The Australian economy was on the wane even before the Coronavirus (COVID-19) crisis hit. In Q4 2019, consumer confidence reached its lowest level since 2014, despite record low interest rates, in the face of consistently low wage growth, diminished household spending and surging house prices. The public mood was further hit by the extensive bushfires that impacted huge areas of New South Wales and Victoria over the 2019-2020 summer.

A comprehensive nationwide 3-month lockdown announced by the prime minister on 25 March in Australia in response to the COVID-19 outbreak will exacerbate this economic weakness and has resulted in a voluntary shutdown by most retail outlets except those seen as essential services: supermarkets, convenience stores, forecourt retailers and pharmacies. Euromonitor International forecasts Australian real GDP growth to contract by 6.3% in 2020.

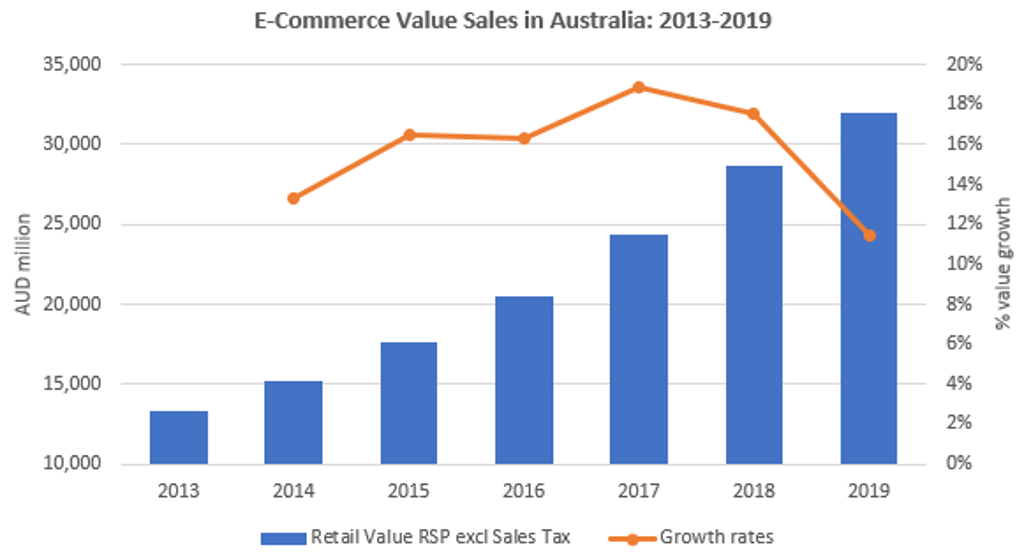

Retailers are prioritising ways to mitigate store closures by engaging with their customer base through digital forms. Some strategies include increasing social media and email marketing, expanding breadth of product offerings online and introducing digital commerce if they currently do not have an online presence. Whilst there were no item restrictions on e-commerce, March saw strong and unprecedented demand for essential items such as toilet paper, hand sanitisers, pasta and rice resulted in low stocks in supermarkets, despite a high level of domestic production.

There was also an increase in e-commerce orders, which caused longer delivery windows; both Woolworths and Coles supermarkets are working hard to meet demands by firstly prioritising deliveries to the elderly, people with disabilities, and those who are required to self-isolate while increasing delivery capacity to curb demand.

