This article is part of a series highlighting the Top 10 Global Consumer Trends 2021 report.

Inevitably, Euromonitor International’s Global Consumer Trends 2021 are heavily influenced by the Coronavirus (Covid-19) pandemic and its economic consequences. Our team of experts based in Dubai explain how two of these trends - Craving Convenience and Safety Obsessed - are key to understanding business in the region as the pandemic recedes.

Craving Convenience: of the Pre-Pandemic era in the New Normal

Pre-pandemic, physical experiences were an integral part of Middle Eastern consumers’ daily life, whether visiting the mall as a lifestyle destination and having the convenience of shopping and eating under one roof in the wealthy GCC countries, or shopping at nearby neighborhood shops in the developing nations like Egypt and Iraq. Across the region, lockdown catalysed digital adoption but as the pandemic enters its second year, Middle Eastern consumers are yearning for the convenience of pre-pandemic life, while adapting to the new normal.

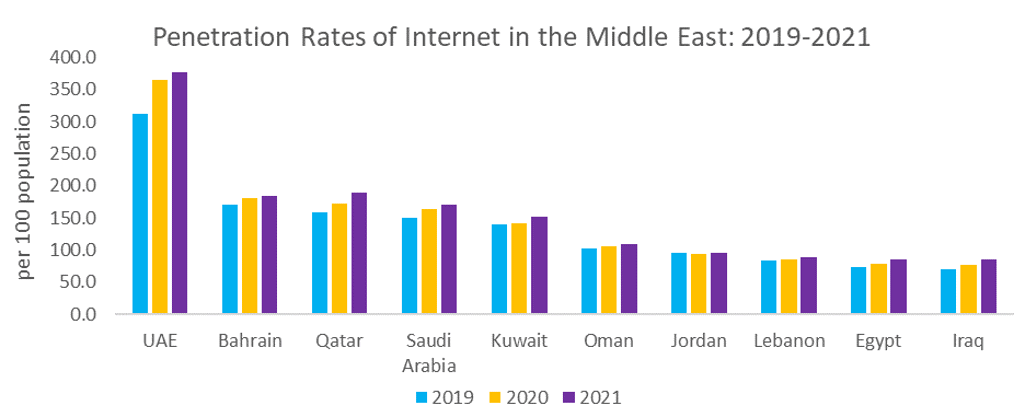

According to Euromonitor International, the percentage of households with internet access is over 94% in GCC countries, denoting an established digital infrastructure that has fostered the acceleration of e-commerce. In UAE alone, internet penetration is as high as 377 per 100 population in 2021, meaning that consumers have multiple devices at their disposal to do various online activities like e-shopping, e-meetups, telemedicine consultations, e-learning courses, and the like for uninterrupted services. The Middle East region also benefits from a young population - the median age being 27 - meaning quick adaptability to digital innovation compared to the older consumers who tend to prefer human interaction.

Source: Euromonitor International Passport Database, Economies and Consumers

Desire to resume a normal lifestyle along with e-readiness harmonises omnichannel based retail

As life out of lockdown resumes and consumers across the Middle East return to visiting malls and stores, businesses need to balance digital strategies with the cultivation of more “human” relationships with consumers. According to Euromonitor’s Digital Consumer survey, 62% of Middle Eastern consumers favor face-to-face interaction for customer service. The preferred channels for essentials such as food and beverages in 2020 continued to be in person at the store, for example, 55% of consumers in the UAE prefer this channel. Hence, a blended and seamless omnichannel approach is considered convenient by consumers for purchasing products and services.

Business adapting through assessing market demands remains crucial

Middle Eastern consumers have valued a holistic approach in their path to purchase, which businesses have responded to and served as the pandemic progresses. Examples include providing value by high-quality products and services at competitive prices, promotion programs, multiple buying options such as click and collect and cash on delivery. Businesses continue to observe their sales trends and loyalty program information to gauge changes in supply and demand, strengthening logistics through placing additional fulfillment centers to ensure products are well-stocked across their channels.

Middle Eastern companies, such as Landmark Group, which houses Centrepoint, Homebox, Lifestyle, Splash, Babyshop, Shoemart amongst others, have benefited through a holistic approach towards online and offline shopping. Consumers can check their reward points through downloading the Landmark Group’s “Shukran” loyalty program through an app and shop in multiple ways, including using click and collect options in-store. Similar offerings were seen by Carrefour with Majid Al Futtaim’s app named ‘’Share’’, IKEA and Matalan. Redtag is offering up to 25% off on WhatsApp offers in Saudi Arabia, in addition to offering an exchange anytime promise policy on items. Pan Furniture offers free interior design service, return on online purchases as well as installment payment plans. The existing customer experience has been enhanced and fast-tracked with the pandemic, pushing consumer convenience to the forefront.

