The Coronavirus (COVID-19) pandemic has triggered the most severe global recession since World War II. In Q4 2020, the end of the pandemic started to be in sight as countries began to roll out effective vaccines. However, grave challenges remain, not least because the end of 2020 saw the emergence of regional second waves that necessitated renewed restrictions and lockdowns, especially in Europe and North America.

As of Q4 2020, five countries – Sweden, Switzerland, China, Australia and Turkey – are expected to have recorded index scores above 100 on Euromonitor’s Recovery Index (in which a score of 100 and over indicates a full recovery in which consumer demand returns to 2019 levels). These economies appear to have recovered due to a strong comeback in consumer confidence. China is, however, the only country in this list where other economic activities – consumer spending, retail sales, GDP and labour market – have surpassed 2019 levels.

Meanwhile, Australia is on track to rebound strongly as the country has suppressed the second wave of the pandemic and infection rates remain low, providing confidence for consumers and businesses. Elsewhere, amid further local/regional waves of COVID-19 infections, 13 out of the 48 economies covered by Euromonitor International’s Recovery Index are expected to have recorded worsening recovery index scores in Q4 2020 compared to the previous quarter.

Top Ten Countries by Recovery Index Score in Q4 2020

Source: Euromonitor International from national statistics/Eurostat/OECD; Euromonitor’s Recovery Index. Note: The bubble size indicates the country’s GDP in 2019. Data for 2020 are forecast.

Recovery landscape in key economies: A mixed picture

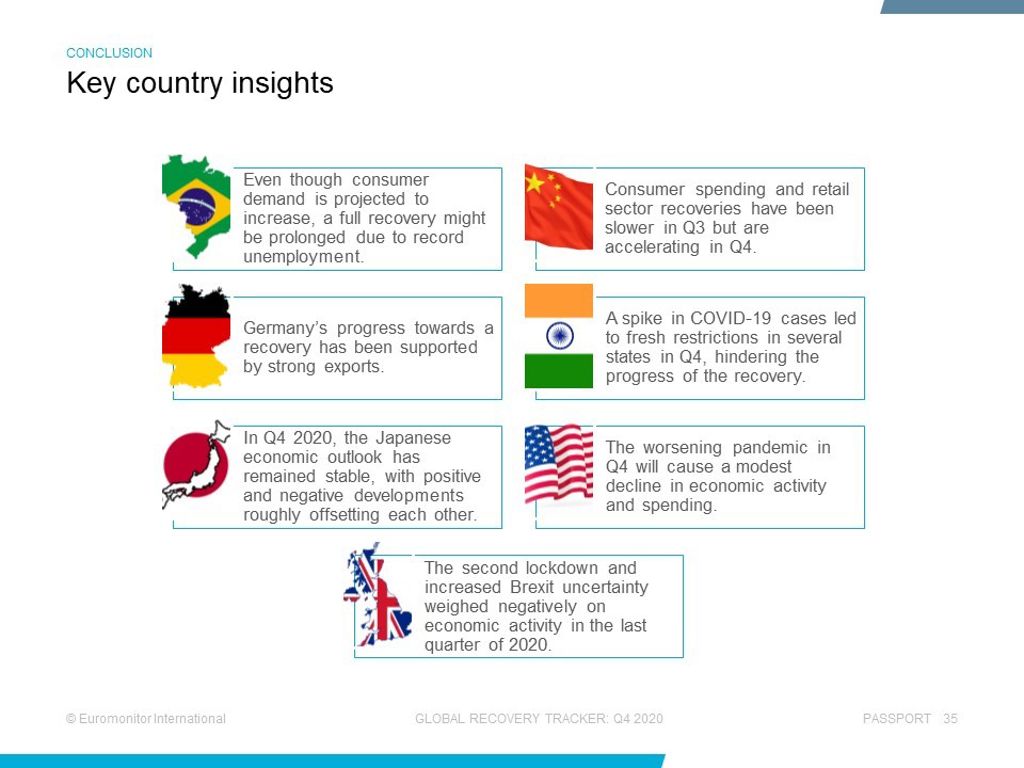

• In Brazil, monetary and fiscal stimuli are having some positive effects on economic activity, causing a slight rebound in Q4 relative to the previous quarter. However, real GDP, consumer spending and retail sales are all significantly below pre-pandemic levels. Even though consumer demand is projected to increase, full recovery might be prolonged due to record unemployment. The country’s Recovery Index score in Q4 2020 is estimated to have risen to 91.5, from 90.2 in the previous quarter.

