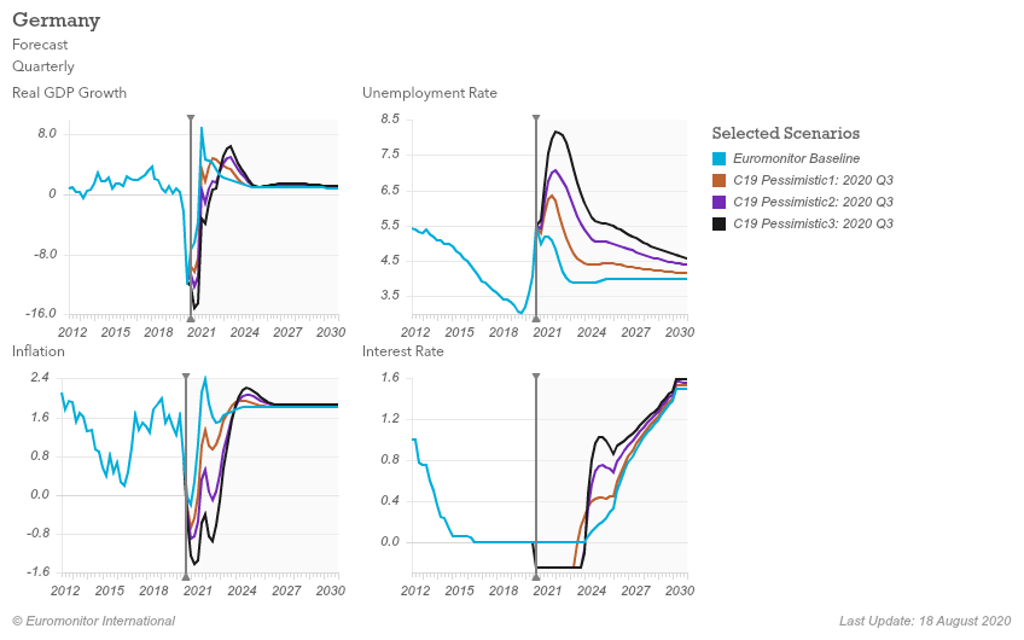

After entering a recession in Q1 2020 as the Coronavirus (COVID-19) pandemic hit, German Q2 2020 real GDP slumped by 11.7% compared to the same quarter in 2019, although the national bank, Bundesbank, expressed optimism of household spending to drive a strong economic recovery in Q3 2020. Germany did not have a lockdown like in some other countries; instead some closures and contact restrictions. Non-essential shops had to close from late March, schools were closed from mid-March, most borders shut and there was a “ban on contact” (“kontaktverbot”) - people could not gather in groups but could meet up with one other person from a different household. However, in most places there were no restrictions for going outside the home.

Although the government quickly implemented a large rescue package and gained initial success through relatively loose movement restrictions – culminating in retail stores reopening in May – the country’s large export-oriented manufacturing sector is suffering due to weak external demand. Temporary closures of non-essential businesses coupled with a dip in manufacturing and consumption are also hurting employment, contrasting with the record-low level in 2019. In fact, employment in Germany dropped in Q2 2020 – the biggest decline since the German reunification, although in the broader European and global major economies context, unemployment will still be very low, translating to a forecast of 5.5% unemployment rate in Q3 2020 – largely thanks to the kurzarbeit scheme - a shorter-hours working arrangement which the government announced in August 2020 would be extended to end 2021. Consumer sentiment is falling, and per capita, disposable income is expected to decline by 5.7% in real terms in 2020.

Faced by these challenges, the already cautious German consumers are becoming even more prudent and selective in their spending. Recent fears of an anticipated second wave starting in Germany already in August, much earlier than anticipated, has exacerbated this caution. The impact has been rather significant for spending on products and experiences in and around the home as German consumers spend more time at home, with some products benefitting while others suffer from the decision to postpone purchases to after 2020.

