The significance of Brexit cannot be underestimated as the most important political issue facing the United Kingdom (UK) since the Second World War. 29th March 2019 should have been the official day of departure of the UK from the European Union (EU), two years on from the triggering of Article 50. However, it has now turned into a milestone marking everything that has not been achieved.

The country has a government in crisis, a population divided and still no certainty for business and consumers on whether the UK will be leaving with or without a deal, or even if Brexit will happen at all. While opposition to Theresa May’s deal is clear, there is no alternative that has managed to gather parliamentary backing.

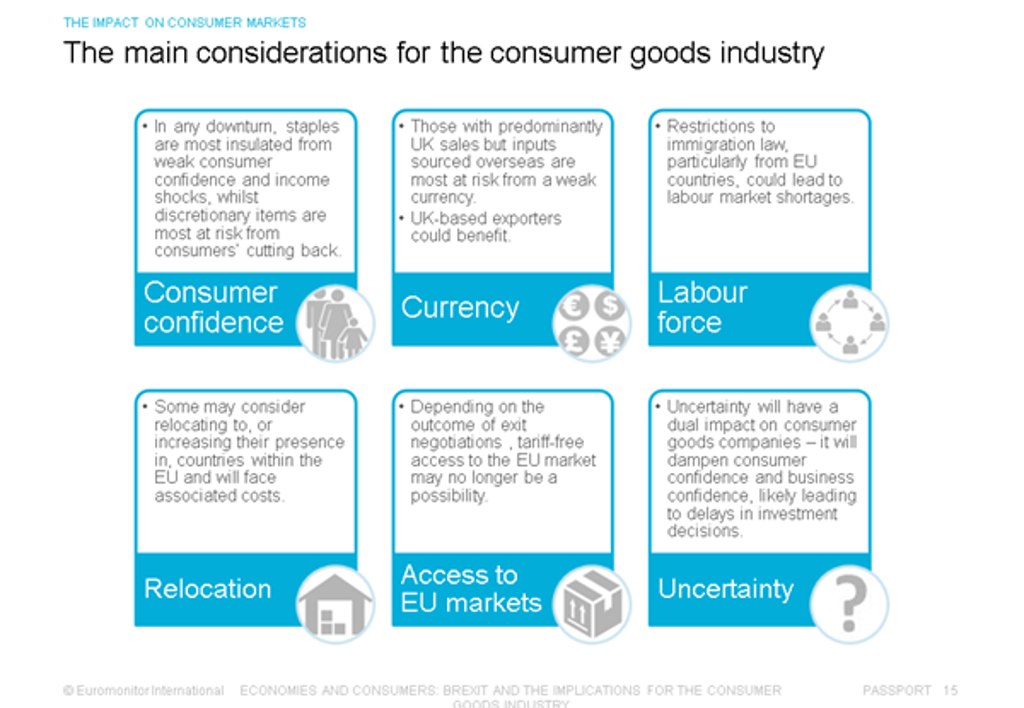

The economic impact of Brexit will be determined by exactly what kind of deal (if any) is achieved. What is certain is that any Brexit scenario will leave the UK worse off than if it stayed in the EU. Brexit will impact every industry and consumer market in the UK, with currency depreciation, labour shortages and trade access to EU markets amongst the key issues.

Alcoholic Drinks: question mark over UK’s role as a wine bottling hub

The scale of Brexit’s impact on and potential significance to the Alcoholic Drinks industry will depend on the outcome of negotiations between the UK and the EU, and the conditions of the UK’s departure. Crucially, the UK is a major bottling hub for wine which is imported, bottled and then re-exported, much of it to the EU. Any change to the UK’s trading relationship with the EU is likely to have a significant impact on this and call into question the UK’s position as a wine bottling hub.

