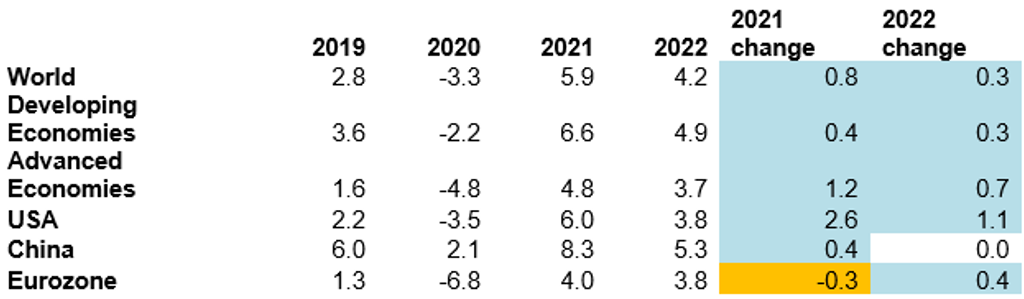

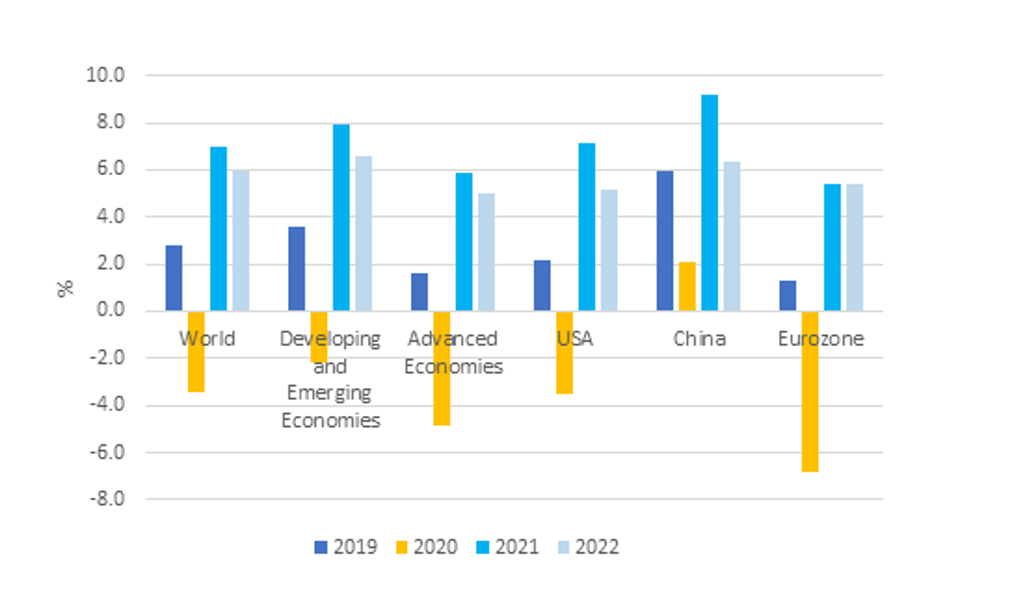

The global economic outlook has shifted upwards significantly since January 2021. As of April, Euromonitor International projects global real GDP growth of 5.9% in 2021 (a 0.8 percentage point upgrade since January) and 4.2% in 2022 (a 0.3 percentage point upgrade since January).

The main driver of the improving global outlook is the US economy, now expected to grow by around 6% in 2021 (2.6 percentage points upgrade since January). The large US forecast upgrade is due to the approval of a larger than expected fiscal stimulus programme of around 9% of GDP, together with faster than expected vaccination progress that could see herd immunity reached during the summer of 2021. The improving US outlook is partly offset by worsening Eurozone forecasts, due to slower than expected vaccination campaigns and the emergence of a third pandemic wave.

Real GDP Growth Baseline Forecasts: 2019-2022

Source: Euromonitor International Macro Model, National Statistics

Note: Regional real GDP growth using PPP weights; revisions are relative to January 2021; figures for 2021 onwards are forecasts; forecasts updated 5 April 2021. Blue indicates forecast upgrades; orange indicates forecast downgrades relative to January 2021.