Source: Euromonitor International

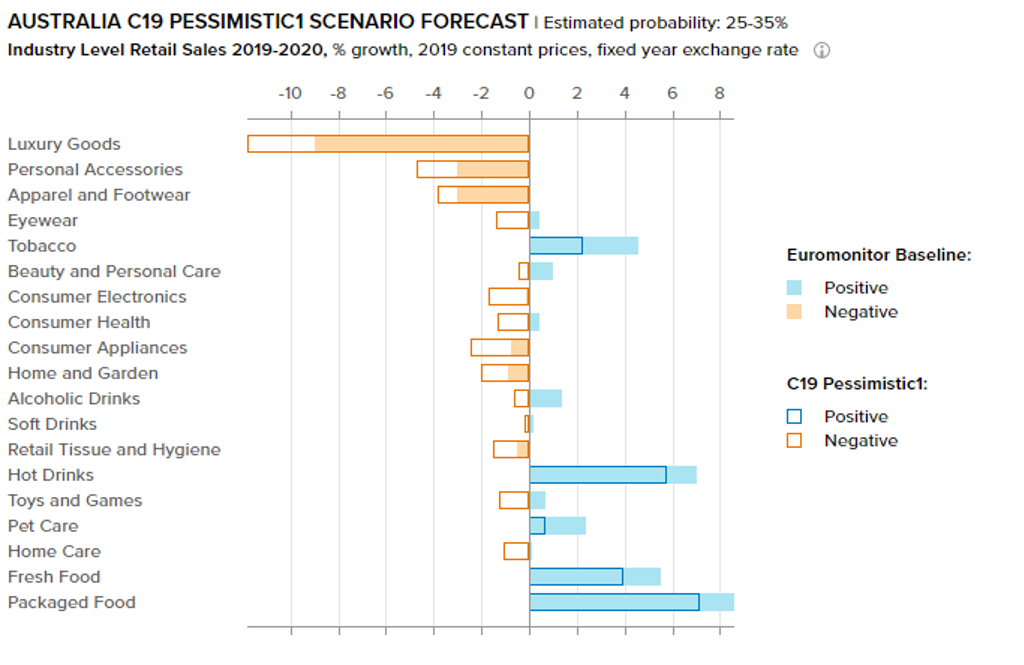

FMCG industries in Australia will be affected in different ways. Not surprisingly, discretionary items such as those in the luxury goods and personal accessories industries will be hardest hit, reflecting both the closure of retail outlets and the longer-term negative impact on disposable income. Conversely, essential items such as fresh food and packaged food will see accelerated demand as consumers stay at home and cook for themselves.

Source: Euromonitor International

Government quick to respond with fiscal stimulus

Australia’s response to the COVID-19 crisis was initially mixed, with continued international travel and a confusing mix of social distancing measures. On 19 March, the NSW government allowed over 2,000 passengers off the cruise ship the Ruby Princess directly into the community; over 600 cases and 11 deaths have been attributed to this, and it is now subject to a criminal investigation. The government’s stimulus-response has, however, been swift. As of 8 April, the Federal government had disbursed three major support packages, totalling AUD214 billion, or 11% of gross national output:

• The government has increased the JobSeeker Allowance (income support) by AUD550/week, offered grants to small business and introduced a Childcare Subsidy totalling AUD1.1billion;

• Businesses that suffer a fall in turnover of over 30% (50% for companies with a turnover of over AUD1 billion) will be offered up to AUD1,500/fortnight to keep employees on their books;

• The government is also looking to buttress Australia’s key agricultural industries, for example by providing AUD110 million for cargo flights to export products like seafood, meat, fruit and vegetables to key export markets, including China, Japan, Singapore and the UAE.

Pricing holds steady for staples as these are produced locally

Despite a spike in demand for several products, including toilet paper, retail prices of food staples such as rice and pasta, hand sanitiser and anti-bacterial surface care remained steady between January and March 2020, with negligible changes. A key factor is that Australia locally manufactures a large proportion of these products, and only a few categories rely on imports from countries like China, Japan and the US. For instance, Australia manufactures around 67% of the total toilet paper sold to consumers, and it is a net food exporter. On the contrary, over 90% of medicines and active ingredients are imported, and this could be a factor in the price increases for vitamins and dietary supplements seen in March 2020.

Australia: Monthly Price Change for Selected Consumer Health Products

Source: Euromonitor International Via database, monthly price change (1 March-31 March 2020) for selected consumer health products

Fresh food and packaged food: domestically produced fresh food should satisfy consumer demand

Panic buying has been most apparent in pantry essentials such as rice, pasta, noodles and other shelf-stable items. In response to this, major retailers have imposed restrictions on the purchase of these items as supermarket shelves remain empty. Fresh food items such as fish, meat and vegetables are mostly sourced domestically, with suppliers and retailers confident in meeting higher consumer demand. Within packaged food, consumers may opt for more economical options; however, there will be demand for high-quality products as consumers attempt to replicate the restaurant experience at home.

A key retailer’s response has been to improve delivery services. For instance, Woolworths offers a AUD80 ‘Basics Box’ containing packaged food, including snacks and other pantry items. A smaller grocery chain, Harris Farm Markets, has also launched Harris Farm Express AUD250 ‘no-choice’ box, which contains essential groceries such as fruit, vegetables, protein and other pantry items to last a few days for a family of four.

Beverages and tobacco: bottle shops set limits on amount purchased per transaction

Sales of essentials such as bottled water, coffee and tea have seen higher demand due to stockpiling, people working from home and substituting out-of-home occasions with at-home consumption.

