The Coronavirus (COVID-19) pandemic has triggered the most severe global recession in nearly a century. Businesses are operating in a world of anxieties and uncertainties, not knowing what will be the new normal or when output and consumer spending will rebound to pre-crisis levels. In this context, Euromonitor International has developed the Global Recovery Tracker and Recovery Index to help businesses track and predict when activity in key markets will recover so as to plan their strategy accordingly.

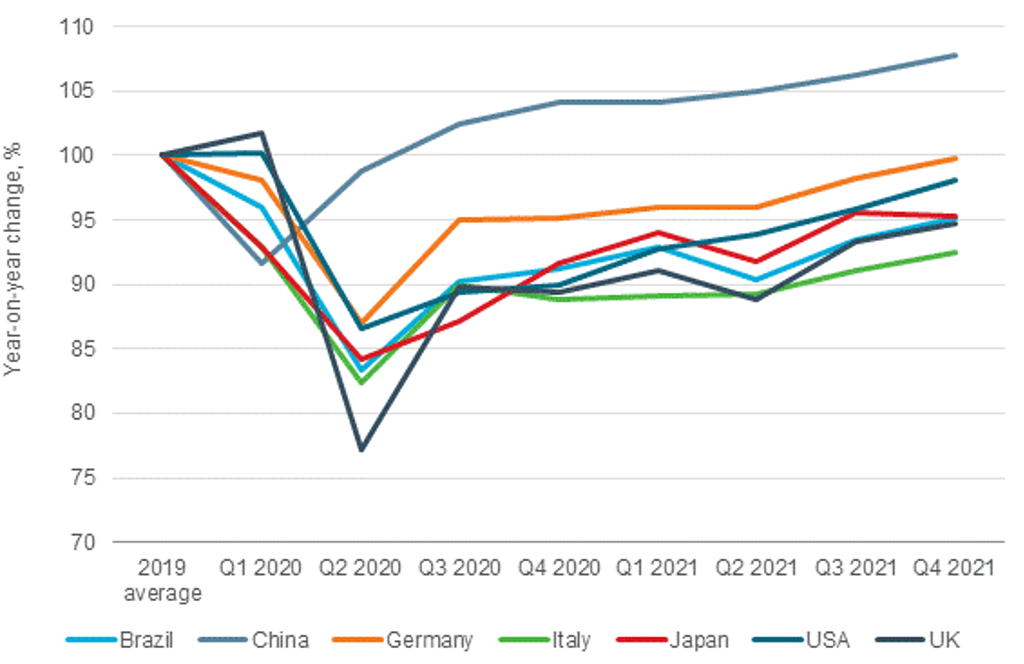

As of Q3 2020, all of the 48 countries covered by Euromonitor’s Recovery Index are expected to have recorded improved recovery index scores compared to the previous quarter when many countries were under strict lockdowns.

Nevertheless, with China being a notable exception, economies have yet to return to pre-pandemic levels of 2019. With further local waves of COVID-19 infection undermining efforts to return to normal, business and consumer confidence are shaken, and with little scope for further fiscal and monetary stimulus, most countries will have a long way to go before their output, labour market, and consumer spending return to pre-pandemic levels.

Key country insights

China is the first major economy to have recovered

Having suffered the pandemic’s blow earlier than other countries, and having subsequently stemmed the spread of the virus, China is the first major economy to see its real economic output, labour market, and consumer spending rebound fully to pre-pandemic levels, as of Q3 2020:

• Euromonitor’s Recovery Index score for China is estimated to have reached 102.4 in Q3 2020, compared to 98.8 recorded in Q2 (an index score of 100 indicates a full recovery to the pre-pandemic level of 2019).

• China represents an important leading signal for the speed and trajectory of the global economy and so it is encouraging to see China’s economic recovery amid persisting challenges from the COVID-19 pandemic. According to official statistics, real GDP in Q3 2020 rose 4.9% over the same period of the previous year, well ahead of the 3.1% year-on-year growth recorded in Q2.

