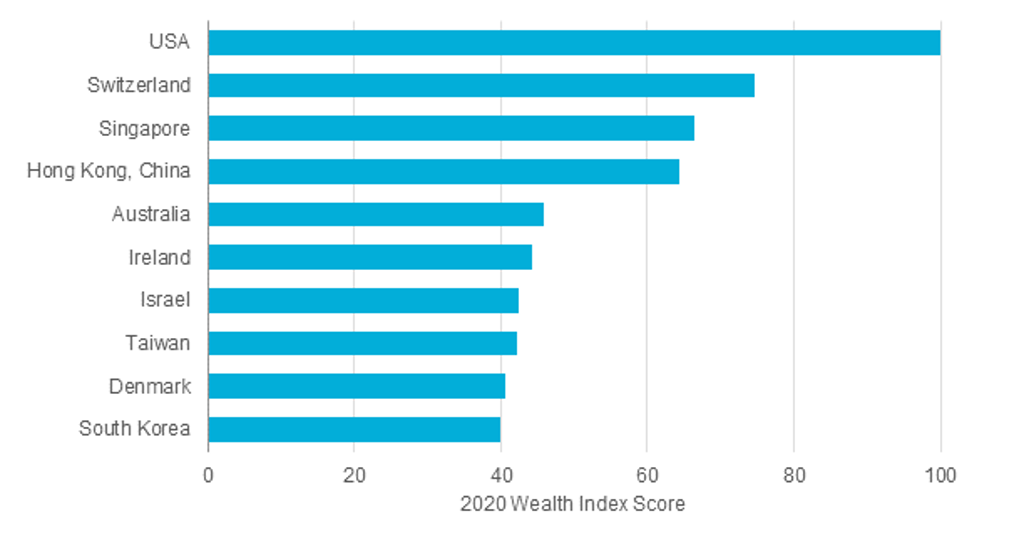

Companies targeting affluent consumer segments – such as wealth management firms and providers of luxury goods and services – must remain on top of global wealth trends if they are to capitalise on market opportunities. According to Euromonitor International’s proprietary Wealth Index, the US retained its position as the world’s top wealth market, whilst Hong Kong was overtaken by Singapore in ranking for 2020. In China, although the wealthy and affluent population continues to expand, the country’s Wealth Index score and ranking deteriorated in 2020, as the negative impacts of the Coronavirus (COVID-19) pandemic on high-value consumption potential and other indicators relating to assets could not be avoided.

Top Ten Markets with the Highest Wealth Index Scores: 2020

Source: Euromonitor International’s Wealth Index

US: Wealth gains driven by soaring share prices

The US ranked first on Euromonitor International’s Wealth Index in 2020, a position that it is expected to retain through to 2030. Despite a contraction in 2020, the country still has by far the largest high net worth and affluent population, and its wealthiest households are large spenders on categories that matter to businesses seeking high-value opportunities.

