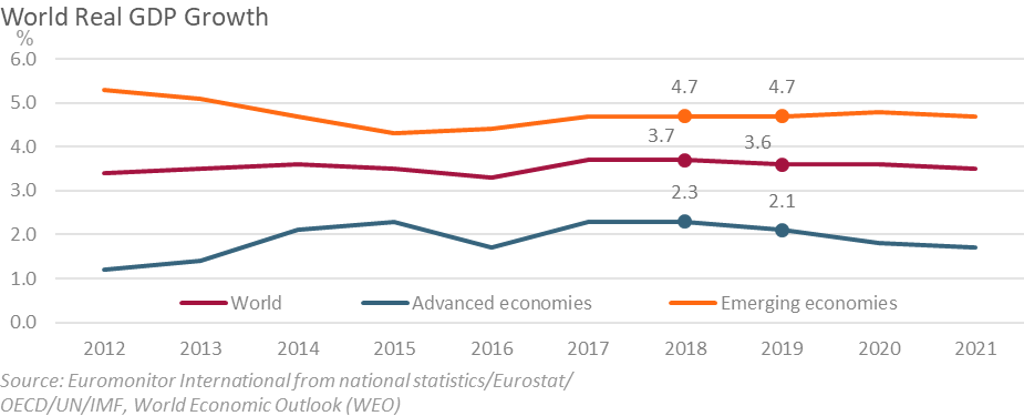

Our recent webinar The Global Economy in 2019 discussed the outlook for the global economy this year. We forecast the global economic growth to start cooling down gradually in 2019, mostly on the back of decelerations across developed economies. Escalating trade tensions and slowing global trade are the main downside risks to the global outlook next year. Worsening financing conditions and the spread of populist rhetoric will also continue to represent an important political risk.

We have received a solid amount of questions, not all of which could be addressed during the live Q&A session. Below we will provide some of the highlights.

How do you expect consumer markets to react to slower global economic growth in 2019?

Real (inflation-adjusted) consumption growth is expected to decline in line with lower GDP and income growth in advanced economies. Consumption growth in China is expected to continue to significantly exceed GDP growth as the country rebalances towards consumption. Chinese private consumption is expected to increase by 7.2% in 2019, compared to 6.1% GDP growth.

You can find out more about global economic forecasts here.

Does the US data show any pick-up in capital investment, R&D from the tax cut enacted in 2018? Is that a sign that the uptick in growth could be sustainable?

There was a pick-up in business capital investment including R&D in 2018, with growth for the whole year likely to come in at 6.5-7.5% in real (inflation-adjusted) terms. However, this response already captures the main impact of the tax cuts on firms’ desired investment levels, and risks of an escalation in the US-China trade war have increased business uncertainty. Growth is likely to slow down towards 3-5% in 2019, declining closer to long-term trend annual growth of 2-3% afterwards.

How likely is it that European interest rates start increasing in 2019?

Our latest baseline forecast calls for a single small interest rate increase during the fourth quarter of 2019, and by the end of 2020 we expect the European Central Bank’s refinancing rate (its central policy rate) to reach 0.4-0.8%. Eurozone short-term interest rates are likely to stay below 1% until the end of 2021.

Do you have more information on the Latin American economy?

Growth in the region overall will remain below trend. Argentina’s economy is likely to continue in a recession, contracting by 1.3% in 2019. Recovery in Brazil will continue with the new government raising prospects of more business-friendly policies and GDP growth of 2.2% in 2019, followed by 2.4% growth in 2020. Colombia’s economy will improve with around 3% growth in 2019 and 3.3% growth in 2020, though still below the 3.5% annual trend forecast for 2023-2027. The Mexican economy is expected to have another year of below trend growth of around 2% in 2019, with growing business uncertainty due to the new government’s more populist stance. Chile and Peru are the only major economies in the region expected to grow at a pace close to trend in 2019, at 3.3% and 3.8%, respectively.

How do you see Mexico? Are US risks directly affecting Mexico? What impact will Mexico's new presidency have on the global market?

In our latest forecasts we expect the Mexican economy to grow by 1.6-2.6% in 2019 and by 1.4- 3% in 2020. The inauguration of President Obrador has increased policy uncertainty, due to risks of significantly less business and private sector investment-friendly policies. While the impact of Obrador’s policies on global markets is likely to be small, the risks of a slowdown in Mexico’s economy have increased.

Overall uncertainty has declined due to the USMCA trade agreement reached with the US in September. The new agreement essentially preserves the main benefits of NAFTA for Mexico, though it still has to be ratified by the US Congress. While Congress is unlikely to block the deal, there is still some uncertainty, also bearing in mind the risk of President Trump changing his mind on the deal (eg due to ongoing tensions related to the US-Mexico border and migrants).

As a result, we still assign a 8-17% probability over 2019 to a breakdown in US-Mexico free trade. Such an outcome would push Mexico into a recession, with GDP growth close to zero in 2019-2020. Mexico is also more heavily exposed to the risk of a downturn in the US economy, which could reduce GDP growth by 0.5-1 percentage points in 2019. We assign this scenario a 10-20% probability in 2019.

What do you have to say about Africa? The continent seems to be growing faster than much of the rest of the world. Do you have an outlook view on Sub-Saharan Africa?

While most of the ongoing global economic power shift is towards Asia, Africa is another region offering high potential to investors. These two regions will be home to some of the world’s fastest growing economies in the coming years. In 2019, three out of the world’s top five growth economies in terms of real GDP are expected to be in Africa: Libya (10.8%), Ethiopia (8.5%) and Rwanda (7.8%).

In Sub-Saharan Africa, the recovery is expected to pick up pace in 2019, supported by acceleration in the region’s major economies. Strong (though declining) global growth and firm commodity prices should support export-driven economies, while investment activity should fuel growth in smaller economies. On the domestic front, risks include political uncertainty stemming from elections in Nigeria and South Africa. Externally, lower appetite for emerging market assets remains a risk, while commodity exporters could face challenges due to a slowing global trade.

Read more about this topic in our report Africa Rising.

Watch the Global Economy in 2019 webinar on demand here.

If you would like to learn more about the recent economic developments and what they mean for the economies globally, follow our white paper series titled the Global Economic Forecasts. The most recent edition can be downloaded here.