Within alcoholic drinks, far higher demand has led to leading bottle shops introducing limits on the amount that can be purchased per transaction. With tighter social distancing guidelines and the closure of pubs and bars until September, Australians are now looking to drink at home. Beer producers have expressed concern that Australia’s current beer demand could cause a supply shortage within weeks if production was interrupted. The Australian wine industry has also suffered since late 2019 from bushfires affecting production, alongside lower demand from COVID-19-hit China.

Tobacco retailers remain open, and industry sources report strong sales due to initial stockpiling, public anxiety leading to higher smoking incidence rates, and smokers lighting up more in the freedom of their own homes. Longer-term economic problems and higher unemployment could put a dampener on sales, especially given the tax-driven high prices of tobacco products.

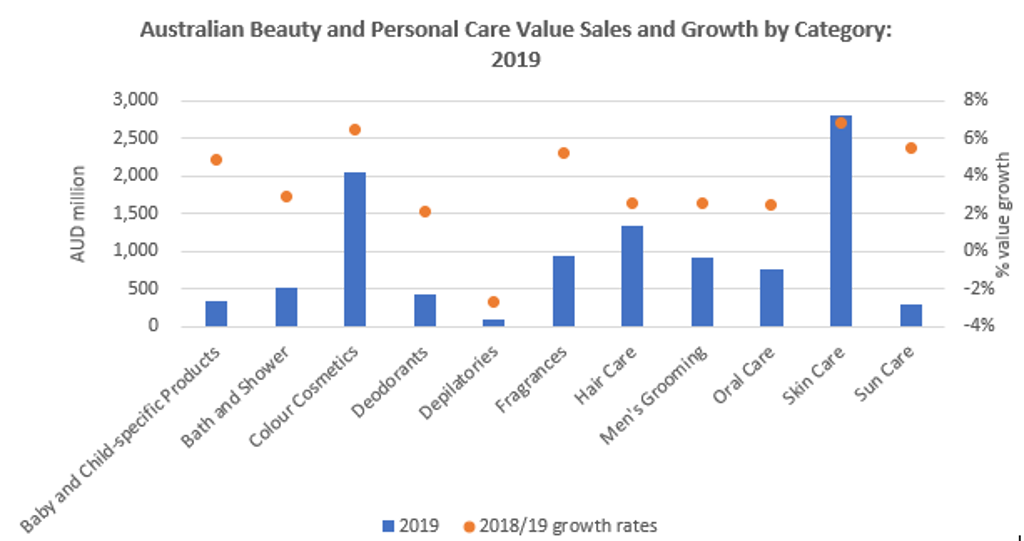

Beauty and personal care: shift to purpose-driven strategies and self-care

Hand sanitisers, bath and shower and skincare are all products that have seen an increase in demand amongst Australians. Local companies are also rushing to produce hand sanitisers, including distilleries such as Archie Rose, Manly Spirits and the Australian icon, Bundaberg Rum. Websites such as Etsy, which serves as a platform for micro-sellers, now include hand sanitiser in their stock.

The industry overall will be severely impacted by the decline in more discretionary products such as colour cosmetics and skincare, which commanded 49% of beauty and personal care value sales in 2019.

Source: Euromonitor International

Despite store closures and job losses, retailers have not stood still:

• For example, beauty specialist retailer Mecca has focused on continuing to provide most of its in-store services online, offering customers free shipping for all their purchases and beauty consultations using FaceTime. The retailer has also launched MECCA Live to broadcast daily beauty updates, including new product developments, live sessions and chats;

• Demand for skincare is rising as more customers indulge in pampering themselves with skincare products such as sheet masks and serums. This is also being driven by online retailers such as Adore Beauty holding regular live Instagram videos with influencers and beauty editors giving tips about skincare regimes and sharing their favourite skincare products. The whole marketing around ‘stay at home essentials’ and ‘self-care in stressful times’ by beauty retailers is driving the demand for skincare products.