Strong global economic recovery forecasts are also backed by milder than expected negative effects of late 2020 and early 2021 social distancing and lockdown measures. Greater economic robustness to the pandemic reflects a mix of more targeted lockdown measures relative to the spring of 2020 and greater adaptation of consumption habits to social distancing (eg online shopping). As of April 2021, global industrial production and trade in goods have mostly recovered, with global goods trade back to pre-pandemic levels. In contrast, services sector activities remain significantly below pre-pandemic levels due to ongoing restrictions on high social contact activities.

Local lockdowns are expected to continue in many countries before widespread vaccinations, with the spread of new, more contagious, coronavirus variants. However, these lockdowns are expected to be much less damaging economically than the ones in the spring of 2020.

Vaccination rates sufficient for herd immunity are likely to be reached in advanced economies and some developing economies in Q3-Q4 2021. However, in most developing economies vaccination rates sufficient for herd immunity are unlikely to be attained before the second half of 2022. Once mass vaccination is attained, a strong recovery is expected in currently depressed high social contact sectors, supported by rising consumer confidence and high cumulated savings. Slower vaccination campaigns in developing economies are expected to delay their recoveries relative to advanced economies (with the exception of China, where real GDP is expected to approach the pre-pandemic level forecast in 2021).

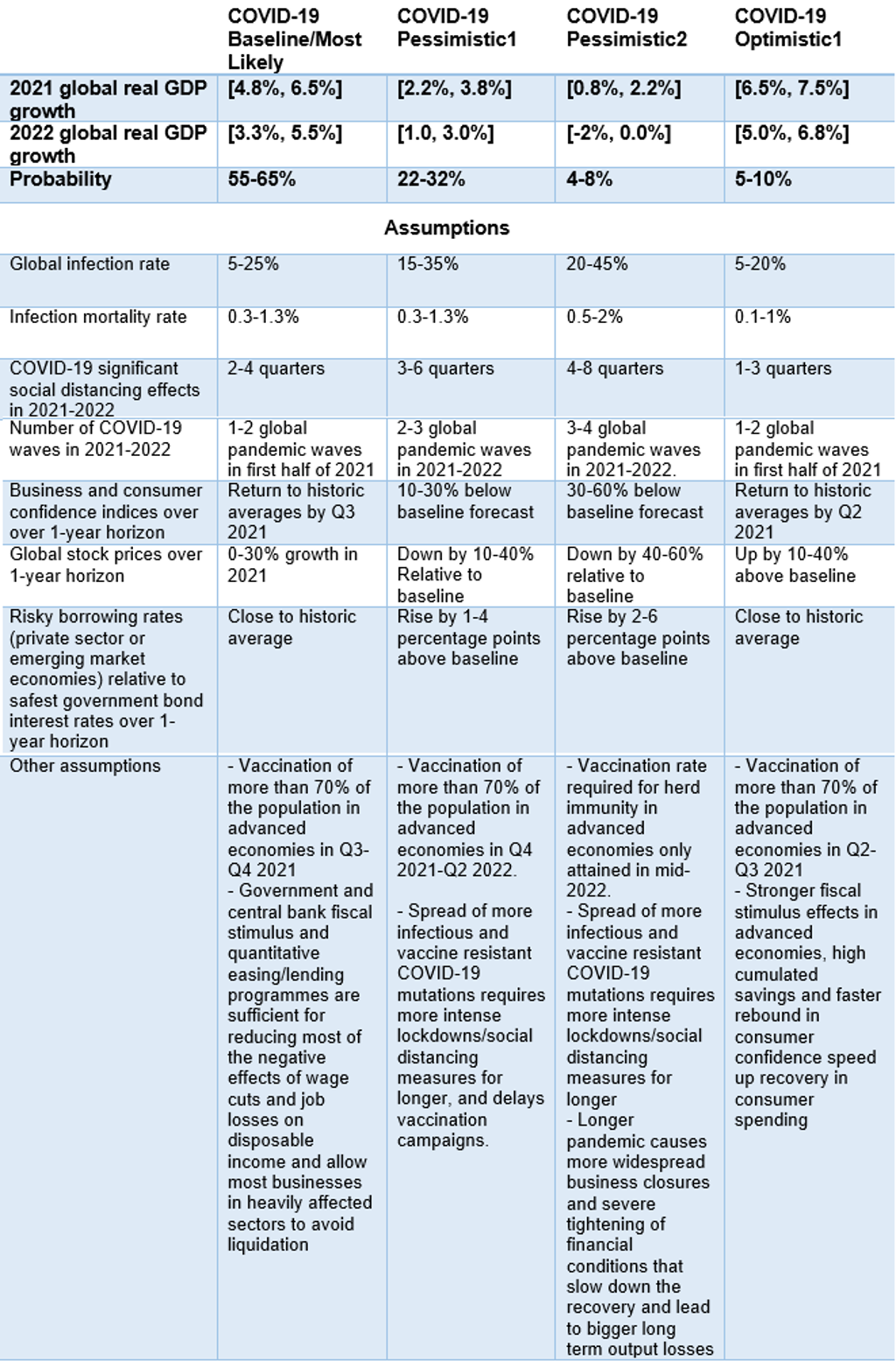