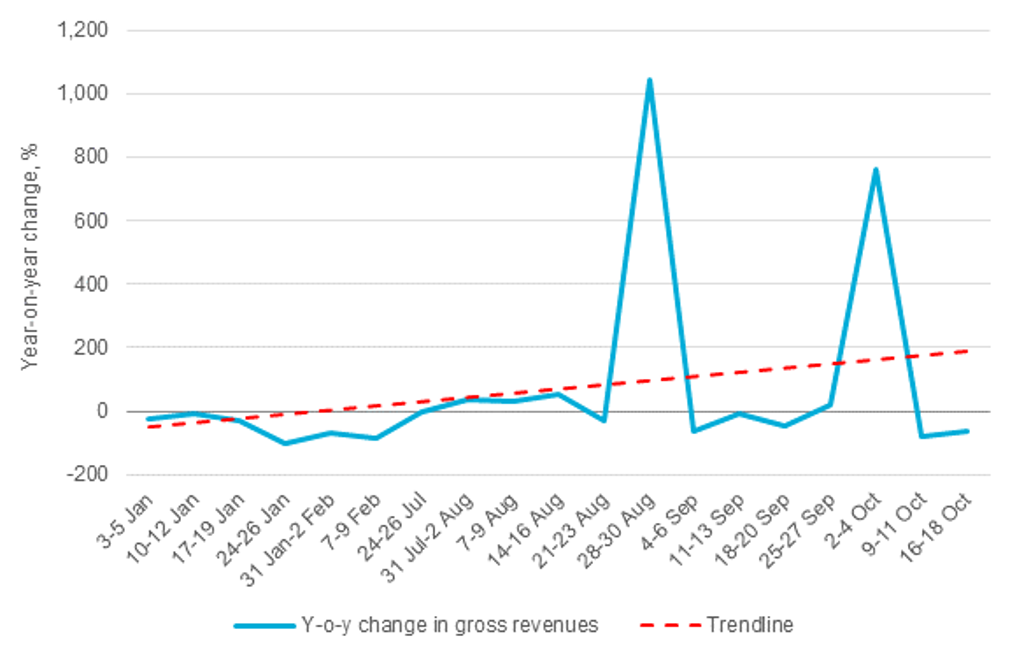

• In a sign of consumer activity returning to normal, China’s box office revenues (in nominal terms) have increased compared to a year earlier, despite a 75% capacity limit in cinemas across the country. Over the three-day (Friday-Sunday) weekend of 28-30 August which coincided with Chinese Valentine’s Day, there were 11 new releases and box office revenues rose by 1,041% over a year earlier. On the National Day weekend (2-4 October), there were 7 new releases and box office revenues rose 761% year-on-year.

China Change in Box Office Revenues Weekends during 3 January – 18 October 2020

Source: Box Office Mojo

Long and bumpy road to recovery elsewhere

China’s recovery will benefit the global economy at large – for example, Germany’s automotive industry is enjoying resurgent car sales in China. Yet, prospects for real GDP to return to pre-pandemic levels before mid-2021 remain distant for most countries due to a further wave of COVID-19 infections, risks of further lockdowns, closed borders and high indebtedness.

• In Q3 2020, consumer spending is estimated to have remained below the pre-pandemic levels in most countries (with China being a notable exception). On the one hand, lockdown measures have restricted what consumers can spend their money on, due to air travel suspended, restaurants and shops being shut or subject to measures to prevent the spread of COVID-19. Equally, the economic fallout of the pandemic has meant consumers are less inclined to spend, with many fearing job losses and expecting their household income to fall in the coming months.

• As the pandemic and its economic fallout have generated headwinds for overall consumer spending, retail sales – the purchase of goods for direct consumption – have experienced some tailwinds. As consumers shy away from spending categories such as travel, hotels and catering, and leisure and recreation due to COVID-19 restrictions and health concerns, they are shifting some of their spending to goods from services. So, instead of eating and drinking out, for example, people are buying food and beverages for consumption at home. In Q3 2020, real retail sales are estimated to have recovered to pre-pandemic levels in 22 out of the 48 countries covered by Euromonitor’s Recovery Index.

• Deteriorating job prospects and rising anxiety about personal and household finances led to a collapse in consumer confidence almost everywhere in Q2 2020. In Q3 2020, the vast majority (42 out of 48) of countries covered by the Recovery Index saw improvements in consumer sentiment compared to the previous quarter, but consumer confidence is estimated to have remained well below pre-pandemic levels in most countries (with China being an exception as its consumer confidence returned to historical average in Q3). Given that many countries are facing a second wave and renewed restrictions, consumer confidence may see further sharp falls later on in 2020.

Recovery Index in Selected Economies Q1 2020 – Q4 2021

Source: Euromonitor International Recovery Index. Note: Data from Q3 2020 are forecast

Outlook

The global economic outlook is mixed, with 20 out of the 48 countries covered by Euromonitor’s Recovery Index expected to see their economy rebound to 2019 levels in Q4 2021. The speed and nature of the recovery across major economies will very much depend on the course of the global pandemic. The recovery seems to be stabilising or even reversing in Q4 as many countries are entering a second or even third pandemic wave.

The outlook could be worsened by the economic impact that further lockdowns might have on the labour market, household incomes, and consumer confidence. Countries with an ageing population are also likely to take longer to recover, as they are more exposed to health risks while their government finances are already constrained.

Factors that can improve the outlook include effective containment measures and reliable national healthcare systems (which allow for economies to restart and open up again), government support to employers and workers (to help cushion the fall in consumer confidence), and a greater focus on equality that underpins a solid and sustainable recovery.

Euromonitor Recovery Index

Euromonitor’s Recovery Index is a composite index which provides a quick overview of economic and consumer activity and helps businesses predict recovery in consumer demand in 48 major economies. The index takes into consideration total GDP and factors that determine consumer spend – employment, consumer spend, retail sales, and consumer confidence. Index scores measure the change relative to the average per quarter for 2019. A score of 100 and over indicates a full recovery in which economic output, labour market, and consumer spending all return to/exceed 2019 levels.

| Recovery Index Breakdown | ||

| Category | Weighting | Focus |

| Economic Activity | 20% | Tracks and forecasts the level of real GDP as this is a broad measure of everything that workers and capital produce in a country. |

| Employment | 20% | Looks at employed population and average actual weekly working hours in each quarter, as these indicators help track households’ primary source of income besides government financial support. |

| Consumer Spending | 25% | Looks at private final consumption expenditure in each quarter, as this is officially the best measure of consumer spending in real terms. |

| Retail Sales | 25% | Focuses on seasonally-adjusted real retail sales data as a timely indicator of economic performance and strength of consumer spending. |

| Consumer Confidence | 10% | Looks at the standardised consumer confidence index to see how consumers across countries feel about their current situation and when they will start feeling better about the future. |