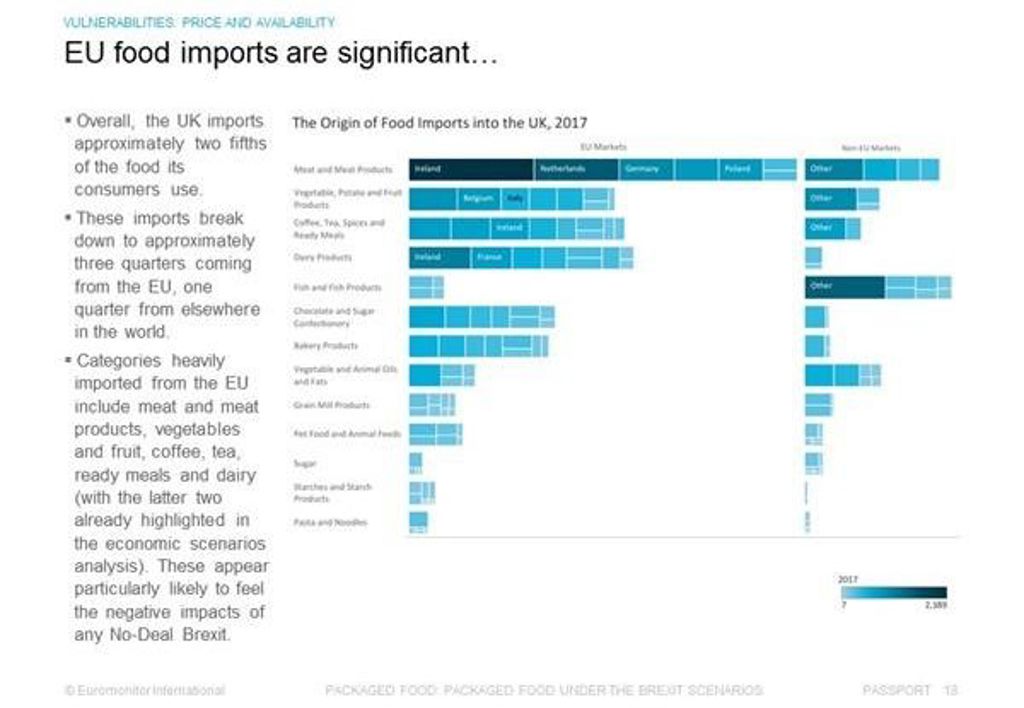

Packaged Food: three-quarters of UK food imports originate from the EU

The prospects of a No-Deal Brexit have made packaged food players jittery. UK-based and other EU companies are adjusting their strategies and preparing their supply chains, while UK retailers attempt to replace products imported from the EU with domestic ones. Overall, the UK imports approximately two-fifths of the food its consumers use. These imports break down to around three quarters coming from the EU. Categories heavily imported from the EU include meat and meat products, vegetables and fruit, coffee, tea, ready meals and dairy.

Soft Drinks: British spring bottled water could benefit from costlier imported mineral water

The introduction of the sugar tax in the UK, and attention on the health and wellness trend has resulted in a boom in bottled water. Spring bottled water is common in the UK, while most natural mineral bottled waters are imported from other European countries. In a No-Deal scenario, natural mineral water sales could see a decline due to an increase in prices and border delays, making it a premium water option. British spring bottled water will be able to benefit from this trend, as well as functional bottled water (purified bottled water with added electrolytes) as a replacement to the minerals in natural mineral water, which appeal to health-conscious consumers.

Hot Drinks: aluminium coffee pods produced in the EU will become more expensive

Due to the rising interest in sustainability and corporate environmental responsibility, coffee pods have come under fire. For this reason, brands are moving to introduce alternative materials in order to roll-out recyclable pods. Aluminium pods are the best solution – they are more expensive but preserve the quality of coffee and allow a long shelf-life. However, the major producers of aluminium pods are in Switzerland, Germany and Italy. In a No-Deal scenario, coffee pods imported to the UK are expected to increase in price.

Cities: impact of Brexit will be felt beyond British cities

While a No-Deal withdrawal from the EU will hit UK consumers the hardest, other global cities will also succumb to its adverse effects, albeit with less magnitude. European cities are especially wary of higher tariffs, extensive customs checks and a falling pound – serious factors which could disturb the functioning of key export industries.

Paris is expected to lose 8,400 households earning more than USD125,000 over 2018-2023 under a No-Deal Brexit withdrawal compared to Euromonitor baseline forecasts. According to the export development agency, Business France, the Paris region accounts for approximately 18% of national exports.