Both pessimistic and optimistic scenarios are becoming less likely as we approach more extensive vaccination campaigns in Q2-Q3. The baseline forecast is now assigned around 60% probability, with pessimistic scenarios of a delayed economic recovery assigned around 33% probability and the optimistic scenario of a faster recovery assigned around 7% probability.

Global Real GDP Index, Baseline and Alternative Scenarios: 2019-2022

Source: Euromonitor International Macro Model, National Statistics

Note: Global real GDP growth using PPP weights; figures for 2021 onwards are forecasts; forecasts updated on 5 April 2021.

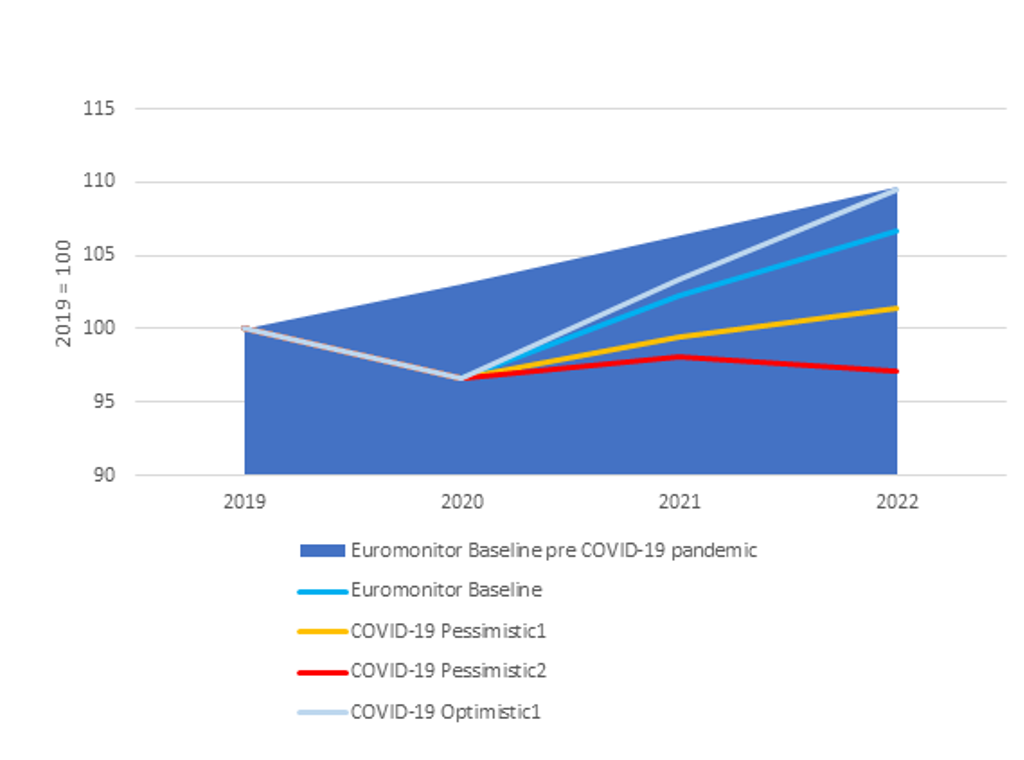

Downside risks remain significant

The baseline outlook for the evolution of the pandemic and the economy remains highly uncertain due to potential delays in vaccine distribution, and the spread of further infection and vaccine-resistant virus variants. In the COVID-19 Pessimistic1 scenario these factors lead to more intense and longer lockdown and social distancing measures relative to the baseline forecast. Vaccination rates sufficient for herd immunity are delayed until Q4 2021 - Q2 2022 in advanced economies and until 2023 in most developing economies. The longer and more intensive social distancing measures cause significant drops in consumption, business revenues, employment and wages relative to the baseline forecast, weakening the economic recovery in 2021-2022. This scenario is assigned a probability of around 27%. The worst-case Pessimistic2 scenario featuring longer delays into 2022 of vaccination campaigns and herd immunity in advanced economies is now only assigned around a 6% probability.

