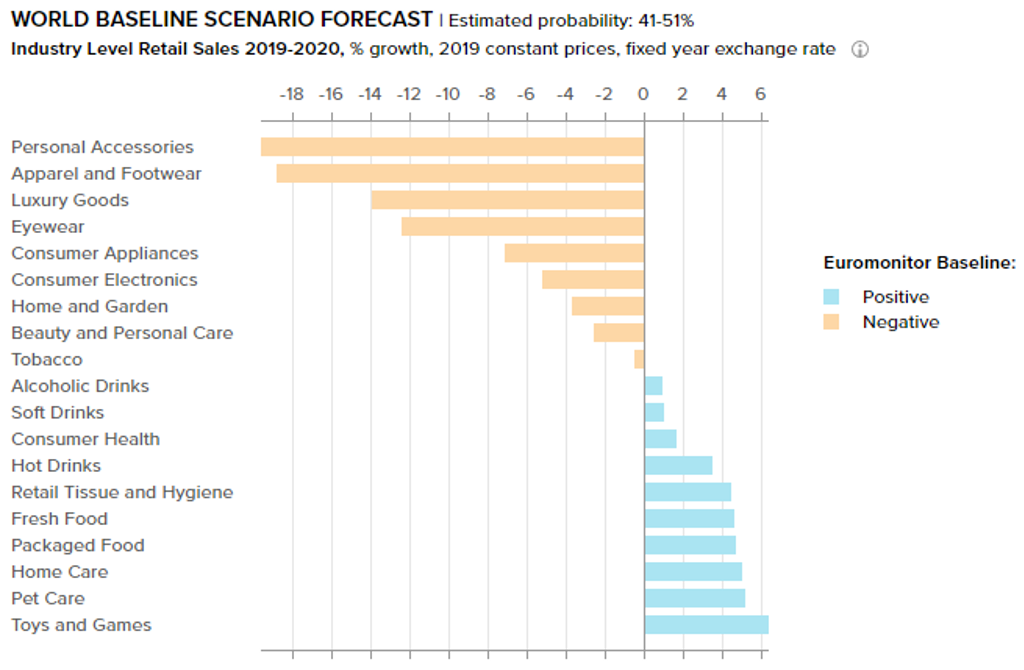

Apparel and footwear has been hit particularly hard by the Coronavirus (COVID-19) pandemic. Specialist retailers and department stores were forced to close down temporarily during the pandemic, as these are not considered essential businesses. Also, remote work, closed schools and cancelled events have diminished consumer need for new clothing and footwear, causing further challenges for retailers. As a result, Euromonitor International’s Post-COVID-19 forecast baseline predicts that global apparel and footwear value sales will decline by 19% at constant exchange rates in 2020 (December 2020 update).

Source: Euromonitor International COVID-19 Dashboard. Last updated on December 15, 2020.

Given the rapid deterioration of the global economy and the ongoing uncertainty regarding COVID-19, the industry is expected to take some considerable time to return to pre-pandemic levels. Countries where COVID-19 cases continue to surge and social distancing measures and travel restrictions remain in place will inevitably continue to see in-store retail sales suffer.

Here is a summary of five key trends shaping the world market for apparel and footwear that have arisen as a result of the pandemic:

Rethinking consumer touchpoints with declining retail footfall

The pandemic has generated further momentum for the already rapidly growing e-commerce channel. E-commerce now represents 28% of global apparel and footwear value sales, according to Euromonitor International’s Apparel and Footwear research (December 2020 update). New digital retail strategies, such as curbside pick-up and order delivery, as well as virtual shopping appointments and livestream shopping, will be significant as the online channel expands. In the US, speciality footwear retailers, such as DSW, as well as brands like Old Navy and American Eagle, have started to offer curbside pick-up options at selected locations. In China, livestreaming has become increasingly popular. Fashion brands like Louis Vuitton and Burberry use livestreaming to demonstrate their products and interact with their customers. This is likely to continue to be popular, as consumers have more time to stay indoors and spend on their mobile devices.