• The Recovery Index score for China already exceeded the 2019 average in Q3 and is estimated to have increased further in Q4 2020. China’s economic activity (measured by real GDP) in Q4 2020 is estimated at around 8% above the average 2019 level – close to pre-pandemic projections – though it has seen slower growth compared to Q3.

• In Germany, the Recovery Index score is estimated to have reached 95.9 in Q4 2020 – a slight improvement from 95.4 in the previous quarter. Germany’s progress towards a recovery has been supported by exports, which are estimated to have risen 23% year-on-year in Q4 2020, largely as a result of an increase in new manufacturing orders from China.

• In India, a large stimulus package combined with interest rate stabilisation is supporting the country’s progress towards a steady economic recovery, although significant challenges remain. In Q4 2020, India’s real GDP is forecast to have risen by 3.5% over the previous quarter, but it is still expected to be 9.8% lower than a year earlier. The country’s Recovery Index score is estimated to have reached 88.3 in Q4 2020, an improvement from 84.4 in the previous quarter.

• Japan’s economic outlook has remained stable, with positive and negative developments roughly offsetting each other. On the positive side, private consumption and retail sales have been strong, due to a massive government fiscal stimulus and a rebound in exports as the Chinese economy picked up significantly. A third wave of the COVID-19 pandemic in the country is, however, weighing negatively on the outlook, although the wave shows signs of subsiding. In Q4 2020, the Recovery Index score for Japan is expected to have reached 91.1, an improvement from 88.0 in the previous quarter.

• In the US, the Recovery Index is expected to increase further to reach 95.0 in Q4 2020, despite a likely slowdown in economic activity, due to rising consumer confidence. News of successful COVID-19 vaccine tests in November and December has significantly raised the likelihood of widespread vaccination by mid-2021, and reduced uncertainty about the end of the pandemic. Together with expectations of a new fiscal stimulus package being agreed by early 2021, this has boosted consumer confidence in Q4.

• In contrast, the Recovery Index score for the UK is estimated to have declined to 86.6 in Q4 2020, from 87.7 in the previous quarter. The second lockdown, implemented in England in November, and increased Brexit uncertainty are expected to have weighed on economic activity in the last quarter of 2020. The economy is estimated to have grown by only 1.3% in real terms in Q4 2020 over the previous quarter, down from 15.5% in Q3 2020 when the country exited the first lockdown. Given the fact that the services sector accounts for around 80% of the UK economy, the lockdowns and social distancing measures have severely impacted total output.

A slow recovery is now more likely

In Q3, most countries were able to relax lockdown measures, which led to a rapid recovery; however, the virus came in a second wave in Q4 and a third wave in early 2021, leading to fresh lockdowns and consequently a slowdown in economic recovery. In our opinion, the economic effects of the second and third waves are likely to be more moderate compared to the first wave as businesses and individuals adapt. Nevertheless, the health crisis is not over yet and economic recovery is likely to be fragile.

After Q4 2020, the speed of the economic recovery will depend on two factors. In the short term, how fast countries will be able to suppress the second wave of the pandemic will decide how deep the current setback in recovery will be. In the medium term, vaccine distribution will lead to a stronger recovery once herd immunity is achieved across countries.

Under the baseline/most likely scenario, where there is one main global pandemic infection wave in 2020 followed by local/regional second waves, economic conditions and consumer activity in most countries will remain below 2019 levels at the end of 2021. It is important for businesses to factor this recovery timeline into their planning and strategise accordingly.

Euromonitor Recovery Index

Euromonitor’s Recovery Index is a composite index which provides a quick overview of economic and consumer activity and helps businesses predict recovery in consumer demand in 48 major economies. The index takes into consideration total GDP and factors that determine consumer demand – employment, consumer spend, retail sales, and consumer confidence. Index scores measure the change relative to the average per quarter for 2019. A score of 100 and over indicates a full recovery in which economic output, labour market, and consumer spending all return to/exceed 2019 levels.

| Recovery Index Breakdown | ||

| Category | Weighting | Focus |

| Economic Activity | 20% | Tracks and forecasts the level of real GDP as this is a broad measure of everything that workers and capital produce in a country. |

| Employment | 20% | Looks at employed population and average actual weekly working hours in each quarter, as these indicators help track households’ primary source of income besides government financial support. |

| Consumer Spending | 25% | Looks at private final consumption expenditure in each quarter, as this is officially the best measure of consumer spending in real terms. |

| Retail Sales | 25% | Focuses on seasonally-adjusted real retail sales data as a timely indicator of economic performance and strength of consumer spending. |

| Consumer Confidence | 10% | Looks at the standardised consumer confidence index to see how consumers across countries feel about their current situation and when they will start feeling better about the future. |