Safety obsessed: safeguarding to normality

Consumer priorities shift to safety and hygiene as they live in the pandemic era

Avoiding Covid-19 has prompted Middle East consumers to adapt heightened safety and hygiene as a key new wellness movement. Protecting loved ones, family, friends, elders and the young has led to intensive cleansing and to adapt to contactless solutions faster. Regular and thorough washing, sanitisation and ventilation have become the new norm across the region and consumers are exploring products that will help them keep away from infection. According to Euromonitor’s Beauty survey, the frequency of hand sanitising in the Middle East is one of the highest when compared globally, with 51% of consumers hand sanitising five or more times per day and 71% washing hands with soap and water five or more times per day. Rising awareness from government and brand campaigns has made safety and protection a key priority among consumers.

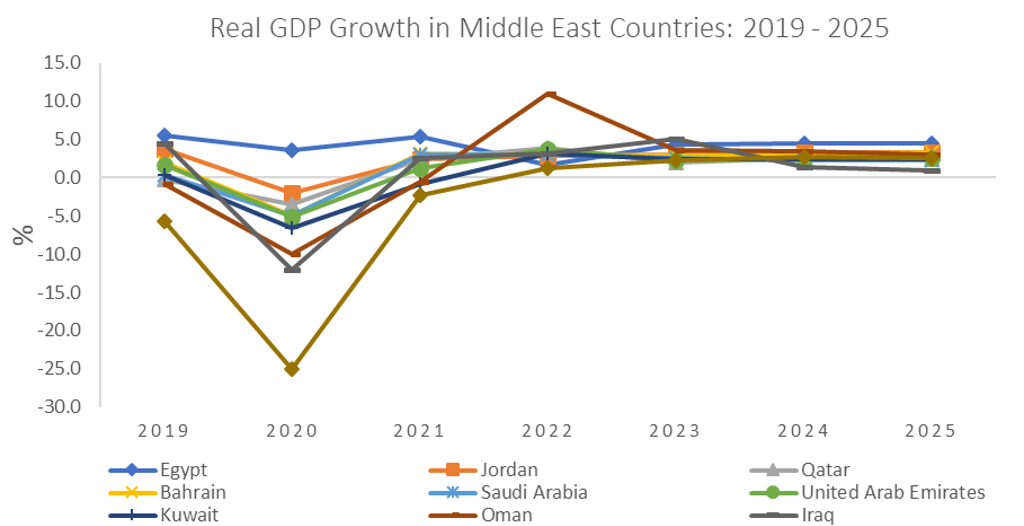

Awareness that a clean environment can help prevent and control infection is imperative in allowing public places to stay open or social gatherings to take place. Effectively controlling infection rates is expected to reduce recourse to lockdown, positively influencing GDP growth in the region over 2021 and into 2022.

Source: Euromonitor International Passport Database, Economies and Consumers Annual Data

Business adapts through innovation, boosting safety across industries

Companies are implementing enhanced safety measures, innovating services and products around safety to reassure consumers, while adapting to their new behaviors and maintain smooth uninterrupted business operations. Malls across the region have reopened with strict health and safety operations in place to persuade customers to return. Frequent sanitation by a mall and instore staff, allocated hand sanitisers for use throughout shared areas, socially distanced limited seating areas in restaurants, and maximum customer allocation at each store according to store size is strictly implemented.

Rising demand for cleansing products such as bath and shower, facial cleansing, home cleaning, disinfection solutions, and the introduction of touchless digital solutions such as the use of QR codes, is increasingly evident. For instance, according to Euromonitor International’s Home Care 2021 survey, multi-purpose cleaners witnessed a growth of 16% in 2020 in the Middle East.

Brands are responding by launching value-added products, examples include Dettol Arabia, protecting from germs causing illness through the new and improved formulation of multipurpose cleaners, and Johnson’s anti-bacterial range including bar soap, liquid hand soap, and body wash with a 3-in-1 feature of washing away germs, keeping skin moisturised and freshly scented. Along with focusing on disinfection, protection through features such as moisturising for care, availability in various variants such as natural, scent-free, derma-tested version is also prevalent within hygiene products. Online catalogs or using apps to view items within hypermarkets or supermarkets and department stores, QR coding to access menu across major restaurants making dining contactless, and banks using biometrics like fingerprint verification on online banking through phone are also key examples of how the industry is adapting to these challenging times.

The two trends highlight that Middle East consumers are acclimatising to their new reality - leading to new ways of behaving, spending, and consuming. Business adaptability and the ability to evolve in this new normal and beyond will continue to prove crucial.

Learn more about the trends Craving Convenience and Safety Obsessed from our Top 10 Global Consumer Trends 2021 white paper.