Coronavirus (COVID-19) has significantly changed consumers’ relationship with food, altering our considerations when choosing what to buy and forcing us to rethink how we get the food we need. A new normal is developing, and while some changes are clear, others are still shaping up.

Pathway opens for healthier eating – but isn’t necessarily chosen

When national lockdowns shifted almost all eating into the home, more time opened to understand and act on food’s role in keeping us healthy. However, many responded with less than healthy choices, turning to processed food and in-home snacks. In addition, the threat of economic recession is likely to see popularity grow for affordable treats like confectionery. Equally, the fact that eat-in restaurants turned to delivery during the lockdown in order to survive has meant even more options for takeaway users.

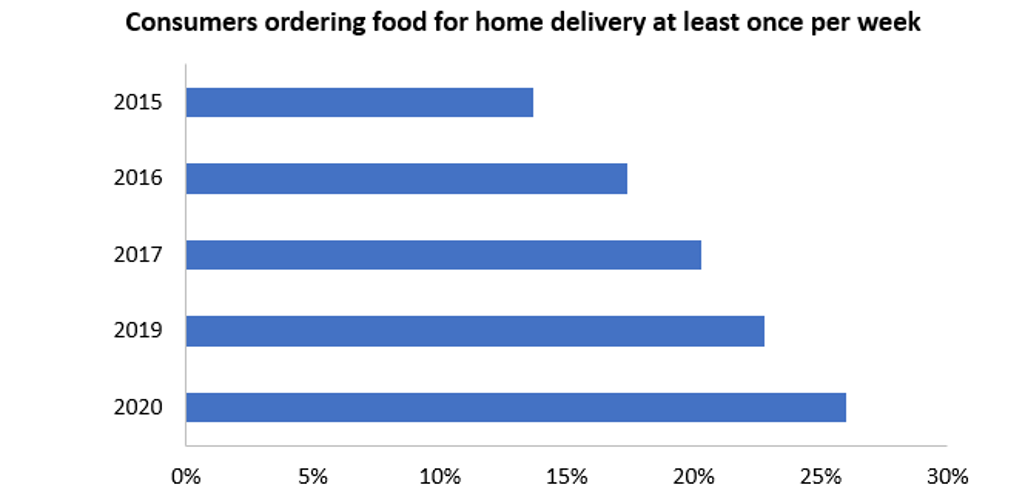

Source: Euromonitor International Lifestyles Survey, Global results, 2015-2020. Q: On average, how often do you do the following for consumption away from home: Order food for delivery away from home. Respondents: 16,353

While the new normal is creating the space and the drivers for healthy eating to blossom, it has also brought contradictory trends.

The core offer becomes vital; premium less so…

In recent years premium food has driven increased spending. The new normal will see a profound impact here, as the recession brings lower average disposable income. This will increase the popularity of economy ranges. Discounters and private label will prosper. And given the continuing need for social distancing and the success of online shopping, it is possible that the core grocery shop will become even more commoditised. Retailers may compete over standard grocery “delivery box” products, catering to a bargain-hunting audience.

…and retail loyalty may suffer

Social distancing, self-isolation, fear of infection and concern regarding shortages on-shelf have driven a surge in online grocery. Retailers are betting that this boost is an acceleration of already impressive growth, hence huge investment by the likes of Amazon, Instacart and Ocado. However, this creates problems for producers who rely on impulse buys and a visual connection with products. As a result, Direct-to-Consumer (DTC) offerings have also grown, another acceleration of an existing digital trend.

With majors such as PepsiCo joining the fray, launching PantryShop.com and Snacks.com in May 2020, the need to use grocery retailers may well diminish in the eyes of consumers. DTC can serve convenience and perhaps price needs, auto-reorder models mean running out of favourites becomes a thing of the past, and the effort of virtual shopping (e.g. booking slots, choosing products) is avoided.

As shoppers become more digitally attuned, they become more open to DTC, a model which holds advantages for producers once they have weathered set-up costs. Both shopper and producer may be more willing than ever to cut out the middleman.

Food for lockdown

As befits a health crisis, people are looking to diets to address their fears. Food that can promise immunity support is a focus, but this will be accompanied by interest in food promising to help with anxiety, sleep problems and perhaps even lethargy (driven by the absence of daily routines). The burgeoning CBD-in-food trend will likely benefit, perhaps even in combinations adding anxiety-reducing properties to energy-boosting foods.