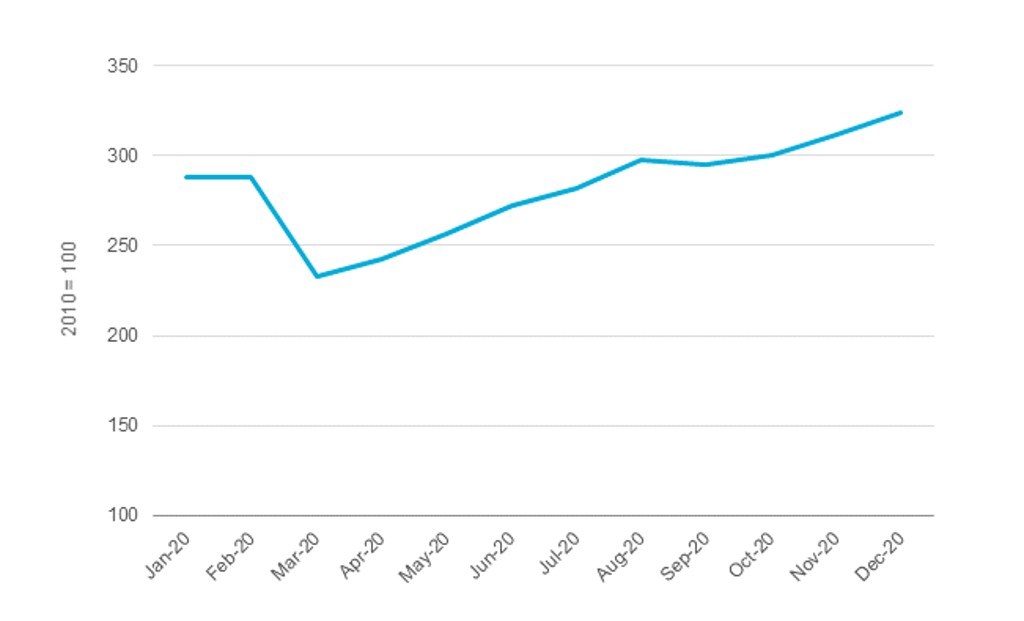

From March 2020 onwards, the US stock market started to recover and soar, which effectively helped to increase the household wealth of high net worth and affluent segments, especially given these individuals are more likely than others to hold financial assets such as stocks and shares.

US Stock Market Index: January-December 2020

Source: Euromonitor International from national statistics/OECD

As the wealth of HNW and affluent households continued to grow in 2020 when poorer households were adversely impacted by job losses and rising household debts during the COVID-19 pandemic, the wealth gap among better-off and worse-off families in the US became even larger than the income gap and is anticipated to continue to widen.

Hong Kong and Singapore swap places

Beset by widespread political unrest that has negatively impacted the economy and business environment, Hong Kong slipped down one place in Euromonitor’s Wealth Index ranking in 2020. All indicators in Hong Kong’s Wealth Index score declined in 2020 compared to the previous year, but the biggest deterioration was seen in assets – a direct consequence of Hong Kong’s troubles, that prompted wealthy households to move their investments and assets out of the territory and often to Singapore.

In 2020, Singapore moved up one place to rank third in the Wealth Index ranking due to a significant improvement in its assets score. Despite being one of the top performers on the Wealth Index, Singapore remains heavily reliant on trade and is vulnerable to global economic and political uncertainties, which can adversely impact wealth gains of the high net worth and affluent populations and hinder the growth of the city-state’s luxury market.

China: Fall in the ranking despite the continued expansion in wealthy and affluent population

Although not featured as one of the top ten markets in Euromonitor International’s Wealth Index ranking, no analysis on the world’s major wealth and luxury markets is complete without mentioning China. In 2020, China was home to the world’s sixth-largest high net worth and affluent population (with 1.8 million adults). Whilst the COVID-19 pandemic caused household wealth to fall and the high net worth and affluent population to contract in many countries, the number of affluent consumers and their wealth continued to rise in China in 2020, as the Chinese economy rebounded to pre-pandemic levels in Q3 2020. Although China’s wealth indicators recorded improved scores, the negative impacts of the pandemic on high-value spending and assets could not be avoided. As a result, China’s Wealth Index score dipped in 2020, and its ranking fell from 27th in 2019 to 29th in 2020.

Euromonitor International’s Wealth Index

In the context of squeezed middle classes and rising inequalities, it is hugely important for businesses to capture high-value opportunities. However, the potential for high-value consumption is dependent on many factors. For example, a country with a high number of ultra-high net worth and high net worth individuals who only travel abroad for luxury spending is not really a country with market potential for luxury companies to target. This is the reason why Euromonitor developed the Wealth Index, which takes into account 21 indicators covering a wide range of factors, from wealth and spending through to homeownership without a mortgage, savings, insurance, and pensions. Each indicator was assigned a weighting based on its perceived importance. A country’s score on each indicator was calculated against the leading country for that particular indicator and has a value range of 0-100.

For more information on Euromonitor’s Wealth Index, listen on-demand to the webinar The Global Wealth Index: How to Capitalise on High-Value Consumers or request a demonstration.