Germany’s Quarterly Macroeconomic Forecasts with COVID-19 Scenarios: 2012-2030

Source: Euromonitor International’s Macro Model

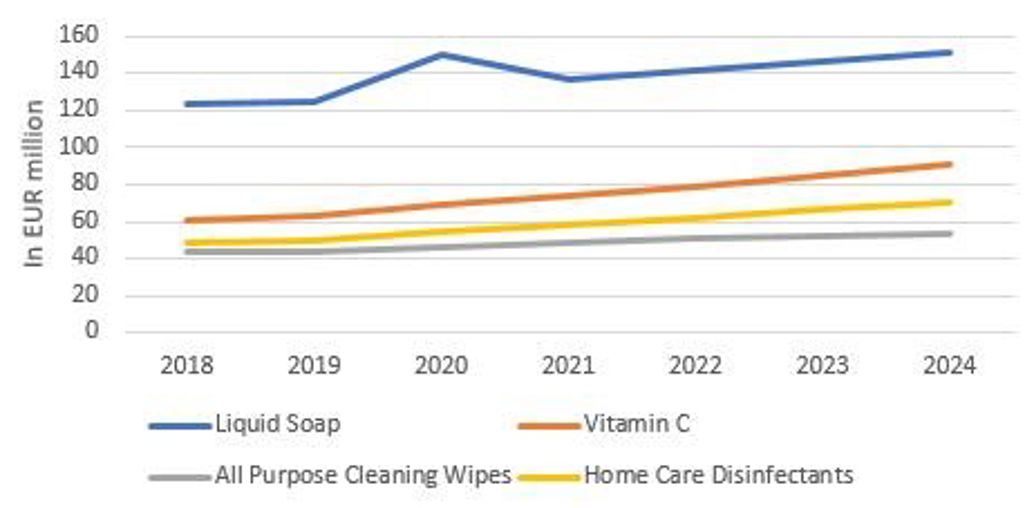

Home care essentials and wellbeing: already strong hygiene standards heighten further

As the COVID-19 crisis hit Germany, health and hygiene became hot topics, leading consumers to stockpile products. There was a rush for products from liquid soap to cleaning products containing antibacterial or disinfectant components such as home care disinfectants – where 10% value growth expected by the end of 2020, all-purpose cleaning wipes and multi-purpose cleaners. Products that aim to boost immune system function, such as vitamin C and multivitamins, also experienced a surge in demand ahead of the peak of the pandemic. Beyond 2020, products that are seen as having a direct impact in reducing the risk of contracting COVID-19 are expected to have their demand settle at a “new normal”: per capita consumption comfortably staying above pre-COVID-19 levels as German consumers will continue being vigilant and step up their hygiene habits.

Meanwhile, with the increased time spent at home, sales of various products associated with the home also went up, such as dishwashing products, with projected 2020 value growth within 7-9%, due to consumers cooking more meals at home as the result of closure of various consumer foodservice outlets for almost two months and more cautious perception of eating out even when outlets reopened. Going into 2021, the demand is expected to settle at a slightly higher level than in 2019 due to more remote working arrangements, but still less time spent at home compared to in 2020.

Projected Constant Value Growth of Select Products Experiencing Surge in Demand: 2018-2024

Source: Euromonitor International

Various products deemed as “home essentials” in fact experienced such level of stockpiling that during the height of the COVID-19 crisis, grocery stores had to limit the number of units purchased. Chiefly this extreme stockpiling applied to toilet paper, as consumers anticipated being confined at home, coupled with the fear of difficulty in finding the product – double-digit value growth is projected by the end of 2020 accordingly. Paper towels also experienced stockpiling although there was an additional factor of more time spent in the kitchen. Other tissue and hygiene products experiencing a surge in demand included pocket handkerchiefs and moist toilet wipes. For these stockpiled home essentials, already in Q2 2020, the demand started to normalise with stockpiled products starting to be used and assurance of no supply chain issues. 2021 sales are thus poised to drop considerably, and ultimately sales for commodities such as toilet paper are set to hover above 2019 levels but still notably below the heights of 2020, due to the positive impact on consumption resulting from more home office practices for white-collar workers.

However, discretionary beauty products – fragrances, and likewise colour cosmetics and premium skincare, all crashed in demand, with fragrances suffering the most; a double-digit value decline is projected for 2020. The slump is the result of lower consumer confidence and the resulting cut in spending on these products, as well as closures of specialist stores. Although drugstores do carry discretionary beauty products, consumers have held off on their spending, amplified by much less time going out. From 2021 onwards, normalisation is gradually expected: higher demand for indulgence and, together with a significant increase of vitamins and immunity-boosting products, this will lead to a new dimension of wellness. Products associated with wellness, including vitamins and immunity-boosting dietary supplements, beauty drinks and a wide range of skincare products, can be expected to have a new ‘’lipstick effect’’ among German consumers.