Beyond food as medicine, if lockdowns persist, marketing foods that fit into a “lockdown diet” may find success – keeping obesity at bay while also addressing mental health. This latter factor means even greater interest in foods that fit with the gut-brain-axis concept, supporting the idea that a “happy gut” has an important role in maintaining mental health.

Innovation slows – but can capitalise

Innovation has taken a back seat. Producers are running at capacity to meet demand and have less incentive to experiment. Many have focused on their most popular products only; not just to meet what consumers want, but also to better serve retailers dealing with unprecedented demand.

In many cases, shoppers are choosing familiar, even nostalgic tastes, boosting products which were otherwise facing difficulties like processed food concerns and non-dynamic brand image.

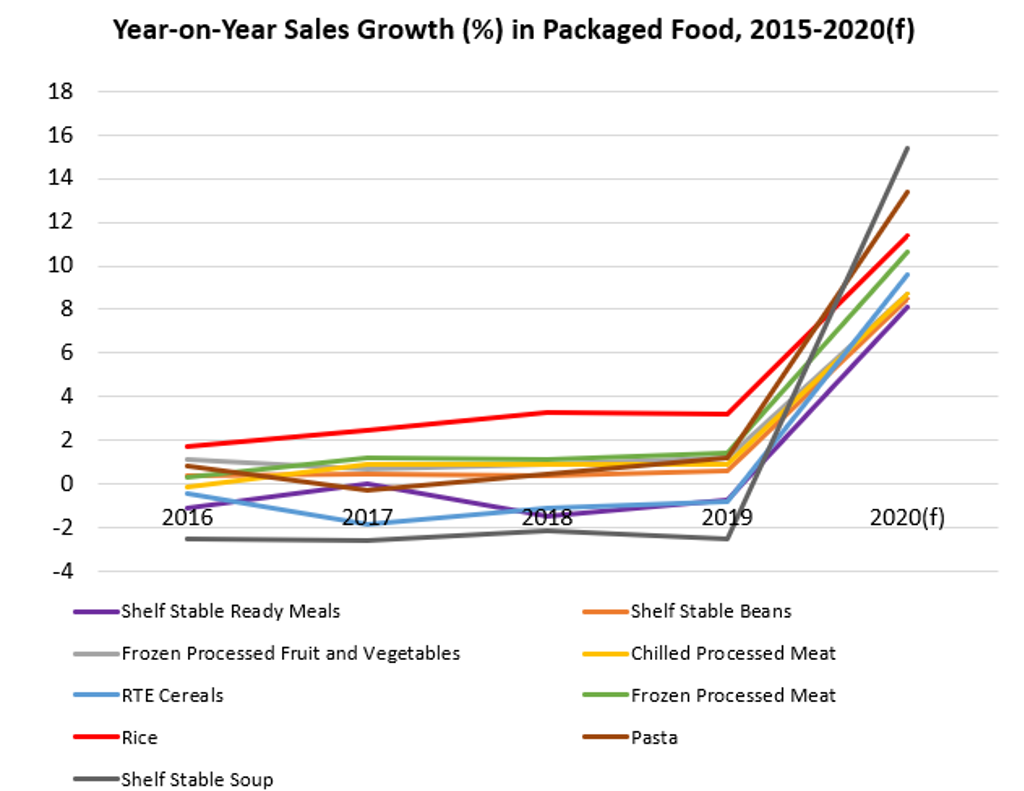

Source: Euromonitor International

Furthermore, the smaller, disruptive, younger companies that have been driving food innovation in recent years are less well-equipped to ride out a recession. Their larger, older rivals can call on reserves and the established brands currently meeting demand.

That said, these shifts do open the opportunity for innovation to succeed in the mid-term. A company which produces something interesting could see significant success with consumers hungry for change.

The new normal is still developing

Overall, the new normal in food is solidifying, with changes such as increased online shopping and increased interest in immunity-boosting foods. But beyond such shifts, we may see developments such as retailer loyalty lessening as DTC reaches more people, the emergence of “lockdown diet” marketing and increased commoditisation of a basic grocery offer. While vaccination remains a hope for the future there are certainly further twists to come for the new normal in food.