Nonetheless, the adverse impact of a No-Deal will still be largely concentrated in UK cities. Using Paris as an example, the fall in the number of households earning more than USD125,000 in 2018-2023 will equate to just 1.1% of the city’s total number of +USD125,000 households – approximately 10 times less than in London.

Travel: Spain will be the hardest hit outbound destination in a No-Deal Brexit

A No-Deal Brexit would wipe USD5.2 billion in potential UK outbound expenditure to destinations around the world over 2019-2025. Despite assurances from the European Commission that flights will continue even in the case of a No-Deal Brexit, there are concerns about the removal of frictionless travel, leading to airport queues, supply chain disruptions, as well as shortages of food and medicines in the UK.

Spain would be the hardest-hit destination by a No-Deal Brexit as the country is highly dependent on the UK, accounting for 22.7% of arrivals to Spain in 2019. Under a No-Deal Brexit scenario, UK arrivals to Spain would decline in the short term, their potential growth reduced by 5.0%, failing to reach 20 million trips by 2022.

Source: Euromonitor International Travel

Other Brexit resources:

Euromonitor International’s Brexit Scenarios Tool helps clients to understand the impact of different scenarios on our baseline forecasts for the UK economy, industries and consumers. It offers a range of outcomes, providing the tools to stress-test strategy, plan ahead and remain profitable in these challenging times.

Quarterly Brexit Report: Q1 2019

Top Five Implications of Brexit Scenarios on the Food Industry

Packaged Food Under the Brexit Scenarios

Will UK Soft Drinks Lose its Fizz with Brexit?

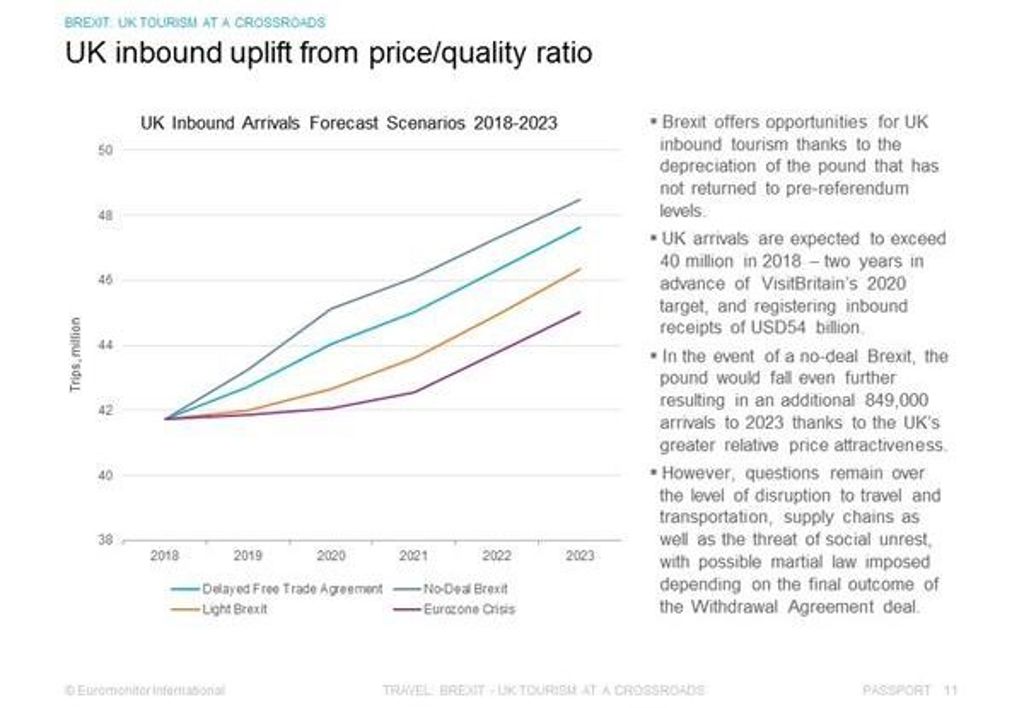

Brexit: Tourism at a Crossroads