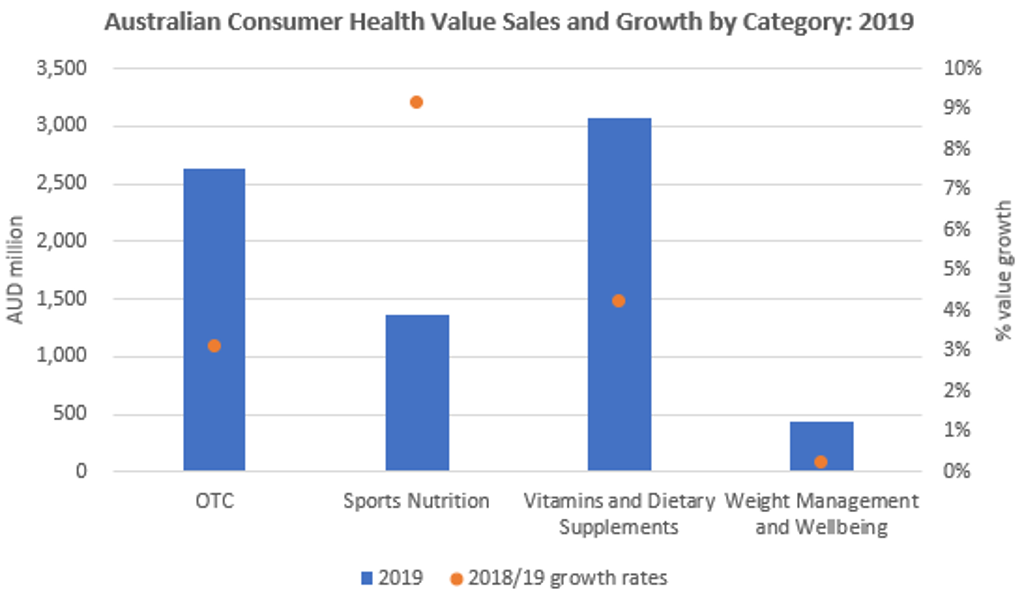

Consumer health: limits on sales of some remedies and supplements

COVID-19 has led to a spike in demand for cough, cold and flu remedies, immunity-boosting vitamins and dietary supplements as well as analgesics, with higher sales of over-the-counter medications, largely related to consumer stockpiling and less about treatment. The government has implemented measures to limit dispensing and sales of products, such as cough, cold and allergy remedies as well as analgesics, to a maximum of one unit per purchase, both online and offline. All paediatric analgesics are now only available behind the counter to enable pharmacists to ensure supply equitability.

Vitamins and dietary supplements made up 41% of total consumer health value sales and saw strong growth in 2019. This is expected to accelerate as Australians take preventative health measures. Companies such as Comvita have seen strong growth in online sales for their immunity-boosting products with ingredients such as Propolis, Olive Leaf extract and Manuka honey. Blackmores has responded to the high demand by introducing a subscription service where customers can sign up to receive a repeat delivery of supplements to their door every four, six, eight or 10 weeks. Retailers such as MyMedkit and Chemist2U are developing new online services and apps, with both offering users the delivery of prescriptions and over-the-counter medication.

Source: Euromonitor International

Tissue and hygiene: manufacturers operating 24/7 to satisfy demand

Products such as toilet paper, disinfectants and surface care items were amongst those that saw the highest initial demand from stockpiling, resulting in empty shelves, short-term supply issues and limits to the number of individual purchases. A large proportion of Australia’s toilet paper is sourced from China, but there is a sizeable domestic supply chain, including brands such as Quilton (ABC Tissue Products Pty Ltd) which have sent their factories into 24/7 overdrive to adjust to the high demand. Manufacturing giant Unilever has stated that factories are operating 24/7 to help keep shelves across Australia stocked with essential cleaning products. As manufacturers have been adjusting their supply chains, an inelasticity of supply will be visible in the short term, with gradually increasing elasticity in the short to medium term.

Toys and games: video games offer an escape for stay-at-home consumers

Consumers have reacted to staying at home by turning to both traditional and video games to escape from the tedium of self-isolation and interact with friends and family. The rising demand has caused popular consoles including Nintendo Switch, PlayStation 4 and Xbox One to become completely sold out across Australia both in-store and online. Puzzles and board games have also been experiencing strong growth: Since mid-March 2020, Monopoly Classic has been the best-selling game, with Scrabble and Uno amongst the top 10.

E-commerce adoption to continue beyond the lockdown

The COVID-19 crisis in Australia has had an immediate impact on retailing and FMCG markets. The lockdown and forced closure of all retail beyond essential services have helped sales of core food and drinks categories, as well as major supermarkets. Smaller businesses, despite promised government support, purveyors of non-essential items, mono-brand retailers and luxury brands are at most risk. Australia’s food supply is mostly national and therefore guaranteed.

Retailers need to be agile and responsive, as seen by the shift to online sales and increased interest in models such as subscription boxes. The COVID-19 crisis has disrupted Australia’s supply chain and transformed consumers’ shopping habits in the short term. E-commerce demand has increased amid the lockdown, and this is likely to continue in the future as a greater variety of providers offer both online sales and services. Australians are likely to more widely adopt this distribution channel. Other retailers, such as those in beauty and personal care, are attempting to replicate in-store services online, which will be key to maintaining the interest of millennial consumers.