Durables’ sales slump while hometainment products benefit from more time spent at home

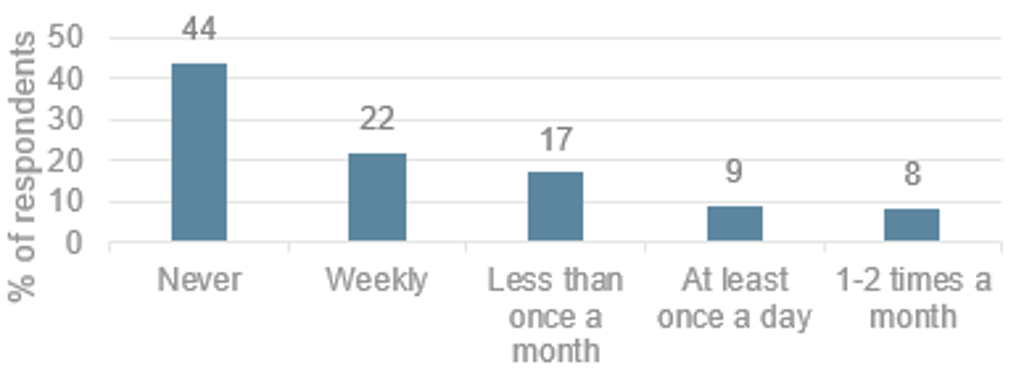

The COVID-19 crisis in Germany has had a relatively mixed, but ultimately negative, impact on overall durables and hometainment products in Germany during 2020. While a spike in working and studying from home has supported the demand for home office furniture and supplies during the initial months of the pandemic, and likewise more time at home also translated to a boost in video games sales, overall consumer confidence slumped alongside unemployment problems for a sizeable chunk of the population, resulting in postponed purchases of big-ticket items including durables.

Due to consumers spending more time at home, demand for some major and small appliances has enjoyed a temporary jump – mainly products that facilitate home cooking and home experiences aiming to substitute going out. Thus, demand for freezers, coffee machines, light fryers and food processors in 2020 went up with consumers expecting that they will have to cook more at home (even after the COVID-19 crisis). However, such products ultimately are in the minority within overall consumer appliances. Consumers will delay replacement purchases – let alone buy new ones – for the bulk of the major appliance products unless deemed really necessary. The same counts for comparable products in consumer electronics such as a new TV– and with various big events including the Euro 2020 Championship and the Olympics getting postponed, consumers can afford to simply postpone their purchase to after 2020.

Frequency of Work from Home in Germany 2020

Source: Euromonitor International Lifestyle Survey 2020 (fielded in February)

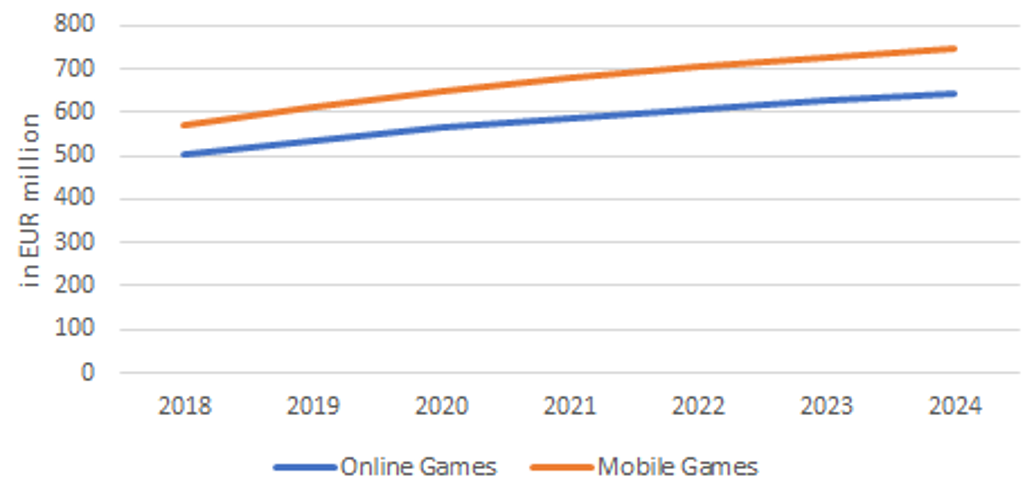

Products within gardening and video games experienced a positive impact from more time spent at home in 2020. The garden gained attraction as a recreational space where Germans do not only increase leisure time but also the willingness to restructure and improve their garden space, which is leading to increased purchases of garden equipment. The same behaviour has been seen in the home improvement space. Meanwhile, various video games products also benefited from the search for more entertainment at home. This shift of free time activities especially affected static consoles positively so far as German consumers upgraded their home entertainment with Nintendo Switch, PS4 and the like, and likewise mobile games, online games and e-sports. The rise of e-sports accelerated in Germany before the COVID-19 crisis and received an added boost as a result. While the increase in sales for the entire year will not be extreme, 2020 would still serve as a more positive year for such products before demand is set to settle going into 2021.