COVID-19 lockdown boosts demand for at-home wellness

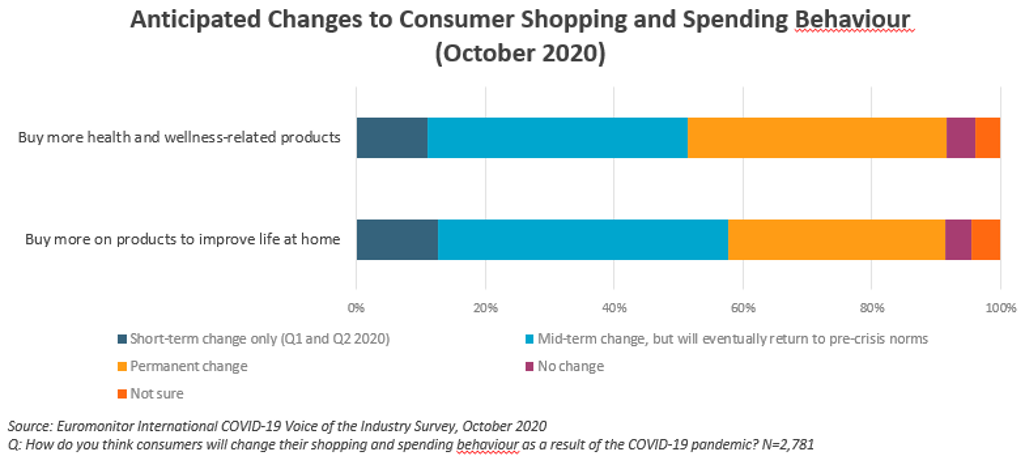

Consumers have shifted to adopting healthy lifestyles, and this trend is ongoing amidst the pandemic. According to Euromonitor International’s COVID-19 Voice of the Industry Survey (October 2020), 41% of professionals across all industries think buying more health and wellness-related products is a mid-term change and purchasing will eventually return to pre-crisis levels, while 40% think this behaviour is a permanent change. While consumers are finding ways to stay active inside their home, sportswear players like Nike, adidas and Lululemon are offering virtual classes to support their at-home experience and continue interacting with their customer base.

Price and value for money are key drivers amidst COVID-19 uncertainty

During the pandemic, brands and retailers are offering heavy discounts in order to stimulate sluggish consumer demand for new clothing and footwear. The widespread global recession and rising unemployment rates will make price and value for money much more important for consumers. People will look for deals and discounts as usual, but they can also be expected to trade down on price points by compromising on brand choice, or might just buy fewer items. Unbranded products and private label are likely to benefit from offering basic items at low prices given the severe economic environment.

Apparel and footwear players rethink their supply chain strategies

Since the pandemic began, manufacturing supply chains and retail operations have been under unprecedented pressure, due to tightening travel restrictions, factory shutdowns and retail store closures. In China, numerous factories across industries were shut down and restrictions on transportation were imposed. This had a substantial impact on the apparel and footwear industry, as China is by far the world leader in both production and exports of apparel and footwear. Companies will explore diversifying their supply chains, with a greater emphasis on seeking alternative suppliers outside China.

Sustainability commitments will remain important in the long term

Consumers are prioritising brands that hold sustainability as a purpose. From changing their supply chain to launching upcycled garments, companies are stepping up their eco-friendly commitments. Also, they are increasingly taking a stand on social issues to show their support and to connect with consumers on a personal and emotional level.

This was apparent in the responses to the Black Lives Matter movement, when a large number of fashion brands, including Nike, Marc Jacobs and H&M, posted statements on their social media and expressed their solidarity. Purposeful leadership is more important than ever, as socially-conscious consumers expect companies to lead with transparency and empathy, aligning their actions with their businesses’ purpose-driven promises.

For further insights of these trends as well as an overview of market performance and prospects, please see World Market for Apparel and Footwear.