The global economy saw the biggest decline in decades in 2020 as a result of the Coronavirus (COVID-19) pandemic, and despite typically higher prices for organic products, global value sales of organic packaged food value grew by 13% at fixed 2020 exchange rates. In fact, the growth rate for organic packaged food was the highest among all health and wellness categories in 2020. High growth rates for organic were seen not only in developed regions such as North America (16%) and Western Europe (9%), but also in developing regions such as Asia Pacific (12%) and Latin America (8%). There are three main reasons that support organic food growth: a focus on preventative health and food safety, sustainability and animal welfare concerns, and changes in market maturity and consumer priorities.

1) The focus on health and food safety

Preventative health became a primary concern amidst the COVID-19 pandemic. Organic foods are viewed as a less harmful alternative to conventional products because they are GMO-free, and they have lower pesticide and antibiotic exposure.

On the other hand, the pandemic has meant more people want to know where and how their food has been produced. In this sense, organic certifications serve as a seal of quality, transparency, and confidence. According to Euromonitor International’s Voice of the Consumer Lifestyles Survey fielded in January-February of 2021, 53% of consumers globally consider the label “Organic” as trustworthy, being one of the most trusted among green labels.

2) Sustainability and animal welfare concerns

According to Euromonitor International’s Voice of the Consumer Health and Nutrition Survey fielded in January-February of 2020, 47% of consumers seek organic food for environmental concerns. With the farming methods used, organic protects the planet from soil and water pollution as it does not use conventional agricultural chemical fertilisers. The non-use of chemicals enhances the biodiversity of the ecological system alongside lower greenhouse gas emissions. All these elements make a positive impact on preventing climate change.

On the other hand, in the same survey, 35% of consumers declared that respecting animal rights was a reason for seeking organic food. In that context, consumers are preparing more home-cooked meals and they are more aware of the provenance of their food. When looking for ingredients, many people prefer animals that have been raised in conditions that suit their natural behaviour, which organic farming follows.

3) Changes in market maturity and consumer priorities

The higher prices of organic products represent a challenge for the category, since COVID-19 has caused global disposable income to fall by around 5% in 2020 in real terms. The pandemic adversely impacted people from all income levels. However, in developed markets such as the US and Europe, competition from private label is expanding and helping to reduce the gap in unit prices with non-organic products, providing consumers with options that work for their budgets.

There are also differences between categories. Baby food is usually one with a mature organic offering and smaller price gaps. Conversely, the difference between non-organic and organic fresh meat prices can be very high, which implies that in developing markets organic options may be scarce.

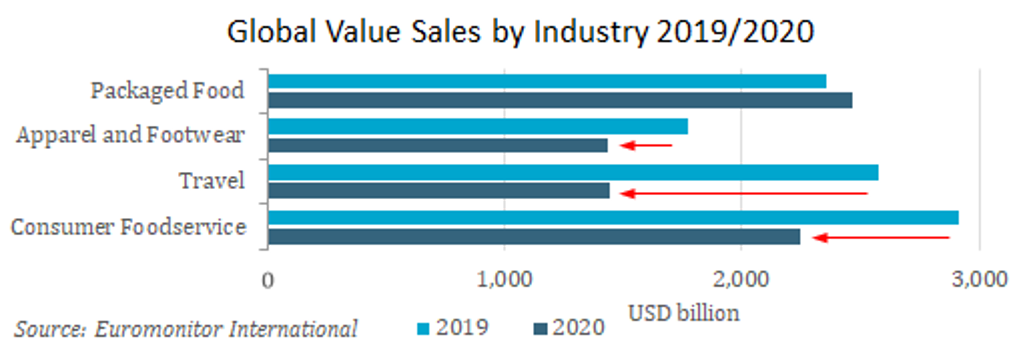

At the same time, the decline in sales in absolute terms seen in 2020 by travel, consumer foodservice, and apparel and footwear, together was equivalent to 90% of total packaged food sales in 2019. Part of these savings enabled consumers to afford the higher prices of organic food, which embodied many of their new priorities, including healthy eating, food safety, sustainability, and animal welfare.

Stronger expansion of organic products forecast in emerging markets

Countries with mature markets, such as the US, France, Germany, and the UK, show attractive market sizes for organic food, but do not promise high growth rates nor high premium price points, as private label abounds. According to Euromonitor International’s Voice of the Consumer Health and Nutrition Survey fielded in January-February 2020, in France, 22% of consumers stated that they seek organic produce, which seems low compared to China, where 44% of consumers stated to actively seek organic. Even though organic seems to have lost some priority when asking consumers, the organic trend is expected to continue growing in Europe. The Farm to Fork strategy of the European Union aims to increase organic farmland to 25% by 2030 and the related investments and initiatives are expected to positively influence demand for organic products.

Stronger expansion is expected in developing countries such as China and Turkey, pushed by factors such as food safety and a growing middle class. The e-commerce channel can prove an important facilitator for growth as it allows a wide consumer base to have access to organic products, even when they are not yet broadly available in modern retail. However, exporters of organic packaged food should consider that expected long economic recovery periods for some countries will maintain the preference and support of local producers of organic food.

If you are interested in knowing more insights about the reasons and prospects for organic food growth, you can find them in this report: Organic Food: Coronavirus and the Future