Online Games and Mobile Games Forecast Value Growth in Constant Terms 2018-2024

Source: Euromonitor International: Toys and Games

Fashion: 2020 slump expected for all players

The COVID-19 crisis has hit the fashion industries in Germany hard in 2020. Non-essential store closures harmed sales considerably, which still represents a big percentage of the revenues generated in the market – from apparel to personal accessories. While luxury product sales were the most affected, personal accessories and apparel and footwear also saw sales slumping. After the closure period between March and May, businesses reopened but with much-reduced foot traffic; it is clear that it will take a considerable time for sales to approach pre-COVID-19 levels, and 2020 is poised to be a big set-back year for all players.

Luxury products’ woes stem partly from the sudden decline of inbound flights which bring luxury shoppers to Germany. Over the last years, the importance of international expenditure in the Germany luxury market value sales had been increasing steadily, in 2019 representing over 20% for luxury eyewear, jewellery, timepieces and premium beauty and personal care. With inbound travel only expected to normalise in late 2021/2022, sales are not expected to recover so quickly for the industry.

Overall fashion industries in Germany are unlikely to recover to pre-COVID-19 levels in as straightforward a manner that some other industries can expect. In an attempt to lure consumers back in and clear stock excess, players are expected to slash unit prices substantially with discount practices in the coming months of 2020. Therefore, value size is expected to approach 2019’s level in a V-shape for some products such as bags and luggage or menswear/womenswear, while other products may not reach the same level in the mid-term, such as for timepieces or jewellery. A price-cut strategy is notably a less likely avenue for luxury players: the companies may increase prices of new collections even higher to compensate revenue lost. This may not be a common strategy among luxury companies, with many opting to reposition themselves as super-premium or premium brands. In this price segment, discounts will be a more acceptable approach.

Amidst the sales crash caused by the COVID-19 crisis, channel shifts are inevitable. E-commerce has been a big winner, reaching consumer segments which were previously more resistant to shopping online. While most fashion companies operate their own e-commerce stores, many sell their products through major e-commerce platforms such as Zalando, Mytheresa, Otto, Asos, or Farfetch. Such platforms attract much more consumer traffic to their online stores and are reshaping how business is done.

Beyond 2020, COVID-19 is likely to have longer-term repercussions within fashion industries in Germany. Some trends will be accelerated, such as the preference of consumers for experiential activities rather than physical goods, which had been pressurising the sales of timepieces and jewellery going into 2020. Other trends, such as sustainable behaviour, may see a temporary setback as disposable income declines and economic uncertainty pushes consumers to adopt a defensive consuming pattern. Nevertheless, companies, especially in the apparel and footwear market are particularly using sustainability as a key differentiator in their value propositions in the coming years.

Recovery likely on the horizon despite continued caution

A longer-term shift linked to more time spent working at home for white-collar workers is expected. While Germany managed to handle the pandemic quite well from May-June onwards, there was already an expectation of a second wave from September, resulting in continued cautious behaviour. With fears of a second wave already starting earlier than anticipated, from August, the time spent at home is likely to be prolonged for the rest of 2020. This will benefit the sales of products of hometainment and durables further in the long term. Already high attention to hygiene practices will become even more entrenched in German consumers’ minds. In contrast, losses experienced by beauty and fashion products are likely to only be short-term.

Businesses across most industries in Germany will need to adapt not only to unforeseen changes in legislation to weather the impact of COVID-19 but also to potential new consumer tastes and behaviours, especially by continuing to explore new e-commerce distribution opportunities that they have not yet adopted, for example selling directly to consumers or using third party delivery platforms – beyond just jumping on the e-commerce bandwagon. The companies who can better address the needs of the post-COVID-19 German consumer are those who can balance the need for reassurance while catering to these shifts in consumer behaviour.

Contributing analysts: Iselie Iglesias, Lan Ha, Magda Starula, Ratna Sita, Hugo Ribeiro, Tim Vattmann.