The latest edition of our Global Economic Forecast report has launched for Q3 2019, looking at the quarterly macro changes for the world’s key economies and what these mean to our view of the likely, optimistic and pessimistic scenarios for the global economy.

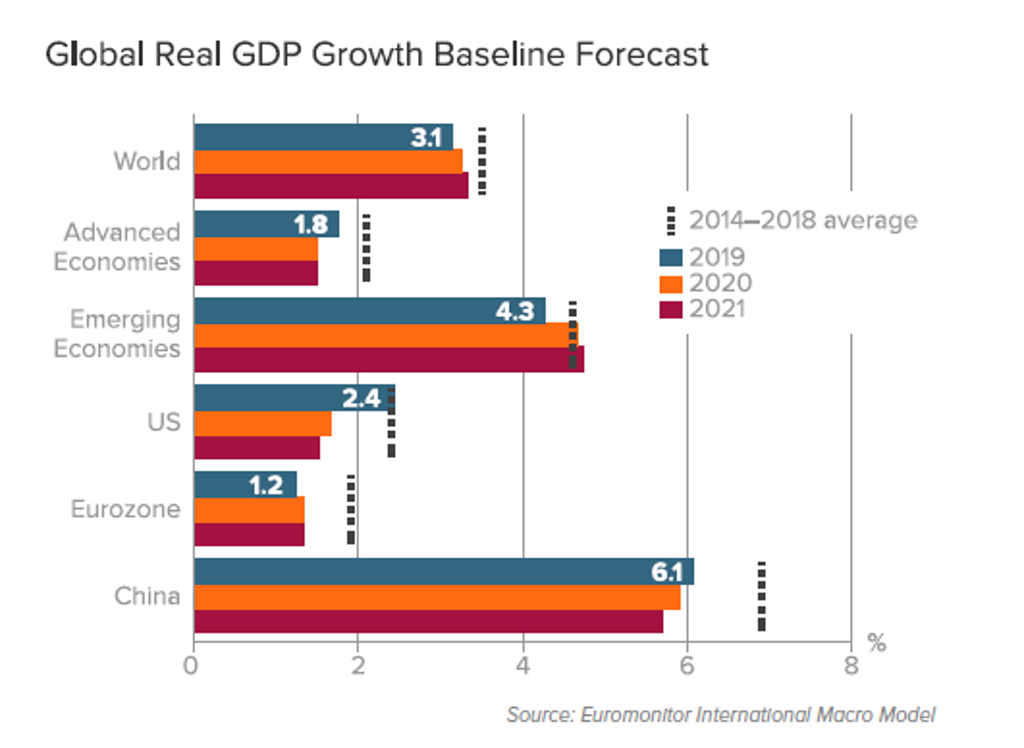

The first half of 2019 has seen downgrades to the global outlook especially in emerging and developing economies with global GDP growth expected to be 3.1% in 2019, rebounding to 3.3% annually in 2020–2021.

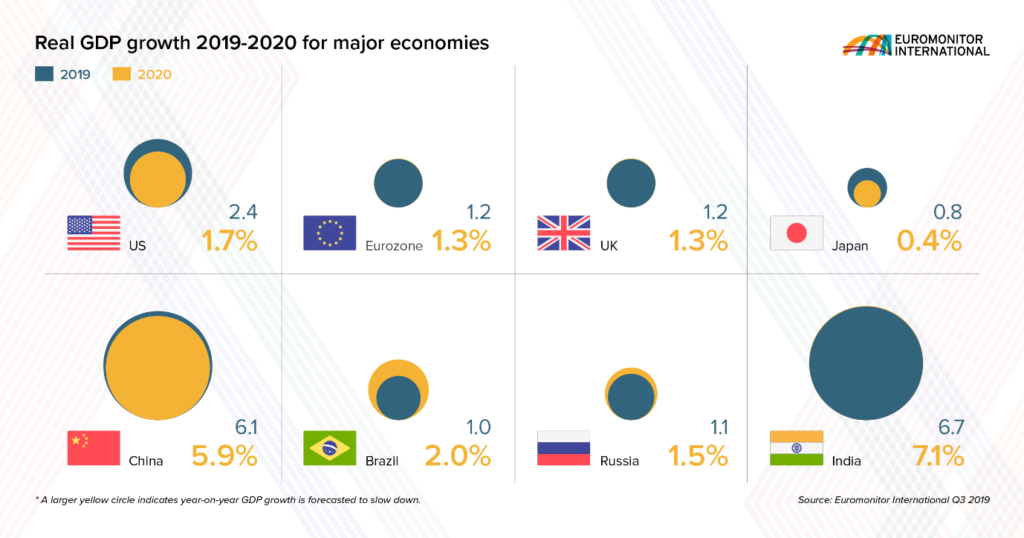

The overwhelming contribution to global growth will continue to come from developing and emerging economies, with their output expected to rise by 4.3% in 2019, improving to 4.7% growth annually from 2020–2021. Advanced economies growth is expected to be 1.7% in 2019, declining to 1.5% annually in 2020–2021.

Overall global downside risks have increased, with rising trade tensions and financial markets volatility since May 2019.

Positive global factors

The global monetary policy stance has become significantly more accommodative since May 2019, supporting equity markets and business investment. The US Federal Reserve has cut its policy rate by 0.25 percentage points in July, with another cut expected by the end of 2019. The ECB has also signalled further potential easing either by interest rates cuts or an expansion of its long-term lending programme for banks.

Global stock markets have rallied in the first half of 2019, completely erasing the end of the 2018 market correction. Emerging markets risk premia declined a little in the first half of 2019, and stock market volatility remains low.

Negative global factors

Tensions from the China-US trade war have escalated with the US planning to impose new tariffs on Chinese imports despite the restart of trade negotiations. Global trade volume growth has declined, constraining growth for export-dependent emerging markets and the Eurozone.

Stock markets remain fragile and below their 2018 peaks. The recent announcements of new US trade tariffs on China have caused new stock price declines and an increase in financial markets volatility. Stock markets are likely to be fairly priced according to fundamentals, but they remain highly vulnerable to rising trade or geopolitical tensions and may reflect excessive optimism about central bank interest rate cuts.

Large declines in long-term advanced economy interest rates, with segments of the US yield curve inverting (long-term rates below the short-term rates), signal heightened global downturn risks.

Global financial crisis recovery dynamics have essentially played themselves out in advanced economies, leaving mainly long-term trend growth in 2020 and beyond. Labour productivity and wage growth rates in advanced economies continue to remain significantly below previous historical trends at 0.5–1.5% annually.

Emerging market economic convergence trends have mainly disappeared outside China and India, with labour productivity growth declining close to the low growth rates of advanced economies.

Euromonitor International’s new macroeconomic outlook, Global Economic Forecasts: Q3 2019 provides the latest Euromonitor International macroeconomic forecasts, assessment of the global economy, discussion of recent events and a deeper analysis of key economies. Download Global Economic Forecasts: Q2 2019 to stay ahead of risks and opportunities as they emerge on a macroeconomic basis.