Global Real GDP Growth COVID-19 Pessimistic1 Scenario: 2019-2022

Source: Euromonitor International Macro Model, National Statistics

Note: Global real GDP growth using PPP weights; figures for 2021 onwards are forecasts; forecasts updated on 5 April 2021.

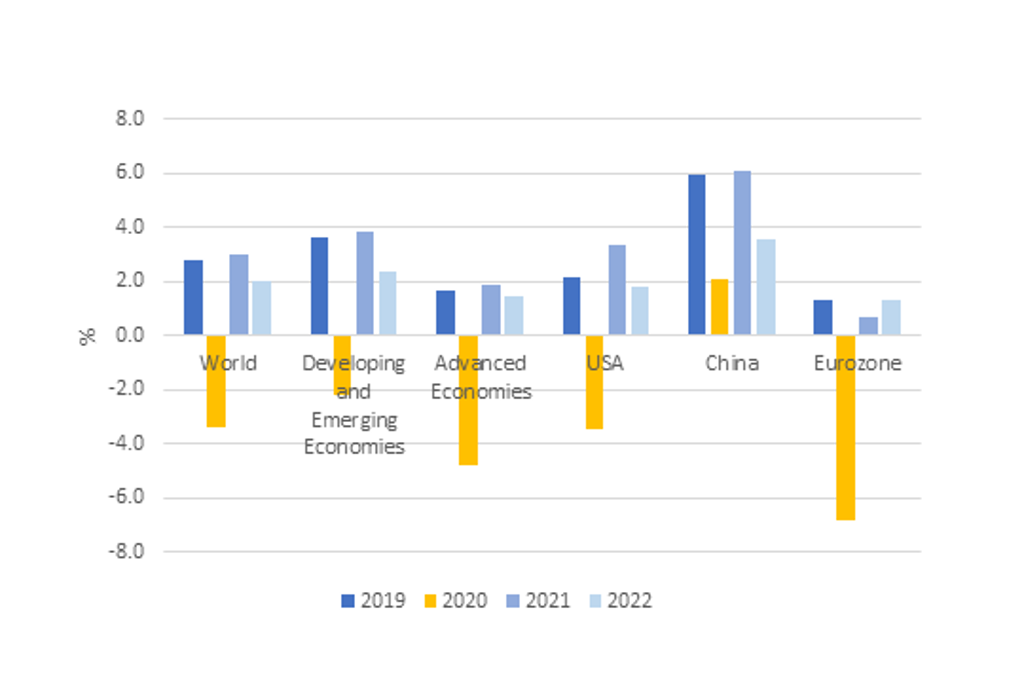

The optimistic scenario could bring the global economy close to its pre-pandemic forecast level

On the upside, vaccination campaigns could accelerate, and the spread of more infectious virus variants may become better contained. In this optimistic scenario, advanced economies approach herd immunity in Q2-Q3 2021. Consumer confidence recovers faster than expected, backed by large savings cumulated during the pandemic and an unprecedented urge to spend in newly reopened high social contact sectors, such as leisure and tourism. The impact of the US fiscal stimulus programme on consumer spending is also likely to be stronger under these conditions. As a result, global real GDP increases by 7.1% in 2021. In the optimistic scenario, global economic activity approaches the level it would have attained without the pandemic in 2022. However, the current slow progress of vaccination campaigns in many countries has reduced the probability of this upside scenario to around 7%.

Global Real GDP Growth COVID-19 Optimistic1 Scenario: 2019-2022

Source: Euromonitor International Macro Model, National Statistics

Note: Global real GDP growth using PPP weights; figures for 2021 onwards are forecasts; forecasts updated on 5 April 2021.